Simon Shares

- Sygnia (JSE code: SYG) results and a forward dividend of maybe as high as 10%.

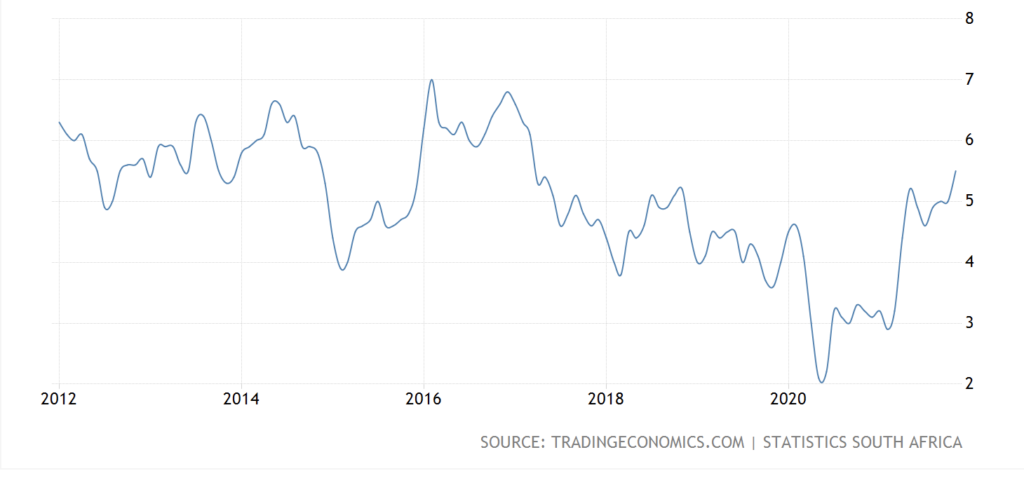

- Local GDP at 1.9% for Q1 2022. The economy has now recovered to its pre-pandemic levels.

- Consumer cracking? I interviewed Evan Walker 36One Asset Management.

- Inverse ETFs that go up as the market falls.

Upcoming events;

[events_list limit="3"]

ddd

Are Robinhood's troubles Purple concerns?

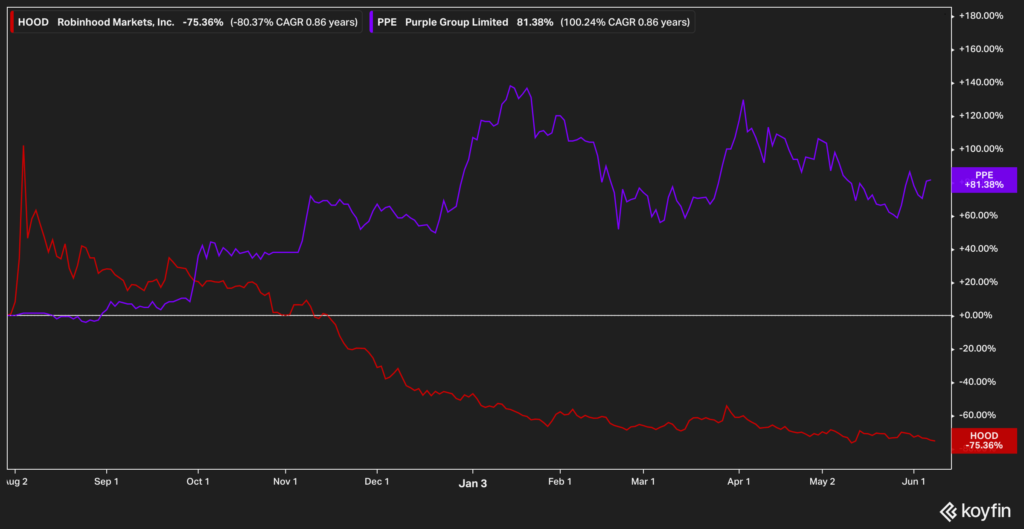

[caption id="attachment_34522" align="aligncenter" width="761"] Robinhood since listing vs. Purple Group[/caption]

Robinhood since listing vs. Purple Group[/caption]

| Robindhood | Purple Group |

|---|---|

| (Nasdaq code: HOOD) | Purple Group* (JSE code: PPE); |

| Listed July 2021 at $38, hit $85 and now under $10 (-75%) | July 2021 145c, high since 350c and now 260c (+81%). |

| Makes most of their revenue from selling the deal flow and Gold accounts. | Revenue is from transactions. |

| The majority of transactions are in options or crypto. | The majority of transactions are in equity, but crypto, EC10, is growing. |

| Needed a quick $billion to settle meme stock trades. | The balance sheet is fine. |

| Huge repetitional damage when they halted trade in some meme stocks. | |

| Value traded by clients has been falling since Q1 2021. | Value traded by clients fell in the last set of results. |

| Not yet profitable. | Profitable, PE ±50x. |

| Users declined in 2022. | Users grew in last results to +1million active accounts. |

| Market cap per user = $478 (ZAR7,400) | Market cap per user = ZAR3,263 |

| Revenue per user (2021) = $80 (ZAR1,250) | Revenue per user = R109 |

Simon Shares

- The good news is the US had a green week last week, for the first time in 8 weeks

- Goldfields (JSE code: GFI) is down on news it paying a chunky 33.8% premium to acquire Canadian Yamana Gold in an all-share deal

- We finally got the petrol price increase and the 150c fuel levy reduction remains in force, for now.

- German inflation hits 7.9% for May. Highest since the 1950s. EU inflation for May 8.1%, the highest ever.

- EU agrees on a partial ban on Russian oil imports

- Monthly dividends in a JSE equity portfolio

- Offshore ETFs paying monthly dividends

Demand destruction in commodities

There comes a point at which a commodities price is simply too high and the price itself reduces demand. Depending on the commodity high prices often need to be high for protracted periods of time.

Simon Shares

- Results are pouring in, food producers are struggling.

- Coronation (JSE code: CML) results with DY of over 10% and PE ±9X.

- Snap Inc (NYSE code: SNAP) profit warning. It now trades at half its listing price.

- Current under recovery in petrol price is 236c, + the 150c fuel levy suspension means we could see a 386c increase in June to over R25 a litre!

- What’s your fav ETF? We ask our readers, Rochelle is first up and likes an offshore ETF with a monthly dividend payment of almost 1%.

- Hello Eskom, best budget power banks.

Slightly better than average is enough

Investors and traders love big winners. That 10 bagger that happens in a matter of months or maybe a few years. But by consistently hunting for those big winners we're taking larger risks.

We're better off aiming for the modest winners.

Beating your benchmark by 2% a year sees you with almost 50% more after twenty years.

A recent Planet Money Podcast, Investing in mediocrity, talks about a fund manager who only ever aimed to be in the top third of all funds. After a decade of succeeding at that, they were the top fund over ten years.

Simon Shares

- 10X Investments buying CoreShares.

- MPC, 0.5% expected.

- Balwin (JSE code: BWN) results vs. Calgro M3 (JSE code: CGR).

- Pick n Pay (JSE code: PIK) results vs. Shoprite* (JSE code: SHP).

Simon Shares

- US April CPI 8.3%; Core CPI 6.2% (month-on-month core was +0.6%)

- FOMC

- Sibanye-Stillwater* (JSE code: SSW) update the market hated.

- Kaap Agri (JSE code: KAL) results

- Wandile Sihlobo on agri in SA.

- New Satrix global healthcare ETF.

- Thungela Resources (JSE code: TGA) could pay an R100 dividend this year, putting them on a +40% DY.

US Tech selloff continues

1-year FAANG returns

° Meta

° Apple

° Amazon

° Netflix

° Alphabet pic.twitter.com/VybsCoWDfh— Simon Brown (@SimonPB) May 9, 2022

Simon Shares

- Combined Motor Holdings* (JSE code: CMH) results, Best ever.

- Renergen* (JSE code: REN) cold commissioning of phase 1 going well.

- New global healthcare ETF coming from Satrix. Currently in IPO and listing 26 May.

- EU unveils a proposal to ban Russian oil imports within 6 months, all refined oil products by the end of the year.

- OPEC+ Sees Production From Non-Opec Participants in OPEC+ at 18.2 mln Bpd in May, 600,000 Bpd Lower Than Last Forecast

- Lyft (Nasdaq code: LYFT) shares fall 26% on disappointing forecast (earnings 75% below expectations) as they say they'll pay drivers more.

- Intel says chip storage till 2024 at least.

Stagflation

"Stagflation is most commonly referred to as the simultaneous experience of three separate negative economic phenomena: rising inflation, rising unemployment, and the declining demand for goods and services."

The best defence is generally commodities.

The world's oldest exchanges starting in India all the way through to Amsterdam.

Staring in Kimberly in 1881 through to the present Simon details the history of stock exchanges in South Africa.

Simon Shares

- US inflation 8.5%, UK 7.0%

- Capitec* (JSE code: CPI) results and a special dividend.

- Dave Segall asking about "Looming food and fertiliser shortages" and impact on local agriculture stocks.

- Purple Group* (JSE code: PPE) trading update (here are my previous expectations).

Simon Shares

- I have closed my Nasdaq long position. Still long FTSE100.

- Purple Group* (JSE code: PPE) trading update. Looks a little better than I expected.

- MTN (JSE code: MTN) more Nigerian woes.

- Reports that Woolies* (JSE code: WHL) may be selling David Jones.

- Elon Musk buys 9.2% of Twitter (NYSE code: TWTR).

- Moodys upgrades sovereign and banks from negative to stable.

- Deutsche Bank says: US recession in 2023 and stocks to fall 20% by summer 2023

The Rouble is almost back at pre-war levels against the US$.

20% interest rates, capital controls, no foreign selling on the Moscow Exchange, selling oil & gas in Roubles (maybe), reports of paying interest on debt with Roubles and of course traders in for a buck.

Simon Shares

- Just One Lap is 11 years old :)

- FOMC, as expected. Local MPC tomorrow.

- Nasdaq, time to buy? Also FTSE100. Both a technical buy, not taking a view on the fundamentals.

Brent almost back at US$120.

- China opened up already, well Foxcon at least.

- Tencent results, flat-lining.

The end of an era! So says Tencent as revenue grows in single digits, the lowest quarterly number since listing back in 2004. Tencent’s declaration is resignation that any expansion will be cautious and controlled. Prosus down 8.2%, Naspers down 8.4%. Prices still look vulnerable

— David Shapiro (@davidshapiro61) March 23, 2022

- Thungela Resources (JSE code: TGA) results and 1800c dividend.

- "developments in terms of new thermal coal projects which have been hampered by financing opportunities, given ESG pressures on carbon fuels"

Simon Shares

- Big banks now all have released results, mostly good albeit off low base.

- Covid cases in China surge, new lockdowns.

- Hello, more supply chain mess.

- People asking if I updated my view on Purple Group* (JSE code: PPE). Nope, volatility likely helping the revenue, but I need new data (results) first.

- Commodities weak, brent oil now in a technical bear market.

China makes peace with tech

Prosus (JSE code: PRX) and Naspers (JSE code: NPN) now flying (+20% n Wednesday). Discount still +50%. Reports of WeChat being hit with a massive fine for money laundering?money launderingChina's state council has in one move just:

*Pledged to keep capital markets stable

*Vowed to support overseas stock listings

*Said dialogue with US re ADRs is 'good'

*Promised to handle risks for property developers

*Clarified regulation of Big Tech will end 'soon'

*BOOM pic.twitter.com/xHYgcbchCo— Sofia Horta e Costa (@SofiaHCBBG) March 16, 2022

Simon Shares

- Shoprite* (JSE code: SHP) results, it's all about innovation.

- Strong un International* (JSE code: SUI) update.

- War in Europe, commodities still the story. Very volatile, that's expected. But I expect more upside and I am happy to hold.

Upcoming events;

Prosus (JSE code PRX) / Naspers (JSE code: NPN) / Tencent (Hong Kong code: 700)

Tencent has been under pressure

Naspers and Prosus have been hit even harder

Live Prosus discount to net asset value (NAV) is now some 55% after hitting 60%.

VK (old mail.ru) has been written down to zero.

Generally unlisted is worth a lot less than stated?

Buy / Sell / Hold?

- VIE structure

- China has not taken sides in the war, so far

- Tax on profits if they sell Tencent

- More Chinese crackdowns?

- Prosus has been wasting money from the sale of 2% stake in Tencent?

- Buying back shares

- Buying Delivery Hero (Frankfurt code: DHER)

Simon Shares

- City Lodge* (JSE code: CLH) results, fair valuation around 800c?

- BHP Group* (JSE code: BHG) will see a significant reduction in its weighting in Top40 and Resi10 indices.

- PSG (JSE code: PSG) exiting the JSE.

- Wilson Bayly Holmes (JSE code: WBO) has lost investor confidence.

- Murray & Roberts* (JSE code: MUR) results. HEPS at 29c a little light, but back in profit.

War in Europe

Inflation is the biggest economic issue.Energy, PGMs and agriculture. Will central banks stick to their rate rising trend?

People want to buy the Russian ETF, why?

Even if peace happens today, sanctions will be in place for some time to come.

Buy Satrix Resi10 ETF* (JSE code: STXRES).

The Oil ETN (JSE code: SBOIL).

Local stocks impacted

- Barloworld (JSE code: BAW) about 20% of revenue.

- Mondi (JSE code: MND) about 12% of revenue.

Upcoming events;

The panellists were;

- Divan Botha – moderator

- Dr Albertus Marais ~ Director at AJM Tax

- Laila Razack ~ CFO of Equites Property Fund

- Simon Brown ~ Founder Just One Lap and host MoneywebNOW

Simon Shares

- Strong Nedbank (JSE code NED) trading update.

- If you held Steinhoff (JSE code: SNH) when it all went wrong in 2017 you have until 15 May to submit a claim.

- Oceana (JSE code: OCE), now the CEO quits?

Upcoming events;

- 22 April ~ Introducing the CoreShares Total World ETF

- 06 March ~ JSE Power Hour: Finding income in JSE listings

What's down with Purple Group* (JSE code: PPE), owners of EasyEquities?

After a high of 349c a month ago it's now 261c.

Firstly it's more sellers than buyers.

The hype of the pandemic trading is fading and easy returns are fading. So less trading, slower new accounts (albeit reports that they still have great new account rates).

Vacation is wild.

For the year ending August 2021

- 737k active accounts (up 45.7%).

- Each account makes R69 profit.

- But as accounts age profits per account increase.

What can we expect to see for the year ending August 2022? (NOTE, the interim results to end February will be out early April).

- 1million accounts? That's 263k new accounts and growth of 35%.

- Profit per account R76 (10% growth, older account more profitable BUT less market volatility means less transactions).

- = R76million profit (I ignore GT247 and Emperor Asset Management)

- With 1.2billion shares in issue that's HEPS of 6.3c = forward PE of ±40x

That seems fair, but there are risks.

- The assumptions above could be wrong

- GT247 could lose money

- New projects cost money

- Dilution with new share issues

- I am only using EasyEquities, ignoring other business units.

There are of course potential upside surprises as well

- The assumptions above could be wrong

- Growth is better

- GT247 makes money and EasyProperties kicks in strongly

I sold 35% of my holding at 315c-345c on the way up, this was because it simply became too large within my portfolio (was the biggest holding after buying at 50c less than 2 years ago). But I am happy to continue holding.

Simon Shares

- Great Sappi (JSE code: SAP) results.

- Strong Hudaco (JSE code: HDC) results.

- Top40 is trading at all-time highs, as is Resi10 and MidCap is almost there.

- Kastle back to work barometer shows office attendance in the US is still not back to levels from before the most recent pandemic wave and around 33% (on average) of pre-pandemic levels. Back in November, the average was just over 38%.

- IPO process explained.

- Ashburton ETFs have moved over to FNB.

- Meta Platforms (Nasdaq code: FB); Facebook, Instagram and WhatsApp

- Down 25% on the day of the results. Fell further and now off 43% from September 2021 highs and back at May 2020 levels.

- Market cap below US$600billion, that happens to be the number House legislators picked as the threshold for a “covered platform” in a package of competition bills aimed at Big Tech.

- Active users declined

- $10billion lost revenue due to new iOS privacy rules

- $10billion on metaverse.

- Regulatory issues.

- Meta threatens to shut down Facebook and Instagram in Europe over proposed regulations. The EU says, 'please do'.

- All said this is just one quarter, the next few quarters will tell us the true story.

Upcoming events;

- 17 February ~ JSE Power Hour: Tax-free investing

Simon Shares

- PGMs are on the move, most notably palladium and rhodium. But the miners are not.

- Combined Motor Holdings* (JSE code: CMH) strong trading update.

- MTN (JSE code: MTN) vs. Vodacom (JSE code: VOD) updates. Who's winning?

- Strong Astral (JSE code: ARL) update, but for the half ending March - so off low base.

- Ascendis (JSE code: ASC) looking to sell three businesses, but that won't leave much behind.

- OPEC+ agrees to a 400k barrel/day increase from March, this was the initial plan from last year.

- The local CPI basket is changing.

- Satrix is listing an India ETF, currently in IPO.

- The local prime interest rate increased 0.25% last week. This adds R152 per R1million of a bond. Not a lot, but this is the second one already and we have many more coming.

- The ARK Innovation ETF (NYSE code: ARKK) has had a tough year and at a point, in January, it was behind the Nasdaq over the life of the fund and it is trailing the Nasdaq over one and three years. That all said, they publish all their research and released their Big Ideas 2022 report which is well worth the read.

Upcoming events;

- 9 February ~ Wealth Creation through Trading and Investing with ThinkMarkets

- 17 February ~ JSE Power Hour: Tax-free investing

Simon Shares

Simon Shares

- PGMs are on the move, most notably palladium and rhodium.

- Oil also still moving, remember the ETN for that.

- Cashbuild (JSE code: CSB) update shows the pandemic home improvement boom is over.

- ArcelorMittal South Africa (JSE code: ACL) update sees them into profit and on a PE of under 2x.

- Steinhoff (JSE code: SNH) settlement approved, but still lots of debt.

Markets are spooked

- Lots to be spooked by;

- FOMC, it's all happening in March

- Asset purchases are also to end in March, but what of the US$9trillion of bonds the Fed holds?

- Valuations are high.

- Rates are rising.

- Inflation is at decade highs.

- Value winning over growth for the first time in an age.

Upcoming events;

Simon Shares

- BHP Group* (JSE code: BHP) is unifying its dual-listed company (DLC) corporate structure effective close 28 January. This will count as a CGT event for shareholders who will have been deemed to have sold their shares and bought the new ones.

- Microsoft (Nasdaq code: MSFT) is buying Activision-Blizzard for $69 billion, but who's the largest gaming company in the world? Tencent (Hong Kong code: 700).

- German 10-year back above 0%.

- [caption id="attachment_31941" align="aligncenter" width="888"]

German 10-year yield[/caption]

German 10-year yield[/caption] - Oil at 7-year highs. There's an ETN for that.

Now for the tenth year in a row, we kick off the new year with a predictions show.

Marc Ashton, Keith McLachlan and Simon Brown put their heads on the block with three wild and woolly predictions for the markets for 2022 followed by a call on the Top40 and ZAR for the year ahead.

Importantly we start each show with a review of the previous year’s predictions and you’ll find the 2021 predictions show here.