A simple diverse ETF portfolio

Simon Shares

- Balwin (JSE code: BWN) knocked their results out of the park, but my bigger picture concerns remain.

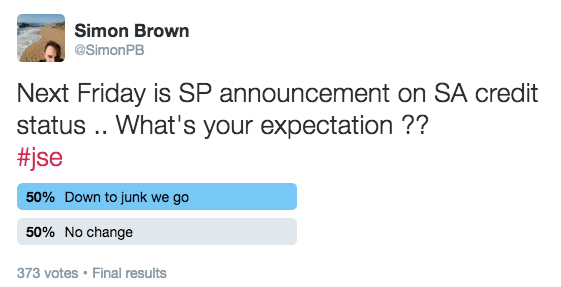

- Standard & Poors down grade or not is next Friday. I did a Twitter poll that came in split by 1 vote. So nobody knows.

- Complexity of costs. Come industry make it simple.

- Mining: Returning to the mean? Peter Major did an excellent JSE Power Hour for us, the video is here.

- On the ETF blog this week we look at the Pref shares ETF (JSE code: PREFTX).

- 2 June at 5.30pm,Keith McLachlan on building a small and mid cap portfolio the right way. Book here.

Nerina Visser, director at ETFsa.co.za

Which ETF if you buying for;

- R300 / month (CTOP50)

- R1000 / month (CTOP50, DBXWD & ASHINF)

- Large lump sum into a TFSA (CTOP50, DBXWD, ASHINF & PTXTEN)

We also chatted about costs, are we missing any ETFs as an industry and how to respond to the potential downgrade from Standard and Poors.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Doing risk right

A very long show this week (over an hour), but totally worth every second of listening.

Last week I reflected on the Sanlam i3 Summit I attend and his week I speak with Roland Rousseau (Head of Barclays Risk Strategy Group) on his presentation at the conference.

Roland is looking at this whole idea of asset or fund manager being outdated and suggesting we rather need risk managers. He has great insights and ideas and this wide ranging conversation on risk has got me thinking a lot more about a lot of things. Real learning, I love it.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

How do we get smarter?

Simon Shares

- Calgro M3 (JSE code: CGR) results were great. We're seeing operational leverage coming through and a lot of projects seem to have only added a modest amount in this year with more coming in the new financial year and the memorial parks look interesting. They did have some issues with Namibia, having to relaunch the retirement development and others. Back in December / January I exited some of my position but am happy to hold the balance.

- Pipcoin = pyramid scam

- What's happened to the PIIGS?

- So Moody's was all nice to us, sure but are we really avoiding the ultimate downgrade to junk? Standard & Poors still the one to watch with June their next update and likely the first to make us junk.

- On the ETF blog this week we look at the Momentum ETF (JSE code: NFEMOM) as well as find out about total return which involves dividends being automatically reinvested into the ETF.

- We're doing a webcast of the lazy trading system on the 12th at 8pm and an IG Boot Camp on Tuesday at 6pm. Book here.

Sanlam i3 2016 Summit

I attended this event last week and have a number of thought from the speakers, in particular Dr Amlan Roy who spoke on demographics (here's a short video interview with him).

My three key learnings;

- Differences more important than similarities (Eusebius McKaiser)

- Demographics most important thing we ignore (Dr Amlan Roy)

- Most of what we think is skill is actually well spent (Roland Rousseau)

We Get Mail

- Samuel

- Is there a way to position my portfolio to minimize risk when a downgrade of the country`s credit rating is on its way? I believe that the downgrade will happen in this year. Is there a way to gain on this?

- Everybody

- Where do I find an offshore broker?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Master class in investing

Simon Shares

- This week we look at a bond ETF, ASHINF.

- We're doing a webcast of the lazy trading system on the 12th at 8pm.

Hlelo Giyose – First Avenue Investment Management

Hlelo talks stocks but the conversation goes into much more than just some of his current preferred stocks. He delves into what makes great companies, how to spot them and when to buy them. A master class in investing.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.