Oil below US$ 80, the first time this year.

-

- OPEC+ made no production changes.

- EU price cap on Russian oil. Done via insurance, but will it work and if it does will oil not move higher?

Simon Shares

- Nampak (JSE code: NPK) results and book build. Worth a speculative punt after the rights issue is done?

- Solid Sygnia (JSE code: SYG) results and strong dividend.

- RMI becomes Outsurance on the JSE, code OUT.

- China zero-covid.

- Local GDP, better than expected.

- Worst ETFs of 2022

- Position your portfolio for 2023

Simon Shares

- MPC upped rates 0.75% with more expected in the new year.

- Solid City Lodge* (JSE code: CLH) update with November occupancies at 60%.

- Rand below R17/US$ and more strength expected.

- Top40 sneaks green for the year after a rough ride.

- This is why we hold

- And don't panic

- Markets recover

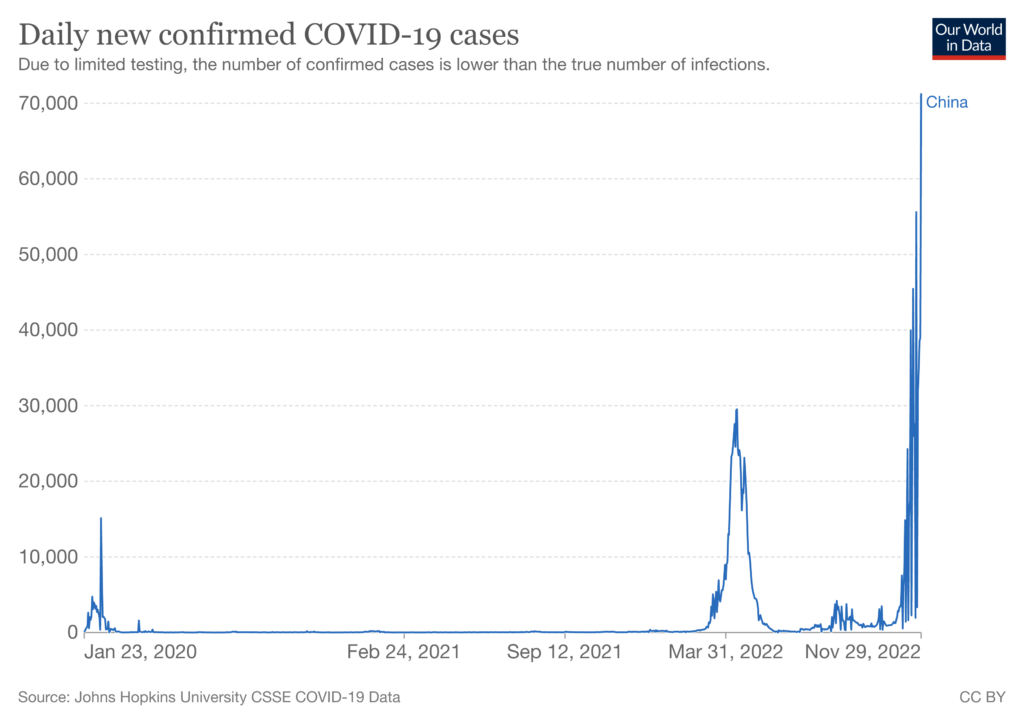

Chinese covid-19 cases hitting new records, by a long way.

This has real implications (bad ones) for the global economy as the second largest is going to be struggling in 2023.

Chinese covid cases since the start of the pandemic

Simon Shares

- Renergen* (JSE code: REN) did a small capital raise and the market not liking after they said earlier in November they wouldn't do one.

- Cilo Cybin will not be listed on the JSE. They planned to raise R500million but only got R20.5million. Those who applied will be refunded.

- Local October CPI was 7.6%, up from 7.5% and vs. an expected 7.4%. Expect MPC to do 0.75% and two 0.25% next taking prime to 11%.

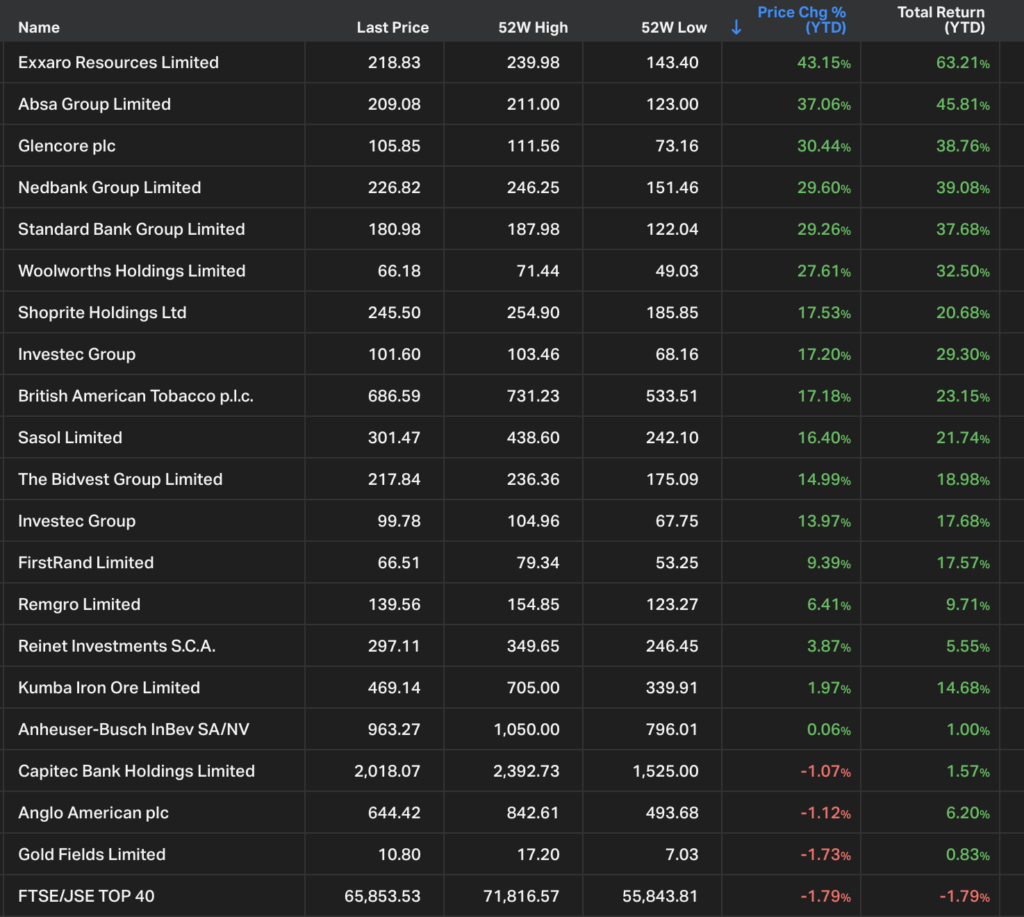

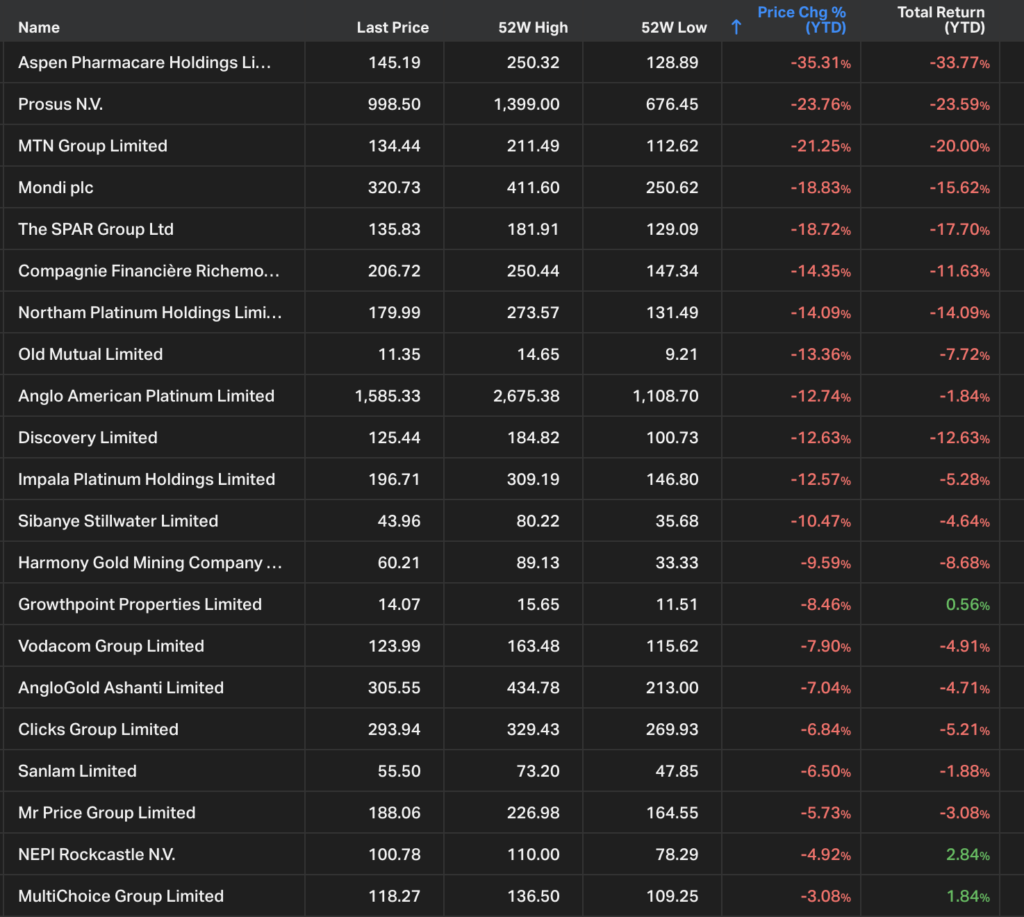

Locally 2022 has not been all horror

It feels really bad but the JSE has had a fair year with sen decent winners as the two images below show.

JSE Top40 stocks year-to-date. (winners)

JSE Top40 stocks year-to-date. (losers)

Binance buys FTX.

No, they walk away.

FTX goes bust.

Keep your coins in a hardware wallet, not on the blockchain unless you trading it. I use a Ledger Nano S Plus.

What's the future for crypto with another exchange hitting the wall?

Simon Shares

- Results wrap;

- Purple Group* (JSE code: PPE)

- Stor-Age* (JSE code: SSS)

- Ninety One (JSE code: N91)

- Transaction Capital (JSE code: TCP)

So you bought a stock and it's done good and you're making money, maybe even lots of it.

Now what?

- First, why did you buy it? That'll often help you decide when to sell.

- Second, is it still going up? Have a line in the sand, using charts, at which you sell.

- Third, is the news still all good? Bad news means to sell.

Simon Shares

- US inflation due Thursday, expected is 7.9%.

- Binance buys FTX

- Time for gold?

- Murray & Roberts (JSE code: MUR) sell Clough for very little but get rid of a lot of inter-company debt.

- Leisure stocks looking good, especially the Sun International* (JSE code: SUI) chart.

- "However, due to the immense interest from the public, as well as international investors to date, we decided to extend the period by 2 more weeks. This will allow for the investors that missed the deadline, to be part of this amazing opportunity to own shares in Cilo Cybin Holdings.". Not a good sign.

- Elon Musk sells Tesla (Nasdaq code: TSLA) shares worth US$4billion after saying in April he would sell no more. But this should be enough to keep Twitter afloat for the next year.

- Meta (Nasdaq code: META) to fire 11,000 workers, about 13% of the workforce.

After the results, are any FAANGs worth buying?

FAANGs, a mixed bag with Meta (NASDAQ code: META) the biggest loser.

Is it worth buying or what of the other FAANGs?

Apple (NASDAQ share code: AAPL) and Amazon (NASDAQ code: AMZN) would be my picks. Why buy the losers?

Simon Shares

- RMI, I got confused between RMI and RMH last week. Former is becoming Outsurance.

- Capital & Counties (JSE code: CCO) trading update shows strong leasing activity at Covenant Garden.

- Octodec (JSE code: OCT) results, discout to NAV +50%, dividend yield ±14%.

- Sasol (JSE code: SOL) convertible bond issue essential a back door right issue. Bonds expire in five years and convert into Sasol shares at US$20.3863.

- RSA Retail Savings bonds now offer 11.5% fixed for five years.

fff

Go where the money is

The Fini15 (JSE code: STXFIN*) is the only green index so far in 2022 and the strongest bank YTD? Absa (JSE code: ABG).

Simon takes us through the journey of finding the strongest sectors and then the strongest shares to find a trade where the money is.

Simon Shares

- Niche JSE listed property stocks, there are a bunch of them and they're mostly looking good.

- Famous Brands (JSE code: FBR) results are back at pre-pandemic levels.

- MTBPS

- Buy triggers on Nasdaq and S&P500

My lazy system has triggered buys on both S&P500 and Nasdaq. A close above last night's close and I'll be long pic.twitter.com/8HAisLdPZr

— Simon Brown (@SimonPB) October 26, 2022

Murray & Roberts (JSE code: MUR) horror update.

"working capital requirements are especially acute"

"financial results for the six months period ending 31 December 2022, to be at least 100% down"

This is not South Africa at all, it's Australia and the US. We've seen Wilson Bayly (JSE code: WBO) walk away from their Australian operations.

Low margins and bankers not keen on bonding projects are going to crunch this industry globally. I would suggest Aveng (JSE code: AEG) is not immune either.

The only time this industry really made money was in the run-up to the world cup, and they were colluding to get operating margins of +5%. So really this is a bust industry.

That all said, decent results from Calgro M3 (JSE code: CGR) while we wait for Balwin (JSE code: BWN).

Simon Shares

- MTN (JSE code: MTN) ditches Telkom (JSE code: TKG) over their Rain talks.

- Pick n Pay (JSE code: PIK) results. Not bad but the market hated selling the stock down 9.3%. Is the issue valuation? Forward PE is ±29c vs. Shoprite* (JSE code: SHP) is on ±21x.

- Combined Motor Holdings* (JSE code: CMH) has great results driven by car rentals surging. But it going to be tough going from here.

- UK inflation returns to a 40-year high of 10.1%.

Simon Shares

- Remgro (JSE code: REM) plans to unbundle its stake in Grindrod (JSE code: GND). There were ideas that maybe Remgro would take out Grindrod, but the unbundling is going in a different direction and Remgro unbundles shares they don't want. Remember also that after the unbundling expect weakness in the Grindrod share price for a few weeks.

- They've held them since 2011 and hold a 24.81% stake

- For every 100 Remgro you'll receive 30.70841 Grindrod shares.

- Last day to trade (LDT) is 11 October 2022.

- You'll receive them with a base cost that Remgro paid, that value is still to be determined.

- Barloworld (JSE code: BAW) trading update is not bad. The big news is that they plan to list Avis by year-end.

- Tiger Brands (JSE code: TBS) trading update was solid off a low base. The chart looks bullish as it rose +10% on Monday after the update. Chart looking decent and a potential delisting target?

- The UK is an absolute mess.

Here the UK 5, 10 & 30 year bonds for September .(with correct carts) . Just September pic.twitter.com/hMj5yP65bC

— Simon Brown (@SimonPB) September 28, 2022

Rampant Dollar

The US$ Index (code: DXY) is at twenty-year highs and within a few percent taking out the highs from the early 2000s and heading back to levels last seen in the mid-1980s.

The reasons are simple and two-fold;

- The world is scared and fear sees investors rushing to the safety of the US$.

- Rising rates in the US now see the US ten-year treasury bills trading around 4%, the highest level in over a decade. So investors can flee to the US$ and buy 10-year bills for a ±4% return.

Importantly this is hitting every currency in the world.

Has earnings implications for US companies selling products offshore as those profits are now lower due to US strength.

When does the strength stop?

- In the short-term a pullback is likely.

- But as long as fears remain the strength will continue and could continue well into next year.

What to do?

- Don't panic.

- Consider some JSE listed currency ETFs.

- Continue with your offshoring strategy.

The tables have turned. Emerging markets are much more resilient against the US Dollar than the rest of the G10. Year-to-date, the Dollar has risen a stunning 15% against the G10 (black), but only 5% against emerging markets (blue). EM is the new standard bearer for stability... pic.twitter.com/ToaQvQB9DS

— Robin Brooks (@RobinBrooksIIF) September 27, 2022

hh

Simon Shares

- FedEx (NYSE code: FDX) spooks the market by withdrawing guidance and saying demand is collapsing.

- Thungela Resources (JSE code TGA) went ex-dividend to 6000c.

- Wilson Bayly (JSE code: WBO) is letting their Australian operations go bust, not giving any more financial assistance.

Has inflation peaked?

- Local inflation down at 7.6% for August from 7.8%.

- US August inflation at 8.3% from 8.5%.

- UK August 9.9% from 10.1%.

- EU 10.1% up from 9.8%.

- Europe and UK still have a winter of energy crisis to contend with.

- US and local looks to have topped, but energy/petrol still needs watching.

- Food inflation remains high and remains a risk.

- A recession will dampen demand and help inflation lower.

- Transport costs are down.

BUT, what of interest rates?

The problem is getting back to target.

- Locally 3%-6%

- US 2%

Rate increases still coming, likely into the new year before pausing.

Then the long wait for inflation to get to target (or near) before rates start coming down. In the US this is at best 2024 but probably 2025. Locally rates may start moving lower in early 2024.

Simon Shares

Trading

- Trading in the Zone – Mark Douglas (detailed review)

- Trend Following – Michael Covel (detailed review)

- Reminiscences of a Stock Operator – Edwin Lefevre

- Market Wizards - Jack Schwager

- The Complete Turtle Trader: How 23 Novice Investors Became Overnight Millionaires - Michael Covel

Investing

- The Little Book of Common Sense Investing - John C. Bogle

- One up on Wall Street – Peter Lynch (detailed review)

- Common Stocks and Uncommon Profits – Phil Fisher (detailed review)

- Effective Investor – Franco Busetti

- The Little Book that Beats the Market - Joel Greenblatt

General

- Thinking, Fast and Slow - Daniel Kahneman

- Fooled by Randomness - Nassim Taleb

Simon Shares

- Anthony Clark on small caps

- Purity baby powder products were recalled by TigerBrands (JSE code: TBS) due to traces of asbestos.

- PSG (JSE code: PSG) unbundling effective at close on Tuesday. Holders at the close will receive

- 3.87 PSG Konsult (JSE code: KST)

- 1.82 Curro (JSE code: COH)

- 0.12 Kaap Agri (JSE code: KAL)

- 1.04 CA Sales (JSE code: CAA)

- 1.02 Stadio (JSE code: SDO)

The bear and bull case for investing in Shoprite

Shoprite* (JSE code: SHP) results saw the stock down 7.5%. Let's dig into what the market maybe didn't like.

- Only 10% earnings growth?

- With one week less and the 2021 riots in the numbers, decent albeit not knock the lights out.

- Only 600c dividend for the full year?

- Very much in line with the average.

- Expensive on PE of over 20x?

- Always is, but mid-range is about 15% lower. So yes, maybe a little more than usual?

- Opening 275 new stores?

- Cost and are they cannibalising their other stores?

- RSA operating margin 6.8%?

- The top end of the long-term range, worries that it may move lower?

But Shoprite remains one of the best food retailers globally and a core holding in my portfolio. I have bids in the market at around R170 which would put it on a PE closer to the mid-range from the last decade.

Sixty60 grew 150% and remains the absolute market leader in the grocery delivery space.

Checkers Xtra Savings has 24.7m members and it turning into a bank account.

- Sold my Murray & Roberts (JSE code: MUR)

Murray & Roberts weekly chart

Not a lekker chart, I've held for a while, but am now out #JSE pic.twitter.com/BKKP4HOLhr— Simon Brown (@SimonPB) September 4, 2022

Simon Shares

- Save R500k with a deposit.

- ETF closing prices are an absolute mess.

- Cashbuild (JSE code: CSB) results see them coming back to earth after a pandemic boost.

- Education stocks all published results. ADvTECH* (JSE code: ADH) is my pick, but all showing student growth and cash generation.

- Shoprite* (JSE code: SHP) gets permission to turn their money market account into a bank account. Grindrod (JSE code: GND) currently runs the service for Shoprite and African Bank is buying Grindrod Bank.

- Walmart (NYSE code: WMT) is set to make an offer to the Massmart (JSE code: MSM) minorities for the remaining 47% at 6800c.

- Netflix (Nasdaq code: NFLX) plans to price its ad-supported plan at $7-to-$9 per month with about 4 minutes of adverts per hour.

- Purple Group* (JSE code: PPE) back at 203c, always be very careful of casing a news story (the Asia deal announced last week with very few details).

- Tsogo Sun Hotels (JSE code: TGO) changes its name on 7 September. They will become Southern Sun Limited (JSE code: SSU).

- UK inflation, Goldman Sachs now saying 22% is possible next year.

- Sun International* (JSE code: SUI) strong results. Consumers under pressure shouldn't hurt too much as they mostly target higher LSMs and they paid the first dividend (88c) since 2016. Currently, ±3200c is resistance.

Greylisting

Financial Action Task Force (FATF)

- Cracking down on money laundering and funding terrorism.

- Greylisting can reduce a country's capital flows by as much as 7.6%, according to an IMF working paper.

- Cabinet has approved a raft of new amendment bills but leaving it late, very late.

Our deadline is September/October after being put on the watch list last year.

The important questions;

- Will we get greylisted?

- What happens if we do?

- If greylisted, how do we get off the list?

Simon Shares

- Nasdaq (650 points), S&P500 (80 points) & Euro Stoxx50 (22 points) trades all closed. FTSE100 still going currently +100 points.

- Old Mutual BEE deal, will go into details, but it only closes in late October so no rush.

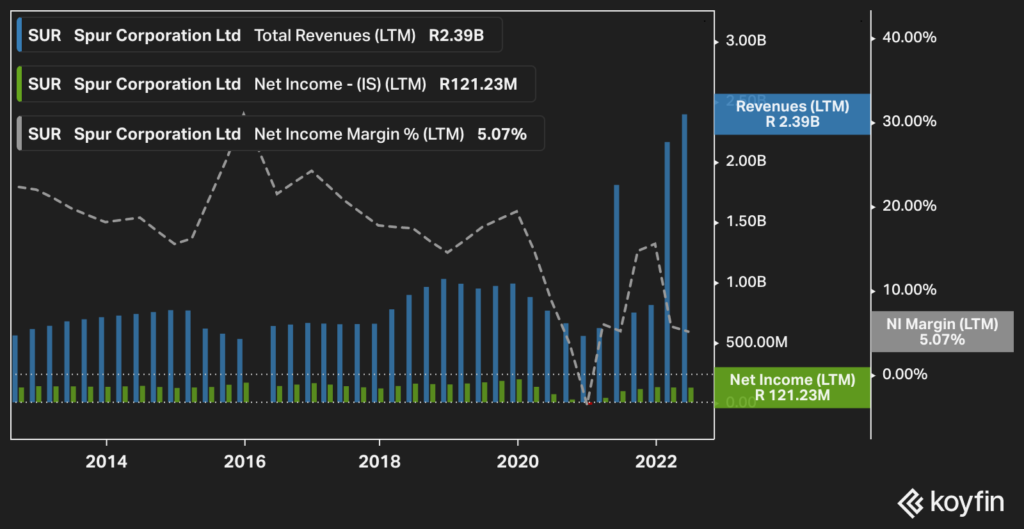

- Spur (JSE code: SUR) looking very good.

- PE ±15x and DY ±5%

- From the Spur earnings call "And we know that only 18% of the South African adult population represents 80% of economically viable consumer segment."

- Revenue at record with space to get margins back to pre-pandemic levels. Net income margin was ±5%, historically over 20%.

- [caption id="attachment_36416" align="aligncenter" width="849"]

Spur; revenue, net income, NI margin[/caption]Afrimat (JSE code: AFT) Gravenhage manganese mine deal failing due to the Water Use License being materially different. They raised ±R650million last month.

Spur; revenue, net income, NI margin[/caption]Afrimat (JSE code: AFT) Gravenhage manganese mine deal failing due to the Water Use License being materially different. They raised ±R650million last month. - Purple Group* (JSE code: PPE) does a deal in Asia.

- Kap Industrials (JSE code: KAP) good results and great insights into other industries.

- Citi now says UK inflation to hit 18% early next year (last week they said 15%).

- Sasol (JSE code: SOL) pays a dividend, 1470c.

Sasol: To answer a separate Q:

The EBIT profit split is:

•Energy: 58%

•Chemicals: 42%

(Despite the high chemicals contribution, it is amazing to see how closely Sasol’s profit still conforms to the old back-of-a-matchbox calc of 5% of the Rand oil price.)— Karin Richards (@Richards_Karin) August 23, 2022

Simon Shares

- BHP Group* (JSE code: BHG) results, have we peaked?

- Absa (JSE code: ABG) results, but maybe the ore important point of the results is their expectation that prime will hit 11% early in 2023.

- Chip shortage seems to be easing.

- Nasdaq is in a bull market, +20% off mid-June lows.

- Brent oil falling.

- Current petrol price reduction is 260c for September.

- UK inflation is 10.1% for July.

- Charles Savage tells us his fav ETFs

- Rochelle Writes, pay down debt or save more with high rates.

Thungela resources (JSE code: TGA) still a buy?

R60 dividend, 40% forward DY

HEPS 6723c, forward PE 2.5x

Mis-priced at listing, unbundling often cause this to happen.

Ukraine's war gave it new legs.

Risks

- Coal price

- Rand strength

- Ukraine war

- Transnet

Simon Shares

- Renergen* (JSE code: REN) the Central Energy Fund has successfully completed their due diligence on the R1billion, final approval is still required.

- Mpact (JSE code: MPT) results.

- US jobs data and unemployment continue to belie the recession talk.

- US inflation for July was 8.5%, a good number.

- A gallon of gas has fallen below $4 in the U.S. for the first time since March.

- Credit Suisse has lowered its 2023 UK GDP forecast to -0.6% from 0.5%; expects the UK to enter a recession from Q4 2022 until Q3 2023.

- Elon Musk sold $6.9-billion (R14.5-billion) of his shares in Tesla (Nasdaq code: TSLA) – his largest sale yet – saying he may need the cash if he has to buy Twitter (NYSE code: TWTR).

Embrace the risk

- Investing is about risk

- Without risk, there is no reward

- Without risk, you are saving

- But the risk needs to be reasonable and the returns realistic

Simon Shares

- Massmart (JSE code: MSM) update, retail margins are being squeezed, the exception is clothing retail.

- Thungela Resources (JSE code: TGA) very strong trading update.

- JSE (JSE code: JSE) results, strong.

- Nancy Pelosi lands in Taiwan and markets don't really care and China will complain - but this is not leading to war.

- Uber (NYSE code: UBER) finally hits cash flow positive.

- OPEC+ 100,000 b/d output hike, expectations (hopes?) were for 4-5x that and the second smallest increase since 1986.

- Earn 11% with Retail Savings Bonds

What's the only thing we control in markets

- The price we pay

- Everything else is beyond our control

- So use your one power carefully

Simon Shares

- New energy rules for South Africa. Who wins?

- Silverleaf Investments on Easy Equities. Know what you're buying.

- Food retailer updates, Shoprite* (JSE code: SHP) winning. Pick n Pay (JSE code: PIK) bounding back and Woolies* (JSE code: WHL) struggling.

- Cashbuild (JSE code: CSB) and Mr Price (JSE code: MRP) updates show consumers under pressure

- IMF upgrades SA GDP growth for 2022 to 2.3% up from 1.9% they expected in April.

- Results from Kumba Iron Ore (JSE code: KIO) and Anglo Platinum (JSE code: AMS)

- US data Wednesday and Thursday.

- Omnia (JSE code: OMN) was ex-div 800c on Wednesday and is now back in the longer-term channel. If you've been waiting to buy, now's your chance.

Simon Shares

- Local June inflation, 7.4%, MPC tomorrow.

- BHP Group* (JSE code: BHG) update, they are worried.

ArcelorMittal South Africa (JSE code: ACL) trading update says global growth and recessions fears "present challenges for the outlook of commodities and steel demand in the next 12 to 18 months.". - China's holdings of U.S. debt fell below $1 trillion for the first time since 2010

- Alviva (JSE code: AVV) delisting at 2500c.

- Brent oil trade keeps on trucking, buy below $100 exit $113.

Brent oil

Brent oil- Nasdaq, triggered a buy, waiting for confirmation which is a close above 12,250 while 7 EMA remains above 21 EMA.

- Building resilient portfolios for tough markets

- Lithium & Battery Tech ETF

- Stats and data on 95 years of bear markets. How much longer? How much lower?

Simon Shares

- US June inflation 9.1%, and core inflation was also up a 5.7%!

- Still stage 4. Rand continues to weaken.

- Back backs between 4 July 2022 & 8 July 2022

- Naspers JSE code: NPN) bought 659,095 shares at an average price of R2 648.3315/share for R1.745 billion (US$104.73 million).

- Prosus (JSE code: PRX) bought 6,240,339 PRX shares at an average price of €67.1361/share for €418.95 million (US$428.59 million).

- SARB now considers cryptocurrencies as a financial asset and will create regulations around them. This means cryptocurrencies can be listed on SA exchange platforms but the process will take 12-18 months.

Dividends, love them but be careful.

- But we also need to remember a few important things about dividends.

- They can disappear as we saw in 2020. Even the most stable dividend payer can stop paying. REITs which have to pay them by law being a REIT structure) stopped paying because payment would see them fail their solvency tests.

- They are backwards-looking. A high dividend yield is certainly attractive, but is it because the price has been falling? Could this be a warning of a dividend cut?

- Cyclical stocks (think commodity stocks) pay massive dividends sometimes, then nothing for years.

- Boards can change the cover ratio. This is the percentage of HEPS they pay as dividends. In tough times they can cut them. As the company matures they pay more.

- Progressive dividends are the worst. The idea is that every year the dividend goes up a set percentage regardless of profits. A few local stocks have tried the idea, all have abandoned the idea.

- Cash dividend vs. script dividend. I'll usually take the script.

Simon Shares

- Still stage 6. Rand continues to weaken.

- Naspers (JSE code: NPN) and Prosus (JSE code: PRX) both are holding well after the hard run the previous Monday on results and buy-back news.

- Resources under pressure, all of them.

- Supply chains adjusting

-

- Just in time is now just in case

- Higher inventories

- Higher costs

- More localisation

-

Upcoming events;

Simon Shares

- Episode #500. Huge thanks to all, I go into some background about the show. Where and how it started, lessons learnt and more.

- Stage 6, the Rand lost 30c.

- Sun International* (JSE code: SUI) update for five months to 31 May 2022 shows they are nearly back at pre-pandemic revenue and this while we still had some restrictions and fewer international travellers.

- Naspers (JSE code: NPN) / Prosus (JSE code: PRX) results. Tencent (Hong Kong code: 700) is 125% of profits. The other businesses are all loss-making and in tough markets. They plan to sell down Tencent and buy back Prosus shares, but the discount to NAV remains around 50%, even after a massive move on the announcement.

- Grindrod (JSE code: GND) good update and share has been flying. This remains a very cyclical business and right now the cycle is paying off.

- Invicta (JSE code: IVT) saw strong results albeit some accounting points improved them a bunch.

- JSE (JSE code: JSE) trading update is surprisingly strong with HEPS expected +24%-32% for six months ending June.

Simon Shares

- Thungela (JSE code: TGA). Coal prices doing great, production is good but rail is the problem but HEPS is expected at 5800c. If we double for the full year we can expect ±R116 and a dividend of ±R100?

- Stor-Age* (JSE code: SSS) results are not exciting but steady.

- Omnia (JSE code: OMN) results were really strong, another special dividend and good future prospects.

- Orion Minerals (JSE code: ORN) raises money to get their Prieska up and running. Expected to take some 19 months.

- Amazon prime coming to South Africa next year. It will seriously challenge Takealot, owned by Naspers (JSE code: NPN)).

- City Lodge* (JSE code: CLH) trading update show them cash flow positive with occupancies back in profit.

Crypto in trouble

Not an inflation hedge nor a store of value. Just another risk asset. The problem is as QE ends and rates rise, will it still see a strong inflow of money? I think not.

It's not the end crypto, but new highs could be some way off.

Simon Shares

- US May inflation, 8.6%. Federal Reserve announced rates last night and surely it was 0.75% for the first time in 28 years?

- Either we have continued high inflation or a recession, maybe even both?

- Time for a Paul Volcker and do a 1% raise?

- It's ugly, Nasdaq and S&P500 both closed at lows for 2022 and are both are now in a bear market.

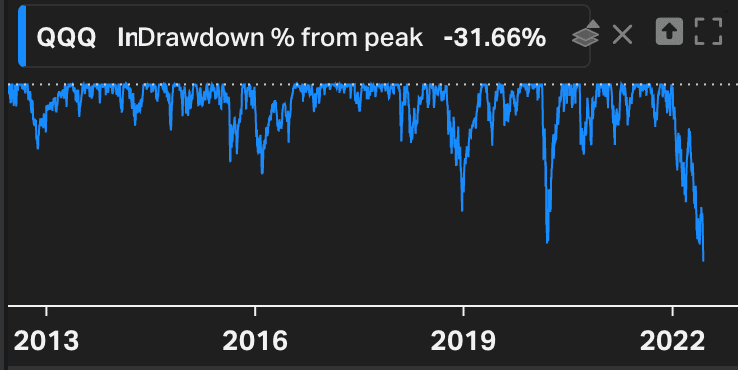

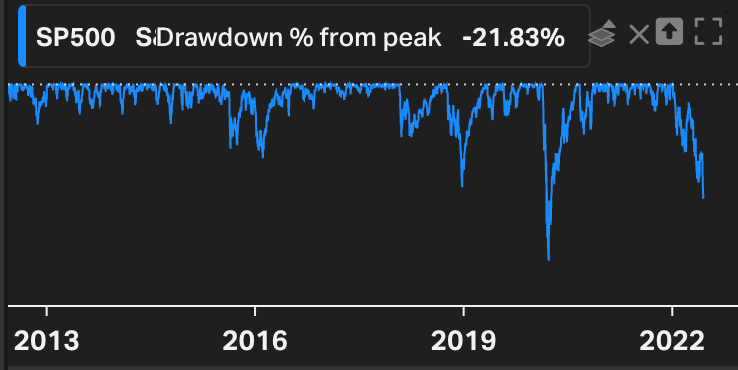

S&P500 draw down at close 13Jun22

S&P500 draw down at close 13Jun22 - And failing a real test or liquidity and exchanges halt withdrawals.