Simon Shares

- MPC raised rates by 0.5% makes prime 11.75%, highest since 2009. The aim I suspect was to protect the rand, and that totally did not work as the currency hit its worst ever levels. Where will the rand go next? Does it ever strengthen again?

- RSA Retail Bond rates reset this morning and I expect the 5-year fixed to potentially increase by a full 15% and the CPI linked also reset and I also expect an increase there.. Will have update on the website.

- Tsogo Sun Gaming (JSE code: TSG) announced in their results last week they had acquired a ±10% stake in City Lodge (JSE code: CLH). Why? Also those were good results, much cheaper than other in the space.

- Zeda (JSE code: ZDD) results were poor. I was looking for FY 400c of HEPS, that's now seems a long shot. Debt is large, no dividend and short-term vehicle rentals is only a little above a quarter of pre-pandemic levels. I was holding and have sold.

- TigerBrands (JSE code: TBS) results were a shocker but not unsurprising? Volumes flat while revenue was +16%, hello inflation. Got some debt, but totally manageable. Load shedding hurting, consumer broken and inflation all over. But the stock trades at ±1.5x book value (see chart here), last tine this happened was 1998 when prime hit 26%.

- Spar (JSE code: SPP) trading update, ouch. Is Shoprite* (JSE code: SHP) eating everybody's lunch?

- Don't forget to action your Purple Group* (JSE code: PPE) rights issue. You have until Tuesday to either sell the rights or take them up.

- Meta (Nasdaq code: META) fined Euro1.2billion by the EU, but stock rises on the day. These fines, even large ones, are just a cost of doing business for the mega large cap tech stocks?

- Nvidia (Nasdaq code: NVDA) gets all the AI hype and love to a trillion dollars.

Simon Shares

- Bond ETFs yielding ±10%. That's chunky and they can go in a tax-free account.

- New INCOME ETF from CoreShares.

Purple Group* (JSE code: PPE) rights issue.

If you held the share yesterday at close on Tuesday 23 May you will see PPEN in your account. 10.20567 for every 100 Purple shares you held.

Each PPEN (letter of allocation or LOC as some are calling it) entitles you to buy 1 new Purple share at 81c.

- You can take up that right and buy, or

- You can sell them in the market

If you do NOTHING by 6 June they disappear with ZERO value

Sanlam will take their R45m and of the R105m public offer they will take up to ±R76m of the R105m if nobody else does. Existing large shareholders have promised to take up their rights at ±R28m. So at the end of the day they will get the R105m.

Simon Brown

Simon Shares

I have been talking about a cracking (broken?) consumer for a few months now. Two recent surveys show exactly this data.

- BankservAfrica’s five-year review of Take-home Pay and Private Pensions in South Africa for February 2018 – February 2023

- "The average nominal salary Take-home Pay Index, increased from R12,573 to R15,438, +22.8%." But CPI was 26.6% and take home pay had kept track until last year.

- Debt Busters Debt Index | Q1 2023 survey

- "Nominal incomes were 2% higher than 2016 levels, however when cumulative inflation growth of 40% is factored in for the same seven-year period, consumers’ purchasing power diminished by 38% over this period.".

- Rand trades at worst level ever on Friday, R19.5169/US$.

- Transaction Capital (JSE code: TCP), last week I sad the worst may be behind them. Well with the ZAR collapsing equalling more inflaiton and rates and petrok increases. Maybe not for SA Taxi or WeBuyCar.

- Purple Group* (JSE code: PPE) rights issue. Full details on 18 May. It will be R105m from Purple Shareholders and R45m from Sanlam at Easy Equities level. Total R150m

- Local PGM production down 14% in Q1.

- Calgro M3 (JSE code: CGR) results saw HEPS just above 150c while the stock trades at ±300x. Value or value trap?

- Sold my Sun International (JSE code: SUI) as price go backwards and I protecting profits. Excluding dividends ±70% return since November 2021.

- OpenAI Sam Altman goes before US Congress to propose licenses for AI.

- Pulling the ladder up behind you to stop others.

- I have been using ChatGPT via Bing and Google Bard. For investors they mostly useless.

- Pulling the ladder up behind you to stop others.

- Octodec (JSE code: OCT) results. Large discount to NAV and DY ±14%.

- Investing in mega trends

Simon Brown

Simon Shares

- Transaction Capital (JSE code: TCP) results where pretty much as expected. Management have essentially thrown the kitchen sink at everything. H2 will be tough but likely a little better. FY24 a clean slate. But market does not agree with me.

- Nutun doing good

- WeBuyCars under pressure, no surprise, consumer cracking

- SA Taxi real ugly, but as detailed in trading update

- US unemployment 3.4%. April CPI 4.9%.

The end of the US$

Bretton Woods essentially created teh US$ as a reserve currency

Now all commodities trade in US$

The end of the US$ is as old as time, really kicked off with the advent of the Euro in 1999.

But who take over?

- China, no?

- BRICS, that’s only China.

- Euro, but they don’t want a strong Euro and the world doesn't want the Euro either.

That said, the US$ will lose influence over time. It has been and will continue to do so. One day it may well be over, but we're a very long way from that.

Simon Shares

- Implats (JSE code: IMP) trading update saw production down and costs up. That's squeezing margins and going to hurt.

- Kumba (JSE code: KIO) nice boost in production, but iron ore prices are falling. Will hurt Afrimat (JSE code: AFT) as well.

- Combined Motor Holdings* (JSE code: CMH) results sees them on a PE of under 5x and DY of ±13%. But return will be mostly from dividends, ±650c over next thirteen months = ±22%.

- Renergen* (JSE code: REN) results. Smaller loss, but no profit as they ramp up Phase 1. A deal with Timelink for LNG and contracts with Consol & Italtile most of Phase 1 LNG (±50 tons a day) is under contracted sale.

- MTN (JSE code: MTN) update from Ghana and Nigeria look good. On PE ±11x, stock is cheap, albeit not without risks (always for MTN).

- All my index trades have been stopped out.

Simon Brown

Simon Shares

- Coronation* (JSE code: CML) trading update, aside from the massive SARS judgement (and hence no dividend), not bad. But not yet time for buying as sellers persist.

- Purple Group* (JSE code: PPE) results saw a loss for the six months ending February 2022. But lots of extra one off expenses (expected for a growth business) and a tough market and they still have excellent growth potential. I continue to hold.

Simon Brown

Simon Shares

- Local CPI 7.1% for March up from 7.0% in February. Expected was 6.9%. Core inflation 5.2% vs expectations of 5.1%.

- Rates higher for longer.

- Reviewing Minister Pravin Gordhan's portfolio. Too many stocks, why not more ETFs?

- Platinum at all-time highs in rands. This as it trades at more than 50% off the all-time US$ highs from 2008.

- Still long all my index trades.

Time to sell Capitec* (JSE code: CPI) as results show them as ex-growth?

- Return in Equity (RoE) 26%

- Cost-to-income (CTI) 39%.

- Impairments +80% and worrying the market

But my worry is it is priced +2x valuations of the other four big banks and it is now largely a mature bank. Sure low cost base, but I do not think it deserves that high valuation so am likely exiting after holding since 2009.

Simon Shares

- US inflation for March at 5.0%, better then expected and initial response form markets was to jump higher. Big wait now is for first week of May and the next FOMC rate decision.

Current open trading positions, long everything

My 7/21 trading system has me long all the indices I trade as below;

- Nasdaq 22Mar23 @ 12,740

- S&P500 21Mar23 @ 4,056

- Euro Stoxx 50 03Apr23 @ 4,317

- ASX200 05Apr23 @ 7,240

- FTSE100 11Apr23 @ 7,793

Simon Shares

- Combined Motor Holdings* (JSE code: CMH) strong trading update puts the stock on a PE of under 5x and a dividend yield of ±15%. A great well run company, but what will get the price moving higher or do we just live off dividends?

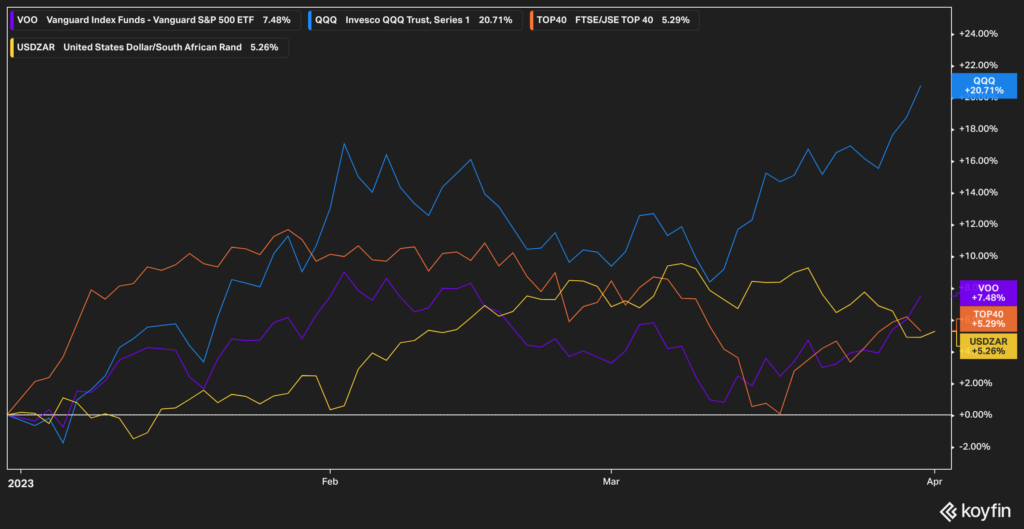

Strong first quarter returns Q1 2023 return[/caption]

Q1 2023 return[/caption]

Top40 stocks, top and bottom performers pic.twitter.com/zwZlJkRpwX

— Simon Brown (@SimonPB) April 3, 2023

Simon Shares

- MPC announcement Thursday.

- Purple Group* (JSE code: PPE) git the 120c bottom of the range, but has suddenly rallied.

- Steinhoff (JSE code: SNH), we now know what as the "Board agrees on a radical draft plan to enter into an insolvency process with creditors".

The problem with dividends - they not tax efficient.

They are great

But tax.

Dividend Withholding Tax (DWT) is 20%. The maximum Capital Gains Tax (CGT) is 18% after the annual R40k exclusion.

And DWT you pay along the way, eroding your return over time whereas CGT you only pay at the end.

Warren Buffett Berkshire Hathaway has never paid a dividend and he says they never will. Rather sell he says, more tax efficient.

Share buys backs are more efficient, but done at high valuations destroy capital.

No easy answer, but maybe we should temper our love?

Simon Shares

- Federal Reserve FOMC raises 0.25% and the market drops as Fed says almost at the top.

- Local CPI comes in slightly higher at 7.0%.

- MPC meets next week, hold on rates or another +0.25%?

- Credit Suisse 'sold' to UBS.

- Steinhoff (JSE code: SNH) votes against the debt deal, now what? Bankruptcy surely?

- Transaction Capital (JSE codeL TCP) bounces, where's the value?

Simon Shares

- Silicon Valley Bank collapse, does this put a pause on US rate increases? FOMC next Tuesday/Wednesday.

- "Moody's cuts outlook on U.S. banking system to negative, citing 'rapidly deteriorating operating environment'"

- Miss expectations and get slammed

- Transaction Capital

- Absa

- MTN

- Multichoice

- Hold winners, ditch laggers.

- Sun International (JSE code: SUI) vs. City Lodge (JSE code: CLH).

ff

Simon Shares

- The local Q4 GDP came in at -1.3%, worse than expected -0.4% and shows the real pain of load shedding and Transnet issues. Q1 2023 not expected to be any better. Every set of results mentions load shedding and retailers are spending ±R1billion a year on diesel.

- Rand is looking weak, very weak.

- Grindrod (JSE code: GND) had good results and are clearly benefiting from the failure of Transnet ports.

- Bank results are looking good with Firstrand (JSE code: FSR) very strong and Nedbank (JSE code: NED) good and doing a R5billion share buy back.

Simon Shares

- Budget 2023 show, audio is fixed

- Solar as a service

- Retail Savings Bonds five-year fixed now at 10.5%

- Satrix takes over most Absa ETFs

City Lodge* (JSE code: CLH) results

- Stale bulls

- Dividend of 5c

- Occupancies at 57%

- Debt gone

- Cater for business, who are Zooming more

- Overall a bit light

Spur (JSE code: SUR) results vs. Famous Brands (JSE code: FBR).

Budget 2023

- Pieter Janse van Rensburg ~ AJM Tax

- Tony Leon ~ former leader of the opposition & ambassador

- Lesego Majatladi ~ Stay Latatude

- Simon Brown

Great insights into the budget, who should be our finance minister and even the Coronation* (JSE code: CML) Con Court appeal against the SARS judgement.

Simon Shares

- Sasol (JSE code: SOL) update was all about troubles with power, ports and rail. In other words SA infrastreucture.

- Pick n Pay (JSE code: PIK), they spending R60million a month on diesel.

- US unemployment is the lowest since 1969 at 3.4%.

- Grey listing for South Africa. The Financial Action Task Force will announce their decision at their 24 February meeting.

A paradigm shift is happening

AI has suddenly landed and it's going to be wild.

I rate it with some other major technological paradigm shifts;

- The personal computer in 1974

- The internet in 1990 (yes we had dial up bulletin boards before then, but that wasn't internet).

- Smart phones with the iPhone in 2007

All were horrid when they launched. But now they drive humanity.

Facebook getting their ads working AI after Apple locked them out.

Search is changing and will Google be the new winner.

We use Dali-E for images on JOL

Chat GPT is great, but it is not accurate. That is actually a design feature, but this is only version 3.5 and already lots of people are using it for real world practical examples.

How is it going to change investing and trading? I don't know but I know many, myself included, are trying things to see what works and what actually adds value.

Quick update, I buying Coronation (JSE code:CML) at ±3750c.

View my portfolio ==>> www.SimonBrown.co.za

Simon Shares

- MPC Thursday (26 January) raised 0.25% and FOMC Wednesday (1 February) expected is 0.25%.

- Capco (JSE code: CCO) good trading update and dividend.

- Renergen* (JSE code: REN) proposing US ADRs with Nasdaq listing in time to raise last capital required for phase 2.

Stocks losing money from load shedding

All listed companies are mentioning load shedding in their updates.

Shoprite* (JSE code: SHP);

"The Group's additional spend on diesel to operate generators across our Supermarkets RSA store base in order to trade uninterrupted during load shedding stages five and six amounted to R560 million for the period."

For the six months ending 2 January 2022 operating profit was R5,113billion. So load shedding costing the group ±10% of operating profit?

Astral (JSE code: ARL) selling chicken R2/kg below cost of production.

"A large portion of the capital expenditure commitments amounting to R737 million, outlined during the F2022 results presentation, has been placed on hold given the current adverse market conditions. The Group has however committed funds towards backup electricity generation solutions to reduce the adverse impact of load shedding."

Simon Shares

- Renergen* (JSE code: REN) finally gets phase 1 helium flowing.

- ArcelorMittal (JSE code: ACL) update, everything they warned about went wrong.

- MPC Thursday (26 January) and FOMC Wednesday (1 February). Raising 0.25% each.

Stocks making money from load shedding

- Reunert (JSE code: RLO). High voltage cables and circuit breakers.

- Mustek (JSE code: MST). Green energy division.

- Famous Brands (JSE code: FBR). Lights out need food.

- Mahube Infrastructure (JSE code: MHB). Wind and solar operations paying a dividend (DY ±13.5%) and trading below NAV.

- Kibo Energy (JSE code: KBO). Are they a going concern? They issued shares to pay a £19,635.44 invoice.

This is well worth a listen, some important data points from @StefMarani that help understands the road ahead .. https://t.co/6CGNRd6QUe

— Simon Brown (@SimonPB) January 24, 2023

@simonbrown_za ArcelorMittal SA horror update as the second half was loss making #investing #share #jse ♬ original sound - SimonBrown

Simon Shares

- Top40 is all about China. Economic data from China for 2022 released this week was weak, but better than expected.

Which food retailer offers the best value?

Food inflation is still high, 12.7% YonY for December.

But likely peaked (good rains, diesel lower and reducing input costs)

Preferred food retailer?

- Always Shoprite* (JSE code: SHP). But expensive, forward PE 19.5x

- Pick n Pay (JSE code: PIK). Forward PE 20.5x and not as good as Shoprite.

- Woolies* (JSE code: WHL). Exited disaster that is Australia. Forward PE 15x and if they can also fix clothing, real winner.

- Spar (JSE code: SPP). CEO and chair exiting after bad press recently. Poland issues but forward PE 10x.

Now for the tenth year in a row, we kick off the new year with a prediction show.

Marc Ashton, Keith McLachlan and Simon Brown put their heads on the block with three wild and woolly predictions for the markets for 2023 followed by a call on the Top40 and ZAR for the year ahead.

Importantly we start each show with a review of the previous year’s predictions and you’ll find the 2022 predictions show here.

I've been buying some Zeda on the JSE.

- Here's why

- A bit about the business

- Risks

- Possible target price