Simon Shares

- Just One Lap is 11 years old :)

- FOMC, as expected. Local MPC tomorrow.

- Nasdaq, time to buy? Also FTSE100. Both a technical buy, not taking a view on the fundamentals.

Brent almost back at US$120.

- China opened up already, well Foxcon at least.

- Tencent results, flat-lining.

The end of an era! So says Tencent as revenue grows in single digits, the lowest quarterly number since listing back in 2004. Tencent’s declaration is resignation that any expansion will be cautious and controlled. Prosus down 8.2%, Naspers down 8.4%. Prices still look vulnerable

— David Shapiro (@davidshapiro61) March 23, 2022

- Thungela Resources (JSE code: TGA) results and 1800c dividend.

- "developments in terms of new thermal coal projects which have been hampered by financing opportunities, given ESG pressures on carbon fuels"

Simon Shares

- Big banks now all have released results, mostly good albeit off low base.

- Covid cases in China surge, new lockdowns.

- Hello, more supply chain mess.

- People asking if I updated my view on Purple Group* (JSE code: PPE). Nope, volatility likely helping the revenue, but I need new data (results) first.

- Commodities weak, brent oil now in a technical bear market.

China makes peace with tech

Prosus (JSE code: PRX) and Naspers (JSE code: NPN) now flying (+20% n Wednesday). Discount still +50%. Reports of WeChat being hit with a massive fine for money laundering?money launderingChina's state council has in one move just:

*Pledged to keep capital markets stable

*Vowed to support overseas stock listings

*Said dialogue with US re ADRs is 'good'

*Promised to handle risks for property developers

*Clarified regulation of Big Tech will end 'soon'

*BOOM pic.twitter.com/xHYgcbchCo— Sofia Horta e Costa (@SofiaHCBBG) March 16, 2022

Simon Shares

- Shoprite* (JSE code: SHP) results, it's all about innovation.

- Strong un International* (JSE code: SUI) update.

- War in Europe, commodities still the story. Very volatile, that's expected. But I expect more upside and I am happy to hold.

Upcoming events;

Prosus (JSE code PRX) / Naspers (JSE code: NPN) / Tencent (Hong Kong code: 700)

Tencent has been under pressure

Naspers and Prosus have been hit even harder

Live Prosus discount to net asset value (NAV) is now some 55% after hitting 60%.

VK (old mail.ru) has been written down to zero.

Generally unlisted is worth a lot less than stated?

Buy / Sell / Hold?

- VIE structure

- China has not taken sides in the war, so far

- Tax on profits if they sell Tencent

- More Chinese crackdowns?

- Prosus has been wasting money from the sale of 2% stake in Tencent?

- Buying back shares

- Buying Delivery Hero (Frankfurt code: DHER)

Simon Shares

- City Lodge* (JSE code: CLH) results, fair valuation around 800c?

- BHP Group* (JSE code: BHG) will see a significant reduction in its weighting in Top40 and Resi10 indices.

- PSG (JSE code: PSG) exiting the JSE.

- Wilson Bayly Holmes (JSE code: WBO) has lost investor confidence.

- Murray & Roberts* (JSE code: MUR) results. HEPS at 29c a little light, but back in profit.

War in Europe

Inflation is the biggest economic issue.Energy, PGMs and agriculture. Will central banks stick to their rate rising trend?

People want to buy the Russian ETF, why?

Even if peace happens today, sanctions will be in place for some time to come.

Buy Satrix Resi10 ETF* (JSE code: STXRES).

The Oil ETN (JSE code: SBOIL).

Local stocks impacted

- Barloworld (JSE code: BAW) about 20% of revenue.

- Mondi (JSE code: MND) about 12% of revenue.

Upcoming events;

The panellists were;

- Divan Botha – moderator

- Dr Albertus Marais ~ Director at AJM Tax

- Laila Razack ~ CFO of Equites Property Fund

- Simon Brown ~ Founder Just One Lap and host MoneywebNOW

Simon Shares

- Strong Nedbank (JSE code NED) trading update.

- If you held Steinhoff (JSE code: SNH) when it all went wrong in 2017 you have until 15 May to submit a claim.

- Oceana (JSE code: OCE), now the CEO quits?

Upcoming events;

- 22 April ~ Introducing the CoreShares Total World ETF

- 06 March ~ JSE Power Hour: Finding income in JSE listings

What's down with Purple Group* (JSE code: PPE), owners of EasyEquities?

After a high of 349c a month ago it's now 261c.

Firstly it's more sellers than buyers.

The hype of the pandemic trading is fading and easy returns are fading. So less trading, slower new accounts (albeit reports that they still have great new account rates).

Vacation is wild.

For the year ending August 2021

- 737k active accounts (up 45.7%).

- Each account makes R69 profit.

- But as accounts age profits per account increase.

What can we expect to see for the year ending August 2022? (NOTE, the interim results to end February will be out early April).

- 1million accounts? That's 263k new accounts and growth of 35%.

- Profit per account R76 (10% growth, older account more profitable BUT less market volatility means less transactions).

- = R76million profit (I ignore GT247 and Emperor Asset Management)

- With 1.2billion shares in issue that's HEPS of 6.3c = forward PE of ±40x

That seems fair, but there are risks.

- The assumptions above could be wrong

- GT247 could lose money

- New projects cost money

- Dilution with new share issues

- I am only using EasyEquities, ignoring other business units.

There are of course potential upside surprises as well

- The assumptions above could be wrong

- Growth is better

- GT247 makes money and EasyProperties kicks in strongly

I sold 35% of my holding at 315c-345c on the way up, this was because it simply became too large within my portfolio (was the biggest holding after buying at 50c less than 2 years ago). But I am happy to continue holding.

Simon Shares

- Great Sappi (JSE code: SAP) results.

- Strong Hudaco (JSE code: HDC) results.

- Top40 is trading at all-time highs, as is Resi10 and MidCap is almost there.

- Kastle back to work barometer shows office attendance in the US is still not back to levels from before the most recent pandemic wave and around 33% (on average) of pre-pandemic levels. Back in November, the average was just over 38%.

- IPO process explained.

- Ashburton ETFs have moved over to FNB.

- Meta Platforms (Nasdaq code: FB); Facebook, Instagram and WhatsApp

- Down 25% on the day of the results. Fell further and now off 43% from September 2021 highs and back at May 2020 levels.

- Market cap below US$600billion, that happens to be the number House legislators picked as the threshold for a “covered platform” in a package of competition bills aimed at Big Tech.

- Active users declined

- $10billion lost revenue due to new iOS privacy rules

- $10billion on metaverse.

- Regulatory issues.

- Meta threatens to shut down Facebook and Instagram in Europe over proposed regulations. The EU says, 'please do'.

- All said this is just one quarter, the next few quarters will tell us the true story.

Upcoming events;

- 17 February ~ JSE Power Hour: Tax-free investing

Simon Shares

- PGMs are on the move, most notably palladium and rhodium. But the miners are not.

- Combined Motor Holdings* (JSE code: CMH) strong trading update.

- MTN (JSE code: MTN) vs. Vodacom (JSE code: VOD) updates. Who's winning?

- Strong Astral (JSE code: ARL) update, but for the half ending March - so off low base.

- Ascendis (JSE code: ASC) looking to sell three businesses, but that won't leave much behind.

- OPEC+ agrees to a 400k barrel/day increase from March, this was the initial plan from last year.

- The local CPI basket is changing.

- Satrix is listing an India ETF, currently in IPO.

- The local prime interest rate increased 0.25% last week. This adds R152 per R1million of a bond. Not a lot, but this is the second one already and we have many more coming.

- The ARK Innovation ETF (NYSE code: ARKK) has had a tough year and at a point, in January, it was behind the Nasdaq over the life of the fund and it is trailing the Nasdaq over one and three years. That all said, they publish all their research and released their Big Ideas 2022 report which is well worth the read.

Upcoming events;

- 9 February ~ Wealth Creation through Trading and Investing with ThinkMarkets

- 17 February ~ JSE Power Hour: Tax-free investing

Simon Shares

Simon Shares

- PGMs are on the move, most notably palladium and rhodium.

- Oil also still moving, remember the ETN for that.

- Cashbuild (JSE code: CSB) update shows the pandemic home improvement boom is over.

- ArcelorMittal South Africa (JSE code: ACL) update sees them into profit and on a PE of under 2x.

- Steinhoff (JSE code: SNH) settlement approved, but still lots of debt.

Markets are spooked

- Lots to be spooked by;

- FOMC, it's all happening in March

- Asset purchases are also to end in March, but what of the US$9trillion of bonds the Fed holds?

- Valuations are high.

- Rates are rising.

- Inflation is at decade highs.

- Value winning over growth for the first time in an age.

Upcoming events;

Simon Shares

- BHP Group* (JSE code: BHP) is unifying its dual-listed company (DLC) corporate structure effective close 28 January. This will count as a CGT event for shareholders who will have been deemed to have sold their shares and bought the new ones.

- Microsoft (Nasdaq code: MSFT) is buying Activision-Blizzard for $69 billion, but who's the largest gaming company in the world? Tencent (Hong Kong code: 700).

- German 10-year back above 0%.

- [caption id="attachment_31941" align="aligncenter" width="888"]

German 10-year yield[/caption]

German 10-year yield[/caption] - Oil at 7-year highs. There's an ETN for that.

Now for the tenth year in a row, we kick off the new year with a predictions show.

Marc Ashton, Keith McLachlan and Simon Brown put their heads on the block with three wild and woolly predictions for the markets for 2022 followed by a call on the Top40 and ZAR for the year ahead.

Importantly we start each show with a review of the previous year’s predictions and you’ll find the 2021 predictions show here.

Holiday show

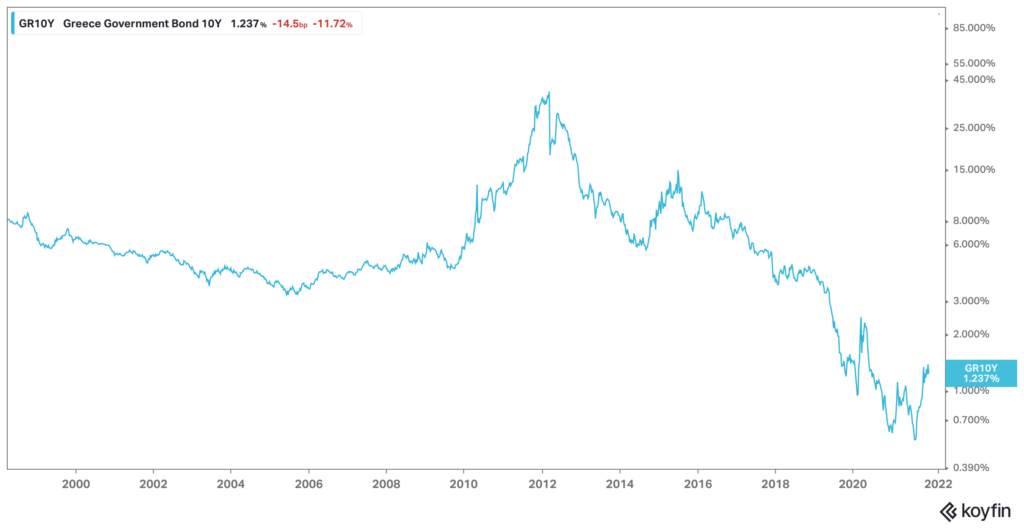

- Back in 2010 the world watched as Greece plunged further and further into a debt crisis with many expecting the EU to not survive. But Angela Merkel saved Greece and the day.

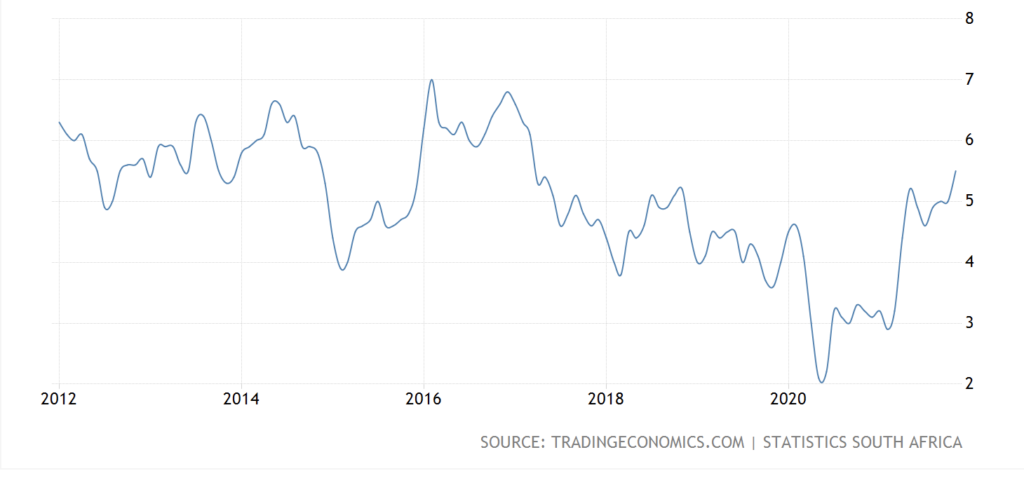

[caption id="attachment_31826" align="aligncenter" width="888"] Greek 10Y bond rates[/caption]

Greek 10Y bond rates[/caption]

Greek debt to GDP (%)

source: tradingeconomics.com

On the 20th September 2021 Chinese property developer missed interest payments on some US$300billion of debt and this spooked markets into a selloff. But three months later nobody cares. What's the background sorry and why does nobody care?

After clogging up the Suez Canal for six days back in March 2021 and halting much of the worlds shipping trade, what happened to Ever Given?

Offshore

/ Strong year of returns globally, CAC40 (France) top index

/ US inflation, not transitory

/ US unemployment looking decent

/ China crackdown

/ Commodities mostly a soft year, the exception is oil

/ Supply chain chaos

Local

/ Good year for local markets

/ Delisitng galore

/ GDP

/ Rand

- Simon has a look back at the winners and losers from the JSE for 2021, year-to-date returns. There certainly are some losers, but mostly it is about winners as the Top40 did 21.5% so far and the top major global index was the Cac40 which returned 29.9%.

-

Find the top ETFs here.

Offshore

/ US Labor Nov Nonfarm Payrolls +210K; Consensus +573K, unemployment improved to 4.2%. Fed's target for 'maximum employment' is for unemployment rate of 4.5%.

/ Didi leaving NYSE

/ Google will no longer require workers to return to the office on Jan. 10, delaying the return indefinitely.

/ Dorsey leaves Twitter

/ OPEC+ agrees to January production hikes

Local

/ Implats comes for RBPlats

/ Capital Appreciation results

/ Tharisa results

/ Bidcorp updates

/ Murray & Roberts update

Simon Shares

- Bidcorp (JSE code: BID). Strong update, they're coming out of this pandemic much stronger.

- Aspen (JSE code: APN) announces manufacturing deal with Johnson & Johnson (NYSE code: JNJ).

- Implats (JSE code: IMP) wants RBPlats (JSE code: RBP), sorry Northam Platinum (JSE code NPH).

- Powell, Fed chair, says inflation is not transitory.

- Oil under severe pressure, OPEC+ meeting was pushed back to Wednesday.

- New variant, I bought City Lodge* (JSE code: CLH) and Sun International* (JSE code: SUI) on Friday.

I did buy somme leisure on Friday, CLH at 400c and SUI at 2100c .. will see shortly if that was a good idea or not ..#JSE https://t.co/aHKZOIxLbu

— Simon Brown (@SimonPB) November 29, 2021

Offshore

/ Powell second term as Fed chair

/ Fed's Bostic says he remains open to faster taper and one or two rate hikes in 2022

/ Online Black Friday sales in the US fell according to data from Adobe Analytics ($8.9bn vs. $9bn)

/ Opec+ meeting this week, production likely to remain unchanged

/ Turkish lira losses 20%

Local

/ New variant crashes markets and leisure stocks (everything)

/ Good Invicta results, but no dividend

/ Good PPC results

/ Brait apital raise via convertiable bond

/ Hospital stock results; Life Healthcare & Netcare

/ Banking stocks

Simon Shares

- Coronation* (JSE code: CML) grows assets, fees and dividends.

- PPC (JSE code: PPC) results look good.

- Purple Group* (JSE code: PPE) price action looking weak.

- PGMs fading again.

- Hospital group stocks; Life Healthcare JSE code: LHC) and Netcare (JSE code: NTC) both had fair results as they get better at managing the pandemic.

- Shoprite* (JSE code: SHP) launched their banking account, under pinned by Grindrod Bank (JSE code: GND) who also stand to benefit from the MTBPS last week whereby the minister said they'd allow independent traffic on the Transnet rail network by end of 2022.

- Turkish lira collapse. This is what happens when your central bank is not independent.

- Two stocks that made a real difference to my portfolio over the last two decades, Capitec* (JSE code: CPI) and Shoprite* (JSE code: SHP).

Twenty years of food retailers on the #JSE pic.twitter.com/BDKeOPU11t

— Simon Brown (@SimonPB) November 23, 2021

Twenty years of local banks .. only really one bank in it as the other 4 battle along the bottom as Capitec does 46% CAGR over the two decades ..#JSE pic.twitter.com/yMx0NSDYrV

— Simon Brown (@SimonPB) November 24, 2021

Simon Shares

- Iron ore below US$100. Kumba (JSE code: KIO) halved since July highs.

- And still falling.

- But Q3 sales were at US$180 / tonne and even at current lows likely they get US$150 / tonne for the second half. Mid-year cost per tonne was US$26 and sale price US$165 / tonne. So the share is pricing in horror stories which likely aren't true fr the full year ending December. BUT next year will be different and you don't try to catch falling knives, wait for a confirmed reversal.

- Woolies* (JSE code: WHL) trading update, really weak.

- Shoprite* (JSE code: SHP) trading update, really strong.

- Strong PPC (JSE code: PPC) update.

- Local inflation came in at 5%, the fourth month we're below US inflation and likely we'll see no change at MPC on Thursday.

[caption id="attachment_31691" align="aligncenter" width="888"] Top40 daily[/caption]

Top40 daily[/caption]

Upcoming events;

- 18 November ~ JSE Power Hour: Opportunities in local and global property

- 25 November ~ The inflation threat, is it becoming structural?

- 02 December ~ JSE Power Hour: Position your portfolio for 2022

- 09 December ~ Portfolio construction with Keith McLachlan

Offshore

/ US inflation, 6.2%. Core inflation highest since 1991.

/ Johnson & Johnson announced plans to split its company into two, separating its consumer health division from its pharmaceutical and healthcare businesses.

/ Elon Musk selling Tesla shares, some planned n September. Rest thanks to the Twitter poll.

/ Singles day in China, muted (+8.5%) but still huge, Alibaba $84.5billion

/ Tencent results. Slowing in all areas. Common prosperity is visible in the results.

Local

/ MTBPS, not much happening - as expected.

/ Vodacom buying Vodafone Egypt, nice deal and adds a strong growth region.

/ Purple Group results, really top class and much better than I expected. 737k funded accounts.

/ Sappi results, doing well as dissolving pulp prices boom. But energy costs hurting.

/ Raubex results strong with a really good pipeline and well positioned for infrastructure

/ Northam scopes Implats and buys 33% of RBPlats

Simon Shares

- Iron ore below US$100. Kumba (JSE code: KIO) halved since July highs.

- Tencent (Hong Kong code: 700) results.

- Northam (JSE code: NPH) buys stake in RBPlats (JSE code: RBP).

- Telkom (JSE code: TKG) results.

- Purple Group* (JSE code: PPE) results.

[caption id="attachment_31661" align="aligncenter" width="888"] Purple Group daily chart[/caption]

Purple Group daily chart[/caption]

Offshore

/ US tapering begins

/ Strong US jobs data

/ US passes $1trillion infrastructure bill

/ Bank of England leaves rates unchanged

/ Strong Pfizer results

/ Elon Musk asks Twitter if he should sell 10% of his Tesla shares, and pay tax

Local

/ Mini budget this week

/ Renergen reserves

/ Dis-Chem results

/ MTN update

/ Purple Group update

/ Petrol increase

Simon Shares

- Federal Reserve FOMC press conference Wednesday evening after a two-day meeting.

- Avis (NYSE code: CAR) up 50x from March 2020 lows after results.

- Pfizer (NYSE code: PFE) results.

- Ascendis (JSE code: ASC) shareholder activists now control 30% of the votes.

- Renergen* (JSE code: REN) announce a six-fold increase in helium reserves.

- Still need to raise UAS$800m or R12.3billion to get phase 2 up and running.

- [caption id="attachment_31627" align="aligncenter" width="888"]

Renergen weekly chart[/caption]

Renergen weekly chart[/caption] US$8.5billion from France, Germany, the UK and the US governments, as well as the EU, to support a just transition to a low carbon economy.