ff

Capitec Results:

- Simon analyzes Capitec's recent financial results, highlighting strong metrics such as return on equity, active clients, and app usage.

- However, he notes concerns about the bank's expensive valuation compared to its competitors.

SARB Monetary Policy Review:

Simon discusses the South African Reserve Bank's recent review, indicating a reluctance for rate cuts in the near future due to inflationary pressures and economic uncertainties.

Key takeaway from the bi-annual Monetary Policy Review of the @SAReserveBank:

Don’t bet on a domestic interest rate cut this year. https://t.co/mhRS5vKIFQ pic.twitter.com/sc5p9GPcf5

— Adrian Saville (@AdrianSaville) April 24, 2024

Sasol Woes:

- Simon discusses Sasol's poor performance following a production update, expressing skepticism about its future prospects despite its low stock price.

Other Market Updates:

Simon touches on Tencent's positive performance, gold and oil price movements, and the potential impact on global markets

UK and Local Inflation:

- UK inflation surprises at 3.2%, lowest in over two years.

- US Fed unlikely to cut rates soon, waiting for FOMC meetings.

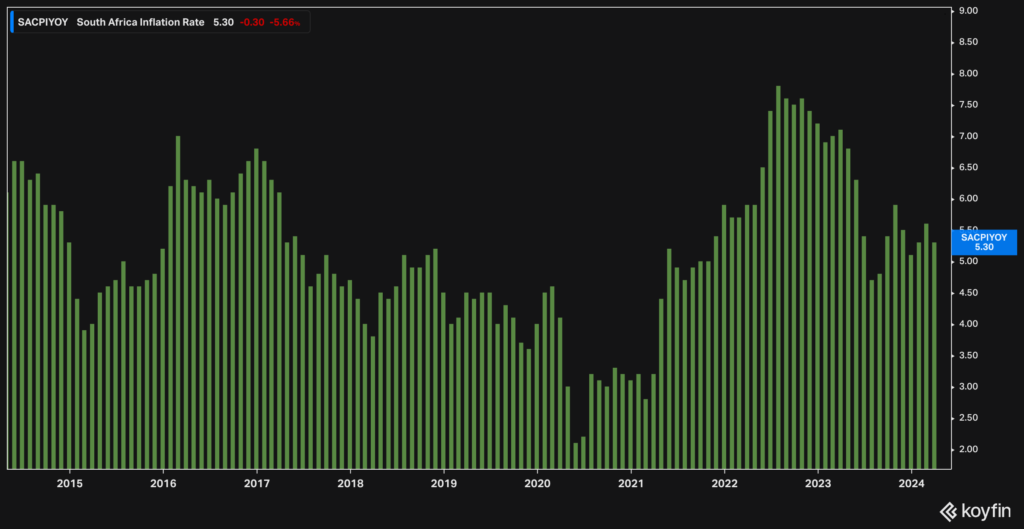

- South Africa's CPI data for March at 5.3%, showing a positive trend.

- Potential for SA rate cuts, depending on US decisions.

[caption id="attachment_41866" align="aligncenter" width="849"] SA Inflation 5.3% for March 2024[/caption]

SA Inflation 5.3% for March 2024[/caption]

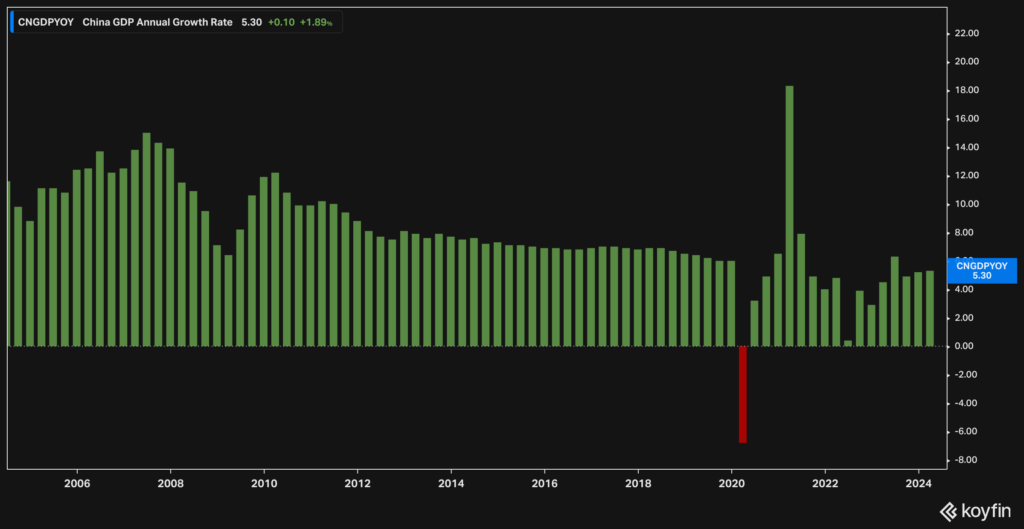

China and Commodities:

- China's GDP surpasses expectations at 5.3%, amid concerns over Fitch downgrade.

- Export data reflects overstocking, driving prices down.

- Despite challenges, China's market appears interesting.

[caption id="attachment_41867" align="aligncenter" width="849"] Chinese GDP YearONYear per quarter[/caption]

Chinese GDP YearONYear per quarter[/caption]

PGMs, oil, gold, and other commodities.

- Gold remains strong, targeting $2500.

- Recent attack on Israel by Iran affects oil prices.

WeBuyCars listing and potential market impact.

Transaction Capital analysis and investor considerations.

Purple Capital* Results:

- Purple Capital swings back to profit, surprising the market.

- Key financial highlights and insights into EasyEquities performance.

- Exploration of new products and their impact on revenue.

- Analysis of client cohort growth and its implications.

- Positive outlook on Purple Capital's performance.

- Expectations of potential price pullback.

kk

Sasol Secunda Reprieve

- Recap of Sasol's recent developments.

- Minister's agreement to Sasol's appeal regarding emissions at Secunda.

- Stock bounce and support level analysis.

- Target prices discussion and outlook for Sasol.

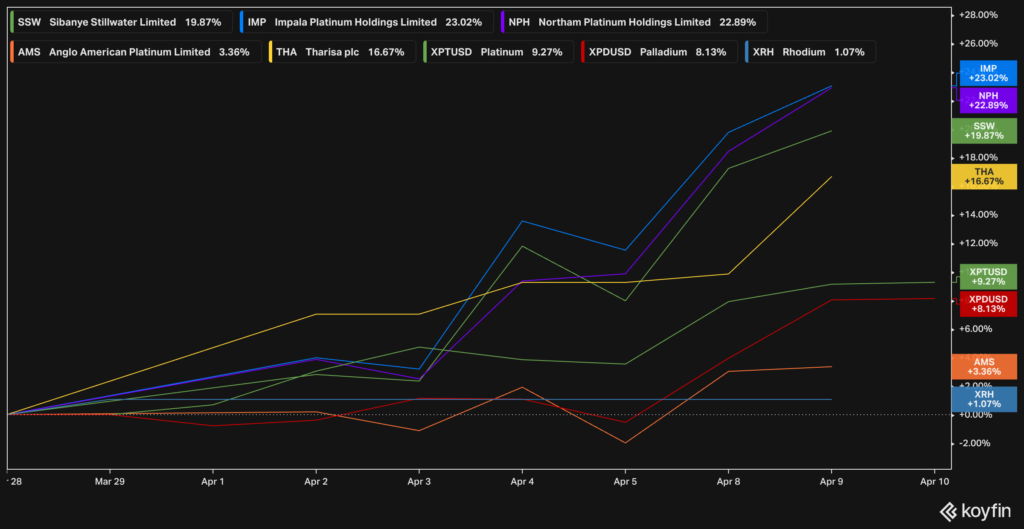

PGM Miners' Performance

- Analysis of platinum group metal (PGM) miners' performance.

- Notable increases in stock prices.

- Consideration of factors affecting the industry, including production cuts and demand for catalytic converters.

- Exploration of whether the current uptrend indicates the beginning of a bull market.

- Discussion on supply and demand dynamics in the PGM market.

- Mention of Sibanye Stillwater's* CEO's forecast.

- Reflecting on year-to-date performance of PGMs.

- Insights into the future trajectory of PGM prices and potential risks.

[caption id="attachment_41807" align="aligncenter" width="849"] PGM and miner moves for the month of April up to the 9th[/caption]

PGM and miner moves for the month of April up to the 9th[/caption]

Fitch Cuts China's Outlook to Negative

- Overview of Fitch's downgrade of China's outlook.

- Analysis of implications for the Chinese economy.

- Examination of the performance of Chinese stocks.

- Commentary on factors contributing to China's economic struggles.

- Exploration of potential effects on global markets.

WeBuyCars Listing

- Preview of WeBuyCars' upcoming listing.

- Discussion on the valuation and market cap of WeBuyCars.

- Comparison with Transaction Capital.

- Speculation on market demand for second-hand cars and implications for WeBuyCars' growth strategy.

- Evaluation of WeBuyCars' disruptive potential in the automotive industry.

Inflation Targeting Discussion

- Analysis of the South African Reserve Bank's inflation targeting strategy.

- Exploration of the history and purpose of inflation targeting.

- Evaluation of the current inflation target and potential for revision.

- Discussion on the process and implications of lowering the inflation target.

- Advocacy for starting the conversation on revising the inflation target to ensure long-term economic stability.

Simon Brown

Charts by KoyFin, use this link for 10% off your first order.

Commodity Market Analysis

- Oil prices are on the rise, currently trading around $89 per barrel, indicating both demand and supply factors at play.

- Factors affecting oil prices include supply disruptions from Russia and Saudi Arabia's production cuts through OPEC+.

- Concerns about inflation are reflected in the rising price of gold, which is currently trading at all-time highs above $2300 per ounce.

- Despite uncertainty, inflation is not expected to decrease soon, especially with increasing energy costs

- Discussion on the delayed rate cuts by the US Federal Reserve and the global outlook on inflation.

Implications of Goldfield's Chilean Mine Production

- Goldfield's Chilean mine is expected to produce gold at significantly reduced costs in the coming years, potentially impacting global gold supply.

- Analysis of the time taken for new mines to commence production, highlighting the challenge of meeting future demand.

Tax Collection Insights from SARS

- SARS reports an additional R10 billion in tax receipts, contributing to a total of R1.7 trillion in tax collections.

- While individual tax collections saw an increase of 8.2%, company tax declined by 9%, reflecting challenges faced by various sectors, including retail and mining.

Performance Review of ETFs (full list here)

- Top performing ETFs in the first quarter of 2024 include those focused on international markets, particularly in technology and Japanese sectors.

- Conversely, local ETFs, especially those tied to South African markets, experienced declines.

- Analysis of factors influencing the performance of specific ETFs and their compound annual growth rates (CAGRs).

Old Mutual Results:

- Surprisingly strong results from Old Mutual.

- Despite stagnant GDP growth and population decline, Old Mutual shows strong growth, indicating market share acquisition.

- Expansion into banking sector questioned due to market saturation.

- Stock analysis: Trading around 1184, showing potential support at 1150 and resistance at 1240-1280.

- Considered cheap with PE ratio around 7.7 and dividend yield over 7%.

- Market consensus predicts an average price target of 14.81.

- Skepticism remains regarding the bank launch and overall upside potential.

MTN Results and Analysis:

- MTN's earnings affected by Naira devaluation in Nigeria.

- Earnings per share down 72%, impacted by tax issues and currency devaluation.

- Stock analysis: Chart showing positive signs, with potential for short-term growth.

- Market consensus includes three strong sells, five holds, and four buys.

- Telco sector struggles due to price pressures and constant capital expenditure.

- Limited upside potential for telco stocks, including MTN.

ADvTech* Results and Operational Leverage:

- ADvTech demonstrates strong operational leverage.

- Operational margins increase due to improved student occupancy rates.

- Revenue up 13%, HEPS up 19%, and dividend per share up 45%.

- Stock analysis: Notably increased in value but still offers potential growth.

- Expectations for around 15% growth in the future.

- Simon Brown expresses satisfaction as a long-term shareholder in ADvTech.

Monetary Policy Committee (MPC) Meeting Insights:

- MPC meeting concludes with no change in rates.

- Governor's hawkish stance indicates possible rate cuts later in the year.

- Inflationary pressures expected to persist due to global factors.

- Delayed rate cuts expected due to inflation concerns.

SALTA Awards Highlights (full details here):

- Simon Brown attends the SALTA Awards.

- Satrix emerges as the big winner with 10 awards.

- People's Choice Awards highlight popular ETFs, with Satrix Top 40 winning for the seventh consecutive year.

- Introduction of a new award category for foreign ETFs.

- Importance of industry events in highlighting the significance of ETFs and listed trackers.

Simon Brown

* Simon holds ungeared positions.

Market Updates:

- Recent news on Markus Jooste's fine and tragic passing prompts reflection on justice and mental health awareness.

- Telkom's sale of its towers business for R6.75 billion highlights strategic shifts and potential opportunities in the telecom sector.

- Ongoing rise in oil prices raises concerns about inflationary pressures and global economic impacts.

Market Analysis and Insights:

Gold's Surge:

- Gold prices hit new all-time highs above $2200, reflecting investor concerns and market sentiment following Jerome Powell's recent statements on inflation and monetary policy.

- Gold mining companies show varied responses, with Pan-African, Goldfields, DRD, and Anglogold Ashanti experiencing gains.

Interest Rates and Economic Outlook:

- Powell's announcement of no immediate rate cuts and a projected total of three cuts for the year signals a cautious approach towards inflation.

- Rising interest rates pose challenges for companies with significant debt burdens, while those with ample cash reserves stand to benefit.

Inflation and Monetary Policy:

- CPI data reflects higher-than-expected inflation rates, prompting speculation about potential rate cuts in South Africa and implications for economic recovery.

- Abenomics, Japan's economic policy experiment, demonstrates the effectiveness of unconventional monetary measures in stimulating growth and combating deflation.

Company Updates and Reflections:

Remgro Results:

- Remgro's net asset value growth raises questions about the effectiveness of its management strategy, despite trading at a significant discount.

Remgro has grown its NAV per share by 5% p.a. since 2010.

Over the same period, the ALSI TR index has done 12% p.a.

If you expect this underperformance to continue (and nothing in their recent capital allocation decisions indicates otherwise), then a fair discount to NAV is…— Piet Viljoen (@pietviljoen) March 19, 2024

- Contrasting performance with Sabvest Capital highlights the importance of superior returns and effective capital allocation in investment decisions.

Sun International:

- Strong financial results from Sun International underscore challenges and opportunities in the leisure and hospitality sector, amid shifting consumer behaviors and economic uncertainties.

Retire well, we're chatting with retirees about what they've learnt and any tricks they can pass on.

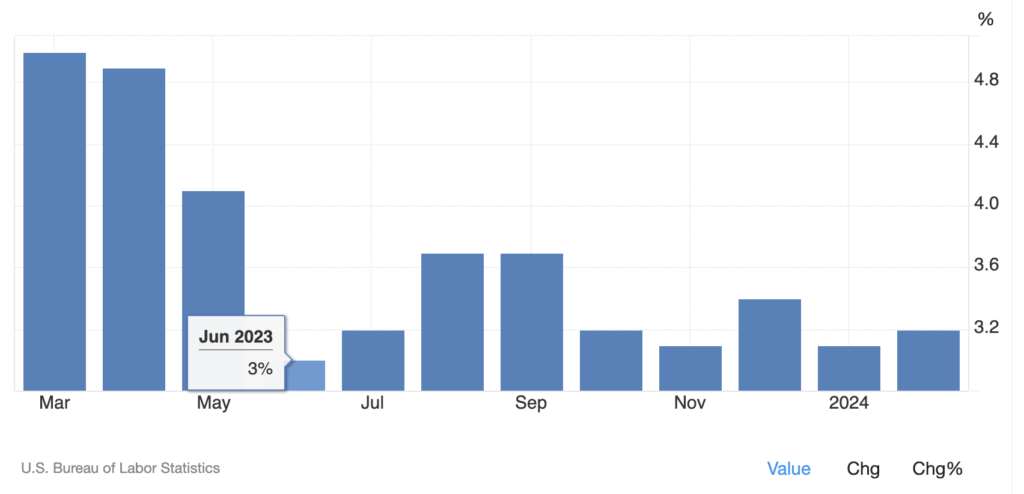

US Inflation Trends:

- US inflation has remained stagnant at 3.2% since June of the previous year, defying expectations.

- Despite initial projections, inflation has not reached the anticipated 4% mark, staying just above 3%.

- Discussion on potential implications for the economy and monetary policy, including the possibility of a mid-year rate cut.

Local Property Market Concerns:

- Review of recent challenges facing Pick n Pay and its impact on property stocks and landlords.

- Analysis of Hyprop's trading update and its implications for the broader property sector.

- Discussion on potential strategies for landlords facing challenges from tenant closures and renegotiations.

Quantum Food and Market Speculation:

- Examination of recent market speculation surrounding Quantum Foods and its stakeholders.

- Evaluation of market reactions to news events and projections for future stock performance.

Get 10% off your first KoyFin order

Financial Sector Insights:

- Analysis of ABSA's poor financial results and the broader challenges facing the banking sector.

- Comparison of valuation metrics and performance across various banking stocks.

- Preview of upcoming industry event focusing on financial education and market insights.

Shoprite* Results and Market Comparison

- Discusses the recent Shoprite results, emphasising excellent performance against a high base.

- Highlights Shoprite's significant CapEx spending, customer savings, and market share gains.

- Compares market cap of Pick n Pay and Shoprite, pointing out the latter's cash reserves.

- Reflects on the historical revenue comparison between Shoprite and Pick n Pay over the past 20 years.

- Shoprite's Competitive Position and Stock Analysis

- Questions whether Shoprite is always destined to be an expensive stock.

- Analyzes the current PE ratio, forward PE, and 10-year mean, suggesting that the stock may not be as expensive as perceived.

- Shares consensus forecasts and target prices for Shoprite, indicating a potential undervaluation.

- Expresses the belief that Shoprite at ±R270 might not be as expensive as it appears, drawing parallels with the valuation of Nvidia.

- Shoprite's Success Factors and Pick n Pay's Struggles

- Explores the factors contributing to Shoprite's success, including central distribution centers and efficiency.

- Contrasts Shoprite's strategy with Pick n Pay's challenges, noting a decline in consumer satisfaction.

- Mentions Pick n Pay's recent financial struggles, including a rights issue and debt increase.

Gold and Bitcoin at All-Time Highs

- Addresses the unusual situation of both gold and Bitcoin reaching all-time highs simultaneously.

- Discusses the fears driving gold prices, such as inflation, interest rates, conflicts, and global elections.

- Highlights gold's potential target of $2,500 and the positive impact on gold mining profits.

- Shares the performance of various gold mining stocks over the past three years.

Canal+ Offer for MultiChoice

- Updates listeners on Canal+'s revised offer of R125 per share for MultiChoice, which is currently trading at R113.50.

- Discusses the time value and risk value of the deal, expressing the view that this might be the final offer.

Finance Costs and Corporate South Africa

- Examines the increase in net finance costs for Sea Harvest, attributed to higher interest rates.

- Acknowledges the challenges faced by Corporate South Africa, including Eskom issues, logistic challenges, and rising interest rates.

- Assures listeners that some of these challenges may start to fade away in the future.

Nikkei 225 reached a new all-time high after 35 years

- Historical context: peaked in December 1989, 82% drawdown by March 2009.

- Factors contributing to the 80s crash: Yen protection, low rates, speculative bubble.

- Current challenges: aging population, economic complexities, recent inflation.

- Investment options: Sygnia JP (SYGJP) - JSE-traded, and Investec's structured product.

Warren Buffett's Annual Letter

- Warren Buffett's annual letter to shareholders released.

- AGM scheduled for May 4th, details about screening yet to be announced.

- Historical and informative; available on BerkshireHathaway.com.

City Lodge Results

- City Lodge results: Revenue up 10%, dividend up 20%, HEPS up 10%.

- Occupancy at 61%, pricing power at 65%.

- Challenges in margins due to increased focus on food and beverage.

- Comparison with other hospitality stocks: Sun International, Southern Sun.

MultiChoice Canal+ Offer

- Canal+ acquires 35.01% of MultiChoice voting rights, triggering a mandatory offer.

- Takeover Regulation Panel ruling.

- Speculation on Canal+ offer price, potential sweetening of the deal.

Bitcoin and Bitcoin Halving

- Bitcoin trading around $59,884, near all-time highs.

- Upcoming Bitcoin halving in April and its potential impact.

- Local perspective on Bitcoin and its role in the market.

- Bitcoin in ZAR trading over a million, emphasising its volatility.

- Discussion on Bitcoin's market cap compared to traditional stocks.

Pick n Pay* Update

- Pick n Pay's disappointing update: debt doubled, sales going backward.

- Market's negative reaction reflected in the stock price.

- Potential exit strategy if weekly close falls below 2022.

* Simon holds ungeared positions.

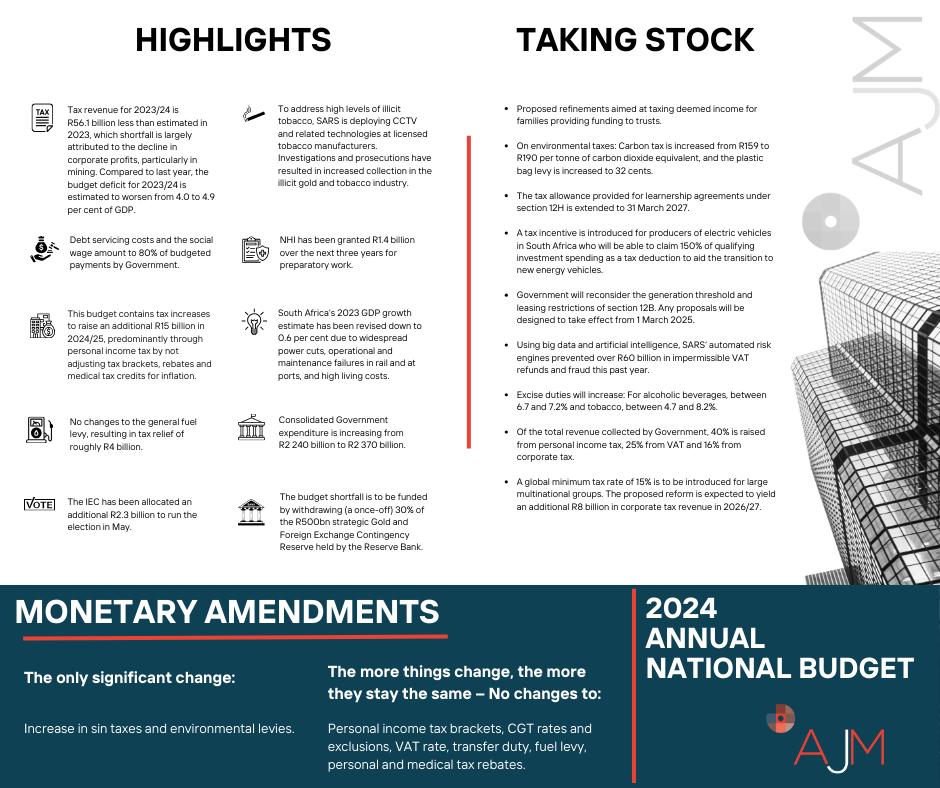

Budget 2024 panel.

For the last many years AJM Tax has done a post budget panel which includes Simon Brown and this year was no different. Hosted in Cape Town the panel was;

- Karyn Maughan, senior legal journalist at News24

- Dr Albertus Marias, Director AJM Tax

- Azhar Varachhia, Managing director Alpha plus Capital

- Simon Brown, Just one Lap and MonewebNOW

Pick n Pay* Chart Analysis

- Resistance zone around 26, potential to touch 26.70

- Higher highs, higher lows, horizontal resistance

- Target: 30 bucks to fill the gap

- Comments on Pick n Pay's potential under Sean Summers

- No need for a rights issue, potential market spook if it happens

- Simon's position: Started building, considering more

- Current status: Down 1.7%, trading at 25.30

Pick n Pay close 13Feb24 (daily)

Pick n Pay close 13Feb24 (daily)

Transaction Capital and WeBuyCars

- Transaction Capital planning to list WeBuyCars

- Unbundling process expected in March

- Valuation: 7.5 billion rand

- Key information: Founders' put option on Transaction Capital is off the table

- WeBuyCar's strong performance in January with a record 14,000 cars sold

- Market Cap of Transaction Capital: R6.5 billion

- Opportunities and challenges in SA Taxi business

- Overall assessment: Looking not too bad

- Current stock level: 850c

- Expectation of pro rata shares for Transaction Capital holders

- Timing details expected in the circular

Gold Price Movement

- Gold weaker despite US and UK inflation data

- Current gold price and chart analysis

- Simon's position in Anglogold Ashanti*

- Observations on unexpected weakness in gold price after inflation data

Canal+ Offer for MultiChoice

- MultiChoice facing a 105 rand Canal+ offer

- Market sentiment: Canal+ likely to come back with a better offer

- Current stock price: 104.63

- Speculation on possible offer prices: 120, 135, or even 160

- Market confidence in Canal+ making a mandatory offer

Global Market Trends and Dollar Strength

- Dollar strength in global markets

- DXY trading at 104.87

- Money flowing into the US due to fear and concerns

- Impact on Rand: Trading at 19.07

- Market skepticism about inflation concerns

DXY (US$ index) 14Feb24 (daily chart)

DXY (US$ index) 14Feb24 (daily chart)

Inflation Analysis

- Recent US and UK inflation data

- Market reaction to inflation numbers

- Central bank concerns about reaching inflation targets

- Jerome Powell's cautious approach and potential rate cuts

- Local inflation expectations and potential rate cuts in South Africa

- The challenge of getting back to the inflation target

Disney results:

Last week's big story was about tech, starting with Disney, a stock recommended here back in September at ±$80.

- Key financials: Linear networks revenue up 9%, Direct-to-consumer up 12%, Parks up 16%

- Direct-to-consumer still incurred a loss of $400 million

- Consumer products, content sales licensing, and ESPN performance discussed

- Overall, not a knockout result but not terrible; I remain a satisfied shareholder

Big move in streaming sports! ⚾️🏀🏈

Disney, Warner Bros., and Fox are joining forces to create the ultimate sports streaming app, merging ESPN, TNT, and Fox Sports (WSJ).

ESPN alone was 18% of Disney's latest quarter revenue.$DIS $FOX $WBD pic.twitter.com/xSPBko0cMO— App Economy Insights (@EconomyApp) February 6, 2024

Meta (formerly Facebook) Earnings:

- Advertising revenue up 24% year on year to 38.7 billion

- Other segments discussed, including Reality Labs (MetaQuest)

- Net profit $14 billion, up 35%; stock surged 20%

- Mark Zuckerberg's dividend income from the declared 50-cent dividend discussed

- Positive sentiments about Meta's performance, particularly in comparison to other tech giants

Canal+ Offer for MultiChoice:

- Canal+ made an offer for MultiChoice at 105 Rand per share

- Market reaction, initial excitement, and stock movement

- Simon's caution about potential risks and timing of the deal

- MultiChoice's response: Board concluded the offer significantly undervalues the group

- Canal+ continued to buy MultiChoice shares, now owning 35.1%

- Discussion on the mandatory offer threshold and potential scenarios

- Regulatory considerations: Foreign ownership rules and competition commissions

- The price of the mandatory offer must be equal to;

(i) identical to, or where appropriate, similar to the highest consideration paid by the bidder for those acquisitions and

(ii) accompanied by a cash consideration, at not less than the highest cash consideration paid if the shares that carry 5% or more of the voting rights were acquired for cash.

- The price of the mandatory offer must be equal to;

- Simon's conclusion: Canal+ likely to succeed, potential challenges, and market dynamics

Breaking News: Canal+ Offer for MultiChoice:

- Canal+, French TV business, offers 105 rand per share for MultiChoice minorities.

- Synergies between the two businesses.

- Legal considerations regarding foreign media ownership.

- MultiChoice closed at 75 rand; market likely to respond positively.

Market Updates:

- Hyprop reports positive festive trading for its tenants.

- Transaction Capital plans to list WeBuyCars in March; potential value unlock.

- Evergrande declared bankrupt with over 300 billion dollars in debt.

- Hong Kong economy expanded 3.2% in 2023.

- China overtakes Japan as the world's top car exporter.

Cristal Challenge Stock Picks:

Richemont*: Luxury brand with potential in a recovering economy.

[caption id="attachment_41062" align="aligncenter" width="849"] Richemont weekly chart close 31Jan24[/caption]

Richemont weekly chart close 31Jan24[/caption]

Calgro M3*: Debt under control, potential dividend, well-managed company.

[caption id="attachment_41063" align="aligncenter" width="849"] Calgro M3 weekly chart close 31Jan24[/caption]

Calgro M3 weekly chart close 31Jan24[/caption]

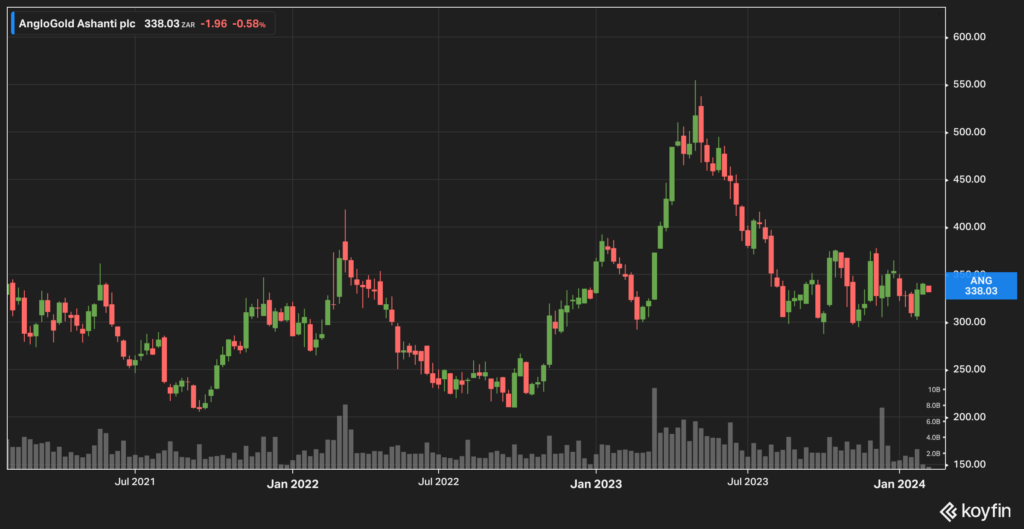

AngloGold Ashanti*: Gold as insurance; geopolitical concerns.

[caption id="attachment_41061" align="aligncenter" width="849"] Anglogold Ashanti weekly chart close 31Jan24[/caption]

Anglogold Ashanti weekly chart close 31Jan24[/caption]

Zeda: New listing, unbundling, potential growth.

[caption id="attachment_41065" align="aligncenter" width="849"] Zeda weekly chart close 31Jan24[/caption]

Zeda weekly chart close 31Jan24[/caption]

Mr. Price*: Positioned well in the retail sector, positive trading update.

[caption id="attachment_41064" align="aligncenter" width="849"] Mr Price weekly chart close 31Jan24[/caption]

Mr Price weekly chart close 31Jan24[/caption]

Closing Remarks:

Reminder to sign up for email alerts before live sessions.

Host: Simon Brown

* Simon holds ungeared positions.

Host: Simon Brown

Date: 1 February 2024

Introduction:

JSE Direct Episode 571 for January 25, hosted by Simon Brown.

Simon introduces the idea of transitioning the podcast to a live format using Riverside, allowing viewers to see charts and interact during recordings.

Market Updates:

Richemont*:

- Stock surged 10% on better-than-expected trading update.

- Identified as an opportunity last year when it pulled back to R2,500.

- Trading at R2,653 at the time of the recording.

AVI:

- AVI delivered a strong update, but struggling with I&J.

- AVI focuses on defending margins, willing to lose volumes for profitability.

- Potential sale or listing of INJ discussed.

Woolies*:

- Mixed trading update.

- Struggles in Australia, especially with David Jones, while food segment remains strong.

- Concerns about the performance of the clothing segment.

Clicks:

- Mostly a strong update, struggles in UDP (wholesale drug distribution).

- Selling price inflation averaged 7.5%, higher than the previous period.

- Clicks achieved highest-ever daily sales in late December.

Economic Updates:

- December spending records discussed with BankserveAfrica.

- Expectations for rate announcements from local and European central banks.

- Hawkish tone expected from local governor; questions about Jerome Powell's stance.

Global Market Highlights:

All-Time Highs:

- S&P 500, Nasdaq, Dow Jones hit all-time highs.

- Russell 2000 still 20% off its highs, considered in bear market territory.

- India's stock market surpasses Hong Kong, becoming the world's fourth-largest share market.

China in trouble, is it over? Should we be worried?

- Simon reflects on recent data and developments in China.

- Population decrease and aging population noted.

- Speculation on a potential $278 billion spending spree to support the market.

- Concerns about state-directed capitalism and common prosperity policies.

- Recent crackdowns in gaming, education, and potential implications for healthcare.

- China's focus on national defense and potential impacts on Taiwan.

- China's shift towards a more inward-looking and self-focused path.

Conclusion:

- Speculation on the impact of China's changes on global growth, commodity prices, and investments.

- Simon announces plans to start recording the podcast live, with notifications on social media and newsletters.

- Acknowledgment of the podcast's longevity (571 episodes) and a request for reviews.

Closing:

Simon Brown signs off, encourages reviews, and mentions future live recordings.

Reminds listeners to take care of themselves and others.

* Simon holds ungeared positions.

In this episode of JSE Direct, Simon Brown discusses various market topics, including the bleak outlook of the Hang Seng Index due to Chinese GDP results.

Positive news for Grindrod with the Maputo Port Development Company's impressive performance.

[caption id="attachment_40966" align="aligncenter" width="849"] Spot uranium price[/caption]

Spot uranium price[/caption]

The approval of 11 Bitcoin ETFs by the SEC. When does the JSE get a crypto ETF?

Do elections matter for markets?

Upcoming elections in 2024 across 70 countries. Simon explores the question of whether elections truly matter for investors, emphasising historical examples where market reactions were short-term and highlighting the importance of focusing on long-term investment strategies amid political volatility.

Now for the eleventh year in a row, we kick off the new year with a prediction show.

Marc Ashton, Keith McLachlan and Simon Brown put their heads on the block with three wild and woolly predictions for the markets for 2024 followed by a call on the Top40 and ZAR for the year ahead.

Importantly we start each show with a review of the previous year’s predictions and you’ll find the 2023 predictions show here.