Holiday show

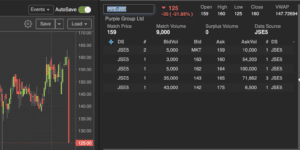

- Back in 2010 the world watched as Greece plunged further and further into a debt crisis with many expecting the EU to not survive. But Angela Merkel saved Greece and the day.

[caption id="attachment_31826" align="aligncenter" width="888"] Greek 10Y bond rates[/caption]

Greek 10Y bond rates[/caption]

Greek debt to GDP (%)

source: tradingeconomics.com

On the 20th September 2021 Chinese property developer missed interest payments on some US$300billion of debt and this spooked markets into a selloff. But three months later nobody cares. What's the background sorry and why does nobody care?

After clogging up the Suez Canal for six days back in March 2021 and halting much of the worlds shipping trade, what happened to Ever Given?

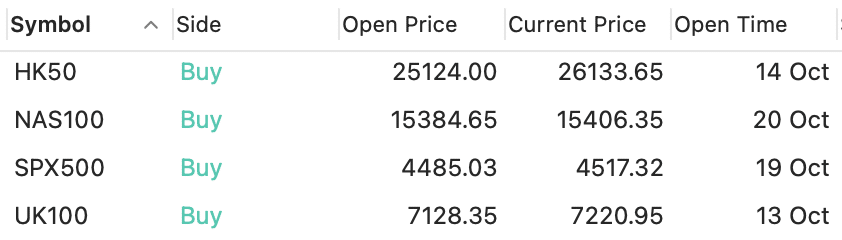

Offshore

/ Strong year of returns globally, CAC40 (France) top index

/ US inflation, not transitory

/ US unemployment looking decent

/ China crackdown

/ Commodities mostly a soft year, the exception is oil

/ Supply chain chaos

Local

/ Good year for local markets

/ Delisitng galore

/ GDP

/ Rand

- Simon has a look back at the winners and losers from the JSE for 2021, year-to-date returns. There certainly are some losers, but mostly it is about winners as the Top40 did 21.5% so far and the top major global index was the Cac40 which returned 29.9%.

-

Find the top ETFs here.

Offshore

/ US Labor Nov Nonfarm Payrolls +210K; Consensus +573K, unemployment improved to 4.2%. Fed's target for 'maximum employment' is for unemployment rate of 4.5%.

/ Didi leaving NYSE

/ Google will no longer require workers to return to the office on Jan. 10, delaying the return indefinitely.

/ Dorsey leaves Twitter

/ OPEC+ agrees to January production hikes

Local

/ Implats comes for RBPlats

/ Capital Appreciation results

/ Tharisa results

/ Bidcorp updates

/ Murray & Roberts update

Simon Shares

- Bidcorp (JSE code: BID). Strong update, they're coming out of this pandemic much stronger.

- Aspen (JSE code: APN) announces manufacturing deal with Johnson & Johnson (NYSE code: JNJ).

- Implats (JSE code: IMP) wants RBPlats (JSE code: RBP), sorry Northam Platinum (JSE code NPH).

- Powell, Fed chair, says inflation is not transitory.

- Oil under severe pressure, OPEC+ meeting was pushed back to Wednesday.

- New variant, I bought City Lodge* (JSE code: CLH) and Sun International* (JSE code: SUI) on Friday.

I did buy somme leisure on Friday, CLH at 400c and SUI at 2100c .. will see shortly if that was a good idea or not ..#JSE https://t.co/aHKZOIxLbu

— Simon Brown (@SimonPB) November 29, 2021

Offshore

/ Powell second term as Fed chair

/ Fed's Bostic says he remains open to faster taper and one or two rate hikes in 2022

/ Online Black Friday sales in the US fell according to data from Adobe Analytics ($8.9bn vs. $9bn)

/ Opec+ meeting this week, production likely to remain unchanged

/ Turkish lira losses 20%

Local

/ New variant crashes markets and leisure stocks (everything)

/ Good Invicta results, but no dividend

/ Good PPC results

/ Brait apital raise via convertiable bond

/ Hospital stock results; Life Healthcare & Netcare

/ Banking stocks

Simon Shares

- Coronation* (JSE code: CML) grows assets, fees and dividends.

- PPC (JSE code: PPC) results look good.

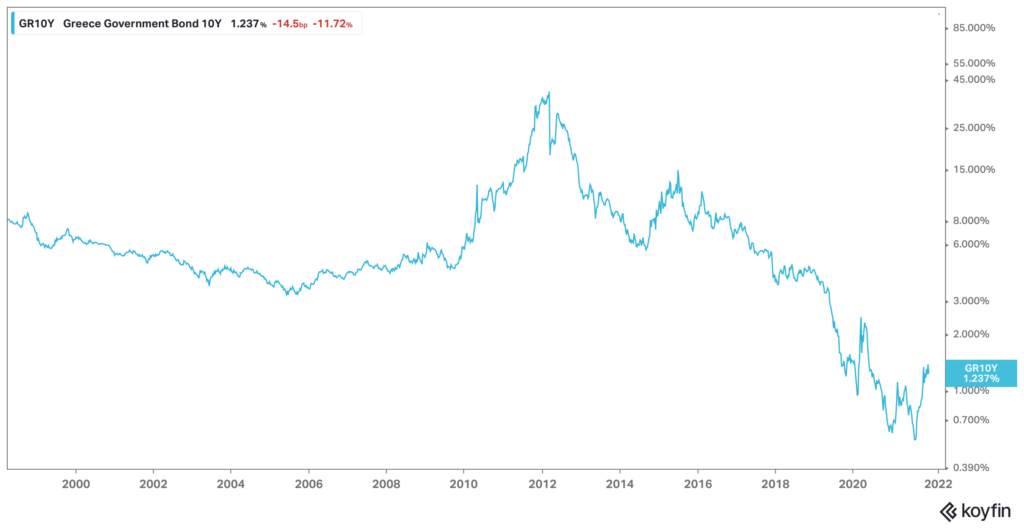

- Purple Group* (JSE code: PPE) price action looking weak.

- PGMs fading again.

- Hospital group stocks; Life Healthcare JSE code: LHC) and Netcare (JSE code: NTC) both had fair results as they get better at managing the pandemic.

- Shoprite* (JSE code: SHP) launched their banking account, under pinned by Grindrod Bank (JSE code: GND) who also stand to benefit from the MTBPS last week whereby the minister said they'd allow independent traffic on the Transnet rail network by end of 2022.

- Turkish lira collapse. This is what happens when your central bank is not independent.

- Two stocks that made a real difference to my portfolio over the last two decades, Capitec* (JSE code: CPI) and Shoprite* (JSE code: SHP).

Twenty years of food retailers on the #JSE pic.twitter.com/BDKeOPU11t

— Simon Brown (@SimonPB) November 23, 2021

Twenty years of local banks .. only really one bank in it as the other 4 battle along the bottom as Capitec does 46% CAGR over the two decades ..#JSE pic.twitter.com/yMx0NSDYrV

— Simon Brown (@SimonPB) November 24, 2021

Simon Shares

- Iron ore below US$100. Kumba (JSE code: KIO) halved since July highs.

- And still falling.

- But Q3 sales were at US$180 / tonne and even at current lows likely they get US$150 / tonne for the second half. Mid-year cost per tonne was US$26 and sale price US$165 / tonne. So the share is pricing in horror stories which likely aren't true fr the full year ending December. BUT next year will be different and you don't try to catch falling knives, wait for a confirmed reversal.

- Woolies* (JSE code: WHL) trading update, really weak.

- Shoprite* (JSE code: SHP) trading update, really strong.

- Strong PPC (JSE code: PPC) update.

- Local inflation came in at 5%, the fourth month we're below US inflation and likely we'll see no change at MPC on Thursday.

[caption id="attachment_31691" align="aligncenter" width="888"] Top40 daily[/caption]

Top40 daily[/caption]

Upcoming events;

- 18 November ~ JSE Power Hour: Opportunities in local and global property

- 25 November ~ The inflation threat, is it becoming structural?

- 02 December ~ JSE Power Hour: Position your portfolio for 2022

- 09 December ~ Portfolio construction with Keith McLachlan

Offshore

/ US inflation, 6.2%. Core inflation highest since 1991.

/ Johnson & Johnson announced plans to split its company into two, separating its consumer health division from its pharmaceutical and healthcare businesses.

/ Elon Musk selling Tesla shares, some planned n September. Rest thanks to the Twitter poll.

/ Singles day in China, muted (+8.5%) but still huge, Alibaba $84.5billion

/ Tencent results. Slowing in all areas. Common prosperity is visible in the results.

Local

/ MTBPS, not much happening - as expected.

/ Vodacom buying Vodafone Egypt, nice deal and adds a strong growth region.

/ Purple Group results, really top class and much better than I expected. 737k funded accounts.

/ Sappi results, doing well as dissolving pulp prices boom. But energy costs hurting.

/ Raubex results strong with a really good pipeline and well positioned for infrastructure

/ Northam scopes Implats and buys 33% of RBPlats

Simon Shares

- Iron ore below US$100. Kumba (JSE code: KIO) halved since July highs.

- Tencent (Hong Kong code: 700) results.

- Northam (JSE code: NPH) buys stake in RBPlats (JSE code: RBP).

- Telkom (JSE code: TKG) results.

- Purple Group* (JSE code: PPE) results.

[caption id="attachment_31661" align="aligncenter" width="888"] Purple Group daily chart[/caption]

Purple Group daily chart[/caption]

Offshore

/ US tapering begins

/ Strong US jobs data

/ US passes $1trillion infrastructure bill

/ Bank of England leaves rates unchanged

/ Strong Pfizer results

/ Elon Musk asks Twitter if he should sell 10% of his Tesla shares, and pay tax

Local

/ Mini budget this week

/ Renergen reserves

/ Dis-Chem results

/ MTN update

/ Purple Group update

/ Petrol increase

Simon Shares

- Federal Reserve FOMC press conference Wednesday evening after a two-day meeting.

- Avis (NYSE code: CAR) up 50x from March 2020 lows after results.

- Pfizer (NYSE code: PFE) results.

- Ascendis (JSE code: ASC) shareholder activists now control 30% of the votes.

- Renergen* (JSE code: REN) announce a six-fold increase in helium reserves.

- Still need to raise UAS$800m or R12.3billion to get phase 2 up and running.

- [caption id="attachment_31627" align="aligncenter" width="888"]

Renergen weekly chart[/caption]

Renergen weekly chart[/caption] US$8.5billion from France, Germany, the UK and the US governments, as well as the EU, to support a just transition to a low carbon economy.

Simon Shares

- Tesla (NYSE code: TSLA) becomes the worlds 7th trillion-dollar company.

- Excellent Santova (JSE code: SNV) results. My bad pandemic crash sale.

- Decent Famous Brands* (JSE code: SSW) results.

- Implats (JsE code: IMP) wants to buy Royal Bafokeng Platinum (JSE code: RBP).

- Sibanye-Stillwater* (JSE code: SSW) buys two Brazilian mines for US$1billion and 19.99% investment in New Century Resources for US$46million.

Upcoming events;

- 04 November ~ JSE Power Hour: Bold predictions from SA's top broker

- 11 November ~ Investment Valuation with Keith McLachlan

From the last week

Offshore

/ Evergrande has its suspension lifted and makes an interest payment

/ Oil remaining stubbornly high

/ Inflation fears, time for gold?

/ Paypal maybe buying Pinterest for US$45billion

/ Netflix results, still growing albeit north America very slowly

/ Facebook getting a new name as the future is the metaverse

Local

/ Local CPI 5% for September

/ Pick n Pay results

/ Excellent results from Combined Motor Holdings

/ Clicks results

/ New Satrix All Share ETF listing in November

/ Renergen launches a helium token

Simon Shares

South Africa inflation rose to 5% in September. Food inflation is 7%, electricity 14%, and fuel almost 20%, with a large petrol price increase expected in November. These increases are partially offset by clothing inflation at 1.6%, appliances -0.4%, and housing rentals around 1%

— kevin lings (@lingskevin) October 20, 2021

- Wesizwe Platinum (JSE code: WEZ) went crazy after releasing a competent person report.

- Calgro M3 (JSE code: CGR).

- Balwin Properties (JSE code: BWN).

- US lists its first Bitcoin ETF, ProShares Bitcoin Strategy ETF (NYSE code: BITO). It doesn't hold actual Bitcoin, rather it uses futures to track gains. losses.

- Everything Rally

My positions for the everything rally.

My positions for the everything rally.

Upcoming events;

- 21 October ~ JSE Power Hour: Small cap investing with Anthony Clark

- 27 October ~ FX and Commodity prices and their effects on investments

- 04 November ~ JSE Power Hour: Bold predictions from SA's top broker

- 11 November ~ Investment Valuation with Keith McLachlan

Offshore

/ September, the CPI increased 5.4% after advancing 5.3% on a year-on-year basis in August.

/ China Q3 GDP at 4.9%

/ Biden announced that the Port of Los Angeles would start operating around the clock, following the Port of Long Beach's lead, to ease congestion

/ $2.7 Trillion in Crisis Savings Stay Hoarded by Wary Consumers

/ Microsoft shuts down LinkedIN in China

/ MTNs IHS Towers lists in NY, MTN stake worth R22bn

Local

/ Government cracking down on imported cement, but not with tariffs.

/ IMF bumps local GDP to 5% for 2021

/ Murray & Roberts expands in the US

/ Long4Life results and offer on the table

/ Tharisa gets their Chrome plant cold commissioned

/ Alaris & CSG both have delisting offers.

Simon Shares

- Murray & Roberts* (JSE code: MUR) expands in the US.

- The government says they'll only use locally produced cement in projects. PPC (JSE code: PPC) and Sephaku (JSE code: SEP both fly higher. But is the market right about this?

- We're off the UK red list, good for local hotels?

- Aveng (JSE code: AEG) have announced plans for a 1:500 share consolidation in December. This usually sees prices weakness after the consolidation.

Upcoming events;

- 14 October ~ Investment Fundamentals with Keith McLachlan

- 21 October ~ JSE Power Hour: Small cap investing with Anthony Clark

- 27 October ~ FX and Commodity prices and their effects on investments

Offshore

/ US jobs disappoints, but unemployment 4.8%.

/ 15% global tax rate approved.

/ Oil continues to run higher

/ Reports that Malaysia is getting back on track with chip packaging sees PGMs run hard as it could be good news for vehicle production

/ Last Tuesday was tenth commemoration of the death of Steve Jobs. A legend and the iPhone one of the best products ever?

/ All facebook properties down on Monday for 6 hours.

Local

/ EOH update shows it’ll make an operating profit

/ Invicta buys Dartcom, moving into communications and renewable energy

/ Zeder results, still waiting on value unlock

/ Sanlam Investment Holdings buying Absa investment businesses.

/ Home loans worth +R56.6 billion were granted in Q2 2021, +40% compared to the same period in 2019.

Simon Shares

- Facebook (Nasdaq code: FB), Instagram and WhatsApp all down on Monday.

- Evergrande is suspended.

- Last week it was a fat finger Purple Group* (JSE code: PPE) taking the stock down to 125c. This week it hits 225c.

- Murray and Robert* (JSE code; MUR) starting to move higher.

- Brent oil is now around $82.

- PGMs remains under pressure.

- EOH (JSE code: EOH) makes an operational profit, but the debt pile remains.

Upcoming events;

- 14 October ~ Investment Fundamentals with Keith McLachlan

- 21 October ~ JSE Power Hour: Small cap investing with Anthony Clark

Offshore

/ China & Europe power shortages

/ Brent oil trading around $80

/ Merck Covid-19 pill, expected to produce 1.7 million courses for the U.S. government for $1.2B

/ Tesla delivered record 241,300 vehicles in the third quarter

/ Work-from-home forever: PwC offers US employees full-time remote work

Local

/ Level 1 & SA expected to be removed UK red list, will tourists return?

/ Capitec results

/ Bidcorp results

/ PPC debt restructuring

/ Purple Group tie up with Discovery Bank

Simon Shares

- FOMC and MPC both keep rates unchanged, No surprise.

- Evergrande is not a threat to the global financial system.

- Fat finger on Purple Group* (JSE code: PPE).

Upcoming events;

- 30 September ~ Power Hour - JSE traded ETNs on Tesla, Apple, clean energy and more

- 14 October ~ Investment Fundamentals with Keith McLachlan

Offshore

/ FOMC leaves rates unchanged and no tapering just yet.

/ Evergrande a worry but not a global threat

/ China bans crypto, again.

/ Britain has a shortage of lorry drivers, and so a petrol shortage.

/ Nike cut its 2022 revenue outlook because of the temporary bottlenecks plaguing supply chains.

Local

/ MPC no change

/ Telkom to spin out towers (Swiftnet) worth about R13billion. Openserve will happen afterwards.

/ PGM prices remain under pressure as vehicle production the world over in under pressure due to chip shortages.

/ Spur results

/ Exxaro has announced the development of a 70 MW solar project as part of the groups “overall renewable energy strategy”.

/ Grindrod sells remaining stake in Grindrod Shipping for R370million

Simon Shares

- Clicks (JSE code: CLS) revised trading update, previous EPS growth was 8%-13%. Now revised to 0%-3%.

- Afrocentric (JSE code: ACT). Great little stock.

- Not a bad update from Famous Brands* (JSE code: FBR)

- US inflation for August was 5.3%.

- US poverty levels went down in 2020, during the pandemic.

- AB Inbev (JSE code: ANH) just keeps on falling, why?

- PGMs getting crushed. Platinum down at US$934, palladium around US$2,000 and rhodium US$13,300. What's happening? When does it reverse?