Offshore

/ Tech wild year

/ Oil goes negative

/ Gold breaks $2,000

/ Brexit

/ Tesla

Local

/ Sasol

/ Top40 green for the year & just off all-time highs

/ Even the Rand recovered most of the losses and trades better than 5 years ago

/ Budget deficit

/ Lots of business rescue, but less than I expected

Simon Shares

- Trellidor* (JSE code: TRL), I've been buying. We've seen DIY stocks doing well and small SA Inc shares surprise to the upside and I think this could be one of them. Interim is end December so an update should arrive mid-February.

- Sygnia (JSE code: SYG) results were really good. This stock was very expensive at listing and above 2400c in 2016 it was crazy. But price came down and earnings increased so now looking fairly priced and very well positioned in the low cost and passive space with even trading contributing around 25% to revenue.

- I received an email about being charged massive fees for a trade that happened over multiple days. This is not new and is how the JSE charges. Trades on one day, same stock and all buys or sells are bulked together and charged as one trade. But trades in separate days are each charged as a new trade and so the brokerage minimums hit and can hit hard, very hard. The way to avoid is when you get that SMS for first trade to adjust the price to ensure full quantity or do an at market trade.

- Next show will be 14 January; predictions with Marc Ashton, Keith Mclachlan and myself. We look back at the previous years and make new bold ones.

- Position your portfolio for 2021

2020 finished n klaar

I've lived a lot of years but no matter how many, none like this one. What is has done is force us to reflect on things. Frankly to reflect on pretty all things as everything got turned upside-down.

As an example, I 'had' to live in Johannesburg because of my TV work. Well, now we know that isn't the case as I have been doing weekly TV shows from my lounge since March. In the future, I continue doing TV work from my lounge, and that the lounge could be anywhere with high-speed Internet.

I also remember hard lockdown surrounded by all my 'things'. They did not make my life beautiful, I missed people and experiences.

I also remember my portfolio crashing and not even checking how bad it was. Markets recover, sure this recovery was swifter than anything I have seen before and made no sense. But markets often don't make sense and fighting them is fruitless.

It also gave us a real-time chance to measure a number of important investment considerations.

- How robust were the stocks you held?

- How diverse was your portfolio?

- Did you react accordingly?

- I sold some much-loved stocks that I thought would be in serious trouble and even bought a gold miner for the first time ever.

- Did you panic?

I did not get everything right, that truthfully is never the aim. But I also did not sit stuck like a deer in the headlights.

Point being, 2020 has been wild and we should reflect, reflect lots on our lives and or portfolios. If we do that right then we'll be stronger in the future.

Lastly, watch out for the push back. Lots of incentives to return to how it was, but is that what you want? Did you like the old way or do you see a new improved way or a blend? Decide and then make it happen.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ US$908billion stimulus plan proposed for the US

/ US markets at new highs

/ Salesforce buying Slack for US$27.7billion

/ Pfizer vaccine starts being administered this week in the UK

/ Oil moving higher

/ Gold bounces need to get above US$1,860

Local

/ Sasol update, likely rights issue will be smaller

/ Locusts in NC, WC & FS and returning rains

/ Barloworld results (and price surge)

/ Vukile benefiting from non-metro malls

/ Top40 closes Friday at third-highest level ever

/ Comair returns to the skies but not the market

Simon Shares

- Really strong November for stocks. France and Italy had their best months ever, S&P500 +11% and JSE +10%.

- The Pfizer / BioNTech vaccine has been approved for use in the UK starting next week. Limited supplies so front line workers and old people first. But this is good news and suggests that the news for 2021 will be more about rolling out of the vaccine albeit probably also lots of second and third waves. But there is a light at the end of the tunnel and it's not a train.

Upcoming events;

- 03 December ~ JSE Power Hour: Position your portfolio for 2021

- Bytes UK (JSE code: BYI) JSE listing is confirmed for next Thursday.

- Purple Group* (JSE code: PPE) very strong results for the year ending August 2020.

- Sygnia (JSE code: SYG) issue a strong trading update, HEPS expected 62%-67% stronger, results due on Tuesday.

- ASISA report record inflows into CIS in SA in Q3 while Q2 saw R88billion added as markets were collapsing. Peeps are smart.

- Decent bounce in gold, but still looking weak even as it moves above the 200-day MA. I hold Pan African* (JSE code: PAN) and continue to hold. The position is small and really is insurance for just in case. 2020 has been wild and I not placing bets in 2021 just yet.

- Aveng (JSE code: AEG) doing rights issue at 1.5c that will double the number of shares to 40billion! They'll then do a consolidation and always be short a consolidation.

- Sasol (JSE code: SOL) seems to have cleaned up much of the mess and old enough assets to make a rights issue below the upper US$2billion level. Coupled with oil looking like it may go higher is good news for the share.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ U.K. economy is forecast to contract by 11.3% this year, "the largest fall in output for 300 years," Chancellor Rishi Sunak tells MPs

/ Musk now the worlds second richest person

/ Janet Yellen tipped for Biden cabinet as Treasury Secretary

/ China imposing tariffs on Australia, especially their wine.

/ Down Jones trades above 30,000 for the first time.

/ Black Friday 2020 online shopping surges 22% to record $9 billion, Adobe says

Local

/ Huge $5billion share buy-back from Prosus and Naspers

/ Firstrand update "the earnings trend for the four months from 1 July 2020 to 31 October 2020 is reflecting a better than anticipated rebound."

/ EOH CEO, Steven van Collier testifies at the Zondo Commission

/ Lewis results and dividend results on a dividend yield of +11%

/ Acquisition and baby range expand Mr Price’s markets

/ Gold under serious pressure

Simon Says

- Another week another vaccine.

- U.K. economy is forecast to contract by 11.3% this year, "the largest fall in output for 300 years," Chancellor Rishi Sunak tells MPs.

- US Jobless Claims +30K To 778K In Nov-21 Week, secondly weekly rise. Continuing Claims -299K to 6,071,000 for Nov-14 week.

- Dow Jones trades above 30,000 for the first time on Tuesday & S&P500 closed at a new all-time high. Dow 20,000 was 25 January 2017 and 10,000 29 March 1999 (12,000 was September 2007).

- Lewis (JSE code: LEW) results with a 133c interim dividend. Double that for the full year makes for a yield fo some 11.9%.

- Stor-Age* (JSE code: SSS) offering their dividend as cash or new shares issued at 1240c. People asking what I'm doing? Taking the shares.

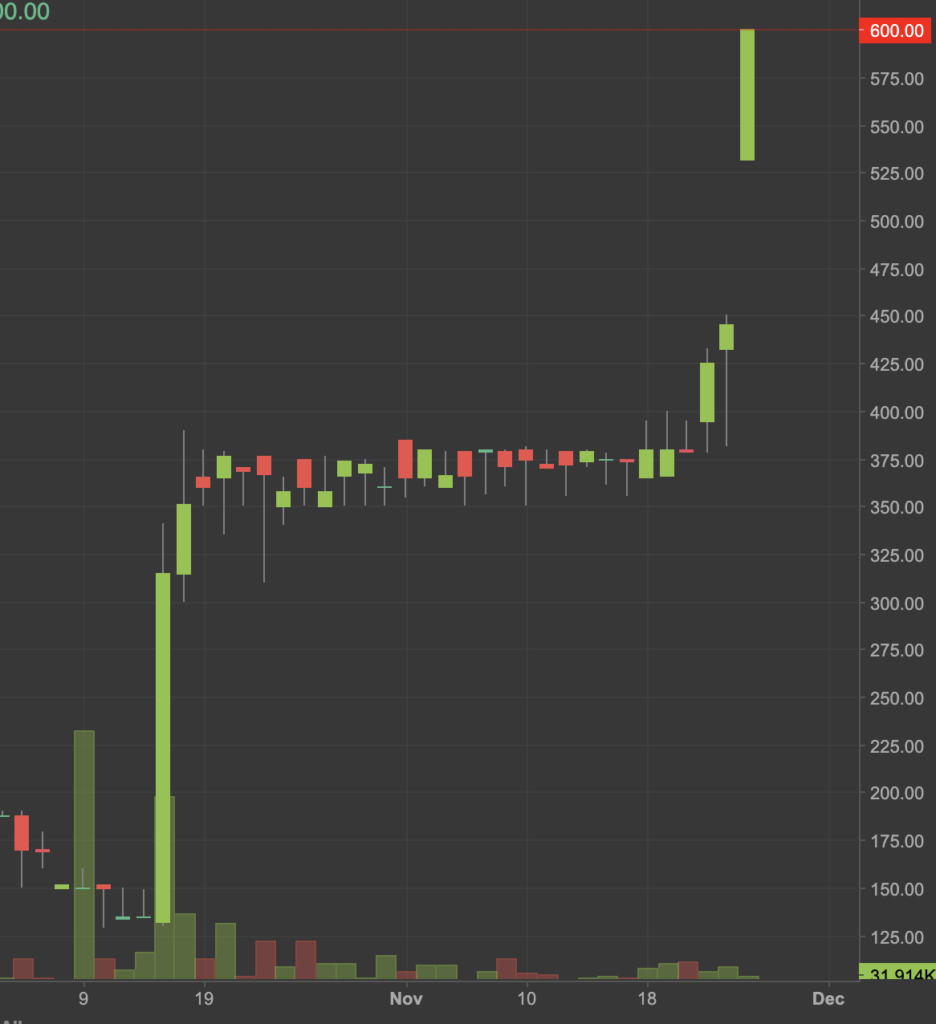

- Adcorp (JSE code: ADR), stock was 130c on 15 October ahead of their trading udate. Results in Wednesday saw it trading at 600c

[caption id="attachment_24206" align="aligncenter" width="888"] Adcorp Daily[/caption]

Adcorp Daily[/caption]

Upcoming events;

- 03 December ~ JSE Power Hour: Position your portfolio for 2021

Bitcoin is tiny, even at highs

Disclaimer upfront, I have been buying Bitcoin because I like to own things that are going up, my average entry price is R204k. This is a trade, so I will take my money at some point.

Looks certain to make new all-time highs and US$20k surely sooner rather than later.

Not a bubble this time, as it was in 2017. That doesn't mean can't collapse or can't become a bubble.

Interestingly the narrative has changed, the talk of Bitcoin for payments, something I said was a long long way off, is no longer the biggie. Now it really positioning itself as an alternative asset. Remember how blockchain would save the world?

But here's what was really interesting to me, the market cap of Bitcoin. ±US$400billion! Less than Tesla, in fact very tiny. Consider how many exchanges, blogs, shows and chatter about this one asset that is so very small. The size also restricts large institutions getting involved.

For comparison, gold is about US$9trillion, NYSE about US$30trillion and total US debt US$27trillion.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ Another Monday another vaccine ~ Moderna

/ 12 million Americans are on track to lose unemployment benefits in December if Congress doesn't extend key programs that were part of the CARES Act passed in March.

/ JPMorgan forecasts negative GDP in the first quarter, the first Wall St. bank to begin forecasting a negative reading. JPM expects the economy to bounce back in

/ Amazon moving into the pharmacy business

/ Boeing 737 Max is back

/ Bitcoin heading for new highs & FSCA proposes making cryptocurrencies an asset class.

Local

/ Moody’s & Fitch downgrade SA further into junk.

/ Somebody wants City Lodge East Africa hotels

/ Results; Stor-Age*, Astral Spar

Simon Shares

- Another week, another vaccine. This time from Moderna and also using the Messenger RNA as does the Pfizer / BioNTech vaccine.

- Stor-Age* (JSE code: SSS) results very solid.

- Wilson Bayly Holmes (JSE code: WBO) results not great as Australia hurts, again.

- Raubex (JSE code: RBX) announces an R2.87billion contract win from Sanral.

- Strong Spar (JSE code: SPP) results.

- Boeing 737 MAX 8 returns to skies as FAA lifts grounding order.

- Brait (JSE code: BAT) net asset value 771c (based on 9x EV/EBITDA), share price 388c.

[caption id="attachment_24160" align="aligncenter" width="888"] Brait monthly chart[/caption]

Brait monthly chart[/caption]

Upcoming events;

- 05 November ~ JSE Power Hour: Searching for income

- 19 November ~ JSE Power Hour: Twenty years of ETFs

Owning unlisted shares

In the last few years, we've seen a bunch of stocks being delisted from the JSE and in pretty much all cases existing shareholders get paid out and no longer hold the stock.

Anchor (JSE code; ACG) are now proposing a delisting at 425c, but with an option to remain invested in an unlisted Anchor.

I have never held an unlisted share outside of companies I have founded or worked for a few simple reasons;

- No JSE oversight

- Lack of communications to minority shareholders

- Majority shareholders acting as if it is their private company

- Zero liquidity to buy and sell

- Zero price discovery

- In short, being screwed over.

That said Anchor will very much still be in the public eye and this is not usually the case when a stock delists. That will help act as a guard rail (not that they need it) so maybe it will be fairer to minority shareholders.

Certainly, I think the 425c offering is very cheeky and I still don't want to hold unlisted stocks, for many this time may be the exception.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ Pfizer/BioNTech vaccine news

/ U.K. economy expands by 15.5% in the third quarter, the most on record yet adds another Sterling150billion in stimulus

/ Disney reports first loss in 40 years, but Disney+ hits 73m subs

/ Emirates eyes return to profitability in 2022 only

/ Deutsche Bank proposes a 5% tax for people still working from home after the pandemic

/ DoorDash files IPO plans, NYSE listing

Local

/ Lockdown level 1 lite?

/ Growth Point raises R4.3billion

/ SA’s unemployment rate 30.8% in Q3

/ Sun International update gives great insight into leisure locally.

/ Telkom results

/ MultiChoice results

Simon Shares

- US elections, everybody nows who won except the orange one and the GOP.

- Vaccine news from Pfizer and BioNTech has changed market behaviour. Banks and consumer stocks now the rage while tech and gold is falling.

- Locally banks are flying.

Interesting to see the JSE All Share up circa 14.4% over the last 6. months yet its biggest constituent Naspers only up 3.71% over the same period. A lot of underlying and broad strength. @SimonPB @CAPITALSIGMAza @smalltalkdaily

— Mark Tobin (@mtobinwex) November 11, 2020

Upcoming events;

- 05 November ~ JSE Power Hour: Searching for income

- 19 November ~ JSE Power Hour: Twenty years of ETFs

Bombastic billionaires*

Somebody strikes it big in one field, and now they think they're the smartest person in any field.

A CEO of a successful company leaves to start a new company, they just assume it'll work and investors believe them. We see this all the time.

The successful business person thinks they know how to run the government.

Heck, we see it during this pandemic when suddenly every second person was (and often still thinks they are) an epidemiologist.

There are some exceptions; Elon Musk and Steve Jobs two who come to mind.

The successful person also readily ignores the role of luck in their success. Fooled by Randomness by Nassim Nicholas Taleb.

The answer is simple. Just because somebody is great in one area, do not assume that they have any skills in any other area.

* Phrase stolen from Anton Harber

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ US elections over

/ US unemployment rate 6.9%

/ Ant IPO cancelled

/ BoE no change & QE increased by £150 billion to £895 billion

/ Berkshire Hathaway bought back a record $9 billion in stock in the third quarter

Local

/ Rand strength

/ Results; Dis-Chem, Richemont & Foschini

/ Aspen vaccine JV with J&J

Simon Shares

- US Election results pretty much playing as expected. Trump doing well in early counting but some important states still to come but he has declared victory and is heading for the courts.

Upcoming events;

- 05 November ~ JSE Power Hour: Searching for income

- 19 November ~ Twenty years of ETFs

Finding infrastructure stocks

Globally one of the key responses to the pandemic is and will be, infrastructure spend. Who are the potential winners?

- PPC (JSE code: PPC)

- Sephaku (JSE code: SEP)

- Reunert (JSE code: RLO)

- Consolidated Infrastructure Group (JSE code: CIL)

- WBHO (JSE code: WBO)

- Murray and Roberts (JSE code: MUR)

- Aveng (JSE code: AEG)

- Raubex (JSE code: RBX)

- Afrimat (JSE code: AFT)

- Brikor (JSE code: BIK)

- Stefanuti Stocks (JSE code: SSK)

- Kumba (JSE code: KIO)

- ArcelorMittal SA (JSE code: ACL)

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Distell Group (JSE code: DHG) issued a solid update albeit short on numbers with one exception. They reduced net debt by some R1.7billion which is a massive number.

- Pick n Pay (JSE code: PIK) is heading into Nigeria and the market is worried as Nigeria is littered with the bodies of corporate South Africa. But they are doing so in smaller regional malls and not going big, so if it fails it won't be costly.

- The Standard Bank (JSE code: SBK) update fits in with news out of a press conference of last week. 90%-95% of loans that took payment holidays are back and paying. A sold number, but it does show lenders are not yet out of the woods.

- Absa changing their distribution policy for the NFGOVI (tracking the top 10 bonds issued by the South African Government). Instead of reinvesting they will now payout distributions.

- Very strong update from Cashbuild (JSE code: CSB) with Q1 revenue up 22% and stock is up some 9% in the news.

Upcoming events;

- 05 November ~ JSE Power Hour: Searching for income

A robust strategy

The US election is some twelve days away and while the pundits have Biden as the clear favourite to become president and the democrats maybe even taking control of the senate. How much should one start adjusting ones portfolio?

Lot's of talking heads are spinning one story or the other as to how to position accordingly, of course, that's if the results go as they expect.

And sure, a Biden win will likely see changes to taxes in the US, a large stimulus come February and maybe a more social friendly budget (such as the Affordable Care Act from Obama).

But these talking heads are firstly short-term traders and really as a trader one should be responding to price action, not trying to predict legislation and the impact?

For a long-term investor chopping and changing every time there is a new president in the White House (or any other house) surely means you're strategy is not robust enough?

What I mean here is that politicians, political parties, polices and the like come and go. Sometimes quickly sometimes slowly. But our long-term portfolio needs to be able to manage all of these changes without having to consistently adjust things.

I always invest with one core long-term theme in mind that guides my investing. A globally growing middle class as people move into the cities and their quality of life and wealth improves.

From here yes tax rates and the like will have an impact. Bu not so significant that I'll have to switch stocks never mind strategy.

As a long-term investor make sure you have a simple and hence robust strategy that is largely immune to the noise emanating from politicians.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- PPC (JSE code: PPC) results. The $150million debt in the DRC is the problem. If they solve that they'll do a rights issue. If not they're bankrupt. The president's speech on Thursday should give them some hope as he likely promises lots of energy and infrastructure spending.

- Balwin (JSE code: BWN) results. Not bad considering, they paid a dividend and I like them at current prices.

- Coronation* (JSE code: CML) issued a good trading update. With Purple Group* (JSE code: PPE) they are my two preferred financial stocks for the post-pandemic bounce (actually making money during the pandemic.

- Keillen Ndlovu on local and offshore listed property.

- Subscribe to our feed here

- Sign up for email alerts as a new show goes live

Bankrupt

- There are a number of listed stocks in business rescue and I am getting asked all the time about when they start trading again.

Intu - Comair

- Basil Read

- Phumelela

- Others I forget about

Short answer, they won't start trading again and you'll get very little or no money back.

First SARS gets paid, then staff and debt holders and if anything is left shareholders will receive a few cents.

Now here's the thing. The company may survive and start trading again. Certainly, Comair and Phumelela look set to continue operations, but with new shareholders.

This is very much part of the business rescue process, the rescue part is about turning debt in equity and also new capital taking new equity. Existing shareholders get left carrying nothing.

Now, sure this sounds way harsh, but this is how investing works. We buy a business and we get all the rewards, reward that is unlimited in how big is can be. But if things hit the wall, we're last in line. So our downside is limited at 100% loss, but the upside is unlimited.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ The Congressional Budget Office estimates that, for the 2020 fiscal year, the U.S. deficit will be $3.13 trillion (15.2% of GDP). This number would cause the total U.S. national debt to come in at 102% of GDP in 2020, the first time since 1946 that the U.S. debt has been larger than its economy.

/ A new stimulus package on or off the table?

/ The U.K. economy grew by 2.1% in August, less than half the pace anticipated

/ JPMorgan says U.S. Capital Gains Tax hike (proposed by Biden) may briefly hit stocks

/ Robinhood says some customer accounts may have become the target of hackers

/ New iPhones expected on Tuesday, with 5G

Local

/ President Cyril Ramaphosa will address both houses of parliament on Thursday to unveil the long-awaited economic recovery plan for the country.

/ PPC results

/ Canal+ buys 6.5% in Multichoice

/ Spur update, strong recovery but early days.

/ FNB lists 20 ETNs over US-listed stocks.

/ Balwin results and the scuffle around Mooikloof

Simon Shares

- How to fix the JSE, some great ideas by Keith McLachlan.

- SARB buys R39.4billion of local government bonds in the secondary market in September.

- French Canal+ takes 6.5% stake in Multichoice (JSE code: MCG).

- Shoprite* (JSE code: SHP) says their loyalty program is a huge part of them gaining R4billion in market share? Launched a year ago it has over 5million members.

- Pick n Pay (JSE code: PIK) date saw "core retail sales - including food, groceries and general merchandise, but excluding liquor, clothing and tobacco - grew 8.7% year-on-year (6.4% like-for-like)."

- Sasol (JSE code: SOL) sells some LCCP for US$2billion, reduces debt burden to $8billion.

- Zeder (JSE code: ZED) keeps dividend and says conditions are improving. But no news on the new strategy.

- AdaptIT (JSE code: ADI) results after I recorded last Wednesday. The stock was at 120c and HEPS expected at +65c. The stock now 250c. The market gets it wrong sometimes, especially in the small-cap space.

- Fed chair Powell commenting Wednesday evening that more needs to be done and that the risk is not in doing too much stimulus, it is in doing too little. Trump has said no stimulus until after the election. The risk here is he loses and couldn't be bothered to do anything, so then we wait till late January to start talks again.

Upcoming events;

Where's the cash?

Cash is always king. Not only is it why we invest, to make cash. But cash is easy to see in the form of dividends and very hard to fake (albeit we have seen businesses take debt to pay a dividend, and if you do see this - run).

I've spoken before about the flood of rights issues hitting the market and we've seen about R50billion so far this year. But now we're hitting the crunch.

Early in the lockdown I warned that investors should have a good hard look at their companies asking if they'd need to raise capital and if the announced capital raise would be enough.

Key for me is that tough times are often tougher in year two. I remember this very clearly from the 2008/9 crisis albeit offset a bit by the world cup in 2010. But for example, Standard Bank retrenched staff in late 2010, some 18 months after markets had bottomed.

The other key point is that this pandemic crisis is far from over. Not only risks of seconds waves (France second wave is way worse than the first and Paris is shutting bars again). Delayed stimulus in the US will hurt the worlds largest economy which is very much experiencing a K shaped recovery.

So take a hard look at a stock cash flow, sure dividends are down or even cancelled. But is there positive cash flow? Is it likely to be increasing or decreasing? How will a tough 2021 impact the cash flows?

In short, will the company survive without a rights issue? Is yes, then it's worth having a look at but they can still mostly expect another 1-2 years of tough trading conditions.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ Trump Covid-19 with elections 4 weeks away.

/ US unemployment 7.9%

/ Disney to lay off 28,000, American Airlines 19,000 & 12,000 United Airlines

/ Palantir lists with direct listing

/ Airbnb listing progressing with $20billion valuation

Local

/ Unemployment numbers

/ August CPI 3.1%

/ Capitec results

/ Alviva results

/ Ascendis Health results (issued, cancelled and re-issued)

/ Remgro results, discount to NAV at 40% (lots of deep discounts to NAV)

/ Sasol sells 50% for $2billion

Simon Shares

Day 188 of lockdown.

- August CPI 3.1%.

- Everybody now suddenly knows about the expanded unemployment rate?

- Capitec* (JSE code: CPI) results were as always solid. Hit hard by the pandemic, but resilient. Valuations are rich, as always.

- Alviva (JSE code: AVV). Remember old Pinnacle, once a darling and then hit by claims of dodge tenders. They bought Datacentrix changed their name to Alviva and issued decent results.

- Everybody asking me about Ascendis Health (JSE code: ASC). To me it is binary, either they sell Remedica for a good price and they can bumble along, or they go bust. Debt is huge and risks are massive, sure some potential reward but why rush it?

- Remgro (JSE code: REM) results, +40% discount to net asset value (NAV). Either you view this as a cheap entry into some listed businesses inside Remgro. Or your view is that holding structures are value destroyers. PSG also at a massive discount to NAV. Typically discount used to be around 15%, but now we're seeing 40% discounts. Now the trade could be a closing of that discount, or just a cheap entry.

- Headline from CNBC "Disney to lay off 28,000 employees as coronavirus slams its theme park business". The pandemic is not over and some companies are still struggling to manage it.

Upcoming events;

Presidential markets

Less than five weeks until the US votes and then who knows how long to count the votes and get Trump out of the White House. The first debate on Tuesday shows what a mess the next few weeks will be.

After the debate, US futures markets were down some 0.75%, was it the debate or just markets? Maybe a bit of both.

Here's the thing. Some white man will win and be installed in January 2021. Market pundits will tell you it matters which. Remember the fear about a Clinton win and what it would do for markets back in 2016? Sure it became moot as Clinton lost, but the idea that one or the other will be better or worse for markets has scant evidence

Mostly it is trolling by one side or the other. The idea that one is anti markets is nonsense, both are ardent capitalists and sure Biden will keep the Affordable Healthcare Act, as an example, but after almost a decade in place, it has not broken markets. Biden may also want some minimum wages etc. Radical ideas for hardened capitalists, but there are minimum wages in many states - and non are bust as a result.

Raising taxes? Not on corporates, that boat has sailed and can't be recalled. On individuals, they can go up and while the rich will moan, what the NYT showed us on the weekend is that the rich don't pay tax anyway.

So how does one position a portfolio head of the election?

- Carry on carrying on.

- Ignore the noise.

- Buy quality when you like the price.

Elections are noise and best ignored and sure they may create volatility - but volatility creates opportunity.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

Day 181 of lockdown.

- The Tongaat (JSE code: TON) deal to sell their starch unit to Barloworld for R5.35billion is happening and the Tongaat share price loved the news.

- We're seeing a strong bounce locally while the US markets are also having a better run, risk back on (for now). But what was odd was gold. It didn't run as stocks were selling off and has actually weakened. The point is that if fears were of a longer sell off gold should do better, except for two things. Firstly nothing is linear and secondly when there is real fear as we saw back in March everything is correlated at 1 and everything sells off.

- The UK back into lockdown, not the hard lockdown of March / April. But lockdown that the government is saying may last six months. This pandemic is not over.

- Property stock results are coming thick and fast and frankly, most are not as bad as I expected. Make no mistake, they're ugly. But I had expected worse and while distributions are being delayed and valuations were written down they're mostly staying within their debt covenants which is hugely important. That said it remains a long road back to the glory days.

- Value Capital Partners (VCP) has bought a 5.28% stake in Cashbuild (JSE code: CSB). VCP has a reputation of not being quiet silent shareholders, but also have an excellent record of fixing broken companies. Now Cashbuild is not broken, but worth watching.

- Under the hood of the SYG4IR ETF.

Upcoming events;

Missing the bus

How often do we not buy a stock only to watch it move higher and regret not buying as we think we missed the bus. Then it just continues moving higher and higher?

The mistake we make is that we think there is a limit to the upside of what stocks can do. But consider for example Capitec* (JSE code: CPI), 2000c during the last crisis and it eventually it some R1,500.

There are plenty of other examples, most recently gold miners.

The problem is that while we want a ten-bagger stock we truthfully struggle with the concept of such huge gains. Further, as I have mentioned before a ten-bagger first has to be a one-bagger and as such buying when it's on the move reduces risk markedly.

So we need to double down on our work. What makes this an excellent stock, no the best stock, to own. What are the real fundamentals and growth prospects and will the rest of the market catch on?

Lastly, use a PEG ratio. Is the expected HEPS growth higher than the PE ratio?

This is far from a perfect science, but don't abandon the bus just because you missed the first one.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ BoE, Fed and BOJ all left rates unchanged, BoE ‘explores’ negative rates.

/ TikTok deal with Oracle (and Walmart) confirmed.

/ Wechat ban from midnight, 3.3million users in America and China threatens to expand its “unreliable entities list”. But “TRUMP'S PROHIBITION ON WECHAT IN U.S. IS PUT ON HOLD BY JUDGE”

/ OECD ups global 2020 gdp, but drops ours

/ Snowflake IPO price of $120 and it opened $245.

/ Apple has lost 22.6% from its intraday record high of $137.98 on 2 September, losing around $532 billion in market value.

Local

/ MPC no change and next move expected to be up, late 2021.

/ Level 1 and open borders

/ Comair rescue plans approved and will delist from the JSE, will resume flying in December

/ Eskom takes 139 farms from Municipality of Matjhabeng as security against R3.4bn debt.

/ Results; Pan African Resources, Woolies and Discovery.

Simon Shares

Day 174 of lockdown. Level 1?

- The Foschini Group (JSE code: TFG) trading update spooked the market, but it was the six months to end September. In other words, all lockdown.

- African Rainbow Capital (JSE code: AIL) results including an R750million non-renounceable rights issue. Trading at some 75% discount to the net asset value (NAV). Sure some decent assets, but the market has hated this one since listing.

- Super Group (JSE code: SPG) results were tough, especially as they have vehicle dealerships locally and in the UK.

- Pan African Resources* (JSE code: PAN) results saw debt halve and profits and cash flow essentially doubling. Remains the best gold miner on the JSE.

- Very solid Metrofile* (JSE code: MFL) results and I would think the delisting at 330c remains on track.

- Brexit deals seem stuck again over the hard border.

Upcoming events;

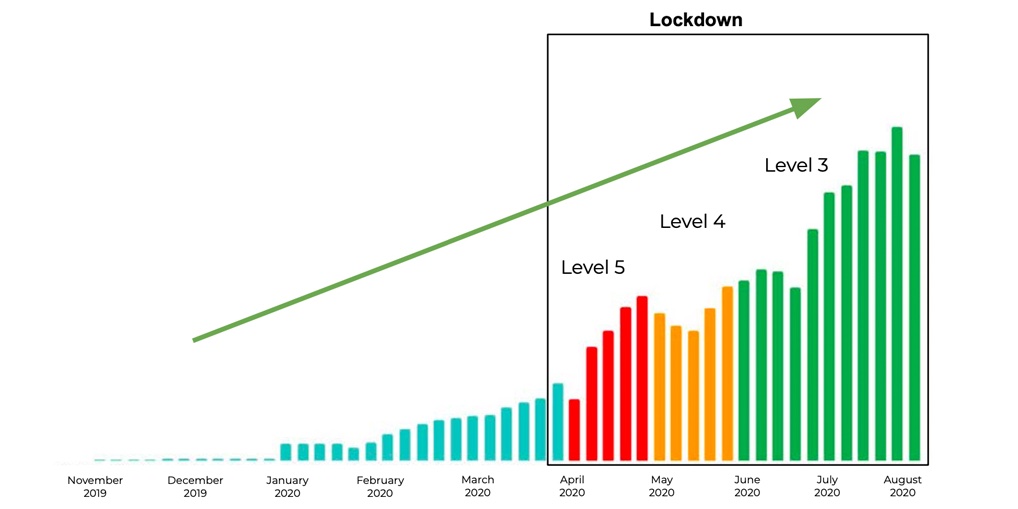

Buying after the lockdown

South Africa is through the peak of the pandemic.

The Lancet Covid-19 Commission classifies 1 case per 100k population as low levels of transmission and WHO says 5 per 100K. The former equates to around 600 new cases per day and the latter 3,000 and we under 1,000.

A second wave remains a real threat, but we're in level 2 with rumours that we'll move to level 1 as the president is speaking Wednesday evening. That'll surely mean borders opening (with restrictions) and maybe some lifting on large event restrictions.

So, should we be rushing out to buy SA Inc. shares? Certainly, they ran hard last week but have come back a bit since then.

Probably we should, but cautiously. Have a shopping list but also have a list of what you want to see;

- Debt levels. Sure business is returning but high levels of debt remain a risk.

- So high cash generation is important.

- Quality. Businesses struggling before the pandemic are best left to their struggles.

- Valuations still matter.

- Some sectors will be slower to recover. Leisure will have an initial boom, but what levels will it drop back to?

- Don't ignore the pandemic winners just because they won already. Some will still have room for more good growth.

- Also, think about the underlying companies. For example Airbus over airlines.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ US markets remain volatile as Nasdaq has worst week since March

/ LVMH Tiffany deal is off/delayed

/ Brexit talks going all messy

/ UK economy grew 6.6% in July as gradual recovery continues

/ Opec turns 60

Local

/ Q2 GDP -51%, or -16.4%

/ Firstrand results

/ Shoprite results

/ Aspen sale & results

/ Zeder CEO quits and the company is looking for a new strategy

/ White & yellow maize above R3k a ton

Simon Shares

Day 167 of lockdown.

- Local Q2 GDP -16.4% (-51% if you annualise it). Makes us one of the worst-hit economies for Q2, not surprising as we did very hard lockdown. Now to get out of the hole and that's going to be the hard part. Of our three main political parties, the honest answer is none of them really have a workable economic policy that we need right now.

- Serious buying of SA inc shares the last two days.

Jeez peeps are buying SA Inc

Top movers in Top40 and MidCap pic.twitter.com/6zgQO5DmHS— Simon Brown (@SimonPB) September 9, 2020

- Shoprite* (JSE code: SHP) results knocked it out the park. Their Sixty60 app is killing it. My local Checkers has a bunch of full-time staff packing and scores of motorcycles outside. Right now they are well ahead of the local competition and even ahead of Amazon Fresh in the US.

Aspen (JSE code: APN) sells commercial rights and intellectual property for the thrombosis business in Europe for R12.6billion. They'll still manufacture & supply the product and will retain the EM part of the business. Good deal and reduces debt significantly. On Bruce Whitfield's show Stephen Saad also commented that they'd never issued new shares, all deals paid for themselves. Sure it got wobbly the last few years, but that remains a significant truth.

Aspen (JSE code: APN) sells commercial rights and intellectual property for the thrombosis business in Europe for R12.6billion. They'll still manufacture & supply the product and will retain the EM part of the business. Good deal and reduces debt significantly. On Bruce Whitfield's show Stephen Saad also commented that they'd never issued new shares, all deals paid for themselves. Sure it got wobbly the last few years, but that remains a significant truth.- AstraZeneca (LSE code: AZN) shares drop 6% after the company announces ‘routine’ safety pause in a coronavirus vaccine trial. Basically somebody got sick from the vaccine. Happens often but does show the problem with rushing the vaccine. Surely we either do it safely or quickly?

* I hold ungeared positions.

Surprises to the upside

We're seeing lots of really bad results now that companies results include the second quarter. But the market is expecting this and in many instances not even selling the stock down much if at all as the bad results roll in.

The flip side is that when we see some decent results the market loves that news and sends the stock soaring higher.

This is because right now our expectation is for bad results so good is a pleasant surprise. I have often spoken about the fact that results or other announcements are often not about the actual numbers, rather it is about the expectations relative to those numbers.

What we are seeing is in part a two-part market. Remembering back in hard lockdown when the question was if the rebound would be V-shaped? Or perhaps W, U with some even suggesting L shaped. Well, Old Mutual says actually it is K shaped.

This makes sense. In the US the upper leg of the K is big tech socks with the rest being the lower leg of the K.

Locally miners are the upper leg and financials the lower leg.

So now we can put this together, K shaped recover and the market-loving positive surprises. Hunt out those top quality companies in the lower leg as they're cheap and if they're quality they'll not only recover but will do so quickly and with great profits. This is where we'll find stocks that still have great upside potential.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ US unemployment 8.4% (Temporary Census work (+238,000 jobs) accounted for around one-sixth of the August gain of 1.4 million jobs)

/ Thursday sell-off with Friday red, but less bad. Monday closed for labour day.

/ India bans another 188 Chinese apps

/ Carnival Corporation's Costa Cruises to Restart Cruise Operations This Weekend out of Italy.

/ Tesla does not go into the S&P500. Instead Etsy, Teradyne and Catalent added. IN order to get into the S&P500 “Companies must be U.S. based, and listed on either the NYSE, the Nasdaq or the Cboe. They also must have a market cap of more than $8.2 billion, and report four straight quarters of profit as determined by U.S. generally accepted accounting principles (GAAP).”

Local

/ Prosus has now gone into the Euro Stoxx 50 and EUR2bn passive inflows should support the share price.

/ Local GDP on Tuesday

/ Results; Truworths, Northam & Implats, Libstar and ADvTech

/ Spur execs leaving (four going by year-end including CEO & COO).

/ Icasa delays spectrum auction to March 2021

Simon Shares

Day 160 of lockdown.

- Northam (JSE code: NHM) results had two comments that caught my attention. They are aggressively buying back their Zambezi pref shares (JSE code: ZPLP). The second was that the amount of rhodium used in a single catalytic converter was 0.3g in 2015 and will be 0.45g in 2025. A 50% increase that supports the price increase.

- Hammerson (JSE code: HMN) have consolidated their shares 5:1 ahead of a massive rights issue which either you follow or exit because if you don't follow you'll be diluted out of existence.

Upcoming events;

- 03 September ~ JSE Power Hour: Under the hood of a passive robo advisor

Level 2 winners?

We're now able to travel between provinces, visit friends and family, go out for dinner and even back to the office. Leisure is back, but is it investable yet?

So who are the first winners as we ease out of hard lockdown?

On the one hand, pent up demand is real. I was at a bush lodge over the weekend and it was full and trying to find somewhere for the September long weekend is proving tricky. So people are out spending. Reports from restaurants in late August are they were packed but then I was at dinner on a wet and cold Tuesday evening and things were quiet.

So the current surge is likely very much just pent up demand and money saved. But what's important is how long this pent up demand lasts and what's real?

- Easy wins are the prepared food space, quick service and sit down dining. But we're off a very low base and I think we'll start seeing discounting as the initial surge dies out and increased costs in terms of PPE and social distancing reducing capacity.

- Hotels are harder, especially those that cater to conferences and business travel. Personally, the idea of a hotel still doesn't sit easily with me. Whereas an Airbnb is something I am happy to do.

- Banks are cheap and the three reported so far all expressed cautious confidence about the second half. But I am less certain, payment holidays will start expiring and the broader economy is hurting.

- That said asset managers and stockbrokers are going to report record results. My preferred is Coronation* (JSE code: CML), Purple* (JSE code: PPE) and Sygnia (JSE code: SYG).

- Miners are certainly in a sweet spot. Pan African Resources* (JSE code: PAN) trading update for the year ending June 2020 had average R15.67 exchange rate and the average gold price was US$1,574. So lots more upside in the current period if the levels hold where they are now.

- Food retail should be doing fine with lower LSM the easy winner as people shop down.

- Food producers are under pressure with increased PPE costs and maize price increases hurting margins in those sectors in which maize is an input.

- Homebuilders, we're seeing massive demand in lower-priced units under R1.5million in large part due to low rates and to a smaller degree in work-from-home. Balwin (JSE code: BWN) is well placed but it a long road home even as they sit with solid land banks and low debt.

- Infrastructure spending is all the rage globally and here we have one clear stand out - Afrimat (JSE code: AFT).

- DIY gets real interesting and Cashbuiild (JSE code: CSB) noted in their results that "group revenue for the six weeks after year-end has increased by 22% on the comparable six week period.". We've seen this in the US with Home Depot and Lowes both having knock out results.

- Pharma, preferred over hospital groups but I do think likely the later has seen the worst of bed nights and should start seeing that increase.

- Property, no thanks.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.