Simon Shares

- Shoprite* (JSE code: SHP) trading update sees full year profits down. But the real point is that the second half of the year was way better than the first half as they fixed DC and IT issues and had no further strike action. But it is still tough with lots of products in deflation which is squeezing margins.

- Massmart (JSE code: MSM) update was a shocker with Game bleeding like crazy. Not a surprise, but as Nic Norma-Smith said on Twitter "Wal-Mart paid $2.3bn for 52% of Massmart in 2010. Today the stake is worth $370m.". Ouch.

- NFEMOM*, the ABSA momentum ETF has been flying and is almost +20% year-to-date and just behind the S&P500 and best over last year (of indices, local and sub, that I track). I always like momentum and when ABSA changed the methodology of this ETF I switched my personal momentum portfolio into the ETF. Just as I did this everybody claimed momentum was dead, and the ETF struggled. But momentum never dies, even when (if?) value ever comes back, those value stocks will gain momentum and so momentum traders will profit.

- Loser indices so far year-to-date are the banks and mid caps, both slightly negative (excluding dividends). The resource index is doing well enough, but the industrial has actually beaten it - likely driven by Richemont* (JSE code: CFR) and Naspers (JSE code: NPN).

- ASX finally breaches the pre crisis levels and makes a new all-time-high, 12 years later.

- Nicky Newton-King is resigning as CEO of the JSE. She's been a great CEO transforming the technical side of the JSE during a period when values traded have been falling off a cliff. On that note, September sees the Naspers (JSE code: NPN) listing their non-SA assets in Amsterdam and while that could in itself see a bump of some 4% to the Top40 - it's going to hurt value traded even further with maybe as much as R1-R2billion of daily trade leaving to trade on Amsterdam instead.

- We think our local property space is having a tough time. But check the Intu (JSE code: ITU) results. A horror show with like-for-like net rental income down 7.7% and guidance for rental growth of -4% to -6%. Capco (JSE code: CCO) a little better and they're splitting out Covent Gardens (their prize asset) but it still tough and the share price remains under pressure while Intu share seems to be racing to the bottom.

- Fall out from Boris Johnson win and insists on a hard Brexit is not so much in the markets, but the currency as Sterling continues to slide to the lowest levels since 2017. This helps much of the FTSE100 as foreign earnings dominate.

- If you get the pamphlet about investing in 72 tonnes or either; iron ore, coal or magnesium. Throw it away, it's a scam, especially the part about holding for 18 months. That will be one massive warehouse bill.

- Another week and platinum continues to edge higher now around US$880.

- The final report of the presidential advisory panel on land reform and agriculture (aka #EWC) was released over the weekend and frankly it is exactly as expected. Sober and sensible. Yes lots of hysteria, there will always be, ignore it, it's mostly ill informed or just based on fear or hate.

- Understanding the SYGEU.

- Money Hacks: Bring down insurance premiums.

- Upcoming events;

- Subscriber to our feed here

- Sign up for email alerts as a new show goes live

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Kumba (JSE code: KIO) results saw production down, but with the average selling price up 57% at US$108 / tonne - they shot the lights out. But this is surely the top here? Rumours are that Vale has iron ore on the water heading for China and slower Chinese GDP may hit demand, sending iron ore back to a more sensible price around US$70 / tonne?

- Platinum continues to edge higher.

- Remember S12J? You could invest in a funds that invested into startups (within certain rules). Then whatever you invested would be deducted from your taxable income (on condition you held for 5 years) and tax would only be CGT, albeit on a zero cost basis. Government is now proposing a limit of R2.5million per person per year. Frankly for the vast majority, this is a non event as that's serious money.

- Alexander Boris de Pfeffel Johnson is the new Prime Minister of England. What one may think of him, markets don't care and for traders / investors that's what matters. That said, hard Brexit remains a stupid idea.

- IMF cutting global GDP growth, including our own. Now they're not always right, in terms of exact numbers they are seldom spot on. But the trend from the IMF has been edging lower for a while now, and on the trend they usually are right.

- I have a new show on BusinessDay TV - The Small Cap Portfolio. Monday live at 6.30pm and repeated during the week or on YouTube. I get one guest and we talk about two stocks of their choosing. We're not talking results, we're talking the profit drivers, risks and so on.

- Theo Botha points out on Twitter that; Pick 'n Pay Lead independent non-executive director Hugh Herman (75). Appointed to the board in 1976. How can this director still maintain his independence after 43 years on the board?

Pick n Pay Lead independent non-executive

director Hugh Herman (75) Appointed to the board in 1976 How can this director still maintain his independence after 43 years on the board?— Theo Botha (@tjbbotha) July 24, 2019

- From an intra-day high of 42% in 2012, Greek 10-Year yields have moved all the way down to 1.99%, their lowest level ever. US 10 Year Bond Yield: 2.07%. Never say never.

- Tax-free as you age

- Understanding the MAPPS Protect ETF

- Invest offshore with the JSE

How many shares to buy?

Two emails in the last week asked about how many shares to buy in any given stock. The problem is that this does not account for the cost of the shares. For example 10k shares in a R10 stock is very different from 10k shares in a R125 stock.

As an aside when I started trading warrants in the late 90's this was exactly how I traded. I bought 50k warrants regardless the price. So some times was R10k other times closers to R50k and my risk was all over the place.

The answer of course is simple, invest based on ZAR amount, not quantity.

I structure my portfolio with the core satellite approach;

- The core is around 55% in ETFs (tax-free maxed out every year)

- 30% in 'til death do us part' top quality stocks

- 8% in second tier small and mid caps

- 7% for trading ALSI futures and ETFs.

The til death do us part is some 10 stocks so when I am buying, I buy at around 3% of total portfolio. Of course as they moves the weightings get our of sync, I manage that by adding new money to other stocks or in some cases selling down when the weighting gets wildly out of sync.

But quantity of shares is not important.

A last point because I get this question all the time. People want a 'penny' stock below 100c because then it can double in price. Any stock, regardless of price can double in price and cheap does not make it easier.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- S&P500 above 3,000 and Dow Jones above 27,000.

- EOH (JSE code: EOH) have found R1.2billion of bad deals over 4 years, 2013-2017. A new dawn, I think so, but I would add a very slow dawn.

- Platinum starting to look decent? We have higher lows and two higher highs. A close above US$910 (still a way off) and things looking real strong. If you're long PGM miners. If not an entry on pull backs looks smart.

- Woolworths* (JSE code: WHL) trading update excited the market and shows a much improved second half, especially in food (expected) and clothing (not expected). Australia remains under pressure but overall good and the real question is if it's a new trend or a one off?

- Anheuser-Busch InBev (JSE code: ANH) has suspended the listing of their Asia-Pacific business that would have seen almost US$10billion being raised. The reason given is tough market conditions but the bigger issue is they wanted the cash to pay off part of the massive debt bill from buying SABMiller - so for now they remain with too much debt.

- FIRE at any age

- Property investment is better together

- Upcoming events;

- 18 July ~ JSE Power Hour: How to invest offshore with the JSE

- 14 August ~ JSE Power Hour: Live Fat Wallet Show

Where are the sellers?

There seems to be bad news every which way you turn, or is there? Trade wars, Iranian war, US tax receipts collapsing and so the list goes on. Yet markets remain in full bull mode albeit with two wobbles recently. Late 2018 and May this year.

The question is why, this is an old bull. In fact this is the longest bull ever and second best in terms of returns, one would think it would be frail and fragile - but no it remains strong.

I suspect part of the reason is that low interest rates and QE in Europe continue to drive buyers who are flush with cash and keen to park it somewhere, anywhere for a return that is positive.

We also have record low bond rates (even negative in many parts of the world worth some US$12trillion) so if you're looking for returns then you have to be invested in stocks to make any real returns.

German bonds issued at -0.75% and over subscribed but likely the ECB bought most of them? But this closes many investors out of the bond market if you want/need positive returns.

A last reason is likely FOMO. Those holding stocks are terrified of missing out so they're simple not selling and any weakness sees them buying and buying.

This will change eventually. Markets will fall and those buyers will turn into sellers. But for now don't stand in front of a raging bull and tell him to stop. He'll just run you over on route to new highs. The trigger is more likely to be higher rates and we seem to be a million miles from that.

This does of course feed into a bigger issue, all the new debt. Now sure central banks are buying much of the debt, but low rates mean more debt generally and how does it all get paid off? Long-term does the planet need a debt forgiveness plan to survive? How does that work and how does it not crash the entire system we have?

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- CSEW40* change confirmed for next Wednesday, it'll now be SMART.

- Trade peace, kinda ~ for now. In classic Trump style, lots of huffing, puffing and threatening the blow the house down. Until a 'deal' is reached.

- Afrimat (JSE code: AFT) walks away from the Universal Coal deal. No details, but likely they didn't like what they saw? Respect, far too many deals get deal mania and concluded no matter what.

- PricewaterhouseCoopers has resigned as auditors of Group5 (JSE code: GRF). Now this is moot as Group5 is in business rescue with no chance of surviving and PWC cites heightened risks due to resignations of many senior execs. But one wonders if they'd had quit in the older auditing days?

- Upcoming events;

fff

- Download the audio file here

- Subscriber to our feed here

- Sign up for email alerts as a new show goes live

- Subscribe or review us in iTunes

Longest economic expansion ever

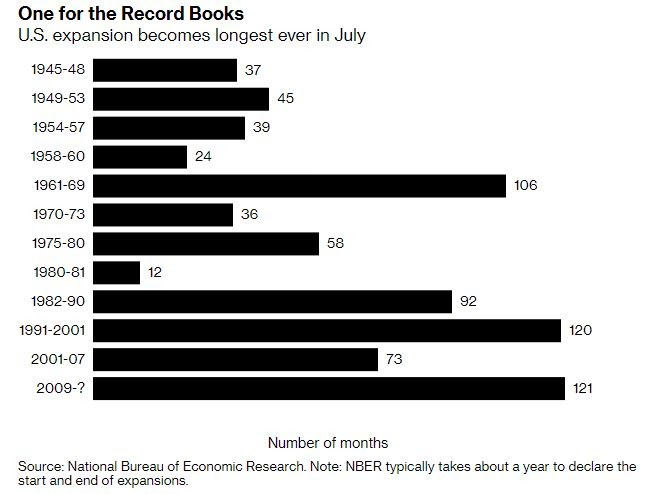

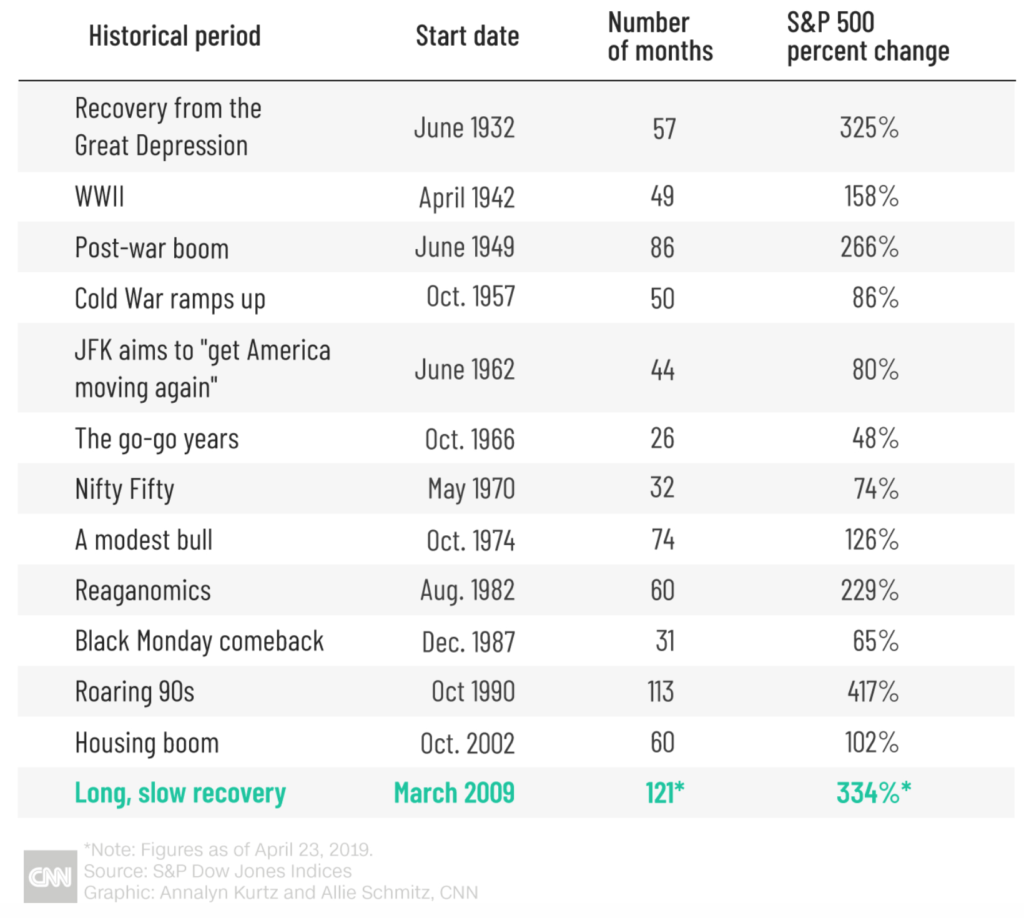

The current US economic expansion is now officially the longest ever at 121 months edging out the 1991-2001 120 month economic expansion and also the longest bull market at 122 months with the return still behind the 1990-2001 dotcom rally.

But this raises two issues.

Where's our rally? Nov17-Oct18 saw out market off more than 20% meaning the end of any bull and we're only up some 10% since the highs of Jun14, five years for 10% and we're +12% so far in 2019. Horror stats albeit we're up almost 400% from the 2009 lows while the S&P500 is up just over 400%. Both great returns (one naturally better than the other), and this does remind us to always think long-term and worry less about the immediate when investing because 400% is a great return over a decade.

Second issue is when does the US collapse? Short answer is no idea. But records are made for being broken and while the US economy doesn't look as strong as it has over many of the past 121 months, there's not yet any wildly flashing signs of concern.

Naturally a black swan is a potential risk, but then it always is.

But here's my question. The Fed looks like it may start reducing rates, all good. But then what happens when things go pear shaped and they have no space for further rate reductions? Negative rates in the Europe or US?

Currently there is some US$12trillion of corporate and government debt with negative rates which is just insane and shows that while markets have run (some markets), we're still feeling the impact of the 2008/9 crisis.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.