Mar 28, 2024

Old Mutual Results:

- Surprisingly strong results from Old Mutual.

- Despite stagnant GDP growth and population decline, Old Mutual shows strong growth, indicating market share acquisition.

- Expansion into banking sector questioned due to market saturation.

- Stock analysis: Trading around 1184, showing potential support at 1150 and resistance at 1240-1280.

- Considered cheap with PE ratio around 7.7 and dividend yield over 7%.

- Market consensus predicts an average price target of 14.81.

- Skepticism remains regarding the bank launch and overall upside potential.

MTN Results and Analysis:

- MTN's earnings affected by Naira devaluation in Nigeria.

- Earnings per share down 72%, impacted by tax issues and currency devaluation.

- Stock analysis: Chart showing positive signs, with potential for short-term growth.

- Market consensus includes three strong sells, five holds, and four buys.

- Telco sector struggles due to price pressures and constant capital expenditure.

- Limited upside potential for telco stocks, including MTN.

ADvTech* Results and Operational Leverage:

- ADvTech demonstrates strong operational leverage.

- Operational margins increase due to improved student occupancy rates.

- Revenue up 13%, HEPS up 19%, and dividend per share up 45%.

- Stock analysis: Notably increased in value but still offers potential growth.

- Expectations for around 15% growth in the future.

- Simon Brown expresses satisfaction as a long-term shareholder in ADvTech.

Monetary Policy Committee (MPC) Meeting Insights:

- MPC meeting concludes with no change in rates.

- Governor's hawkish stance indicates possible rate cuts later in the year.

- Inflationary pressures expected to persist due to global factors.

- Delayed rate cuts expected due to inflation concerns.

SALTA Awards Highlights (full details here):

- Simon Brown attends the SALTA Awards.

- Satrix emerges as the big winner with 10 awards.

- People's Choice Awards highlight popular ETFs, with Satrix Top 40 winning for the seventh consecutive year.

- Introduction of a new award category for foreign ETFs.

- Importance of industry events in highlighting the significance of ETFs and listed trackers.

Simon Brown

* Simon holds ungeared positions.

Mar 22, 2024

Market Updates:

- Recent news on Markus Jooste's fine and tragic passing prompts reflection on justice and mental health awareness.

- Telkom's sale of its towers business for R6.75 billion highlights strategic shifts and potential opportunities in the telecom sector.

- Ongoing rise in oil prices raises concerns about inflationary pressures and global economic impacts.

Market Analysis and Insights:

Gold's Surge:

- Gold prices hit new all-time highs above $2200, reflecting investor concerns and market sentiment following Jerome Powell's recent statements on inflation and monetary policy.

- Gold mining companies show varied responses, with Pan-African, Goldfields, DRD, and Anglogold Ashanti experiencing gains.

Interest Rates and Economic Outlook:

- Powell's announcement of no immediate rate cuts and a projected total of three cuts for the year signals a cautious approach towards inflation.

- Rising interest rates pose challenges for companies with significant debt burdens, while those with ample cash reserves stand to benefit.

Inflation and Monetary Policy:

- CPI data reflects higher-than-expected inflation rates, prompting speculation about potential rate cuts in South Africa and implications for economic recovery.

- Abenomics, Japan's economic policy experiment, demonstrates the effectiveness of unconventional monetary measures in stimulating growth and combating deflation.

Company Updates and Reflections:

Remgro Results:

- Remgro's net asset value growth raises questions about the effectiveness of its management strategy, despite trading at a significant discount.

Remgro has grown its NAV per share by 5% p.a. since 2010.

Over the same period, the ALSI TR index has done 12% p.a.

If you expect this underperformance to continue (and nothing in their recent capital allocation decisions indicates otherwise), then a fair discount to NAV is…— Piet Viljoen (@pietviljoen) March 19, 2024

- Contrasting performance with Sabvest Capital highlights the importance of superior returns and effective capital allocation in investment decisions.

Sun International:

- Strong financial results from Sun International underscore challenges and opportunities in the leisure and hospitality sector, amid shifting consumer behaviors and economic uncertainties.

Mar 14, 2024

Retire well, we're chatting with retirees about what they've learnt and any tricks they can pass on.

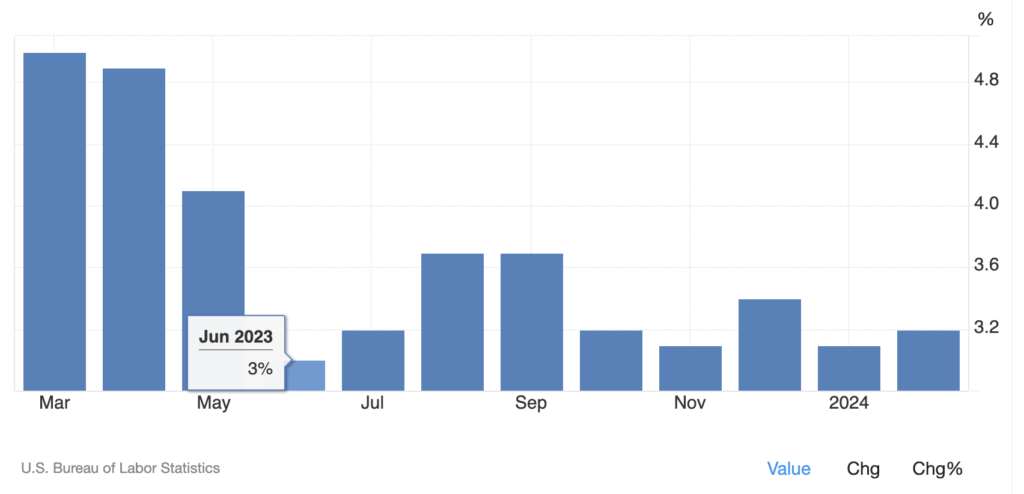

US Inflation Trends:

- US inflation has remained stagnant at 3.2% since June of the previous year, defying expectations.

- Despite initial projections, inflation has not reached the anticipated 4% mark, staying just above 3%.

- Discussion on potential implications for the economy and monetary policy, including the possibility of a mid-year rate cut.

Local Property Market Concerns:

- Review of recent challenges facing Pick n Pay and its impact on property stocks and landlords.

- Analysis of Hyprop's trading update and its implications for the broader property sector.

- Discussion on potential strategies for landlords facing challenges from tenant closures and renegotiations.

Quantum Food and Market Speculation:

- Examination of recent market speculation surrounding Quantum Foods and its stakeholders.

- Evaluation of market reactions to news events and projections for future stock performance.

Get 10% off your first KoyFin order

Financial Sector Insights:

- Analysis of ABSA's poor financial results and the broader challenges facing the banking sector.

- Comparison of valuation metrics and performance across various banking stocks.

- Preview of upcoming industry event focusing on financial education and market insights.

Mar 7, 2024

Shoprite* Results and Market Comparison

- Discusses the recent Shoprite results, emphasising excellent performance against a high base.

- Highlights Shoprite's significant CapEx spending, customer savings, and market share gains.

- Compares market cap of Pick n Pay and Shoprite, pointing out the latter's cash reserves.

- Reflects on the historical revenue comparison between Shoprite and Pick n Pay over the past 20 years.

- Shoprite's Competitive Position and Stock Analysis

- Questions whether Shoprite is always destined to be an expensive stock.

- Analyzes the current PE ratio, forward PE, and 10-year mean, suggesting that the stock may not be as expensive as perceived.

- Shares consensus forecasts and target prices for Shoprite, indicating a potential undervaluation.

- Expresses the belief that Shoprite at ±R270 might not be as expensive as it appears, drawing parallels with the valuation of Nvidia.

- Shoprite's Success Factors and Pick n Pay's Struggles

- Explores the factors contributing to Shoprite's success, including central distribution centers and efficiency.

- Contrasts Shoprite's strategy with Pick n Pay's challenges, noting a decline in consumer satisfaction.

- Mentions Pick n Pay's recent financial struggles, including a rights issue and debt increase.

Gold and Bitcoin at All-Time Highs

- Addresses the unusual situation of both gold and Bitcoin reaching all-time highs simultaneously.

- Discusses the fears driving gold prices, such as inflation, interest rates, conflicts, and global elections.

- Highlights gold's potential target of $2,500 and the positive impact on gold mining profits.

- Shares the performance of various gold mining stocks over the past three years.

Canal+ Offer for MultiChoice

- Updates listeners on Canal+'s revised offer of R125 per share for MultiChoice, which is currently trading at R113.50.

- Discusses the time value and risk value of the deal, expressing the view that this might be the final offer.

Finance Costs and Corporate South Africa

- Examines the increase in net finance costs for Sea Harvest, attributed to higher interest rates.

- Acknowledges the challenges faced by Corporate South Africa, including Eskom issues, logistic challenges, and rising interest rates.

- Assures listeners that some of these challenges may start to fade away in the future.

©JustOneLap.com