Simon Shares

Simon Shares

- Somebody buying Metrofile (JSE code: MFL). Started late on Tuesday, sending it almost 13% on the day and holding Wednesday.

- Mediclinic (JSE code: MEI) paid £432m for 29.9% of Spire Healthcare (LSE code: SPI) in 2015. They're now supporting a buyout from a third party valuing that stake at £287.8m.

- Healthcare stocks earnings remain under pressure as elective surgery remains limited.

- Afrimat (JSE code: AFT) to acquire R650m manganese mining rights.

- Gold above US$1,900 and even with Rand strength (currently 13.85) we're finally seeing gold in ZAR moving a little higher.

- No change to the repo rate at last weeks MPC meeting. All the excitement was that the next move will be up, but we knew that. Of more interest is that the govoner talks bout 4.5% rather than the 3%-6% range. He always has but it seems MPC will based rate decisions on that 4.5%.

Upcoming events;

- 27 May ~ JSE Power Hour: Manage your money like a rock star!

- 01 June ~ ThinkMarkets: Key points to investing

- 24 June ~ JSE Power Hour: Rand ~ stronger for longer

SAB Zenzele Kabili

Listing on the BEE board of the JSE on 28 May.

No IPO process ahead of that.

R40 listing price.

But trades subject to supply / demand.

I would expect it to boom initially then settle around R40.

No lock-in period, so you can buy / sell as you wish.

This is very much a long-term investment.

Will be ownership of global AB Inbev (JSE code: ANH) shares worth R5.4billion.

AB Inbev market cap is around R1.8trillion. So a small slice of the entire group of less than 1%.

- Important, you are not just getting SAB, it is the entire global group.

There is debt included, geared about 55% at 70% of prime payable over ten years.

- Another reason to view it as long-term.

- 75% of dividends will be used to settle the debt.

This is a long-term investment option and NOT a get rich quick scheme.

We have also seen some BEE schemes fail spectacularly.

Not all stockbrokers are enabling trading in the shares. SAB have a trading desk, call them on 0861 900 903.

Only BEE qualifying investors can buy the shares.

Simon Shares

- Santova (JSE code: SNV) were very solid and they are now truly a global logistics business.

- Distell (JSE code: DGH) announced that Heineken wants a 'majority' stake in the company. Details are scant with major shareholders being PIC and Remgro (JSE code: REM) both just over 31%. But does the majority mean they want the cider business or +50% of the shares which would trigger a mandatory offer to minorities? This of course after Heineken threatened to take their beer and go home last year during the alcohol ban.

hmmm, wasn't it just last year Heineken was hating on us so much they was canceling projects and threatening to take their beer and go home ..

— Simon Brown (@SimonPB) May 18, 2021

- Balwin (JSE code: BWN) & Calgro M3 (JSE code: CGR) results both showed a tough year. But I like this space. Calgro offering its units at the R500k price point (R4,000 monthly bond costs) while Balwin starts at a little under R1million to around R2million. So different markets.

- Redefine (JSE code: RDF) results saw loan-to-value (LTV) improving but what struck me is that they value properties twice a year. Most doing it over a rolling three years.

- Local CPI hit a 14-month high in April, mainly driven by rising transport and food prices. The rate was 4.4%, up from 3.2% in March.

- Thursday is the MPC rate decision, no change expected.

- Eurozone April CPI +0.6% on Month, +1.6% on Year. Core CPI +0.5% on Month; +0.7% on Year

- Crypto crashing, entire crypto market cap is off 20% today on news China is cracking down (again).

Upcoming events;

jjjjj

What's with the 'special' shares?

Special shares usually with high voting rights and often with limited or zero economic rights.

They enable insiders to retain voting control even while they may not actually control the company.

The most well known are the Naspers~N (JSE code: NPN) A shares that give control to a few parties.

Shoprite* (JSE code: SHP) has the same for Christo Wiese which he tried to sell back to the company. But they have zero economic rights and only are votable by Wiese

More recently it surprised many that while Remgro (JSE code: REM) owns a little over 31% of Distell (JSE code: DGH) they ave a pile of B shares that gives them 56% voting control.

In the older days, companies used pyramid structures, but those have long since largely left the JSE and no new ones can be listed.

The challenge is how to know about them? The annual report will detail them.

Generally, they don't matter massively, until they do. And then they matter. Wiese failed to receive the required number of votes to get back onto the Shoprite board in 2018, but then he used his special shares to basically override shareholders.

- Subscribe to our feed here

- Sign up for email alerts as a new show goes live

- Subscribe or review us in iTunes

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ US inflation

/ Disney results

/ US pipeline shut down due to ransomware attack

/ UK rejects (softly) Bidens plan for global corporate tax rate

/ Chinese industrial production and retail sales due Monday

Local

/ Naspers / Prosus share swap

/ Raubex results

/ Ascendis swaps debt for assets

/ Clicks buys Pick n Pay pharamacy business

/ Cape Town airport has best month since lockdown, still 40% down from 2019

/ Long4Life results and NAV discount

Simon Shares

- Raubex (JSE code: RBX) results saw the second half record HEPS of some 110c after a loss in the first half. The previous full-year, 2020, HEPS was only 161.7c, so the business is looking good. That said, lots of debt and the expanding order book needs to be converted into profit.

- Transaction Capital (JSE code: TCP) results see the dividend returning.

- A super-strong trading update from Lewis (JSE code: LEW) with HEPS more than doubling. At the time of their interim results, they paid a dividend of 133c when the stock was around 2400c. If they can do a 250c dividend (should be easy?) the forward dividend yield sits at around 8%.

- US inflation data spooked higher than expected, even considering the April base effect. April Consumer Prices +4.2% and Core CPI +3%, highest since 2009. Used cars (stimulus cheques?) were +10% and made up a third of the core CPI increase. Fed will do nothing.

- Ascendis (JSE code: ASC) has announced they've reached a deal with debt holders. Basically, they're swapping the crown jewels (Remedica) for their large debt pile. The debt cost was R280million for the last six month period ending December and this will improve solvency and keep Ascendis alive. But are the remaining assets attractive enough for investors?

Upcoming events;

More Naspers shuffles

Naspers (JSE code: NPN) and Prosus (JSE code: PRX) have announced another deal to try and close the discount between themselves and their holding in Tencent (Hong Kong code: 700).

Prosus will acquire up to 45.4% of Naspers shares via a share swap whereby holders of Naspers can get 2.27 new Prosus shares for every one Naspers share.

This will increase Prosus liquidity (in theory) and markedly reduce Naspers weighting in the Top40 and Swix indices. The latter argument makes sense and is likely a part of the reason for the discount that Naspers experiences. The problem is that with the weighting above 20% most funds are not allowed to hold over a certain percentage (lower than the Naspers weighting), so they can not go overweight, or even match index weight, for Naspers and this reduces potential buyers of the stock.

Will it work? Maybe.

They have tried many other tricks, unbundling Prosus and earlier MultiChoice (JSE code: MCG) and that hasn't worked. But the weighing in the indices is a real problem.

Of course, the very easy fix here is to simple unbundle the Tencent holding - but that's not going to happen any time (aside from some sales every three years as we saw recently).

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ US jobless claims below 500k, lowest since pandemic started. But overall employment slips to 6.1%, up from 6% in March.

/ Janet Yellen says rates will need to rise

/ ECB Official Calls for Accepting Inflation Overshoot

/ Saudi Aramco Q1 profits +30%

/ Gold +$1,800

Local

/ Moodys skips reviewing SA credit rating

/ MTN update

/ Sibanye Stillwater update

/ Kaap Agri results

/ Karooooo results

/ Anglo American gets coal demerger shareholder approval

Simon Shares

- Purple Group* (JSE code: PPE) now has 1million clients across all platform. A wowzer number.

What an incredible milestone achieved today. Across all platforms & partners we've reached 1 million registrations. @CapitecBankSA @SATRIX_SA @BidvestBankSA @EasyEquities hard to describe how grateful I am to all you #invstr legends that challenge us to rise each day. 🙏🙏🙏

— Charles H Savage (@CharlesHSavage) May 5, 2021

- Combined Motor Holdings (JSE code: CMH) full year results. Second half saw decent cash flow, back to profit and dividends.

- Metrofile* (JSE code: MFL) are cancelling 4.18628% of their treasury shares.

- MTN (JSE code: MTN) first-quarter update, good numbers with group EBITDA +21.3%. Forward PE of around 11x is decent as it's being priced as a utility, albeit was even better back at 6000c when forward PE was c8x.

- Revego (JSE code: RVG) cancelled the listing.

- Tax Tuesday: Tax obligations for global citizens

Upcoming events;

PGMs Flying, miners not so much

Palladium above US$3,000 (all-time high)

[caption id="attachment_26363" align="aligncenter" width="888"] Palladium weekly chart[/caption]

Palladium weekly chart[/caption]

Platinum above US$1,200 (six-year high)

[caption id="attachment_26365" align="aligncenter" width="888"] Platinum weekly chart[/caption]

Platinum weekly chart[/caption]

Rhodium above US$29,000 (all-time high)

PGMs are considered a 'green' metal in that they help reduce CO2 emissions.

Demand remains above supply.

- But production will increase.

- Scrap is increasing (especially with iron ore at records)

- Rand is strengthening and will likely continue to do so

But the listed miners are languishing nowhere, why?

=====

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ April a green month for US indices

/ Palladium almost $3k and copper almost $10k

/ Knock out results; Microsoft, Apple, Alphabet & Amazon

/ US Q1 GDP +6.4%

/ Biden 100 days

Local

/ Resi10 the main local index green in April (midCap & Property did well)

/ Gilbertson quits Gemfields

/ Tongaat update, just misses debt reduction targets

/ Steinhoff to list Pepco in Warsaw

/ Astral update

/ AdaptIT needs another week to decide on the two offers

Simon Shares

- Revego* (JSE code: RVG) was supposed to list today but has delayed their listing. I applied for allocation as I like the business model of renewable energy with guaranteed inflation-linked off-take agreements. They invest into operational renewable asset and are targeting a 8%-10% dividend yield, based off the 1000c listing price.

Upcoming events;

JSE protections

With the Revego listing delayed the money I put into the book build last Thursday has not been seen since. The company was supposed to issue a SENS on Monday and list on Thursday, but we heard nothing until Thursday morning. It has been delayed by a few days.

What struck me was that I was not worried about the chunk of money that I had put into the book build and which I have not see or heard from in a week now. The reason for my lack of concern is the protections the JSE exchange offers.

- Extra regulation around the companies act.

- Stockbroker regulations.

- Investor fund.

- FSP insurance.

This of course does not stop crookery from executive teams nor does it stop businesses from going bust.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- South African inflation was 3.2% in March 2021.

- Pick n Pay (JSE code: PIK) results show it was all liquor and tobacco that was the pain as it was off 31%.

- Karooooo (JSE code: KRO) has returned after exiting as Cartrack. The market seemed confused as it opened at 6500c, it is now trading R480. Still well off the adjusted highs f over R900 as everybody got all excited about the Nasdaq listing.

- Long4Life (JSE code: L4L) hints at possible unbundling as it looks to unlock shareholder value. I'm confused, they were just consolidating by buying up businesses? I held them but sold early in the pandemic as they were so small in my portfolio and weren't doing much with their cash.

- Absa (JSE code: ABG) loses their CEO.

- Cell C reports R5.5billion full-year loss. Horror story and I never understood what Blue Label (JSE code: BLU) saw in the business.

- PSG results without Capitec* (JSE code: CPI) and they're buying back their preference shares.

Upcoming events;

- 22 April ~ Introducing the CoreShares Total World ETF

- 06 March ~ JSE Power Hour: Finding income in JSE listings

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ Coinbase lists

/ China Q1 GDP 18.3%

/ Reports Jack Ma will divest from Ant Group

/ Gold looking strong, but miners lagging (Rand strength?)

/ Just more than half of U.S. adults have gotten at least one COVID-19 vaccine dose ~ CDC

Local

/ Rand strength

/ Karoooo lists on Wednesday

/ Capitec results

/ EOH looking better

/ Sasol goes green

/ Local CPI later this week

Simon Shares

- New Global ESG ETF from Sygnia.

- Anglo American (JSE code: AGL) to list their coal assets, Thungela Resources.

- Comair has finally been delisting from the JSE and shareholders will receive 4.26c per share.

Upcoming events;

- 15 April ~ Everything ETFs and tax-free investing

Capitec and Purple Group (EasyEquities) results

Two stocks that I own; Purple Group* (JSE code: PPE) and Capitec* (JSE code: CPI). Both with really good results and I'll go into the numbers in detail.

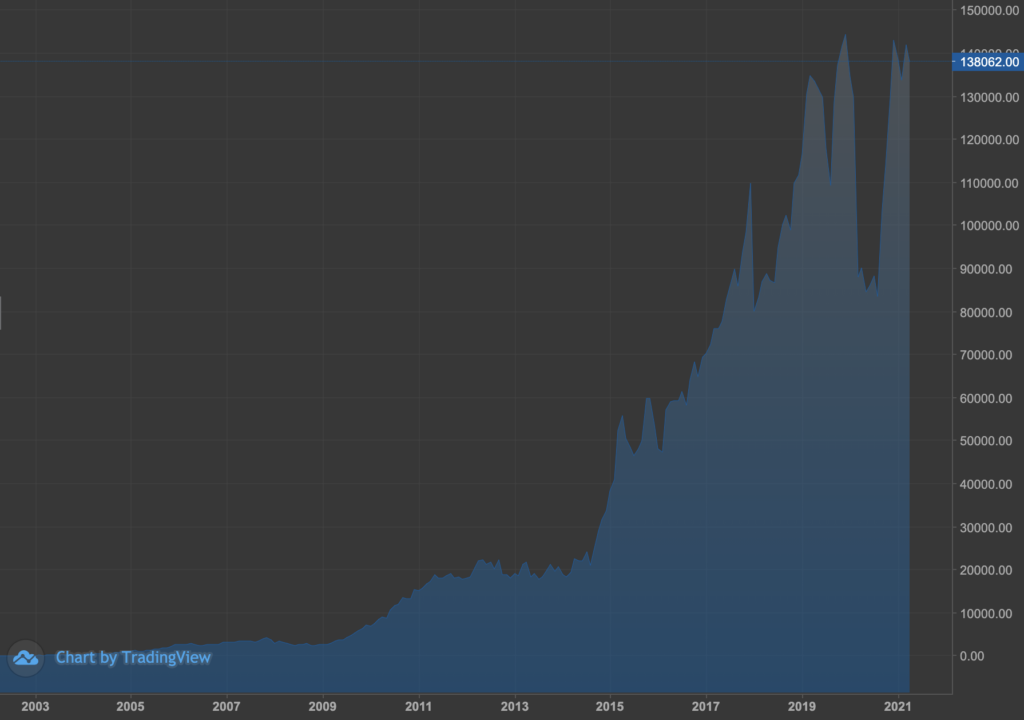

Capitec monthly chart since listing

Capitec monthly chart since listing

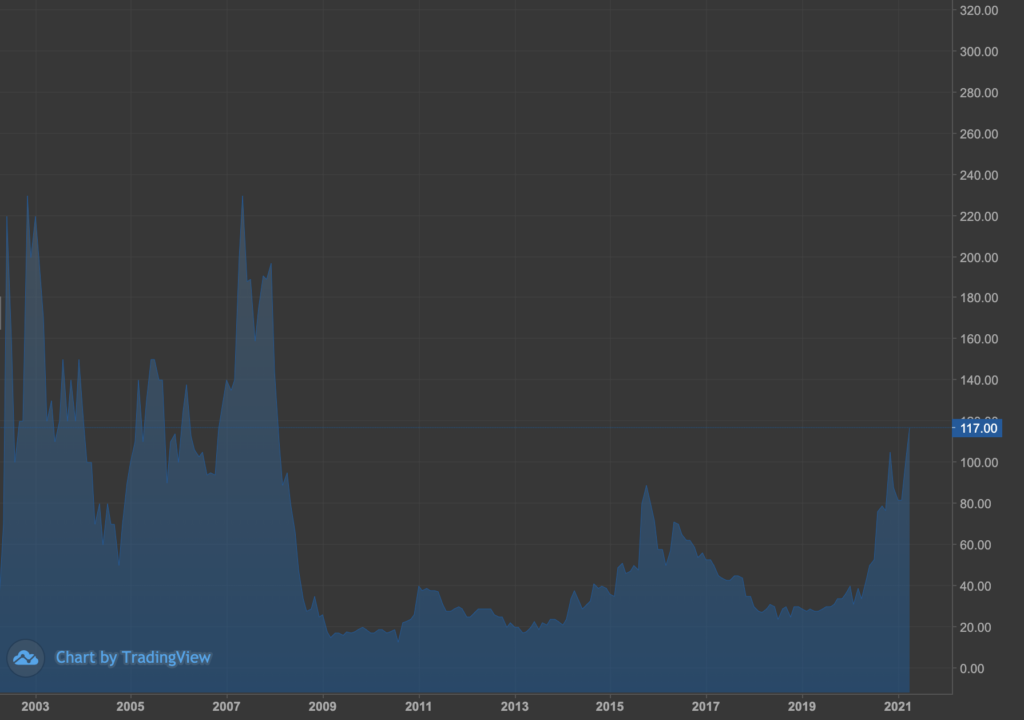

Purple Group monthly chart since listing

Purple Group monthly chart since listing

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ New highs for S&P500 & Nasdaq

/ Yellen wants global minimum corporate tax rate

/ Semi conducter chip shortage continues to hurt production

/ China slaps Alibaba with $2.8 billion fine in anti-monopoly probe

/ Goolge pushes back on WFT, wants staff back in the office from September

Local

/ Prosus sells another 2% of Tencent

/ Purple results

/ IMF says local GDP 3.1% in 2021 and 2% in 2022

/ Anglo exits SA coal by setting up a new JSE-listed miner

/ 650c Cash offer for AdaptIT

/ Pick n Pay update

Simon Shares

- Prosus (JSE code: PRX) selling another 2% of Tencent.

- Purple* (JSE code PPE) trading update for six months ending February. HEPS of about 0.85c. They did 1.54c HEPS for full-year ending August after a loss in the first half last year. So this period showing slower growth.

- Growthpoint (JSE code: GRT) announced that their healthcare fund tops R3.2bn with Cintocare Hospital acquisition.

- The JSE is investigating PPC (JSE code: PPC) trades amid insider trading suspicions as the share moved ahead of the announcement last week.

- The IMF now says SA’s economy will grow faster at 3.1% in 2021 and 2% in 2022, but it will take over two years to recover from the 7% collapse we saw last year.

- Janet Yellen wants all countries to have a minimum corporate tax rate.

Upcoming events;

- 15 April ~ Everything ETFs and tax-free investing

Selling to early

This is a problem for both traders and investors.

Part of the problem is the thrill of a winner, we've made money and we want to lock in that profit so the thrill doesn't go away, and we sell - but we sell way early.

The bigger issue is what are you trying to achieve?

- As always know your strategy and know why you entered a position.

- Be real about taking profits, that is why we're in the market.

- But balance that with giving winners space to win even more.

Analysis of previous winners you exited early. Why did you do exit and what could you have done to stay in longer? What about some you exited at the right profit point?

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- PPC (JSE code: PPC) have made a deal with their DRC lenders. They potentially owed US$175million but now are only on the hook for US$16.5million. This stock was 60c in November and is now around 240c.

- Renergen* (JSE code: REN) says helium concentration is +3%. But reference the US has the current best concentration level at 0.35%.

- Sabvest (JSE code: SBP) results show a discount to net asset value (NAV) of some 50%. Add to this PSG (JSE code: PSG), Remgro (JSE code: REM), Naspers (JSE code; NPN) and Prosus (JSE code: PRX) discounts all in the order of 40% or more. The market is clearly hating on holding companies? Back in the day, a 30% discount was a lot, 15% about the average, and at times PSG has been at a premium to NAV.

- Ever Given is free, but shipping rates remain elevated as they were before Ever Given got stuck.

- MPC no change to rates, but changes to Q1 GDP and the vote.

- Goldman analysts say go long on Russia, South Africa stocks.

- Bank of America Securities conference on investing in SA had record offshore attendance with Clicks (JSE code: CLS) and Shoprite* (JSE code: SHP) topping the list of interest.

Upcoming events;

- 15 April ~ Everything ETFs and tax-free investing

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ S&P500 closes at all-time high, Nasdaq still 6% off highs

/ US Personal Spending fell 1.0% in February, slightly more than expected, but January spending was revised upward by a full percentage point to 3.4%.

/ Ever Given remains stuck in Suez Canal

/ Intel to build new silicon chip fab plants for $20bn

/ Tencent results

/ WeWork to go public, via a Spac, with $9bn valuation

Local

/ CPI 2.9% for Feb and MPC no change

/ Magda Wierzycka quits as Sygnia CEO

/ AdvTech results

/ Old Mutual results

/ Remgro results overshadowed by 40% discount to NAV

/ Goldman analysts say go long on Russia, South Africa stocks

Simon Shares

- AdvTech* (JSE code: ADH) solid results in a tough market.

- Vivo Energy (JSE code: VVO) issued an update on Moroccan industry review and seems it's back to square one.

- Resilient (JSE code: RES) results not the horror show expected.

- Aveng (JSE code: AEG) wants to do another rights issue, again at 1.5c and raise R100m.

- Tencent solid results.

- Ever Given gets stuck in the Suez Canal.

- February local CPI at 2.9%.

Upcoming events;

- 15 April ~ Everything ETFs and tax-free investing

Why all the panic?

A small rise in US ten-year treasury yields and a little inflation and suddenly it is the end fo the world for markets.

Inflation is likely to move higher in the US as the stimulus money gets spent. This is different from the stimulus after 2008/9, which went to banks who hoarded it and stuck it into markets. This time money goes directly to consumers who'll send the money.

But the Federal Reserve is happy that structural inflation is not returning and a little inflation in the system isn't the end of the world.

But to listen to many experts here comes hyperinflation and the end of the world as high inflation = high rates and as such money moves into income funds rather than equity.

Further if one digs into Modern Monetary Theory (MMT) government spending is not the end of the world, certainly for the US government. Here's a fun one, to deal with inflation, raise taxes? In fact have an automatic process that removes congress, if inflation heads above say 3%, taxes go up 4%. Above 5% taxes increase 8% and so on.

But back to the panic, stop. Markets never go in a straight line and suddenly getting all bearish because of some selling is going to make sleeping ever again impossible.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Shoprite* (JSE code: SHP) delivered really strong results for the six months ending December.

Shoprite daily chart[/caption]Purple* (JSE code: PPE) is up some 20% in the last ten days. A buyer has arrived and thanks to low liquidity they're moving the price.

Shoprite daily chart[/caption]Purple* (JSE code: PPE) is up some 20% in the last ten days. A buyer has arrived and thanks to low liquidity they're moving the price.

- Good update from AdVTech* (JSE code: ADH) and results fro Stadio (JSE code: SDO) while Curro (JSE code: COH) was modest. Seems tertiary education was the winner and schools are under pressure but longer-term a sector I like.

- Astral (JSE code: ARL) update.

- TSA travel numbers are hitting their highest levels since lockdown started. Still only about half what they were before lockdown but the US is vaccinating and opening up. This while Europe looks to be starting the third wave and locally nobody will give/sell us any vaccines. So globally this re-opening is going to be very lumpy with the US and UK seemingly winners in the vaccine front (ironic after they were losers on the pandemic front).

- Sun International (JSE code: SUI) nothing to write home about. Lots of chatter about the re-opening trade with City Lodge (JSE code: CLH) up about a third in March. But with at least one more (and maybe even two more) Covid-19 surges and resultant lockdown restrictions I am staying cautious for now.

- The March 16-17 FOMC statement comes out between my recording and you listening. No rate change so it's all about the language. Even in the face of a strong economy are they still prepared to do whatever it takes and leave rates low into 2023?

Upcoming events;

- 15 April ~ Everything ETFs and tax-free investing

Small caps for the win

MidCap index is up about 10% so far in 2021, nice and pretty much exactly what thee Top40 has done. Of course, the Resi10 has done almost 20%, but the winner, small caps up some 20%.

The property index has returned single digits in 2021 so far, but technically it is looking ready to break higher.

We also now have all the large bank results and they were okay. The index is up some 5% and looking tired. There is value here but not sure there is any need to rush.

Property index, daily chart[/caption]

Property index, daily chart[/caption]

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ $1.9trillion stimulus bill signed by Biden and on route

/ Tencent on notice as China cracks down on fintech players

/ The tech-heavy Nasdaq has underperformed the Dow for four straight weeks — a first since 2016

/ Friday 1,357,111 people were screened at U.S. airports, marking the highest number of travellers since the pandemic began.

/ U.S. 10 Year Treasury hits 1.625

/ Huawei listed anew as a threat to US national security

Local

/ GDP for 2020 -7%

/ SA records first annual surplus in 2020 (last was 2002)

/ Woolies sells Elizabeth Street Property

/ MTN results (dividend cancelled) and Ambition 2025

/ AfroCentric results

/ Aspen results see more debt slashed

Simon Shares

- Ascendis (JSE code: ASC) lenders are flexing their muscle. Back in February L1 Health, Blantyre bought enough debt to be able to block any asset sales and with over R7billion in debt Ascendis desperately needs to sell their European crown jewels. There is now a forbearance agreement in place until the end of April by when the company needs to have sorted out their debt. A rights issue is not an option at current prices so a debt for asset swap with the lenders? This will maybe resolve the debt issue, but then what does that leave Ascendis?

- Renergen* (JSE code: REN) find a bunch more gas they did not expect to find.

- Growthpoint (JSE code: GRT) office vacancies at 18%. Lots of concern about malls as we're over traded and online shopping. The latter is a very long-term issue, the former will see some die. But office is the real concern.

- Solid AfroCentric (JSE code: ACT) results. Everybody (well many) love Discovery* (JSE code: DSY) yet here is a pure health stock with great potential, cheap valuation and they consider NHI to actually be something that would further benefit the company.

Very good Metrofile* (JSE code: MFL) results. Debt is going faster than expected, business is solid and the anon bidder has exited the building leaving only the one stuck in Australia. They should be able to easily do 30c HEPS for the full year putting then on a forward PE of under 10x. This set of results they only paid out half of HEPS as a dividend, but this should increase from next financial year as debt becomes way smaller. - MTN (JSE code: MTN) finally pricing as a utility.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ NFP added 379k jobs (large beat) and US unemployment 6.2% (at this pace it’ll take until April 2023 to get back to where we were in February 2020)

/ $1.9trillion stimulus bill approved by Senate

/ China sets 6% 2021 GDP target

/ Germany charges Steinhoff execs

/ UK taxes going up to highest in 50 years

/ Nasdaq is red year-to-date

Local

/ One year of Covid, ZAR 40c weaker, Top40 +20% (both from Jan20 levels)

/ Harmony out of Top40 and Resi10, replaced by Glencore

/ Rhodes Food update “..sales started recovering in January and February 2021…” after TigerBrands said January was poor?

/ Firstrand results

/ Spur results

/ Treasury expected to be another R30billion ahead on tax collections

Simon Shares

- A great research report on Blue Gem covering Renergen (JSE code: REN). What I really like about the report is that Keith shows you all his workings so you can make your own call on his working and decide.

- Spur (JSE code: SUR) were a horror show, no surprise it was the six months to end December with all the various lockdown levels. Two things struck me. They're positioning themselves well for the post-pandemic dining life, dark kitchens, exploring drive-through were feasible. But the biggie was how the company has changed in the last decade or so. It used to be Spur with a little pizza and sushi. But it really is now a collection of brands across different eating experiences and price points. My concern in the short term is a third and fourth wave. We can see as lockdown and alcohol bans get stricter their traffic decreases markedly and I am pretty sure that the rest of 2021 will see at least another two waves of the pandemic with the resulting harder lockdowns.

- Two awesome points from Nerina Visser in an interview I did with her yesterday on MoneywebNOW. Firstly she comments about the saving of dividend tax within a tax-free account. I have run the numbers and over a very long-term that saving is actually more than what one saves on capital gains tax. Secondly, what if you don't have the R36k lump sum to invest? Well, do you have some discretionary ETFs? If yes, sell them, move them into your tax-free account and then continue buying the ETF outside of the tax-free every month for the rest of the year. You get the tax-free benefit from day one.

Upcoming events;

- Weekly, Wednesday at 5.30pm ~ Follow the Trader

- 04 March ~ Things I wish I knew: the beginner trader

It's a bull market

[caption id="attachment_24772" align="aligncenter" width="888"] Top40 weekly chart[/caption]

Top40 weekly chart[/caption]

I was chatting with some friends from around the world about markets. I say it's a bull market, especially locally. They all had a dozen different, and solid, reasons why I was wrong. But they miss one very important point - price.

The simple truth is that markets the world over are at all-time highs and heading higher. We can kick and scream all we want, but price is the truth and the price is heading higher.

Deciding that it is all crazy and heading to cash, or worse taking short positions is a fool's game.

Sure one day the market will peak and somebody will have that Tweet where they called it. But that's not because they're super smart, but because if you call something often enough eventually you'll be right.

Bull markets never feel 100% comfortable, that's the nature of the best. There is always a reason to be sceptical, that's the nature of the beast. But stop stressing and enjoy the ride, that's what bulls are for.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ US Durable Goods Orders Surge In January To Pre-COVID Highs

/ FB to pay Australian media

/ Latest Warren Buffet letter

/ Warren Buffett's $10 billion mistake: Precision Castparts

/ House passes $1.9 trillion Covid relief bill, sends it to Senate

/ Opec+ meets on Thursday

Local

/ Budget

/ Sasol results (no rights issue)

/ TymeBank gets R1.6bn

/ Goldfields gets go-ahead to build 40MW solar plant at South Deep Mine

/ Implats results and dividend

/ Woolies results

Budget 2021 with AJM Tax

I was again invited to moderate the AJM Tax post-budget panel with three excellent guests;

- Pieter Janse van Rensburg – AJM Tax

- Daniel Silke - Political Futures Consulting

- Adriaan Giessing – Seed Investments

You can download the AJM Rax budget highlight booklet here.

Upcoming events;

- Weekly, Wednesday at 5.30pm ~ Follow the Trader

- 04 March ~ Things I wish I knew: the beginner trader

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ Australia fight with Google and Facebook

/ Uber loses appeal in UK, drivers are workers not independent contractors

/ Former Bank of England Governor Carney joins board of digital payments company Stripe

/ US return to Paris Agreement

/ US jobless claims up to four-week high

/ Gold under pressure as it trades at lowest levels since June

Local

/ Sibanye Stillwater results

/ Truworths results

/ BHP results and monster dividend

/ Rand at 14.50

/ Two interesting update titbits; Tigerbrands worried about January sales and Dis-Chem sees connivance malls much better than malls, but malls returning to normal.

/ Value Group delisting

Simon Shares

Interesting titbit from TigerBrands (JSE code: TBS) update "It is too early to conclude whether the lower consumer demand levels evident in the month of January reflect an even more challenging environment than what was experienced over the past year."

Upcoming events;

- Weekly, Wednesday at 5.30pm ~ Follow the Trader

- 18 February ~ Everything ETFs and tax-free investing

- 04 March ~ Things I wish I knew: the beginner trader

BHP* (JSE code: BHP) results were good, the cash flow was excellent with the dividend up 55% and payout ratio 85%.

This is the benefit of commodity prices at higher levels but also due to low debt levels an almost zero capex requirements from most commodity miners.

This raises three questions;

Are we in a commodity supercycle?

I think not, sure prices are at best levels in about five years. But that's off a low base rather than a super cycle. sure demand has picked up and global infrastructure spend is rising in response to the pandemic. But we don't have China growing at almost 10% a year sucking in almost all of the world's commodities as we did back in the early 2000s.

Last time we ha a commodity supercycle it died the day after a global bank did a 100-page report on how it would last another decade.

Will commodity prices go higher?

They can but mostly I think they won't. Platinum could hit US$2,000 but for the rest our best bet is they stay around current levels. Oil, who knows. Will the frackers return in mass with higher prices? Demand will certainly continue to increase as we get out of the pandemic, but how long can Opec+ keep their collective foot on the production brake pedal? I think not long as they'll need the money.

How long will it last?

The elevated prices can probably last 3-5 years at best and this will see cash flows at high levels, especially as debt gets paid own. But the miners need to find new mines to mine or they run out of product to sell (as we're seeing with Pan African Resources* (JSE code: PAN) and their new mines / operations. So at some point, we'll start seeing green and brownfield capex projects coming back and that'll need some cash so dividends will start to drop.

My big fear is mega deals. These always destroy value albeit the miners look at them as an easy way to increased supply for themselves. If a stock I hold gets an offer, I'll take the money and run. If a stock I own makes an offer, I'll take the money and run.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.