Yield focused ETF from CoreShares

CoreShares has merged their PTXSPY EF into PTXTEN and now converted it into a new CSPROP.

CSPROP is a new property ETF that has yield as 75% of the weighting adding both diversity and yield to the ETF.

Simon chats to Chris Rule about the new ETF, why the changes and the details.

Find more here.

Up coming events;

- 31 October ~ Live Fat Wallet Show recording

- 7 November ~ Millennials navigating markets and the investment landscape

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Crowd1 ~ I been digging into it. Scam, a multi level marketing gimmick with no actual product apart from getting other friends, family and fools involved.

- Ascendis Health (JSE code: ASC) trading updates illustrates the risks of relying too much on net asset value (NAV). They are writing down R4.2billion of "goodwill, intangible assets and property, plant and equipment". In other words everything. But the company has a market cap of only R2.2billion and that R4.2billion equates to some 850c per share totally destroying the reported NAV of 1435c.

- Calgo M3 (JSE code: CGR) and Balwin (JSE code: BWN) results were both under pressure form a stretched consumer with Balwin having less issues and producing the better results and profits. Both are well positioned for when the economy improves with Balwin in the slightly higher LSM market and Calgo with their burial operations. I sold Calgo a way back and would look to be buying one or both, but not just yet. Buying property requires confidence so they will turn later than say food, big box and white appliance retailers as these are cheaper products and hence bought earlier in the up turn.

- Rumours of an offer for Capital and Counties (JSE code: CCO). UK property assets are cheap, most trading well below NAV and sure Brexit is real risk and will hurt. Many, such as Capital and Counties, are great assets and will survive.

- Speaking of Brexit. One week to go. Tic. Toc.

- Rand R14.65/USD. Never write off the Rand. Over the long-term it is a one way bet at a few percentage points a year. But short term is really is all about flows in and out of South Africa and what drives those flows is not as simple as load shedding and the like.

- Sasol (JSE code: SOL) taking pain again on Tuesday, off over 7% on a Cadiz report suggesting the dividend may be cut. For the past 10-15 years the Sasol dividend yield has averaged just under 4%, chunky. Right now the historic is almost 5% but a slashing of dividend by 50% will still see 2.5%. So maybe an even greater slash of the dividend? I think that's pretty certain as they need to pay down debt aggressively. This share has been a horror show.

- Prosus (JSE code: PRX) is making a takeover bid for Just Eats, which has been rejected by the board but time will tell. More interestingly is the Prosus theory which is that eating at home is going to largely disappear. Much like we mostly made our own cloths in the 1800s but today nobody does. They say cooking at home will be the same, in time nobody will cook at home. Interesting idea, especially in terms of home design - saving space in the kitchen and money on appliances. But then spending that money on delivery.

- Rhodium, almost 700% in three years.

- I am doing an ALMI trading demonstration webcast on 28 October at 8.15am Book here.

- Up coming events;

Operating margins

Pick n Pay (JSE code: PIK) results were good, but the increase in operating margin was outstanding and this had a serious boost to profits.

Operating margin is the profit after the costs of sales, such as salaries, rentals and products, but before paying interest or tax. Hence a 'clean' profit margin as opposed to net margin that will also have interest, tax and other costs deducted first.

It is especially important for retailers but not banks or miners for example. For those sectors we need other metrics such as impairments, cost-to-income and head grade etc.

Every since Richard Brasher took over at Pick n Pay I have been moaning about their operating margin. He's been getting much right but the operating margin was stuck at 2%. Then in the last set of results tey crept a little higher and now are solid 2.8% up from 2.5%.

This too me suggests the turn around at Pick n Pay is now complete.

Of note is that Shoprite* (JSE code: SHP) has an operating margin of over 5% and even the recent earnings collapse saw it stay above 4%, so they earn about double from every 100c spent at their tills. The question is how high can the Pick n Pay operating margin go? Shoprite benefits form higher margins in the rest of Africa, Pick n Pay doesn't. So 5% may be too far for Pick n Pay, but can they get to 4%?

A last point. Pick n Pay Tuesday results saw most retailers rally on the back of hope that the result wee not only a good performance from Pick n Pay but maybe also an improvement in consumer confidence and spending.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

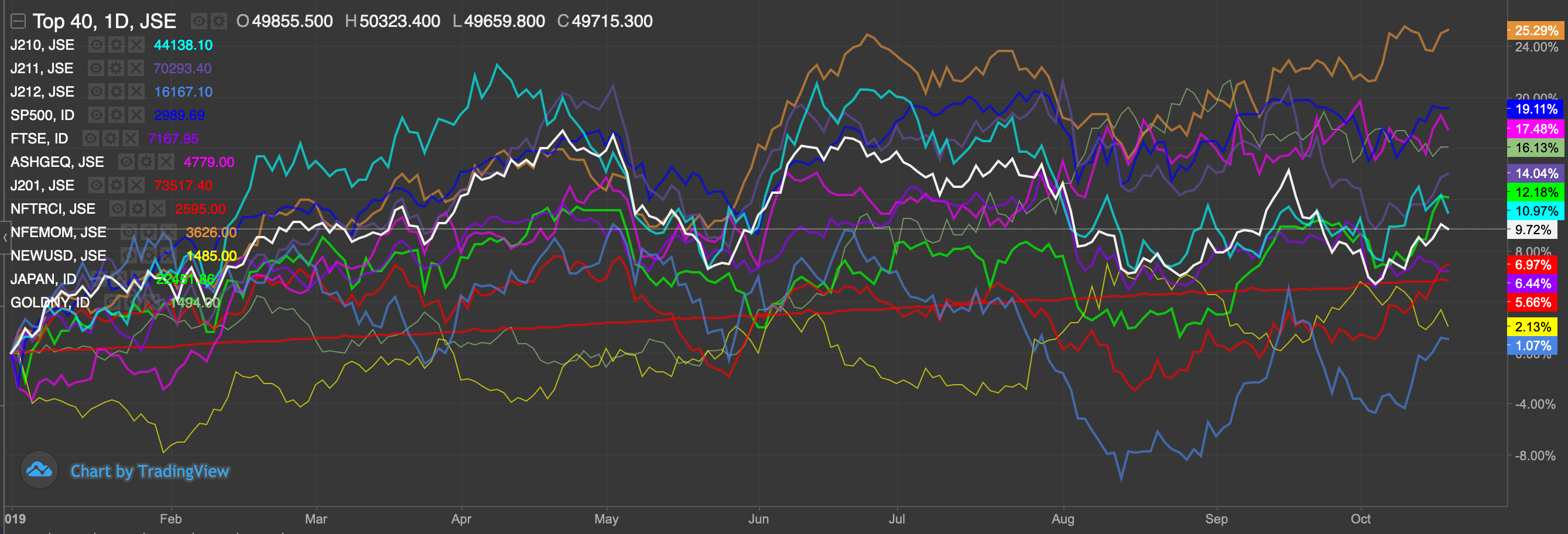

A late and short show this week, discussing the chart below showing return so far for 2019 (to close 17 October 2019). Surprisingly, all positive and some real good returns.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- #WhatsAppStokvel This is a scam, of course it is. You're only asking because you know it is and you're hoping somebody will give you 'permission' to go ahead anyway. Anything that requires you to recruit others in order for you to profit is always 100% a scam.

- Long4Life* (JSE code: L4L) upping their stake in Spur (JSE code: SUR) to over 10%. Is it a pure valuation play or does Joffe have something bigger in mind?

- Brexit, tic toc. Three weeks to go.

- Clicks (JSE code: CLS) issued an improved and updated trading update that sent the share to new all-time highs. One can argue about valuations here, but not the quality. Clicks is best of breed.

- 4Sight (JSE code: 4SI) was a stock i warned against since day one. Far too much jargon and hype that have not turned into profits. But go read the resignation letter of Geoffrey Carter from 7 October. Man is he maximum unhappy.

- I am doing an ALMI trading demonstration webcast on 28 October at 8.15am Book here.

- Will Trump juice the markets? A few people pointed out that maybe China will not want to do an agreement to hurt Trump and maybe get a democratic party winner in 2020. certainly possible.

- Understanding your statement.

- Understanding momentum ETFs.

- Up coming events;

Commodity miners catch 22

Implats (JSE code: IMP) is buying a Canadian palladium miner for some R11.5billion.

Now the deal looks decent, 3m ounces producing about 220k a year with an all in sustainable cost of some $820 and making EBITDA of some R1.6billion a year, so PE of 7x.

But those numbers are all grand with palladium just off all-time highs of $1,700. What happens when palladium falls?

This is the challenge of single commodity miners. You can't buy at the bottom because you have no money, but buying at the top screams a 'hail mary' pass.

The catch 22 is how else do miners grow? Every day the mine they lose some value as they mine reserves.

Maybe the smallish size of this deal is what saves it?

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Up coming events;

Up coming events;

10x South African Retirement Reality Report 2019

Simon chats with 10x Investments founder and CEO about their second Retirement Reality Report and a 1million give away into a retirement annuity.

You can find the full report here.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.