ff

Capitec Results:

- Simon analyzes Capitec's recent financial results, highlighting strong metrics such as return on equity, active clients, and app usage.

- However, he notes concerns about the bank's expensive valuation compared to its competitors.

SARB Monetary Policy Review:

Simon discusses the South African Reserve Bank's recent review, indicating a reluctance for rate cuts in the near future due to inflationary pressures and economic uncertainties.

Key takeaway from the bi-annual Monetary Policy Review of the @SAReserveBank:

Don’t bet on a domestic interest rate cut this year. https://t.co/mhRS5vKIFQ pic.twitter.com/sc5p9GPcf5

— Adrian Saville (@AdrianSaville) April 24, 2024

Sasol Woes:

- Simon discusses Sasol's poor performance following a production update, expressing skepticism about its future prospects despite its low stock price.

Other Market Updates:

Simon touches on Tencent's positive performance, gold and oil price movements, and the potential impact on global markets

UK and Local Inflation:

- UK inflation surprises at 3.2%, lowest in over two years.

- US Fed unlikely to cut rates soon, waiting for FOMC meetings.

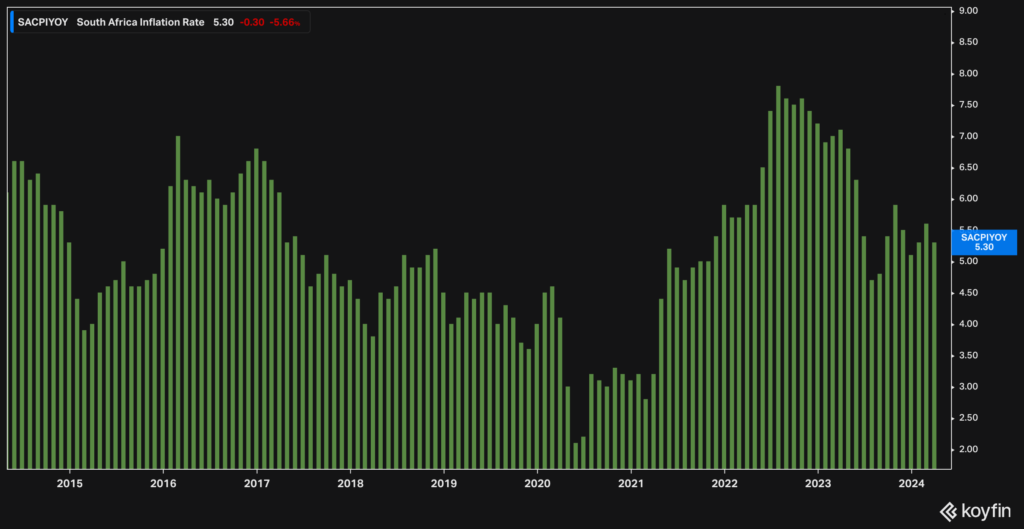

- South Africa's CPI data for March at 5.3%, showing a positive trend.

- Potential for SA rate cuts, depending on US decisions.

[caption id="attachment_41866" align="aligncenter" width="849"] SA Inflation 5.3% for March 2024[/caption]

SA Inflation 5.3% for March 2024[/caption]

China and Commodities:

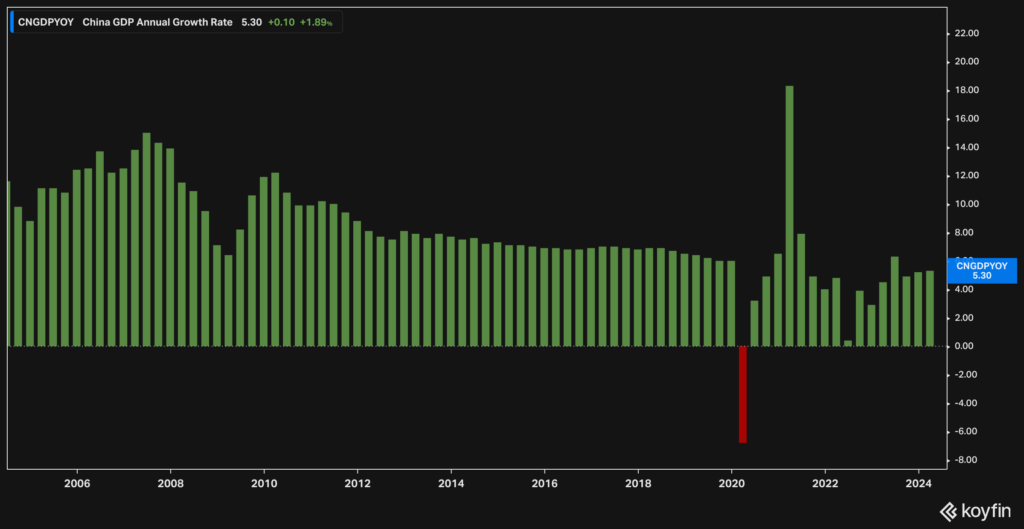

- China's GDP surpasses expectations at 5.3%, amid concerns over Fitch downgrade.

- Export data reflects overstocking, driving prices down.

- Despite challenges, China's market appears interesting.

[caption id="attachment_41867" align="aligncenter" width="849"] Chinese GDP YearONYear per quarter[/caption]

Chinese GDP YearONYear per quarter[/caption]

PGMs, oil, gold, and other commodities.

- Gold remains strong, targeting $2500.

- Recent attack on Israel by Iran affects oil prices.

WeBuyCars listing and potential market impact.

Transaction Capital analysis and investor considerations.

Purple Capital* Results:

- Purple Capital swings back to profit, surprising the market.

- Key financial highlights and insights into EasyEquities performance.

- Exploration of new products and their impact on revenue.

- Analysis of client cohort growth and its implications.

- Positive outlook on Purple Capital's performance.

- Expectations of potential price pullback.

kk

Sasol Secunda Reprieve

- Recap of Sasol's recent developments.

- Minister's agreement to Sasol's appeal regarding emissions at Secunda.

- Stock bounce and support level analysis.

- Target prices discussion and outlook for Sasol.

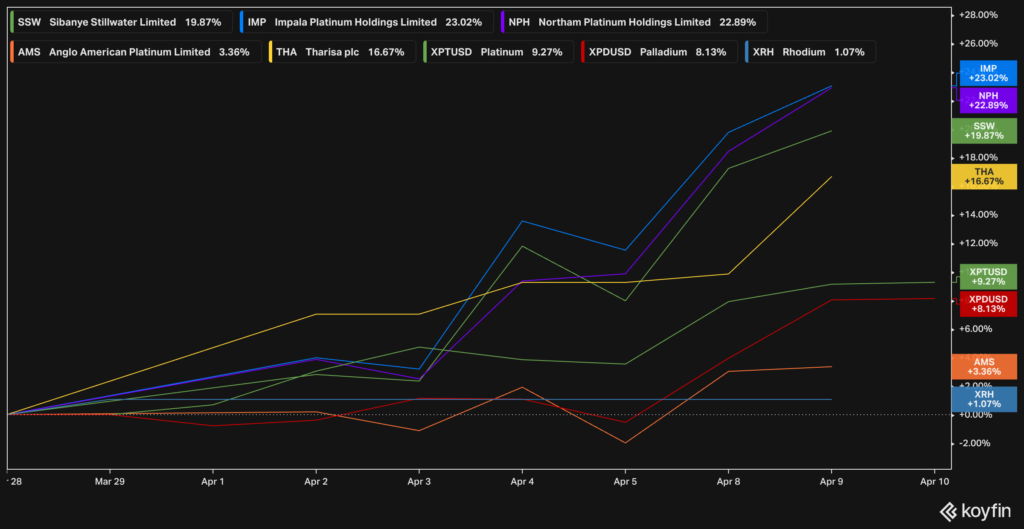

PGM Miners' Performance

- Analysis of platinum group metal (PGM) miners' performance.

- Notable increases in stock prices.

- Consideration of factors affecting the industry, including production cuts and demand for catalytic converters.

- Exploration of whether the current uptrend indicates the beginning of a bull market.

- Discussion on supply and demand dynamics in the PGM market.

- Mention of Sibanye Stillwater's* CEO's forecast.

- Reflecting on year-to-date performance of PGMs.

- Insights into the future trajectory of PGM prices and potential risks.

[caption id="attachment_41807" align="aligncenter" width="849"] PGM and miner moves for the month of April up to the 9th[/caption]

PGM and miner moves for the month of April up to the 9th[/caption]

Fitch Cuts China's Outlook to Negative

- Overview of Fitch's downgrade of China's outlook.

- Analysis of implications for the Chinese economy.

- Examination of the performance of Chinese stocks.

- Commentary on factors contributing to China's economic struggles.

- Exploration of potential effects on global markets.

WeBuyCars Listing

- Preview of WeBuyCars' upcoming listing.

- Discussion on the valuation and market cap of WeBuyCars.

- Comparison with Transaction Capital.

- Speculation on market demand for second-hand cars and implications for WeBuyCars' growth strategy.

- Evaluation of WeBuyCars' disruptive potential in the automotive industry.

Inflation Targeting Discussion

- Analysis of the South African Reserve Bank's inflation targeting strategy.

- Exploration of the history and purpose of inflation targeting.

- Evaluation of the current inflation target and potential for revision.

- Discussion on the process and implications of lowering the inflation target.

- Advocacy for starting the conversation on revising the inflation target to ensure long-term economic stability.

Simon Brown

Charts by KoyFin, use this link for 10% off your first order.

Commodity Market Analysis

- Oil prices are on the rise, currently trading around $89 per barrel, indicating both demand and supply factors at play.

- Factors affecting oil prices include supply disruptions from Russia and Saudi Arabia's production cuts through OPEC+.

- Concerns about inflation are reflected in the rising price of gold, which is currently trading at all-time highs above $2300 per ounce.

- Despite uncertainty, inflation is not expected to decrease soon, especially with increasing energy costs

- Discussion on the delayed rate cuts by the US Federal Reserve and the global outlook on inflation.

Implications of Goldfield's Chilean Mine Production

- Goldfield's Chilean mine is expected to produce gold at significantly reduced costs in the coming years, potentially impacting global gold supply.

- Analysis of the time taken for new mines to commence production, highlighting the challenge of meeting future demand.

Tax Collection Insights from SARS

- SARS reports an additional R10 billion in tax receipts, contributing to a total of R1.7 trillion in tax collections.

- While individual tax collections saw an increase of 8.2%, company tax declined by 9%, reflecting challenges faced by various sectors, including retail and mining.

Performance Review of ETFs (full list here)

- Top performing ETFs in the first quarter of 2024 include those focused on international markets, particularly in technology and Japanese sectors.

- Conversely, local ETFs, especially those tied to South African markets, experienced declines.

- Analysis of factors influencing the performance of specific ETFs and their compound annual growth rates (CAGRs).