Jun 29, 2022

Simon Shares

- Episode #500. Huge thanks to all, I go into some background about the show. Where and how it started, lessons learnt and more.

- Stage 6, the Rand lost 30c.

- Sun International* (JSE code: SUI) update for five months to 31 May 2022 shows they are nearly back at pre-pandemic revenue and this while we still had some restrictions and fewer international travellers.

- Naspers (JSE code: NPN) / Prosus (JSE code: PRX) results. Tencent (Hong Kong code: 700) is 125% of profits. The other businesses are all loss-making and in tough markets. They plan to sell down Tencent and buy back Prosus shares, but the discount to NAV remains around 50%, even after a massive move on the announcement.

- Grindrod (JSE code: GND) good update and share has been flying. This remains a very cyclical business and right now the cycle is paying off.

- Invicta (JSE code: IVT) saw strong results albeit some accounting points improved them a bunch.

- JSE (JSE code: JSE) trading update is surprisingly strong with HEPS expected +24%-32% for six months ending June.

Jun 22, 2022

Simon Shares

- Thungela (JSE code: TGA). Coal prices doing great, production is good but rail is the problem but HEPS is expected at 5800c. If we double for the full year we can expect ±R116 and a dividend of ±R100?

- Stor-Age* (JSE code: SSS) results are not exciting but steady.

- Omnia (JSE code: OMN) results were really strong, another special dividend and good future prospects.

- Orion Minerals (JSE code: ORN) raises money to get their Prieska up and running. Expected to take some 19 months.

- Amazon prime coming to South Africa next year. It will seriously challenge Takealot, owned by Naspers (JSE code: NPN)).

- City Lodge* (JSE code: CLH) trading update show them cash flow positive with occupancies back in profit.

Crypto in trouble

Not an inflation hedge nor a store of value. Just another risk asset. The problem is as QE ends and rates rise, will it still see a strong inflow of money? I think not.

It's not the end crypto, but new highs could be some way off.

Jun 14, 2022

Simon Shares

- US May inflation, 8.6%. Federal Reserve announced rates last night and surely it was 0.75% for the first time in 28 years?

- Either we have continued high inflation or a recession, maybe even both?

- Time for a Paul Volcker and do a 1% raise?

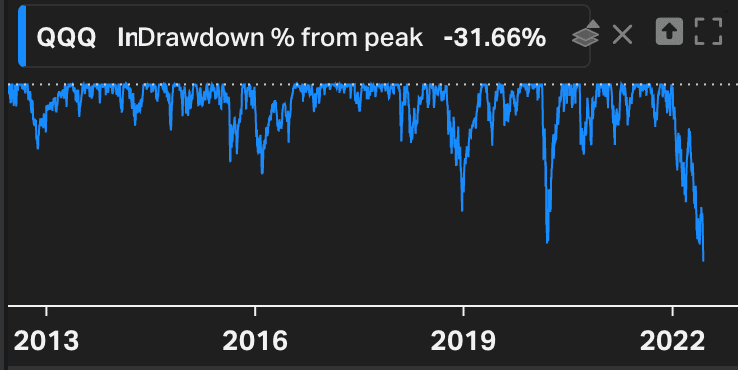

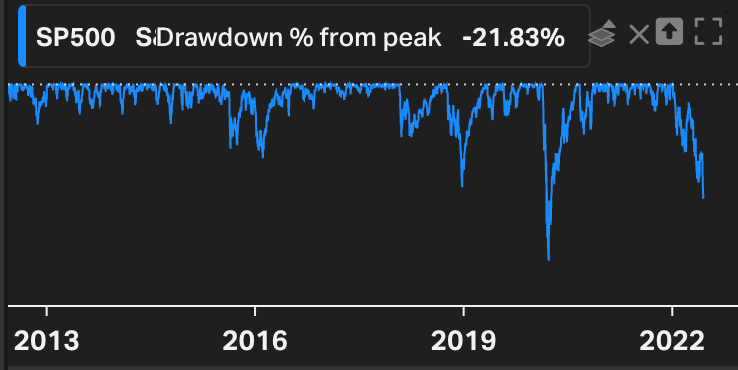

- It's ugly, Nasdaq and S&P500 both closed at lows for 2022 and are both are now in a bear market.

S&P500 draw down at close 13Jun22

S&P500 draw down at close 13Jun22 - And failing a real test or liquidity and exchanges halt withdrawals.

Jun 8, 2022

Simon Shares

- Sygnia (JSE code: SYG) results and a forward dividend of maybe as high as 10%.

- Local GDP at 1.9% for Q1 2022. The economy has now recovered to its pre-pandemic levels.

- Consumer cracking? I interviewed Evan Walker 36One Asset Management.

- Inverse ETFs that go up as the market falls.

Upcoming events;

[events_list limit="3"]

ddd

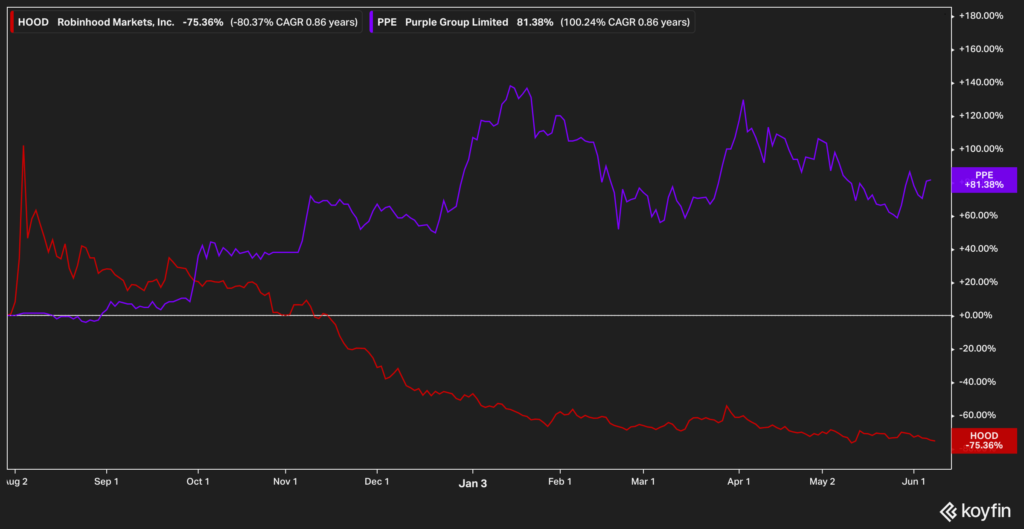

Are Robinhood's troubles Purple concerns?

[caption id="attachment_34522" align="aligncenter" width="761"] Robinhood since listing vs. Purple Group[/caption]

Robinhood since listing vs. Purple Group[/caption]

| Robindhood | Purple Group |

|---|---|

| (Nasdaq code: HOOD) | Purple Group* (JSE code: PPE); |

| Listed July 2021 at $38, hit $85 and now under $10 (-75%) | July 2021 145c, high since 350c and now 260c (+81%). |

| Makes most of their revenue from selling the deal flow and Gold accounts. | Revenue is from transactions. |

| The majority of transactions are in options or crypto. | The majority of transactions are in equity, but crypto, EC10, is growing. |

| Needed a quick $billion to settle meme stock trades. | The balance sheet is fine. |

| Huge repetitional damage when they halted trade in some meme stocks. | |

| Value traded by clients has been falling since Q1 2021. | Value traded by clients fell in the last set of results. |

| Not yet profitable. | Profitable, PE ±50x. |

| Users declined in 2022. | Users grew in last results to +1million active accounts. |

| Market cap per user = $478 (ZAR7,400) | Market cap per user = ZAR3,263 |

| Revenue per user (2021) = $80 (ZAR1,250) | Revenue per user = R109 |

Jun 1, 2022

Simon Shares

- The good news is the US had a green week last week, for the first time in 8 weeks

- Goldfields (JSE code: GFI) is down on news it paying a chunky 33.8% premium to acquire Canadian Yamana Gold in an all-share deal

- We finally got the petrol price increase and the 150c fuel levy reduction remains in force, for now.

- German inflation hits 7.9% for May. Highest since the 1950s. EU inflation for May 8.1%, the highest ever.

- EU agrees on a partial ban on Russian oil imports

- Monthly dividends in a JSE equity portfolio

- Offshore ETFs paying monthly dividends

Demand destruction in commodities

There comes a point at which a commodities price is simply too high and the price itself reduces demand. Depending on the commodity high prices often need to be high for protracted periods of time.

©JustOneLap.com