FTSE 100 structured product

In the last show for 2019 Simon chats to Viv Govender and Gary Booysen from Rand Swiss on their latest structured product. This time it is an auto call over the FTSE100 in US$. We also chat a bit about Brexit and what it actually means; good, bad or ugly.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Len Jordaan, Index and Structured Solutions, Absa CIB

Simon and Len delve into understanding risk and how it applies to your Exchange Traded Fund (ETF) selection, both as a basket of different ETFs you put together but also as to which individual ETF you may be buying for a tax-free or discretionary portfolio.

Some links we refer to;

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Upcoming events;

Simon Shares

- Third quarter GDP came in at -0.6% making the fourth negative GDP in the last seven quarters (since Jan 2018). Our economy is dying. Important the economy is not the market, but it is still dying.

- Sygnia will not be charging you 0.34% to exit their Itrix ETFs. But man the communication around this was a horror show that a final tweet seems to suggest it only if you're directly exiting via the ManCo. So moot for us ordinary investors.

- Tongaat (JSE code: TON) report is out and it another horror show. They're going after previous executives, including the previous CEO and CFO. But are refusing to release the full report.

- Talking of reports, Steinhoff (JSE code: SNH) is being sued by the PIC for their full PWC report. They only released a short version of the +3,000 page report claiming it was confidential. But if shareholders are going to sue, and they are. Then this report is an important part of the case against Steinhoff and the former executives.

- Purple Capital (JSE code: PPE) owners of Easy Equities results show much improvement in terms of number of clients, revenue and ultimately a reducing loss. Their path to break even seems easy enough now, likely two - three years. That said the share still has some large sellers now at 33c/34c, above the 30c they camped at for some eighteen months.

- A thought on the trade wars which Trump is heating up rather than winning 'easy'. We(the world)has always assumed that Trump was largely in control and could end them at any point. But I think that narrative may be totally wrong. Firstly China wants any phase one to include going back to zero tariffs and Trump is saying no. But I also think that frankly China may just did in their heels and wait out the next 1-5 years Trump is in power. They're not happy with him signing the Hong Kong bill and they can manage the crisis way better than he can. A side note; bail out to farmers is now larger than the vehicle manufacturer bailout of 2008 and still farmer bankruptcies is up 24% this year.

- SAA. I have flown SAA every flight I could for 20 years. But no more and it is frankly time to let the airline go to the wall. Rumours are that's exactly what Moboweni wants, but Gordhan is digging in his heels, incorrectly at this point.

- Lots of hysteria about the CompCom declaring mobile operators must reduce data fees by 30%-50%. Firstly read the actual report, this is a recommendation for ICASA to deal with if the telcos don't respond within two months. Secondly, remember when ICASA enforced reduced interconnect rates? According to the telcos this was the end of the world. Funny how they still make massive profits. The short version is the telcos price gouge because they can and they won't willing stop. Here's an example;

"(MTNs) 2nd most expensive pricing is in Rwanda where a GB of MTN data costs almost half of what it costs in its home market".

"Only in the DRC ($8) does Vodacom charge its customers more, on average, for a gigabyte of data than in South Africa ($7.83)."

- Grand Parade (JSE code: GPL) cautioned they are in negotiations about the "disposal of a material interest in Burger King SA". So after exiting Sun Slots what would they have left? And who is the potential buyer?

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Woolies* (JSE code: WHL) update is same old same old. Local food doing great, fashion okay and Australia still under pressure with the refurbishments due to end March 2020.

- Brait (JSE code: BAT) announces a large recapitalisation with a cR5.5billion rights issue at a 27% discount to the share price and about 60% new shares. This is also a massive discount to net asset value (NAV) which is now 3800c and a share price at decade lows. Christo Wiese will not take up his rights, rather Ethos Capital (JSE code: EPE) will and they'll become about a c15% shareholder.

- Transaction Capital (JSE code: TCP) monster results. Very strong, double digit everything. This was one of the stocks Petri Redelinghuys picked on my Small Cap Portfolio show recently (along with Jubilee Metals (JSE code: JBL)).

- British American Tobacco (JSE code: BTI) update was good in all areas and margins are growing. They do however warn that e-cigarette sales growth to hit low end of target.

- Charles Schwab is taking over TD Ameritrade. Not surprising after Schwad cut brokerage to zero, and everybody else was forced to follow suit. It's now a game of size. More clients, more cross selling, more interest turn etc. Bigger is way the way forward for now.

- Understanding the Krugerrand Custodial Certificate

- Creating returns in a low growth world

- Upcoming events;

It's not ok to just be your best

“It’s not ok to not be the best trader you can be.....it’s NOT OK” Mike Bellafiore

You have to be better than your best. You have to continually be getting better. There is no rest for traders. We have to be always improving. Trading is largely a zero sum game, you have to better than the others.

've often stated that any trader who thinks they have arrived as a trader will swiftly be shown the door by the market. It is a continual process of improvement and caution against believing our own hype.

So, what do you do in order to always be improving? The easy answer is a trading journal that you keep and a constant reviewing of your trades.

- The journal would include trade details, but also what happened post exit. Your perfect trade score and how the trade felt.

- It would also include the entry and exit which you'll be able to review. Did you jump too soon? Is this a frequent problem? If so what are you doing about it?

- Are exits a problem? Taking profits too soon? Ignoring stops? If so what are you doing about it?

For me personally I have a journal and track my perfect trades. But as I also only trade for about 10-15 minutes after the 8.30am futures open, I'll often record my screen while trading and I review these videos.

The review is not only checking to see if my entries were good (exits are either at target or stop so automated and not important for this process). Did I get in timeously? Or late or early?

Am I missing information? I am watching the bids/offers and last trades, so not a lot of data. But I can miss data as I move between screens (trade, orders, chart, depth, etc.).What I find at time is that I take a long trade, for example. And it was right, but as I was entering the trade it switches to neutral or even short and I miss that change.

- It's almost as if I am rushing, scared of missing out (or paying a higher price). So now I have a process. I set the trade screen. But as I go to click 'trade' I run my eyes over the bids/offers a last time to make sure I am on the right side of the trade.

- My other problem is I flip between the different screens too much. I really only need to watch the depth and last trade screen (which is same block for my platform). But while waiting I get restless so I am flipping around for no real purpose. The solution here is easy.

Close all the tabs/browsers and also get rid of all other data on my trade screen, except what I need - depth and last trades.

Point is alway be improving. Alway be checking in on yourself. Always be striving to be better every day.

My last point is to always remember that trading is like a high wire trapeze artists without a net or safety harness. We get no second chances. We can do 99 perfect trades and then 1 horrid trade gives it all back. As a trader we need to be 100% all the time. Not 100% in terms of profitable trades. 100% in terms of perfect execution every time. Because one slip and our money pile is back at the beginning, or as a trapeze artist, we a pile of broken bones on the floor.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Upcoming events;

- 21 November ~ Creating a portfolio at the market highs

- 05 December ~ Position your portfolio for 2020

Ironman your trading

This is an hour long recording of a live event I presented in Cape Town on Tuesday.

The PDF is here.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- SAA retrenchments, a test for the bigger Eskom process?

- Telkom (JSE code; TKG) to buy CellC? R1 would seem a fair price and would benefit both Blue Label (JSE code: BLU) and Telkom. Rumours that MTN (JSE code: MTN) is also in the running to buy CellC, but I can't see the competition commission allowing that. Of note is that Blue Label have not issued a SENS (Telkom has, but not naming CellC). The reason is that with CellC being written down to zero the deal is not material.

- Aspen (JSE code: APN) sells Asian operations for Euro400million. This should take the groups debt down to just a little over R30billion and will within debt covenants and manageable.

- Rebosis (JSE code: REB) failed to declare a dividend in the latest results yet as a REIT it is required to do so by law otherwise they have to pay tax n the profits.

- The protests in Hong Kong continue on and are getting more violent as the authorities dig in their heels. This is hurting the economy in Hong Kong but I don't see the authorities giving in any time soon. Also remember that after the 1997 handover Hong Kong operates as a "One country, two systems" with China. This expires in 2047 and truthfully nobody knows exactly what that means. But likely China will want Hong Kong to move closer to it and so is not going to back down on the current protests.

- Good results from Spar (JSE code: SPP) continuing the results trend from Pick n Pay (JSE code: PIK) and Shoprite* (JSE code: SHP) trading update.

- An update from Steinhoff (JSE code: SNH) saying they're still considering listing Pep Europe. But the biggie is they may also do a rights issue to help pay legal fees? Really? Not sure many shareholders would be happy to partake in that waste of money. An yes I still think Steinhoff is heading for zero.

- Brexit, election on 12 December. Likely Conservatives win, but not guaranteed and will they have a majority or not?

- Upcoming events;

Short squeeze (or a long squeeze)

A short squeeze is when a stock surges, usually on some good news - but the surge seems disproportionate to the news.

The theory is that a lot of people were short (had sold the stock to profit from the downside), then the good news sends them all heading for the exits. In order to exit they have to by so you have the positive buyers sending prices higher but you also have the short sellers who're sending the price higher.

This is potentially what we saw on Blue Label on Tuesday when rumours started circulating that they had two potential buyers for CellC.

This is one of the real risks of shorting stocks, you're downside in a short position is unlimited as a stock can go forever.

With options your risk is always only 100% as it is the right wheres other derivatives are the obligation.

One could also see a long squeeze, but this is a phrase I have never heard mentioned before.

This would be when bad news sends a stock crashing as holders of the stock all head for the exits at once, think Steinhoff.

The difference is that short sellers are also short-term in nature. Sure that may be months or even years, but it's never forever whereas as holders could be looking to hold forever.

Also short sellers profit or loss is paid daily whereas long holders losses are only on paper. Real but always a hope of recovery.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- October was a decent month for the Top40, adding almost 3% and now 9.5% year-to-date excluding dividends.

- Moodys makes us negative but not junk and the ZAR soars.

- Finance minister, Tito Mboweni, says government 'not considering' the idea of prescribed assets. https://www.businesslive.co.za/bd/national/2019-11-05-treasury-not-considering-prescribed-assets-mboweni-says/

- The Shoprite* (JSE code: SHP) update what was way more interesting for the fact that Christo Wiese got voted off the board, until he used his zero economic but voting shares that he tried to sell to Shoprite for some R3billion. The actual update shows SA doing well and importantly we're seeing some inflation while the rest of Africa continues to struggle and the new Xtra Savings Rewards Programme got 1million sign ups in the first week.

- Afrimat (JSE code: AFT) results knocked it our of the park with their iron ore business (Demaneng) is paying for itself in double quick time.

- Famous Brands* (JSE code; FBR) results show things still tough, especially in the UK as operating margins get killed. They used to be over 20% and are now hanging onto 11% by a thread.

- Uber lost another $1billion in one quarter, again due to interest, depreciation and stock based compensation costs. Last quarter they blamed listing costs this time they point out Uber taxi is profitable if it weren't for the costs above and Ubereats lost almost $400million. How does food delivery lose money? What are the costs? At listing Uber aid they may never be profitable, and maybe they were right?

- ETF blog ~ New CoreShares property ETF (CSPROP).

- VIDEO: Live trading ALMI price action for 300 points.

- Upcoming events;

ddd

- Download the audio file here

- Subscriber to our feed here

- Sign up for email alerts as a new show goes live

- Subscribe or review us in iTunes

Goals, processes and habits

Goals need process and process becomes habit and achieves goals

In my trading presentations I always talk about goals and the problem of having a single giant size goal that while desirable is frankly overwhelming. My advice is always to break goals down in small bite size pieces, with one example of those bites always being doing a single perfect trade, followed by another perfect trade, and another and another.

This idea applies to everything we want to achieve in life. Truthfully we have the ability to do almost anything. Almost because doing a marathon in under 2 hours is going to be out of our reach - by an hour. But the goal of doing a first marathon is easy enough, if we break it down. First couch-to-5km, then 10km and so on.

Buy breaking a large goal down into small pieces we're able to achieve as we go along and hence we also make it 100% achievable.

Then as we're going along achieving our smaller goals via processes they fast become habits and soon our goals are done.

I started swimming just over a year ago, my goal was a Midmar Mile which I did back in February in a horror time of 44 minutes. But back then my target time was 48 minutes, so I was chuffed. Now my goal for the 2020 Midmar Mile is under 30 minutes. Hard, very hard. But it breaks down into 4 pool sessions a week and every pool session has it's own goal. Distance or speed or technique. So 4 times a week I wake up eager to try and hit my goal and most weeks I end the week having hit at least 3 sometimes all 4 of my goals.

And slowly I am moving forward.

Important is that I really look forward to and enjoy my training sessions, something that 18 months ago seemed like a crazy idea.

Most important is that is that I structure my process to fit within me. So I do not do early morning training, I train mid morning because that works better for me and hence is easier for me to do. If I was also trying to wake up at 5 to be at the pool by 6, it would be way harder.

So we need to move this into our trading and investing. What's the goal? Large dividend paying portfolio? FIRE? Trading for income? It can be anything but then it has to be broken down into small processes that enable that goal.

- Example, invest enough to live off investments within ten years?

- Get family onboard.

- Cut living expenses. Live small and cheap.

- Max out tax-free.

- Buy ETFs.

- None of these are hard, but all will require effort and work.

Want to be successful trader living off trading income.

- How much capital do I need? Do I have enough? How do I get enough?

- Pause, do I even know how to trade?

- Learn technical analysis and price action.

- Practise ~ place 1,000 stop losses.

- Practise ~ enter 1,000 trades.

- Practise ~ exit 1,000 trades.

What would make a perfect trade? Now do one, and another and another.You now have goals that can be broken down into processes.

You'll also notice that none of this results in overnight success because overnight success takes years.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Yield focused ETF from CoreShares

CoreShares has merged their PTXSPY EF into PTXTEN and now converted it into a new CSPROP.

CSPROP is a new property ETF that has yield as 75% of the weighting adding both diversity and yield to the ETF.

Simon chats to Chris Rule about the new ETF, why the changes and the details.

Find more here.

Up coming events;

- 31 October ~ Live Fat Wallet Show recording

- 7 November ~ Millennials navigating markets and the investment landscape

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Crowd1 ~ I been digging into it. Scam, a multi level marketing gimmick with no actual product apart from getting other friends, family and fools involved.

- Ascendis Health (JSE code: ASC) trading updates illustrates the risks of relying too much on net asset value (NAV). They are writing down R4.2billion of "goodwill, intangible assets and property, plant and equipment". In other words everything. But the company has a market cap of only R2.2billion and that R4.2billion equates to some 850c per share totally destroying the reported NAV of 1435c.

- Calgo M3 (JSE code: CGR) and Balwin (JSE code: BWN) results were both under pressure form a stretched consumer with Balwin having less issues and producing the better results and profits. Both are well positioned for when the economy improves with Balwin in the slightly higher LSM market and Calgo with their burial operations. I sold Calgo a way back and would look to be buying one or both, but not just yet. Buying property requires confidence so they will turn later than say food, big box and white appliance retailers as these are cheaper products and hence bought earlier in the up turn.

- Rumours of an offer for Capital and Counties (JSE code: CCO). UK property assets are cheap, most trading well below NAV and sure Brexit is real risk and will hurt. Many, such as Capital and Counties, are great assets and will survive.

- Speaking of Brexit. One week to go. Tic. Toc.

- Rand R14.65/USD. Never write off the Rand. Over the long-term it is a one way bet at a few percentage points a year. But short term is really is all about flows in and out of South Africa and what drives those flows is not as simple as load shedding and the like.

- Sasol (JSE code: SOL) taking pain again on Tuesday, off over 7% on a Cadiz report suggesting the dividend may be cut. For the past 10-15 years the Sasol dividend yield has averaged just under 4%, chunky. Right now the historic is almost 5% but a slashing of dividend by 50% will still see 2.5%. So maybe an even greater slash of the dividend? I think that's pretty certain as they need to pay down debt aggressively. This share has been a horror show.

- Prosus (JSE code: PRX) is making a takeover bid for Just Eats, which has been rejected by the board but time will tell. More interestingly is the Prosus theory which is that eating at home is going to largely disappear. Much like we mostly made our own cloths in the 1800s but today nobody does. They say cooking at home will be the same, in time nobody will cook at home. Interesting idea, especially in terms of home design - saving space in the kitchen and money on appliances. But then spending that money on delivery.

- Rhodium, almost 700% in three years.

- I am doing an ALMI trading demonstration webcast on 28 October at 8.15am Book here.

- Up coming events;

Operating margins

Pick n Pay (JSE code: PIK) results were good, but the increase in operating margin was outstanding and this had a serious boost to profits.

Operating margin is the profit after the costs of sales, such as salaries, rentals and products, but before paying interest or tax. Hence a 'clean' profit margin as opposed to net margin that will also have interest, tax and other costs deducted first.

It is especially important for retailers but not banks or miners for example. For those sectors we need other metrics such as impairments, cost-to-income and head grade etc.

Every since Richard Brasher took over at Pick n Pay I have been moaning about their operating margin. He's been getting much right but the operating margin was stuck at 2%. Then in the last set of results tey crept a little higher and now are solid 2.8% up from 2.5%.

This too me suggests the turn around at Pick n Pay is now complete.

Of note is that Shoprite* (JSE code: SHP) has an operating margin of over 5% and even the recent earnings collapse saw it stay above 4%, so they earn about double from every 100c spent at their tills. The question is how high can the Pick n Pay operating margin go? Shoprite benefits form higher margins in the rest of Africa, Pick n Pay doesn't. So 5% may be too far for Pick n Pay, but can they get to 4%?

A last point. Pick n Pay Tuesday results saw most retailers rally on the back of hope that the result wee not only a good performance from Pick n Pay but maybe also an improvement in consumer confidence and spending.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

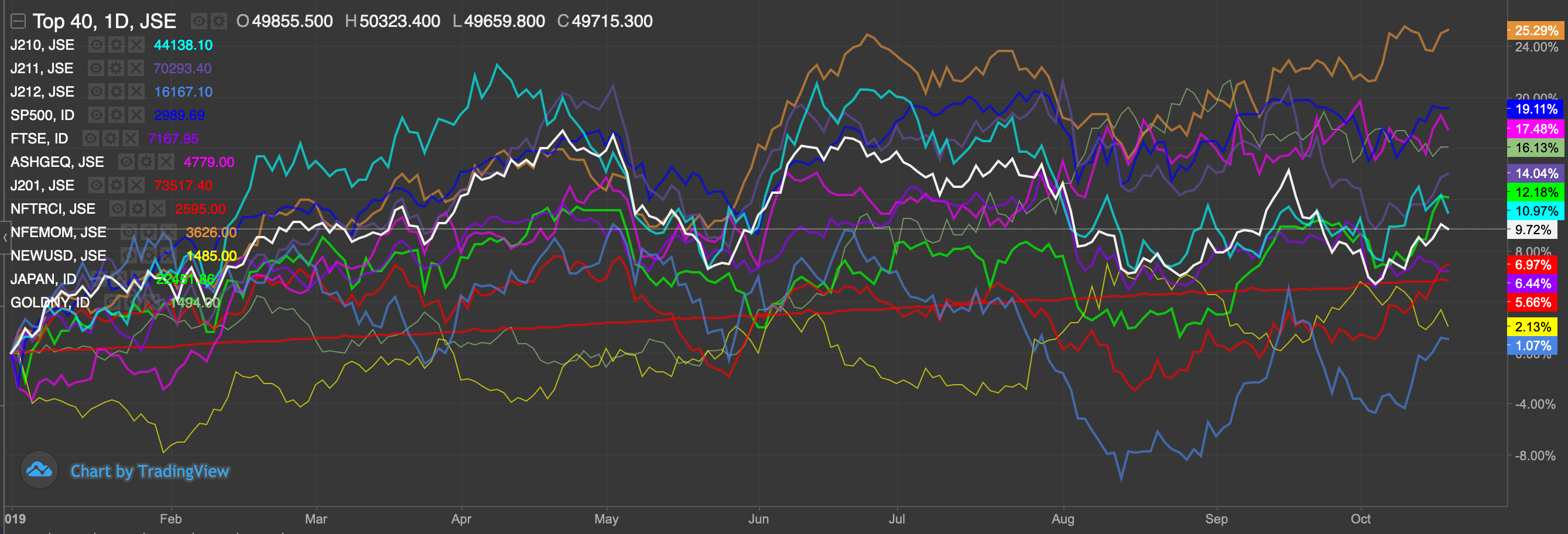

A late and short show this week, discussing the chart below showing return so far for 2019 (to close 17 October 2019). Surprisingly, all positive and some real good returns.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- #WhatsAppStokvel This is a scam, of course it is. You're only asking because you know it is and you're hoping somebody will give you 'permission' to go ahead anyway. Anything that requires you to recruit others in order for you to profit is always 100% a scam.

- Long4Life* (JSE code: L4L) upping their stake in Spur (JSE code: SUR) to over 10%. Is it a pure valuation play or does Joffe have something bigger in mind?

- Brexit, tic toc. Three weeks to go.

- Clicks (JSE code: CLS) issued an improved and updated trading update that sent the share to new all-time highs. One can argue about valuations here, but not the quality. Clicks is best of breed.

- 4Sight (JSE code: 4SI) was a stock i warned against since day one. Far too much jargon and hype that have not turned into profits. But go read the resignation letter of Geoffrey Carter from 7 October. Man is he maximum unhappy.

- I am doing an ALMI trading demonstration webcast on 28 October at 8.15am Book here.

- Will Trump juice the markets? A few people pointed out that maybe China will not want to do an agreement to hurt Trump and maybe get a democratic party winner in 2020. certainly possible.

- Understanding your statement.

- Understanding momentum ETFs.

- Up coming events;

Commodity miners catch 22

Implats (JSE code: IMP) is buying a Canadian palladium miner for some R11.5billion.

Now the deal looks decent, 3m ounces producing about 220k a year with an all in sustainable cost of some $820 and making EBITDA of some R1.6billion a year, so PE of 7x.

But those numbers are all grand with palladium just off all-time highs of $1,700. What happens when palladium falls?

This is the challenge of single commodity miners. You can't buy at the bottom because you have no money, but buying at the top screams a 'hail mary' pass.

The catch 22 is how else do miners grow? Every day the mine they lose some value as they mine reserves.

Maybe the smallish size of this deal is what saves it?

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Up coming events;

Up coming events;

10x South African Retirement Reality Report 2019

Simon chats with 10x Investments founder and CEO about their second Retirement Reality Report and a 1million give away into a retirement annuity.

You can find the full report here.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Blue Label (JSE code: BLU) shares flying after writing down CellC to zero. Up some 30%. I guess the market is relived CellC is only going to zero.

- WeWork gets a new CEO as founder Adam Neumann steps aside. Makes sense, aside from a lot of crazed decisions he's made. Founders are a different type of person from a CEO.

- The new top end iPhone is on sale for pre-order locally. At almost R33k, yip a full years tax-free. Even if buying on contract, that's an insane amount fo money for a phone that doesn't even make coffee.

- Peter Moyo again refused entry to work at Old Mutual (JSE code: OMU). This is beyond messy.

- Banking strike, with way more horror stories than actual facts. Facts are the union is not happy about retrenchments. But the many many messages I have received about cash running out and online banking not working I suspect are bogus. I suspect I am one of the few left who still use cash anyway?

- JUUL CEO Kevin Burns has just announced he is quitting.

- Wealthy Maths: Calculating dividends

- Up coming events;

Can Trump juice the markets?

More than anything he wants a second term and the election is in November next year (still over 13 months away).

Now he has a lot of troubles, including a possible impeachment attempt being announced Wednesday afternoon.

But Bigger is the trade wars impact on global economies and hence stock markets. We're seeing real evidence that they are hurting with Germany at risk of a recession and some horrid data out of Asia on Monday.

Point is winning a second term with a weak / tanking economy and stock market is hard, very hard.

So he needs to juice the economy and the market and he can do that easy.

Announce full and real trade peace with China, spinning it however required. This will set the market alight and help a struggling global economy and if he times it right, winning him a second term

The trick is when does he do this? Thirteen months out from the election may be too soon. But waiting for April or so may be too late. In fact it all may be too late. But I expect him to try.

Of course ultimately this would be sticking a band aid on a severed limb, but if all that is wanted is enough juice for a second term, it may work. Eventually we'll get the recession and global markets will slide, and very likely this has already started.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Local inflation came in at 4.3% in August from previous of 4.0%. This a little higher than expected with food one of the main drivers. Maybe we're finally seeing food inflation that will help the retailers. MPC rate announcement on Thursday, 20 out of 25 economists say no change. If they'e right then I think a November cut is certain.

- Prosus (JSE code: PRX) remains in the Top40 and Indi25 indices that it went into when spun out of Naspers (JSE code: NPN). I haven't been able to confirm weightings but the big question is does the two of them exceed what Naspers was weighted? For capped indices this gets real messy, say Naspers was capped at 10%, it'll still be 10%, but will now also include Prosus.

- Flavoured vaping, flavoured cigarettes next? Two states and President Trump are hitting out against flavoured vaping with a ban the likely outcome. I have spoken about this before, the tobacco industry went full tilt into vaping as a new gateway into getting new smokers and it's working. Except now regulators are pushing back and the question is if menthol cigarettes will be next? If it is then the industry is dead in the US market.

- Breaking news is that "India's cabinet approves ban on e-cigarette sales and production".

- Saudi Arabia oil production is coming back, majority this week 100% within 2-3 weeks. Currently we have over supply (before the attacks) so oil will revert back lower.

- Sasfin (JSE code: SFN) results show a book value of around 5000c yet the share has, for years now, traded well below book value. Otherwise not bad results, but they cut the dividend cover from 40% of HEPS to only 20%?

- Comair (JSE code: COM) results boomed on the back of the payment from SAA (ie: us). But otherwise it seems that the market is ignoring their non airline businesses that are now some 40% of group profits. They also seem to be benefiting from SAA reducing their flights early last year and the grew air traffic.

- Up coming events;

The Netflix Challengers

Apple has launched Apple TV+ for $5 or free for a year if you buy a device. Disney+ also launches in November for $5.99 or $12.99 if you also take Hulu and ESPN+.

We also have HBO, Peacock (coming next year), Amazon Prime (essentially free in the US) and a bunch of others.

Locally we only have Netflix, Amazon and Showmax.

But don't forget YouTube, I mostly watch YouTube, but I am a very light TV watcher, maybe 5 hours a week at most. YouTube is of course free, or you can pay to make the ads go away.

So now things get real for Netflix. At last results they had 151.6million globally with some 55million in the US. A recent price increase saw 130k US subscribers exit, but at an extra $1 per month that still added over US$600million to annual revenue.

But here's the Netflix problem;

- They're spending some US$15billion on content which is US$100 per subscriber who is paying around US$150 on average in the IS and lower in the rest of the world. So the numbers add up. But that content bill will continue to grow and competition has got real in the last year.

- Disney has an advantage of a serious back catalogue whereas Netflix has a much shorter and weaker back catalogue and has lost a lot to Disney, Stars etc. who have pulled their content for their own services.

- The idea was that cutting the cable and moving to streaming would markedly cut the bill. But now with all these services it ends up the same or even more. Users are going to start to be icky abut what and when they subscribe. For example, subscribing to HBO when GoT is on, then pausing.

Netflix is not dead, but for the first time competition is real and investors need to watch subscriber numbers and content spend.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Hello Prosus (JSE code: PRX). Spun out of Nasper (JSE code: NPN) and trading on JSE and Amsterdam Euronext. I expect Prosus to be the better deal as Amsterdam is a larger market for those wanting access to Tencent and the other assets. And the local fun damager saying that Prosus will do well as local fun damagers don't understand tech should hang his head in shame. The issue was simple weighting, one couldn't have Naspers at full weight in a fund, never mind over weight. So they had to decide how under weight they wanted to be and as such a large discount happened.

- As I record value unlock is some 3% with Prosus at R1,204 and Napsers off R1,100 adding R104 of value.

- Bottom line for me is that I expect Prosus to be the better asset due to the Amsterdam listing.

- And the awkward moment was the JSE not reflecting the indices right as they hadn't included Prosus in the indices that Naspers was in. So everything looked real ugly for a while. They fixed it. For next day or two Prosus will live in same index as Naspers, then JSE will rebalance either kicking Prosus out or keeping it in and kicking out the smallest.

- Intu (JSE code: ITU) flies on reports of a possible bid for the company by Orion Capital Managers. The problem is that the first two bidders both walked away, but I guess at some price the deal works?

- Labat (JSE code: LAB) is buying into cannabis, well kinda. A very small deal and we'll see. But I for one would not being buying the shares. Labat do not have the best track record on anything and sure cannabis is becoming legal all over. But that doesn't mean the profits flow, where I come from we don't call it cannabis we call it weed, because it grows like a weed.

- Famous Brands* (JSE code: FBR) trading update mostly as expected. GBK doing better after last years restructuring while local brands doing modest after inflation and new stores removed. The new issue is manufacturing where Lamberts Bay Foods is down 39% after losing one client? Talk about concentration risk.

- Moody's says no junk status for 12-18 months. So no need for immediate panic and first they need to drop us to negative outlook anyway.

- Jack Ma steeping down at chair of Alibaba. He stepped down as CEO in 2015 and is an amazing individual. He's 55 and got his first computer at age 33 starting Alibaba in 1999 and the company is now worth some US$460billion.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Local Q2 GDP came in at 3.1%, higher then expected but what struck me was the comment from Stats SA ~ "spurred on by a build-up of inventories and increased household expenditure". Now we have seen Woolies* (JSE code: WHL) and Shoprite* (JSE code: SHP) both comment that the second half to end June was stronger than the first, and this statement would suggest it was the second quarter. But who are these people? Or is it maybe base effect?

- An Eskom briefing on Wednesday seems to show that the utility has been stabilised with issues such as not enough coal largely fixed. But important point is stabilised, not yet improving. A start I suppose.

- Group5 (JSE code: GRF) is leaving the JSE as it exits business rescue. Shareholders can expect to get zero back. This is the risk of investing, we get the upside, but if it goes wrong we can lose it all.

- Discovery* (JSE code: DSY) results were pretty much in line with the first half and they continue to spend a lot of the new businesses. Price is, as always, slightly ahead of embedded value and PE is now a little under 15x. David Shapiro Tweeted;

— David Shapiro (@davidshapiro61) September 4, 2019

- Ring fencing tax losses

- Upcoming events;

- 05 September ~ JSE Power Hour: Benefits of offshore investing

US recession

US ISM came in at 49.1 which is contraction. This is now another recession warning adding to the inverted yield curve. It is frankly looking more and more likely the US will have a recession in 2020 or maybe early 2021.

Technical recession is two consecutive quarters of negative quarter-on-quarter GDP growth.

OECD data shows 6 US recessions since 1970, about one a decade which is frankly not very many. But what it also shows is that when the US hits a recession so does most of the rest of the world. No surprise there, either because they lead everybody down or because they only enter recession when globally things are real bad.

So what to do?

In short nothing. Just carry on carrying on.

- Firstly, maybe the US won't enter a recession any time soon, or maybe not for an age.

- Secondly, maybe the recession is only in 2021 and the market rallies first than collapses back to levels above the current levels. Remember Trump has an election next year and he can juice the stock market (and US economy) like crazy by making real trade peace with China and what does he want more; a second term or better trading terms with China?

- Thirdly, it may be a mild recession. Still not fun, but not earth shattering.

- Fourth, maybe locally we don't get hit too hard by it? I know that sounds crazy, but say Eskom debt gets fixed and consumer confidence and growth start returning? May sound unlikely, but not impossible.

Point is there are simple too many variables and as such, we just carry on carrying on. Buy your ETFs, keep a well stocked emergency fund and if you're nearing retirement, recession or not, be in the process of de-risking your short-term cash needs.

If you're really scared, and you should not be, have a look at the target volatility ETFs from Absa. Here's an interview I did and a blog post from Kristia here.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- An economic proposal out of National Treasury. Good looking document, but as always implementation is what matters.

- Adrian Gore, CEO of Discovery* writes a great piece for the World Economic Forum "Things are bad and getting worse for South Africa. Or are they?". Full of actual facts rather than emotions that typically cloud the debate.

- Naspers (JSE code: NPN) shareholders have agreed to the Prosus unbundling and it will be effective at the open on 11 September. I expect Prosus to trade around R950 and it we do see some value unlock, and I expect that we will, this could add some 4% to the Top40. Not on the day but over the week or so of the unbundling.

- Exxero (JSE code: EXX) results had a special dividend and growing profits. But what strikes me is a PE of 4x? The market is pricing it as if coal as an energy source will be dead within 4 years?

- Wealthy Maths: How to calculate future value

- Managed volatility ETFs explained

- Upcoming events;

- 05 September ~JSE Power Hour: Benefits of offshore investing

Prescribed asses

A lot of people are worryingly asking me about the ANC governments idea for prescribed assets. In other words a law requiring asset managers to invest in a certain way, expected that this would require buying of SOE debt or maybe even equity, albeit I think equity is almost certainly not on the table, just debt and frankly Eskom debt.

Now first off, personally I am in two minds about prescribed assets. The capitalist in me thinks they are a terrible idea. Investor should be able to invest where they want, even in 6% fee offshore funds if that rocks their returns. But we live in a developmental state with extreme inequality and as such I certainly think that prescribed assets do have a place in our economy, and we already have them in the form of reg 28 and nobody died from that. So I think the issue is balance and reg 28 strikes the right line of balance.

Let's quickly touch on regulation 28 of the Pension Fund Act. Before 1994 the NP government had prescribed assets and when the ANC came to power they scrapped that, but did put in place limits on how pension fund managers had to invest in terms of assets classes and offshore vs. local.

- The 2018 budget increased reg 28 rules to allow 30% offshore with a further 5% invested into the rest of Africa. A maximum of 75% into equities (with a cap of 15% in a +R20billion share and 5% cap on shares under R2billion). Property is capped at 25%, commodities at 10% and alternative investments capped at 15%.

So we have prescribed assets and yes people grumble about the reg 28 limits, but in no way has it been the end of the world.

Any change too prescribed assets would likely happen within the reg 28 environment but when asked in parliament last week President Ramaphosa was very vague on exactly what the government means. But I have some thoughts.

Magda Wierzycka, CEO of Sygnia (JSE code: SYG) had an excellent idea she put forward on Bruce Whitfields show. The PIC issues a zero coupon R200billion ten year bond to Eskom. This removes half their interest payments and gives them ten years to fix their balance sheet. If they succeed, boom. If not then we are right were we are now. Nothing ventured nothign gained.

The risk of course is to the PIC returns, but as a defined benefit pension fund tax payers would be on the hook for any shortfalls to the Government Employees Pension Fund (GEPF), and right now tax payers are anyway on the hook for Eskom. Further the GEPF is currently funded at 108%, so not anywhere close to falling over.

So maybe prescribed assets is actually just for Government Employees Pension Fund (GEPF) assets? And I like this idea very much, gives Eskom wiggle room and a decade while not killing our treasury in the mean time. Now many of you are spitting into your coffee at the thought of this. But let's be realistic. Eskom is way over debted and sure it is the result of state capture. But we can't roll back the clock, all we can do now s try and fix it.

Another fun fact is that SOE debt has not been defaulted on, and this is unlikely to change. So actually the great yields offered by, for example, Eskom bonds, is actually a great return. As long as they don't default and frankly they are either directly or implicitly under written by government so default is not going to happen.

As evidence of this is Future Growth invests into SOE debt and has great returns to boot.

But at he end of the day - we await full details from government which will probably arrive with a plan to save Eskom as they're the reason we're even talking about this and Minister Gordhan has promised details in early September.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Shoprite* (JSE code: SHP) results a show of many parts. Locally second half much better after the disaster of the first half. Rest of Africa swings into a R265million loss after making R1.6billion in 2016 FY.

- Dischem (JSE code: DCP) below 2000c. Was always way over valued but still on a PE of over 20x so not yet cheap.

- AdvTech* (JSE code: ADH) decent trading update. Lots of moving parts, but stripping that all out leaves HEPS +5% - +9% up and on a PE of under 15x much cheaper than Curro (JSE code: COH) and Curro no longer has the tertiary segment which is doing better than schools right now.

- Trump has delayed the new China tariffs because this could hurt the US consumer in the yearend shopping season. But in the same breath he says China is paying the tariffs? The man is a nut job.

- Local CPI came in at 4%, below previous of 4.5% and expected at 4.3%. Simply there is no inflation in the system right now and another rate cut from the MPC is surely assured as we move even lower below the 4.5% mid point of the range?

- Top40 is still green for the year. Off the +11% from earlier, but it's still +5.1% excluding dividends. But it fells like we're down 100%. That all said, over the last year Top40 is 8.8% excluding dividends.

- ETFs for investing and retirement.

- Dividend ETFs.

- Subscriber to our feed here

- Sign up for email alerts as a new show goes live

Is an IMF bailout really imminent?

"The IMF's primary mission is to ensure the stability of the international monetary system—the system of exchange rates and international payments that enables countries and their citizens to transact with each other." (source)

Upon the founding of the IMF, its three primary functions were: to oversee the fixed exchange rate arrangements between countries, thus helping national governments manage their exchange rates and allowing these governments to prioritize economic growth, and to provide short-term capital to aid the balance of payments. (source)

Lots of hype (hysteria?) about an IMF bailout for South Africa with all sorts of talking heads weighting in suggesting it is a certainty.

But an IMF bailout is not happening any time soon, the facts are simple and we're a long way off even entering talks about a bailout.

Now sure our economy and stock market are both under pressure but the IMF cares nothing about the latter and the former is struggling but it is a long way from a death spiral.

- Our government debt is +/-90% in Rands, so currency weakness does not kill our debt burden, whereas foreign currency debt kills when the currency weakens. Tis is a big reason for most bailouts and it is simple not a risk for us.

- Our Balance of Payments (BoP) is fine at some 4-5 months. Now sure more would be better, but that is not anywhere near a crisis. When Pakistan got their recent bailout BoP was down to a few days.

- Our currency is fairly stable, certainly it is not crashing

Bottom line, we're not seeing capital flight so no IMF bailout waiting in the wings.

So why are we seeing all sorts of hysteria headlines saying an IMF bailout is practically a certainty when it patently is not?

Also, why the fear from market friendly economists and the like? All these economists who criticise government for not being market friendly enough would surely love the IMF market friendly conditions for a bailout? Or are they practising double speak?

Both the in country IMF head (Montfort Mlachila) and our own SARB governor (Lesetja Kganyago) state that it is not currently on the table.

Now sure, 'currently not on the table' can change. But which of the above will trigger the change? What else could trigger the change?

Short answer is Eskom, but there are plenty of balance sheet / debt options for Eskom and minister Mboweni says we'll have details soon.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Brought Index and Structured Solutions, Absa CIB

Simon Shares

- US yield curves have inverted across the range. Shorter term rates are higher then longer-term rates. Now every recession has been proceeded by a yield curve inversion. But not every yield curve inversion has been followed by a recession. So maybe it's warning us or maybe it's not. In short, we'll see lots of hysteria and end of world doom sayers out in force, but as always just carry on carrying on.

- Upcoming events;

Managed volatility ETFs with Len Jordaan

Index and Structured Solutions, Absa CIB

Three Exchange Traded Funds (ETFs) issued by Absa earlier in the year.

- NFEHGE

- NFEMOD

- NFEDEF

Download the managed volatility product brochure Absa Volatility Managed SA Equity Indices.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Trade wars are back, but this time 'only' 10% on US$300billion of goods. No surprises? China is responding by allowing their currency to weaken to decade lows.

- Fed cuts 0.25%. Trump says that's not enough, but he is priming an excuse. He has an election next year and if the market / economy is weak - he'll blame the Federal reserve.

- Iron ore futures lost 10% last week and are currently around US$92, I been warning of this and Vale is producing again so the shortage is disappearing. Now sure Kumba Iron Ore (JSE code: KIO) has high quality lumpy iron ore which attracts a higher price. But the US$108 / tonne they got in the last results will not be repeated.

- Delta (JSE code: DLT) and Rebosis (JSE code: REB) talking about a possible merger? In many ways it makes sense, but the issue is debt on the Rebosis CEO is quoted as saying they need to fix their debt levels, not sure that does this.

- Nedbank (JSE code: NED) results show the quality of our banks. They're growing (yes very modestly at low single digits) but in an economy that is not growing. That takes skill.

- Curro (JSE code: COH) trading update was bleak. HEPS growth of 3% - 9% after one offs are stripped out on a stock on a PE of around 35x (after 13% sell off on Tuesday). Stock back at 2013 levels and some c70% off the highs of late 2015. The lesson here is simple, all business models mature in time, growth slows and one needs to be very careful about what price we pay. On a PE of over 100x with slowing growth was madness.

- Upcoming events;

How lucky are your investments?

Delphine Govender tweeted a great comment from Daniel Crosby about the role of luck in investing, or trading.

Never a truer word by @danielcrosby. The role of luck; market sentiment leads us as investors & our clients to think we were right because of the outcome; when being right in investing is about basis for the investment decision turning out correct (more than less). pic.twitter.com/qESB66vBqL

— Delphine Govender (@Delphine_DG) August 4, 2019

Truth is when luck strikes we claim it as skill, when it really was just pure good luck. Now don't get me wrong, when luck strikes - grab it with both hands.

But the problem is that by claiming luck as skill we skew out actual ability claiming credit where it's not due and as such we think we're better than we actually are and the problem here is glaring.

So in short when we're dissecting an investment we need to ask the question about how much of the return was luck vs. how much was skill. Now sure this isn't easy, but if we're honest with ourselves we certainly can spot luck and we need to admit as such.

Personally I know I had two very lucky trades. My first purchase in October 1987 (DiData) and Capitec* (JSE code: CPI). The former I was actually trying to buy another stock and the latter was more a purchase in anger as I had missed my preferred entry price and it just kept on moving higher. These two transform my portfolio returns, without them I still beat the market - but by a lot less.

So how did we spot that luck?

- Did something significant happen you never expected?

- Major competitor going bust?

- New market proving way more profitable?

- Serious shift in the landscape they operate in?

- Legislation changes that favour their products?

- Finding what they weren't looking for (gold miner finding PGMs)?

- A serious expected risk suddenly disappears?

- Did the stock valuation far and away exceed any realistic expected valuation?

None of this is rocket science to spot, you had reasons for buying. You list them (you do write down your research?) and then something comes out of left field to boost profits?

The flip side of course is bad luck, and sure that happens as well. So we also need to dissect bad luck. How much did it hurt but also do we keep on experiencing bad luck? If yes, maybe it's less about bad luck and more about lack of skill which we're blaming on bad luck because that's easier? Maybe we're just not very good at figuring out the risks?

I have long stated that the only book by Nassim Nicholas Taleb worth reading is Fooled by Randomness as it goes deep into the role of luck in investing, trading and life. Read it.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Shoprite* (JSE code: SHP) trading update sees full year profits down. But the real point is that the second half of the year was way better than the first half as they fixed DC and IT issues and had no further strike action. But it is still tough with lots of products in deflation which is squeezing margins.

- Massmart (JSE code: MSM) update was a shocker with Game bleeding like crazy. Not a surprise, but as Nic Norma-Smith said on Twitter "Wal-Mart paid $2.3bn for 52% of Massmart in 2010. Today the stake is worth $370m.". Ouch.

- NFEMOM*, the ABSA momentum ETF has been flying and is almost +20% year-to-date and just behind the S&P500 and best over last year (of indices, local and sub, that I track). I always like momentum and when ABSA changed the methodology of this ETF I switched my personal momentum portfolio into the ETF. Just as I did this everybody claimed momentum was dead, and the ETF struggled. But momentum never dies, even when (if?) value ever comes back, those value stocks will gain momentum and so momentum traders will profit.

- Loser indices so far year-to-date are the banks and mid caps, both slightly negative (excluding dividends). The resource index is doing well enough, but the industrial has actually beaten it - likely driven by Richemont* (JSE code: CFR) and Naspers (JSE code: NPN).

- ASX finally breaches the pre crisis levels and makes a new all-time-high, 12 years later.

- Nicky Newton-King is resigning as CEO of the JSE. She's been a great CEO transforming the technical side of the JSE during a period when values traded have been falling off a cliff. On that note, September sees the Naspers (JSE code: NPN) listing their non-SA assets in Amsterdam and while that could in itself see a bump of some 4% to the Top40 - it's going to hurt value traded even further with maybe as much as R1-R2billion of daily trade leaving to trade on Amsterdam instead.

- We think our local property space is having a tough time. But check the Intu (JSE code: ITU) results. A horror show with like-for-like net rental income down 7.7% and guidance for rental growth of -4% to -6%. Capco (JSE code: CCO) a little better and they're splitting out Covent Gardens (their prize asset) but it still tough and the share price remains under pressure while Intu share seems to be racing to the bottom.

- Fall out from Boris Johnson win and insists on a hard Brexit is not so much in the markets, but the currency as Sterling continues to slide to the lowest levels since 2017. This helps much of the FTSE100 as foreign earnings dominate.

- If you get the pamphlet about investing in 72 tonnes or either; iron ore, coal or magnesium. Throw it away, it's a scam, especially the part about holding for 18 months. That will be one massive warehouse bill.

- Another week and platinum continues to edge higher now around US$880.

- The final report of the presidential advisory panel on land reform and agriculture (aka #EWC) was released over the weekend and frankly it is exactly as expected. Sober and sensible. Yes lots of hysteria, there will always be, ignore it, it's mostly ill informed or just based on fear or hate.

- Understanding the SYGEU.

- Money Hacks: Bring down insurance premiums.

- Upcoming events;

- Subscriber to our feed here

- Sign up for email alerts as a new show goes live

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Kumba (JSE code: KIO) results saw production down, but with the average selling price up 57% at US$108 / tonne - they shot the lights out. But this is surely the top here? Rumours are that Vale has iron ore on the water heading for China and slower Chinese GDP may hit demand, sending iron ore back to a more sensible price around US$70 / tonne?

- Platinum continues to edge higher.

- Remember S12J? You could invest in a funds that invested into startups (within certain rules). Then whatever you invested would be deducted from your taxable income (on condition you held for 5 years) and tax would only be CGT, albeit on a zero cost basis. Government is now proposing a limit of R2.5million per person per year. Frankly for the vast majority, this is a non event as that's serious money.

- Alexander Boris de Pfeffel Johnson is the new Prime Minister of England. What one may think of him, markets don't care and for traders / investors that's what matters. That said, hard Brexit remains a stupid idea.

- IMF cutting global GDP growth, including our own. Now they're not always right, in terms of exact numbers they are seldom spot on. But the trend from the IMF has been edging lower for a while now, and on the trend they usually are right.

- I have a new show on BusinessDay TV - The Small Cap Portfolio. Monday live at 6.30pm and repeated during the week or on YouTube. I get one guest and we talk about two stocks of their choosing. We're not talking results, we're talking the profit drivers, risks and so on.

- Theo Botha points out on Twitter that; Pick 'n Pay Lead independent non-executive director Hugh Herman (75). Appointed to the board in 1976. How can this director still maintain his independence after 43 years on the board?

Pick n Pay Lead independent non-executive

director Hugh Herman (75) Appointed to the board in 1976 How can this director still maintain his independence after 43 years on the board?— Theo Botha (@tjbbotha) July 24, 2019

- From an intra-day high of 42% in 2012, Greek 10-Year yields have moved all the way down to 1.99%, their lowest level ever. US 10 Year Bond Yield: 2.07%. Never say never.

- Tax-free as you age

- Understanding the MAPPS Protect ETF

- Invest offshore with the JSE

How many shares to buy?

Two emails in the last week asked about how many shares to buy in any given stock. The problem is that this does not account for the cost of the shares. For example 10k shares in a R10 stock is very different from 10k shares in a R125 stock.

As an aside when I started trading warrants in the late 90's this was exactly how I traded. I bought 50k warrants regardless the price. So some times was R10k other times closers to R50k and my risk was all over the place.

The answer of course is simple, invest based on ZAR amount, not quantity.

I structure my portfolio with the core satellite approach;

- The core is around 55% in ETFs (tax-free maxed out every year)

- 30% in 'til death do us part' top quality stocks

- 8% in second tier small and mid caps

- 7% for trading ALSI futures and ETFs.

The til death do us part is some 10 stocks so when I am buying, I buy at around 3% of total portfolio. Of course as they moves the weightings get our of sync, I manage that by adding new money to other stocks or in some cases selling down when the weighting gets wildly out of sync.

But quantity of shares is not important.

A last point because I get this question all the time. People want a 'penny' stock below 100c because then it can double in price. Any stock, regardless of price can double in price and cheap does not make it easier.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- S&P500 above 3,000 and Dow Jones above 27,000.

- EOH (JSE code: EOH) have found R1.2billion of bad deals over 4 years, 2013-2017. A new dawn, I think so, but I would add a very slow dawn.

- Platinum starting to look decent? We have higher lows and two higher highs. A close above US$910 (still a way off) and things looking real strong. If you're long PGM miners. If not an entry on pull backs looks smart.

- Woolworths* (JSE code: WHL) trading update excited the market and shows a much improved second half, especially in food (expected) and clothing (not expected). Australia remains under pressure but overall good and the real question is if it's a new trend or a one off?

- Anheuser-Busch InBev (JSE code: ANH) has suspended the listing of their Asia-Pacific business that would have seen almost US$10billion being raised. The reason given is tough market conditions but the bigger issue is they wanted the cash to pay off part of the massive debt bill from buying SABMiller - so for now they remain with too much debt.

- FIRE at any age

- Property investment is better together

- Upcoming events;

- 18 July ~ JSE Power Hour: How to invest offshore with the JSE

- 14 August ~ JSE Power Hour: Live Fat Wallet Show

Where are the sellers?

There seems to be bad news every which way you turn, or is there? Trade wars, Iranian war, US tax receipts collapsing and so the list goes on. Yet markets remain in full bull mode albeit with two wobbles recently. Late 2018 and May this year.

The question is why, this is an old bull. In fact this is the longest bull ever and second best in terms of returns, one would think it would be frail and fragile - but no it remains strong.

I suspect part of the reason is that low interest rates and QE in Europe continue to drive buyers who are flush with cash and keen to park it somewhere, anywhere for a return that is positive.

We also have record low bond rates (even negative in many parts of the world worth some US$12trillion) so if you're looking for returns then you have to be invested in stocks to make any real returns.

German bonds issued at -0.75% and over subscribed but likely the ECB bought most of them? But this closes many investors out of the bond market if you want/need positive returns.

A last reason is likely FOMO. Those holding stocks are terrified of missing out so they're simple not selling and any weakness sees them buying and buying.

This will change eventually. Markets will fall and those buyers will turn into sellers. But for now don't stand in front of a raging bull and tell him to stop. He'll just run you over on route to new highs. The trigger is more likely to be higher rates and we seem to be a million miles from that.

This does of course feed into a bigger issue, all the new debt. Now sure central banks are buying much of the debt, but low rates mean more debt generally and how does it all get paid off? Long-term does the planet need a debt forgiveness plan to survive? How does that work and how does it not crash the entire system we have?

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- CSEW40* change confirmed for next Wednesday, it'll now be SMART.

- Trade peace, kinda ~ for now. In classic Trump style, lots of huffing, puffing and threatening the blow the house down. Until a 'deal' is reached.

- Afrimat (JSE code: AFT) walks away from the Universal Coal deal. No details, but likely they didn't like what they saw? Respect, far too many deals get deal mania and concluded no matter what.

- PricewaterhouseCoopers has resigned as auditors of Group5 (JSE code: GRF). Now this is moot as Group5 is in business rescue with no chance of surviving and PWC cites heightened risks due to resignations of many senior execs. But one wonders if they'd had quit in the older auditing days?

- Upcoming events;

fff

- Download the audio file here

- Subscriber to our feed here

- Sign up for email alerts as a new show goes live

- Subscribe or review us in iTunes

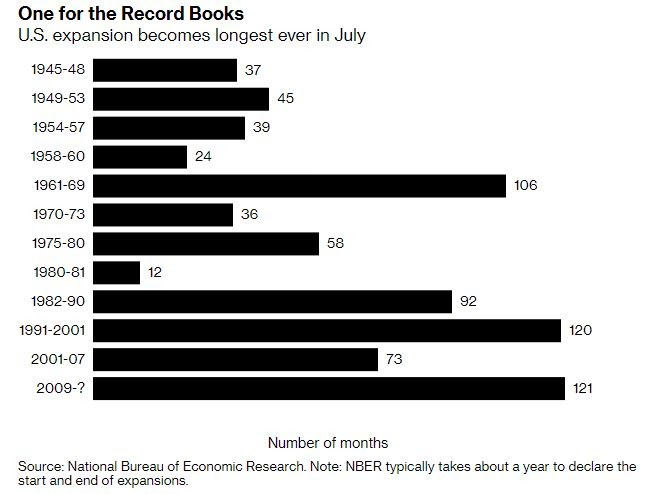

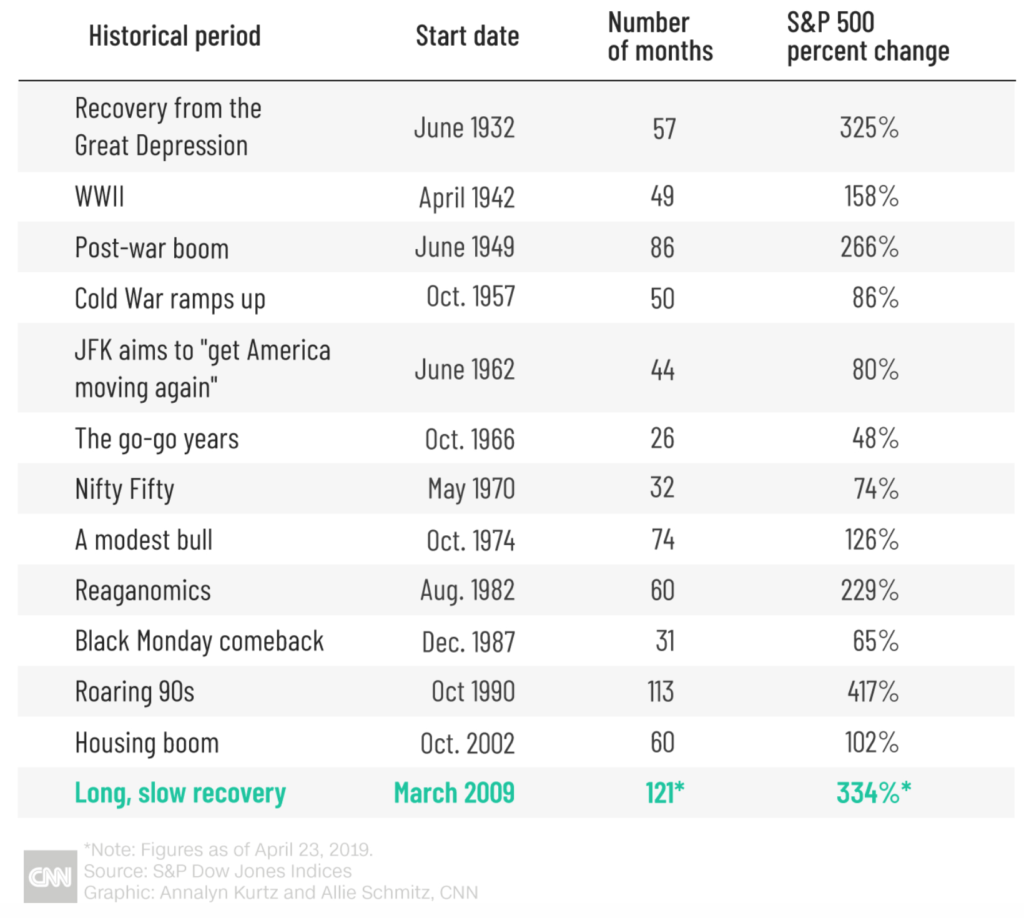

Longest economic expansion ever

The current US economic expansion is now officially the longest ever at 121 months edging out the 1991-2001 120 month economic expansion and also the longest bull market at 122 months with the return still behind the 1990-2001 dotcom rally.

But this raises two issues.

Where's our rally? Nov17-Oct18 saw out market off more than 20% meaning the end of any bull and we're only up some 10% since the highs of Jun14, five years for 10% and we're +12% so far in 2019. Horror stats albeit we're up almost 400% from the 2009 lows while the S&P500 is up just over 400%. Both great returns (one naturally better than the other), and this does remind us to always think long-term and worry less about the immediate when investing because 400% is a great return over a decade.

Second issue is when does the US collapse? Short answer is no idea. But records are made for being broken and while the US economy doesn't look as strong as it has over many of the past 121 months, there's not yet any wildly flashing signs of concern.

Naturally a black swan is a potential risk, but then it always is.

But here's my question. The Fed looks like it may start reducing rates, all good. But then what happens when things go pear shaped and they have no space for further rate reductions? Negative rates in the Europe or US?

Currently there is some US$12trillion of corporate and government debt with negative rates which is just insane and shows that while markets have run (some markets), we're still feeling the impact of the 2008/9 crisis.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.