Simon Shares

- Transaction Capital (JSE code:TCP) results swung into a massive loss, no surprise. SA Taxi loss making but overall H2 was better then H1 in all three divisions.

- Purple Group* (JSE code: PPE) results also swung into a loss. But as a discretionary consumer business, why is everybody so surprised?

- Average client has 1.45 products. This seems low, very low.

- Philippines not yet regulated, but they not giving up.

- Project delays.

- Tigerbrands (JSE code: TBS) show a tough environment and RFG (JSE code: RFG) may offer better value.

- Local Q3 GDP at -0.2%.

- Gold at all-time highs.

Simon Brown

Share buybacks and stock compensation, the bad and the ugly

Share buybacks are good right? The company uses their free cash to buyback shares which reduces the number of remaining shares such that each share has a higher claim over future profits which adds to their value.

Further they're tax efficient in that paying dividends results in dividend tax.

BUT;

- Firstly, in cyclical stocks you need to be buying back at lows, not highs and the companies usually have no free cash at lows, so either they don't buy back or they do so at highs when they have the cash. Horrid value destruction.

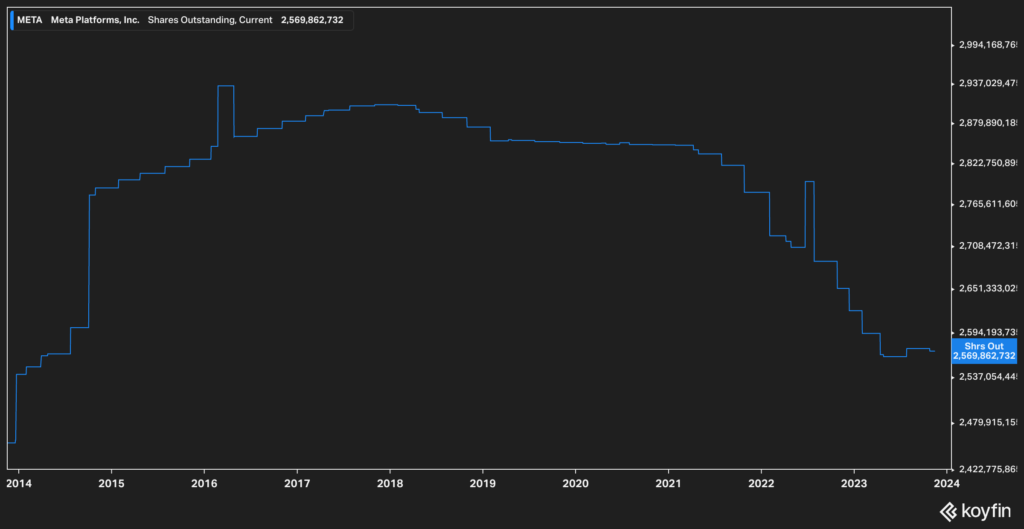

- Secondly, some companies are buying back but also issuing new shares to staff, at times at a rate faster or similar to what they're buying back. This is then effectively an underhand salary to staff. This is especially an issue with large tech stocks, see examples below.

- Thirdly, new share issues are considered non-cash, but ultimately they are cash as you gave somebody real shares that have future claim on profits.

- Fourthly, often acquisitiosn are done with stock increasing the outstanding shares. Many will see this as a free deal as shares don't cost. But they do cost as they reduce every other shares value and if the company has been buybacks, well then they paid cash for those shares, just indirectly.

Locally we do see buybacks, but share issues are relatively small so the impact is less shares and more value per share.

Using IFRS accounting diluted HEPS uses the share count of all outstanding shares PLUS all promised shares not yet delivered. These are basically options that could become shares and gives a way better reflection of the profit, even thugh not yet issued they will potentially come to makret and be issued.

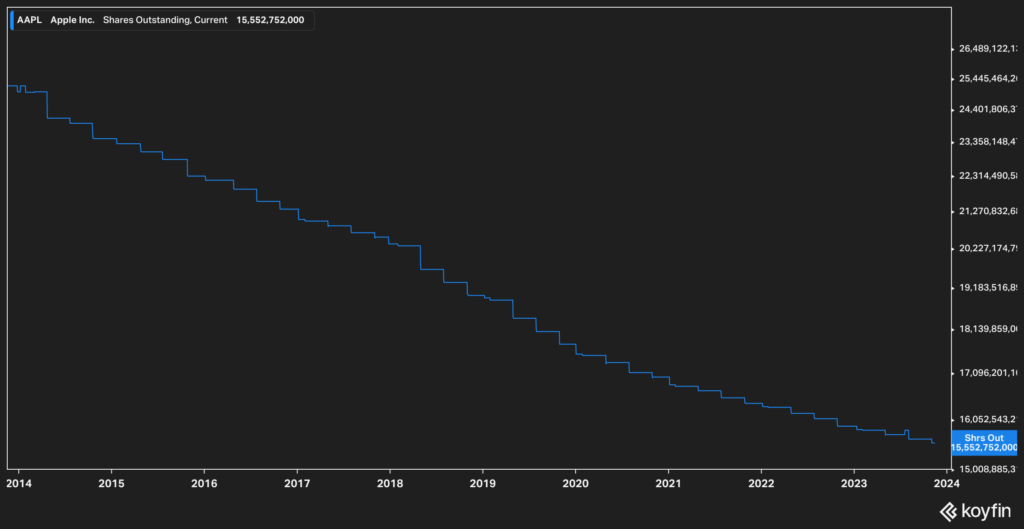

Apple (Nasdaq code: AAPL) has been buying back shares and as such over the last decade it's outstanding shares is down about 38%.

Meta (Nasdaq code: META) has also been buying back, but they also issue shares at such a pace that over the last decade shares outstanding is basically flat.

Charts from Koyfin 15% discount for first 2 years

Simon Shares

- US October CPI was 3.2%, down from 3.7% in September (after peaking at 9.1% in June 2022) and markets absolutely loved the data. Expectations for Fed rates is now no more raising and cuts starting maybe as soon as the 19-20 March or 30 April - 1 May meeting.

- Shoprite* (JSE code: SHP) trading update shows they still knocking it out of the park and taking market share.

- Woolies* (JSE code: WHL) trading update had more excuses tha a five-year old caught eating all the picnic ice cream.

- Decent Stor-Age* (JSE code: SSS) results with ±10% yield and discount to NAV of ±25%. The yield is nice, but you can get the same in cash right now. But when rates start coming down the yield is more impressive and lower rates could see higher valuations.

- A global luxury ETF

Simon Brown

The problem with telcos

I have long said that telcos such as MTN (JSE code: MTN) and Vodacom (JSE code: VOD) is that they are essentially utilities and should be priced as such.

But actually that statement is wrong.

Sure voice (who still calls using voice?) and data are utilities like water and electricity.

BUT the telcos have a problem, capex.

Yes we're using more and more data but prices keep coming down, I recently bought an effective 80 GB for little over R400. And all that while capex is increasing. They're busy rolling out 5G but as soon as that's done it'll be tine for 6G. It's a never ending tread mill.

Simon Shares

- Brent oil is weak and telling us a story about global growth

- Clicks (JSE code: CLS) vs. Dis-Chem (JSE code: DCP) results contrats.

Updating minister Gordhan's portfolio

Public Enterprises Minister Pravin Gordhan has declared his holdings, we reviewed his portfolio last time in April and there are some interesting changes, he is fairly active in buying and selling. Most notable is the total value is up almost R2million?

Simon Shares

- Purple Group* (JSE code: PPE) have introduce a platform fee. Certain behaviours will see the fee waived and I speak to Charles Savage on my MoneywebNOW show Thursday morning.

- Renergen* (JSE code: REN) results show a loss, LNG output for phase 1 ±40% and helium on stream by year end. Phase 2 has been split into two parts and the conditions of the $750million is not a Nasdaq listing but rather a capital raise with a listing for part two of phase 2.

- MTBPS was bleak as expected and we could see some tax hikes in February.

- Gold almost had its highest ever monthly close for October.

Living small, an update

Back in 2017 Simon and his wife down scaled into a small (relative) apartment and also got rid of one of their cars again. As they now move again Simon updates in their experience of living small.

Simon Shares

- Famous Brands (JSE code: FBR) results. Revenue up and HEPS lower.

- TigerBrands (JSE code: TBS) loses their CEO and posts a decent trading update.

- Jamie Dimon said central banks’ forecasts have been “100% dead wrong”.

- Sasol (JSE code: SOL) trading update, lots of movingp arts, but the market not trusting management? That said stock is cheap and we're seeing some upward movement on price.

hh

Renergen* (JSE code: REN), now what?

Late September the price started breaking down and end September a Tweeter started posting about them.

I'm not going to defend every point raised, that's the job of the company and after an initial poor response, Monday saw a more detailed SENS.

Paid research.

Ultimately all research is paid for. Sometimes it is paid for by the company and here the issue is disclosure.

I think the bigger issue is a complete lack of disclosure in our industry. By FinTwit or the fancy analysts, albeit assume the latter is always talking their book, which is fair.

Perhaps the biggest point from this last few weeks is;

- Know your stock. Like really know it. When I buy a new holding I put together a lis of 3-5 things I like and 3-5 risks. I may be wrong on any of them, but it makes me do the digging and at least have a decent view of both sides of the story.

- Careful of "new" news. It may be accurate (or it may not), but it also often lacks detail which maters. This was mostly the case with the Twitter news on the stock.

Now what for Renergen

- Results next Friday.

- LNG is flowing.

- Helium is not, but company has said they expect the leak repaired this month.

- In short they are in the same place as they were before all this started. BUT.

- They need to do a US capital raise and list in the Nasdaq. A low share price makes this much more dilutive. How this will play out I have no idea.

I hold and continue to hold Renergen*. It was never going to be smooth sailing and the risks are real. Yes they have the gas and helium in the ground, phase one is half working but phase two is large, complex and expensive with real risks.

Simon Shares

- Middle East war could get really bad for inflation and rates if oil prices rise markedly.

- Decent Calgro M3* (JSE code: CGR) results.

- Horror Pick n Pay (JSE code: PIK) results.

- Local ETF total returns over the last five years.

There are bold traders. here are old traders. There are no bold and old traders.Bold traders

What is a bold trader and why do they die out?

- Wild swings for the fence

No position size management

Stop loss for losers

Enter outside of system and process

Simon Shares

-

Famous Brands (JSE code: FBR) trading update, Spur (JSE code: SUR) really has taken the mantel of best QSR/restaurant business on the JSE.

-

Very strong US jobs and upward revisions from previous month. But wage inflation only 0.2%. So market was confused but ended happy. Tuesday also saw US 10-year yields moving lower which excited everybody. But I am sceptical, this is only one data point and I think the FOMC hikes at their 31 Oct/01 Nov FOMC meeting.

-

Water crisis. This is going to hurt and it not going away any tine soon. Which businesses get hurt most?

US 10-year yields highest since 2007

Bad news all round (unless you buying).

Almost 40% of US government debt expires in the next four years and will be re-issued at markedly higher rates, 9x higher in some cases.

Money flowing into US bonds for yield.

- This sees less money entering the stock market

- Sees a stronger US$ (check DXY strength, all currncies weaker against US$)

Hits valuations lower as higher rates makes cash worth less in the future, but so far the market has ignored this fact.

Simon Shares

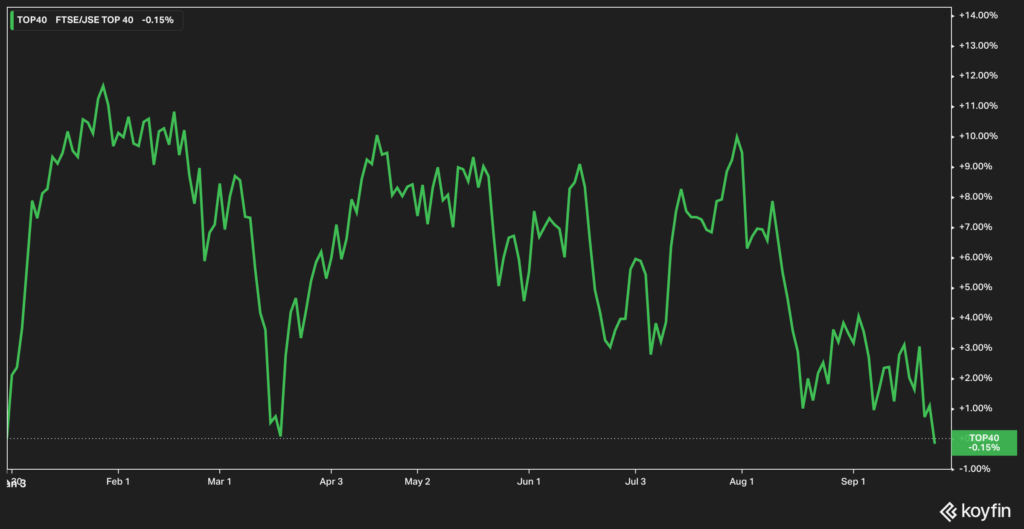

- The Top40 closed negative for the year on Tuesday. This after being almost +12% in late January and trading at all-time highs.

Simon Shares

- Shoprite* (JSE code: SHP) results "2023 was extraordinary".

Chart by Koyfin 15% discount for first 2 years

- Richemont (JSE code: CFR) getting interesting, let's see if support holds.

- [caption id="attachment_40005" align="aligncenter" width="849"]

Richemont weekly ~ 07Sep23[/caption]Nampak (JSE code: NPK) nil paid letters are trading, code NPKN. Remember either sell them or take up the rights.

Richemont weekly ~ 07Sep23[/caption]Nampak (JSE code: NPK) nil paid letters are trading, code NPKN. Remember either sell them or take up the rights. - Calgro M3* (JSE code: CGR) trading statement, HEPS +20% for the first six months ending August.

- The latest PMIs out of Europe all quite weak, not only declining from the previous month, but lower than the preliminary numbers from the middle of last month

- Profit from the Longevity Boom with Healthcare ETFs

- The tax ABCs of buying a property

Simon Brown

Simon Shares

- Bidcorp - excellent

- AvdTech* - really good, stock at all-time highs

- Stadio - good student growth

- Motus - poor HEPS, good dividend

- Woolies* - not bad, but wow only got R1.1billion for David Jones

- Sasol - impairments galore

- Adcock Ingram - capacity utilisation is weak

- Aspen - good second half

- KAP - tough out there

- Super Group - strong numbers

dd

Spur and Calgro M3, two stocks I have been watching and both have seen their prices break higher.

- Calgro M3 (JSE code: CGR) builds lower income housing and after a few troube years os back on track.

- Latest results were for year ending February 2023.

- PE ±2.5%

- Cash on hand ±R172million, market cap is ±R440million

- NAV 951c (including unused land valued at ±30% of NAV) while share price 365c

- Spur (JSE code: SUR) sells fast casual food and the pandemc hurt. Latest results have some base effect as they are for six months ending June 2023.

- Forward PE ±5x

- Dividend yield ±14%

- Spur remains their key brand.

Simon Shares

- Thungela (JSE code: TGA) results saw HEPS down 67% which is the same as the price of coal over the last year.

- UBS cuts China's GDP growth forecast for 2023 from 5.2% to 4.8%

- CoreShares ETFs name change to 10X.

- Local inflation for July was 4.7%, a really strong number and better then the market expected, this even as administrative prices kicked in during July. Transport was negative for the period.

Charts by Koyfin 15% discount for first 2 years

China in trouble as economic data keeps on disappointing?

Chinese data keeps disappointing, every since the -7.5% export data from April. Expected was a strong rebound after they lifted zero-covid restrictions. But not happening.

Just this week;

- Among 70 Chinese cities, 49 saw a fall in new home prices month-on-month in July from 38 cities the previous month.

- China suspends youth unemployment data after record high.

- Over the last decade they’ve halved the number of indicators they publish.

- Retail sales lower

- Industrial production lower

- fixed asset investments lower

Simon Shares

- MTN (JSE code: MTN) results had an interesting update on their fintech business. reports were they would list it, but for now Mastercard has taken a stake valuing the business at ±R100billion while MTN market cap is ±R250billion.

- Satrix is shutting down three of the ETFs they got from Absa. They are the Volatility Managed ETFs. They two small and not core to teh Satrix startegy. If you hold them on close 29 September you'll be paid out the NAV. The three are;

- STXMEQ

- STXDEQ

- STXGEQ

- Buying the Nasdaq local or offshore? Which is better?

- Every time is actually different

- How to double your retirement fund

Aspen looking cheap?

Aspen (JSE code: APN) announces a acquisition in Latin America for US$290m on a price/sales of ±3x and PE of ±5x. This is a classic Stephen Saad sort of deal. Strong cash generation to pay down the debt.

After having gone quiet when the balance sheet case under serious pressure (with debt of ±R50billion) Aspen is back?

Chart looking good for a break higher.

Forward PE of ±12x is below 1 standard deviation over last twenty years and looking cheap.

Charts by KoyFin, click here for 15% off a two year subscription.

Simon Shares

- FOMC raised 0.25% as expected last week. In the press conference Powell suggested no recession coming and with inflation for June at 3% has the fed successfully threaded the inflation needle without any serious repercussions (so far)?

- MTN (JSE code: MTN) trading update, 169c cost for 'currency moves' likely the Nigerian Naira devaluation.

- Prosus (JSE code: PRX) agrees to sell part of PayU to Rapyd for $610m. They’ll keep the Indian market part of the business.

- How is your crypto taxed?

- Nominal vs effective interest rate, know the difference.

Central bakers have very few tools to achieve their mandates around inflation (and in some cases also protecting a currency and aiding GDP growth). Interest rates have a blunt lagged effect and their only other tool is what they say and we need to understand this central banker speak.

Last week it was the South African Reserve Bank MPC rate announcement that left prime unchanged for the first time since November 2021. The vote was close and the governor spent a lot of time saying they had not finished hiking, this was just a pause.

The Federal Reserve FOMC has been saying the same about pausing before more hikes.

But any hikes will surely be data dependent which is what they always say. So the threat of more hikes is central bak speak for don't get too excited.

Simon Shares

- Shoprite* (JSE code: SHP) trading update shows just why they are the best food retailer in South Africa, even probably the world. This as they had to spend R1.1billion on diesel for the 52 weeks. This will hurt margins, but they're still profitable.

- The Rand is on a tear, and this time it is not US$ weakness nor commodities booming. It's just good old fashioned people buying our Rand.

- Global luxury ETF, better than buying the watch

- Reducing tax on interest earned

As expected Local CPI for June came in at 5.4%, lowest in twenty months and well within the 3%-6% target range from the South African Reserve Bank. Yes base effect as June last year was the first +7% inflation print of this cycle.

When do we start talking rate cuts? Truthfully not yet, a pause would be nice eve as the gov always targets 4.5% not the range.

Simon Shares

- MPC is Thursday, I expect no raise and can we start talking about rate cuts yet?

- USDZAR currency forecasts from Goldman Sachs:

- End 2024: 16.00

- End 2025: 15.00

- End 2026: 14.00

- Decent UK inflation as it dropped to 7.9% for June vs. expected 8.2%. But still highest in Europe. Italy 6.9%, Germany 6.4%, Netherlands 5.7%, Euro area 5.5%, France 4.5% & Spain 1.9%.

- Pick n Pay (JSE code: PIK) very poor update. "SA sales declined 0.3% (0.0% like-for-like)" while "internal selling price inflation" was 9.5%, so they went backwards at a fairly alarming rate

- ArcelorMittal South Africa (JSE code: ACL). Monday CFO quit after just two weeks and then Tuesday a horror update.

- Transnet selects a private port operator to run the container terminal in Durban.

- Koyfin 15% discount for first 2 years

- The Indian Nifty 50 at all time highs and we have an ETF for that.

Simon Shares

- US inflation for June was 3.0%, expected was 3.1% and previous 4.0%.

- Next FOMC meeting is 25/26 July.

- I think they still do a 0.25% rate hike, but then maybe pause for good, well until cuts start next year.

Nasdaq100 special rebalance to cut the 'Magnificent Seven' to "address over concentration in the index by redistributing the weights."

Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla are the magnificent seven. They account for 55% of the index.

- Effective close 21 July

- Done twice previously; December 1998 and May 2011.

- The combined weight of the five stocks with the largest market caps will be set to 38.5%, currently it is 46.7%.

- Nasdaq100 is a modified market capitalisation index. So market capitalisation is not the only consideration, albeit is the biggest contributor.

- Overall this has already seen some selling in the big five, and buying in those that are expected to be weighted higher. Final weightings will be announced after close in Friday 14 July.

The Four Horsemen of Big Tech

A phrase coined in the late 1990s for Microsoft, Intel, Cisco Systems and Dell Computer as they stormed higher in the dot com craze.

All had horrid collapses and took o a decade plus to recover their dot com levels and Cisco and Intel have been modest investments at best with Dell delisting.

Are we seeing the same with the magnificent seven?

Yes, no, maybe.

It is different this time, they all have real tech and make real profits. But have they gone wild on the AI bonanza? Absolutely. Now sure, AI will only get better and all seven have a real chance of be the real leaders in the space (in different ways). But valuations are stretched and this current earnings season is important as are the next few as well.

Two-pot system is confirmed, here all the details

- Starts 1 March 2024

- All future reg28 and pension contributions will be split into two pots

- One third savings

- Two thirds investments

- You can withdraw the savings component before retirement

- Tax still payable

- Existing funds will convert automatically into the new two-pot system

- Of existing funds R25,000 will be transferred into the savings pot

- Concerns about everybody taking out their R25,000 and crashing the market are over done.

Simon Shares

- Top ETFs so far in 2023, so +50% returns in just six months.

- New-vehicle sales in SA +14% for June. But last year June Toyota Durban was still closed after flooding. But still a decent number.

- Pep (owned by Pepkor) has started offering credit to customers, they own Capfin so have experience in lending.

- China will control exports of some metals used in the semiconductor industry. Gallium and germanium are considered “minor metals.” They're not rare but costly to produce and China supplies ±80%

- SARB says fight to tame inflation monster is paying off. First time he has even hinted that maybe inflation is coming down.

SA Inc watch list.

Building a list of stocks that are cheap, very cheap, and could give good return n the next year or three. Criteria;

- Must be profitable, so positive PE ratio

- Must be cheap, so PE below 8x

- Small as in market cap under R8billion

- No REITs

Using Koyfin I get 46 stocks including REITs and detail them in the podcast. I'll create a watchlist on Google docs and share that link in time.

What about just the mid cap ETF from FNB? FNBMID. Sixty stocks but problem is the top holdings are; Sibanye-Stillwater*, Discovery*, Nedbank, Bidvest and Remgro. That's already ±25% of the ETF and none really for my requirements as above.

Simon Shares

- Local crypto exchange, Revix, suspends trade or withdrawals on 24% of client crypto assets as their South Korean partner has issues with a provider.

- Naspers (JSE code: NPN) & Prosus (JSE code: PRX) plan to remove the complex web of cross holdings to a simple structure whereby Naspers owns 47% of Prosus who owns the stake in Tencent (Hong Kong code: 700).

- Good Invicta (JSE code: IVT) results.

- Rand all over the place.

- Brent weak, surely suggesting the global economy is weak. But so far the promised 2023 recession has not arrived, remember the hard vs. soft landing debate of late 2022?

Simon Brown

Local CPI 6.3% for May (lowest since April 2022) from 6.8% in April and vs expected 6.5%. A very good number and we should see June below 6% as June last year was the first +7% in this cycle at 7.4%. Simple base effect should put some serious pressure on inflation over the next few months.

So is inflation largely over locally? Probably.

Can we start talking about when the MPC starts cutting rates? The next MPC rate announcement is July, the day after we get June inflation and we'll see that the governor says. But cuts are maybe fourth quarter fo this year, at soonest. Standard Bank thinks another 0.25% hike later this year and consensus is cuts only starting next year.

Simon Shares

- UK core inflation rises from 6.8% to 7.1% and CPI 8.7%. They are in trouble.

- Standard Bank (JSE code: SBK) trading update. Very much two parts, bad debts are ugly and profts are lookign great. They also expect a 0.25% rate increase in the second half of the year?

- Afrimat (JSE code: AFT) deal to buy Lafarge for ±R1billion. String vertical intergration and potential to boost profits to essentially be paying around a 3x PE. They also say that it looks lie constructions has bottomed in 2022.

- Omnia (JSE code: OMN) results. Agri struggling with margin pressure, ining booming while chemicals slips. But overall good and stock si cheap.

- Transaction Capital (JSE code: TCP) secures funding for Gomo. Securing the capital was a major market concern and now they have a bak using their balance sheet and they earn a margin. Good deal but market still selling.

- How to Diversify Your Commodity Exposure With the PICK ETF

- Dividend portfolio paying monthly

dd

Disappearing dividends

Just this week Spar (JSE code: SPP), MultiChoice (JSE code: MCG) and Telkom (JSE code:TKG) have all cut dividend to zero.

We had big dividend payer Coronation (JSE code: CML) drop theirs to provision for the SARS fine and historically good dividend payer Pick n Pay (JSE code: PIK) reduce theirs.

This shows the pain that companies are experiencing, not all, but certainly some, It perhaps also shows quality, for example Shoprite* (JSE code: SHP) increased their dividend.

The problem is we love dividends for cash flow and they tend to grow ahead of inflation, sometimes well ahead of inflation. They're also taxed better than traditional income from bonds or cash (albeit not as low as CGT). But the downside is that any dividend can disappear at any time.

For investors such as myself, reduced dividend is not a big problem. I like the cash flow but don't need the income for expenses. For those living on dividends the pain is real. If the income is required you need a good amount of bond and cash investments and REITs that aside from the pandemic pay consistently, albeit REITs reduced over the last 5 or 6 years.

Another option is something like dividend aristocrats (we have a local and offshore ETF for these). Here we have companies with decade long track record of paying dividends, but remember Steinhoff (JSE code: SNH) was in the local dividend aristocrat ETF, so even this is not guaranteed. But a basket or ETF works well.

Simon Shares

- US CPI for May 4.0%, lowest since March 2021.

- Latest IEA global oil market outlook: peak oil combustion by 2028?

- Petrol demand to peak this year

- Road transport oil demand peak 2025

- All transport by 2026

- Overall oil for combustion peak 2028

- ZAR 18.33

- Massive moves expected in Richemont (JSE code: CFR) on Thursday 15 June as the index rebalances. Could see ±R4billion of selling.

Simon Brown

Simon Shares

- SEC sues Binance and CEO for U.S. securities violations.

- SEC Charges Coinbase for Operating as an Unregistered Securities Exchange, Broker, and Clearing Agency.

- First quarter GDP was 0.4% and we avoid a technical recession.

- Pepkor (JSE code: PPH) price slide.

- Tigerbrands (JSE code: TBS) horror results.

- Oceana (JSE code: OCE) results knock it out the park.

Sun City visit. Excellent resort, but very quiet which many commentators suggest is because it's a random weekend in June?

I sent this past weekend at Sun City, vacation club. Some thoughts.

The resort is world class, well maintained with a ton to do for kids and adults.

1/n pic.twitter.com/29yaV2GP8b

— Simon Brown (@SimonPB) June 5, 2023

Buying SA Inc.

Not yet but building a watch list with the plan being to buy 10-15 stocks over the months ahead.

Why?

- Inflation comes down

- Rates decrease

- Load shedding ends (Renewable Energy Grid Survey points to 66 GW development pipeline in South Africa).

- Government finds a way out of the ICC Putin arrest warrant mess.

- Rand improves (already 100c better than the R20/US$ of last week)

- I hold ungeared positions.

Simon Brown