Offshore

/ U.K. economy is forecast to contract by 11.3% this year, "the largest fall in output for 300 years," Chancellor Rishi Sunak tells MPs

/ Musk now the worlds second richest person

/ Janet Yellen tipped for Biden cabinet as Treasury Secretary

/ China imposing tariffs on Australia, especially their wine.

/ Down Jones trades above 30,000 for the first time.

/ Black Friday 2020 online shopping surges 22% to record $9 billion, Adobe says

Local

/ Huge $5billion share buy-back from Prosus and Naspers

/ Firstrand update "the earnings trend for the four months from 1 July 2020 to 31 October 2020 is reflecting a better than anticipated rebound."

/ EOH CEO, Steven van Collier testifies at the Zondo Commission

/ Lewis results and dividend results on a dividend yield of +11%

/ Acquisition and baby range expand Mr Price’s markets

/ Gold under serious pressure

Simon Says

- Another week another vaccine.

- U.K. economy is forecast to contract by 11.3% this year, "the largest fall in output for 300 years," Chancellor Rishi Sunak tells MPs.

- US Jobless Claims +30K To 778K In Nov-21 Week, secondly weekly rise. Continuing Claims -299K to 6,071,000 for Nov-14 week.

- Dow Jones trades above 30,000 for the first time on Tuesday & S&P500 closed at a new all-time high. Dow 20,000 was 25 January 2017 and 10,000 29 March 1999 (12,000 was September 2007).

- Lewis (JSE code: LEW) results with a 133c interim dividend. Double that for the full year makes for a yield fo some 11.9%.

- Stor-Age* (JSE code: SSS) offering their dividend as cash or new shares issued at 1240c. People asking what I'm doing? Taking the shares.

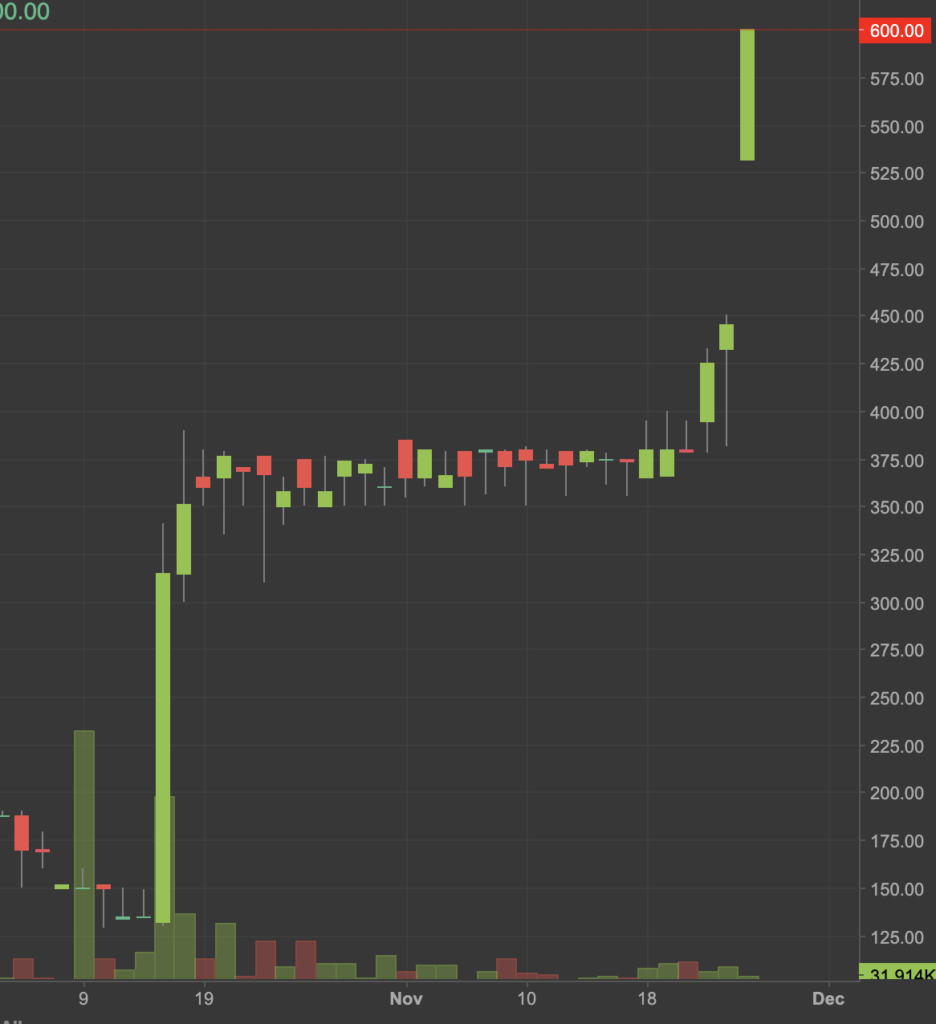

- Adcorp (JSE code: ADR), stock was 130c on 15 October ahead of their trading udate. Results in Wednesday saw it trading at 600c

[caption id="attachment_24206" align="aligncenter" width="888"] Adcorp Daily[/caption]

Adcorp Daily[/caption]

Upcoming events;

- 03 December ~ JSE Power Hour: Position your portfolio for 2021

Bitcoin is tiny, even at highs

Disclaimer upfront, I have been buying Bitcoin because I like to own things that are going up, my average entry price is R204k. This is a trade, so I will take my money at some point.

Looks certain to make new all-time highs and US$20k surely sooner rather than later.

Not a bubble this time, as it was in 2017. That doesn't mean can't collapse or can't become a bubble.

Interestingly the narrative has changed, the talk of Bitcoin for payments, something I said was a long long way off, is no longer the biggie. Now it really positioning itself as an alternative asset. Remember how blockchain would save the world?

But here's what was really interesting to me, the market cap of Bitcoin. ±US$400billion! Less than Tesla, in fact very tiny. Consider how many exchanges, blogs, shows and chatter about this one asset that is so very small. The size also restricts large institutions getting involved.

For comparison, gold is about US$9trillion, NYSE about US$30trillion and total US debt US$27trillion.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ Another Monday another vaccine ~ Moderna

/ 12 million Americans are on track to lose unemployment benefits in December if Congress doesn't extend key programs that were part of the CARES Act passed in March.

/ JPMorgan forecasts negative GDP in the first quarter, the first Wall St. bank to begin forecasting a negative reading. JPM expects the economy to bounce back in

/ Amazon moving into the pharmacy business

/ Boeing 737 Max is back

/ Bitcoin heading for new highs & FSCA proposes making cryptocurrencies an asset class.

Local

/ Moody’s & Fitch downgrade SA further into junk.

/ Somebody wants City Lodge East Africa hotels

/ Results; Stor-Age*, Astral Spar

Simon Shares

- Another week, another vaccine. This time from Moderna and also using the Messenger RNA as does the Pfizer / BioNTech vaccine.

- Stor-Age* (JSE code: SSS) results very solid.

- Wilson Bayly Holmes (JSE code: WBO) results not great as Australia hurts, again.

- Raubex (JSE code: RBX) announces an R2.87billion contract win from Sanral.

- Strong Spar (JSE code: SPP) results.

- Boeing 737 MAX 8 returns to skies as FAA lifts grounding order.

- Brait (JSE code: BAT) net asset value 771c (based on 9x EV/EBITDA), share price 388c.

[caption id="attachment_24160" align="aligncenter" width="888"] Brait monthly chart[/caption]

Brait monthly chart[/caption]

Upcoming events;

- 05 November ~ JSE Power Hour: Searching for income

- 19 November ~ JSE Power Hour: Twenty years of ETFs

Owning unlisted shares

In the last few years, we've seen a bunch of stocks being delisted from the JSE and in pretty much all cases existing shareholders get paid out and no longer hold the stock.

Anchor (JSE code; ACG) are now proposing a delisting at 425c, but with an option to remain invested in an unlisted Anchor.

I have never held an unlisted share outside of companies I have founded or worked for a few simple reasons;

- No JSE oversight

- Lack of communications to minority shareholders

- Majority shareholders acting as if it is their private company

- Zero liquidity to buy and sell

- Zero price discovery

- In short, being screwed over.

That said Anchor will very much still be in the public eye and this is not usually the case when a stock delists. That will help act as a guard rail (not that they need it) so maybe it will be fairer to minority shareholders.

Certainly, I think the 425c offering is very cheeky and I still don't want to hold unlisted stocks, for many this time may be the exception.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ Pfizer/BioNTech vaccine news

/ U.K. economy expands by 15.5% in the third quarter, the most on record yet adds another Sterling150billion in stimulus

/ Disney reports first loss in 40 years, but Disney+ hits 73m subs

/ Emirates eyes return to profitability in 2022 only

/ Deutsche Bank proposes a 5% tax for people still working from home after the pandemic

/ DoorDash files IPO plans, NYSE listing

Local

/ Lockdown level 1 lite?

/ Growth Point raises R4.3billion

/ SA’s unemployment rate 30.8% in Q3

/ Sun International update gives great insight into leisure locally.

/ Telkom results

/ MultiChoice results

Simon Shares

- US elections, everybody nows who won except the orange one and the GOP.

- Vaccine news from Pfizer and BioNTech has changed market behaviour. Banks and consumer stocks now the rage while tech and gold is falling.

- Locally banks are flying.

Interesting to see the JSE All Share up circa 14.4% over the last 6. months yet its biggest constituent Naspers only up 3.71% over the same period. A lot of underlying and broad strength. @SimonPB @CAPITALSIGMAza @smalltalkdaily

— Mark Tobin (@mtobinwex) November 11, 2020

Upcoming events;

- 05 November ~ JSE Power Hour: Searching for income

- 19 November ~ JSE Power Hour: Twenty years of ETFs

Bombastic billionaires*

Somebody strikes it big in one field, and now they think they're the smartest person in any field.

A CEO of a successful company leaves to start a new company, they just assume it'll work and investors believe them. We see this all the time.

The successful business person thinks they know how to run the government.

Heck, we see it during this pandemic when suddenly every second person was (and often still thinks they are) an epidemiologist.

There are some exceptions; Elon Musk and Steve Jobs two who come to mind.

The successful person also readily ignores the role of luck in their success. Fooled by Randomness by Nassim Nicholas Taleb.

The answer is simple. Just because somebody is great in one area, do not assume that they have any skills in any other area.

* Phrase stolen from Anton Harber

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ US elections over

/ US unemployment rate 6.9%

/ Ant IPO cancelled

/ BoE no change & QE increased by £150 billion to £895 billion

/ Berkshire Hathaway bought back a record $9 billion in stock in the third quarter

Local

/ Rand strength

/ Results; Dis-Chem, Richemont & Foschini

/ Aspen vaccine JV with J&J

Simon Shares

- US Election results pretty much playing as expected. Trump doing well in early counting but some important states still to come but he has declared victory and is heading for the courts.

Upcoming events;

- 05 November ~ JSE Power Hour: Searching for income

- 19 November ~ Twenty years of ETFs

Finding infrastructure stocks

Globally one of the key responses to the pandemic is and will be, infrastructure spend. Who are the potential winners?

- PPC (JSE code: PPC)

- Sephaku (JSE code: SEP)

- Reunert (JSE code: RLO)

- Consolidated Infrastructure Group (JSE code: CIL)

- WBHO (JSE code: WBO)

- Murray and Roberts (JSE code: MUR)

- Aveng (JSE code: AEG)

- Raubex (JSE code: RBX)

- Afrimat (JSE code: AFT)

- Brikor (JSE code: BIK)

- Stefanuti Stocks (JSE code: SSK)

- Kumba (JSE code: KIO)

- ArcelorMittal SA (JSE code: ACL)

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.