Nikkei 225 reached a new all-time high after 35 years

- Historical context: peaked in December 1989, 82% drawdown by March 2009.

- Factors contributing to the 80s crash: Yen protection, low rates, speculative bubble.

- Current challenges: aging population, economic complexities, recent inflation.

- Investment options: Sygnia JP (SYGJP) - JSE-traded, and Investec's structured product.

Warren Buffett's Annual Letter

- Warren Buffett's annual letter to shareholders released.

- AGM scheduled for May 4th, details about screening yet to be announced.

- Historical and informative; available on BerkshireHathaway.com.

City Lodge Results

- City Lodge results: Revenue up 10%, dividend up 20%, HEPS up 10%.

- Occupancy at 61%, pricing power at 65%.

- Challenges in margins due to increased focus on food and beverage.

- Comparison with other hospitality stocks: Sun International, Southern Sun.

MultiChoice Canal+ Offer

- Canal+ acquires 35.01% of MultiChoice voting rights, triggering a mandatory offer.

- Takeover Regulation Panel ruling.

- Speculation on Canal+ offer price, potential sweetening of the deal.

Bitcoin and Bitcoin Halving

- Bitcoin trading around $59,884, near all-time highs.

- Upcoming Bitcoin halving in April and its potential impact.

- Local perspective on Bitcoin and its role in the market.

- Bitcoin in ZAR trading over a million, emphasising its volatility.

- Discussion on Bitcoin's market cap compared to traditional stocks.

Pick n Pay* Update

- Pick n Pay's disappointing update: debt doubled, sales going backward.

- Market's negative reaction reflected in the stock price.

- Potential exit strategy if weekly close falls below 2022.

* Simon holds ungeared positions.

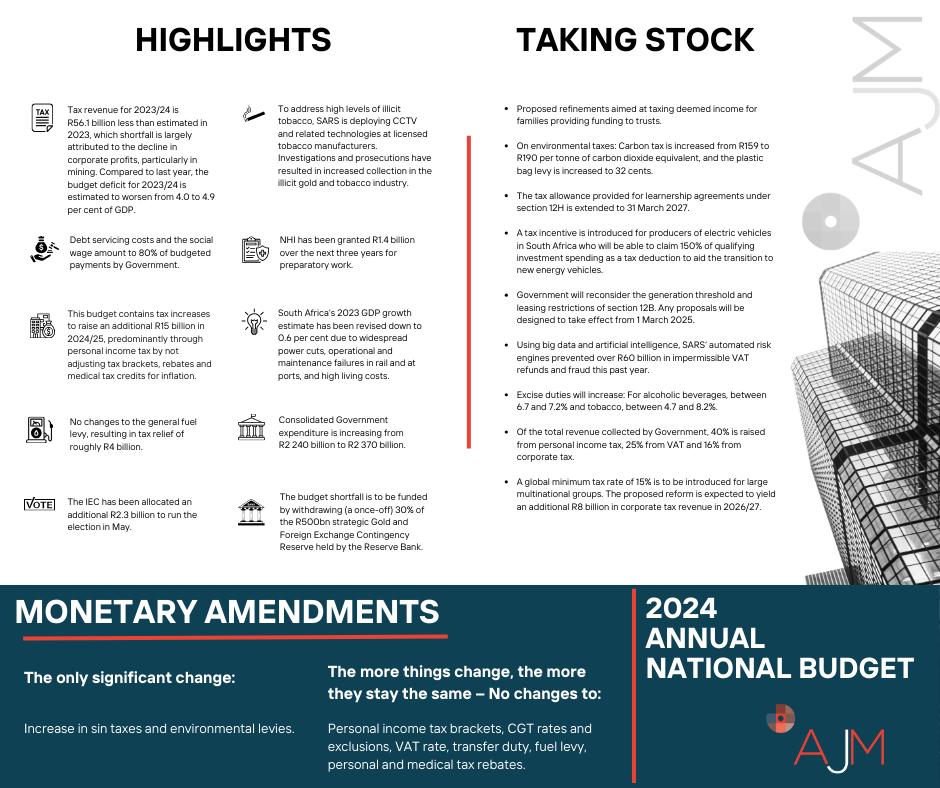

Budget 2024 panel.

For the last many years AJM Tax has done a post budget panel which includes Simon Brown and this year was no different. Hosted in Cape Town the panel was;

- Karyn Maughan, senior legal journalist at News24

- Dr Albertus Marias, Director AJM Tax

- Azhar Varachhia, Managing director Alpha plus Capital

- Simon Brown, Just one Lap and MonewebNOW

Pick n Pay* Chart Analysis

- Resistance zone around 26, potential to touch 26.70

- Higher highs, higher lows, horizontal resistance

- Target: 30 bucks to fill the gap

- Comments on Pick n Pay's potential under Sean Summers

- No need for a rights issue, potential market spook if it happens

- Simon's position: Started building, considering more

- Current status: Down 1.7%, trading at 25.30

Pick n Pay close 13Feb24 (daily)

Pick n Pay close 13Feb24 (daily)

Transaction Capital and WeBuyCars

- Transaction Capital planning to list WeBuyCars

- Unbundling process expected in March

- Valuation: 7.5 billion rand

- Key information: Founders' put option on Transaction Capital is off the table

- WeBuyCar's strong performance in January with a record 14,000 cars sold

- Market Cap of Transaction Capital: R6.5 billion

- Opportunities and challenges in SA Taxi business

- Overall assessment: Looking not too bad

- Current stock level: 850c

- Expectation of pro rata shares for Transaction Capital holders

- Timing details expected in the circular

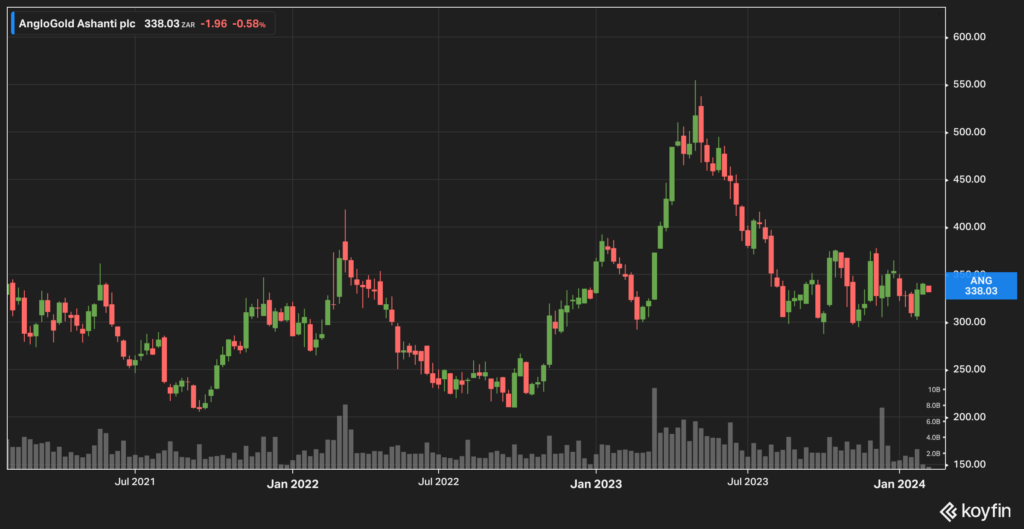

Gold Price Movement

- Gold weaker despite US and UK inflation data

- Current gold price and chart analysis

- Simon's position in Anglogold Ashanti*

- Observations on unexpected weakness in gold price after inflation data

Canal+ Offer for MultiChoice

- MultiChoice facing a 105 rand Canal+ offer

- Market sentiment: Canal+ likely to come back with a better offer

- Current stock price: 104.63

- Speculation on possible offer prices: 120, 135, or even 160

- Market confidence in Canal+ making a mandatory offer

Global Market Trends and Dollar Strength

- Dollar strength in global markets

- DXY trading at 104.87

- Money flowing into the US due to fear and concerns

- Impact on Rand: Trading at 19.07

- Market skepticism about inflation concerns

DXY (US$ index) 14Feb24 (daily chart)

DXY (US$ index) 14Feb24 (daily chart)

Inflation Analysis

- Recent US and UK inflation data

- Market reaction to inflation numbers

- Central bank concerns about reaching inflation targets

- Jerome Powell's cautious approach and potential rate cuts

- Local inflation expectations and potential rate cuts in South Africa

- The challenge of getting back to the inflation target

Disney results:

Last week's big story was about tech, starting with Disney, a stock recommended here back in September at ±$80.

- Key financials: Linear networks revenue up 9%, Direct-to-consumer up 12%, Parks up 16%

- Direct-to-consumer still incurred a loss of $400 million

- Consumer products, content sales licensing, and ESPN performance discussed

- Overall, not a knockout result but not terrible; I remain a satisfied shareholder

Big move in streaming sports! ⚾️🏀🏈

Disney, Warner Bros., and Fox are joining forces to create the ultimate sports streaming app, merging ESPN, TNT, and Fox Sports (WSJ).

ESPN alone was 18% of Disney's latest quarter revenue.$DIS $FOX $WBD pic.twitter.com/xSPBko0cMO— App Economy Insights (@EconomyApp) February 6, 2024

Meta (formerly Facebook) Earnings:

- Advertising revenue up 24% year on year to 38.7 billion

- Other segments discussed, including Reality Labs (MetaQuest)

- Net profit $14 billion, up 35%; stock surged 20%

- Mark Zuckerberg's dividend income from the declared 50-cent dividend discussed

- Positive sentiments about Meta's performance, particularly in comparison to other tech giants

Canal+ Offer for MultiChoice:

- Canal+ made an offer for MultiChoice at 105 Rand per share

- Market reaction, initial excitement, and stock movement

- Simon's caution about potential risks and timing of the deal

- MultiChoice's response: Board concluded the offer significantly undervalues the group

- Canal+ continued to buy MultiChoice shares, now owning 35.1%

- Discussion on the mandatory offer threshold and potential scenarios

- Regulatory considerations: Foreign ownership rules and competition commissions

- The price of the mandatory offer must be equal to;

(i) identical to, or where appropriate, similar to the highest consideration paid by the bidder for those acquisitions and

(ii) accompanied by a cash consideration, at not less than the highest cash consideration paid if the shares that carry 5% or more of the voting rights were acquired for cash.

- The price of the mandatory offer must be equal to;

- Simon's conclusion: Canal+ likely to succeed, potential challenges, and market dynamics

Breaking News: Canal+ Offer for MultiChoice:

- Canal+, French TV business, offers 105 rand per share for MultiChoice minorities.

- Synergies between the two businesses.

- Legal considerations regarding foreign media ownership.

- MultiChoice closed at 75 rand; market likely to respond positively.

Market Updates:

- Hyprop reports positive festive trading for its tenants.

- Transaction Capital plans to list WeBuyCars in March; potential value unlock.

- Evergrande declared bankrupt with over 300 billion dollars in debt.

- Hong Kong economy expanded 3.2% in 2023.

- China overtakes Japan as the world's top car exporter.

Cristal Challenge Stock Picks:

Richemont*: Luxury brand with potential in a recovering economy.

[caption id="attachment_41062" align="aligncenter" width="849"] Richemont weekly chart close 31Jan24[/caption]

Richemont weekly chart close 31Jan24[/caption]

Calgro M3*: Debt under control, potential dividend, well-managed company.

[caption id="attachment_41063" align="aligncenter" width="849"] Calgro M3 weekly chart close 31Jan24[/caption]

Calgro M3 weekly chart close 31Jan24[/caption]

AngloGold Ashanti*: Gold as insurance; geopolitical concerns.

[caption id="attachment_41061" align="aligncenter" width="849"] Anglogold Ashanti weekly chart close 31Jan24[/caption]

Anglogold Ashanti weekly chart close 31Jan24[/caption]

Zeda: New listing, unbundling, potential growth.

[caption id="attachment_41065" align="aligncenter" width="849"] Zeda weekly chart close 31Jan24[/caption]

Zeda weekly chart close 31Jan24[/caption]

Mr. Price*: Positioned well in the retail sector, positive trading update.

[caption id="attachment_41064" align="aligncenter" width="849"] Mr Price weekly chart close 31Jan24[/caption]

Mr Price weekly chart close 31Jan24[/caption]

Closing Remarks:

Reminder to sign up for email alerts before live sessions.

Host: Simon Brown

* Simon holds ungeared positions.

Host: Simon Brown

Date: 1 February 2024