Offshore

/ Evergrande has its suspension lifted and makes an interest payment

/ Oil remaining stubbornly high

/ Inflation fears, time for gold?

/ Paypal maybe buying Pinterest for US$45billion

/ Netflix results, still growing albeit north America very slowly

/ Facebook getting a new name as the future is the metaverse

Local

/ Local CPI 5% for September

/ Pick n Pay results

/ Excellent results from Combined Motor Holdings

/ Clicks results

/ New Satrix All Share ETF listing in November

/ Renergen launches a helium token

Simon Shares

South Africa inflation rose to 5% in September. Food inflation is 7%, electricity 14%, and fuel almost 20%, with a large petrol price increase expected in November. These increases are partially offset by clothing inflation at 1.6%, appliances -0.4%, and housing rentals around 1%

— kevin lings (@lingskevin) October 20, 2021

- Wesizwe Platinum (JSE code: WEZ) went crazy after releasing a competent person report.

- Calgro M3 (JSE code: CGR).

- Balwin Properties (JSE code: BWN).

- US lists its first Bitcoin ETF, ProShares Bitcoin Strategy ETF (NYSE code: BITO). It doesn't hold actual Bitcoin, rather it uses futures to track gains. losses.

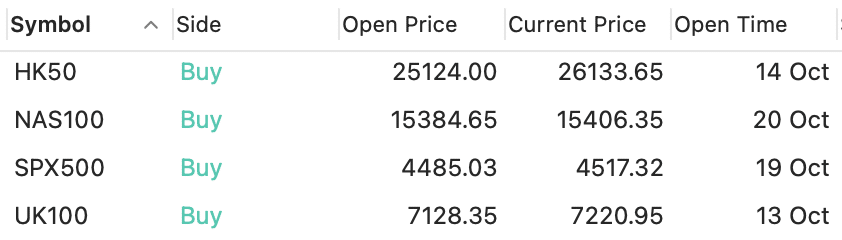

- Everything Rally

My positions for the everything rally.

My positions for the everything rally.

Upcoming events;

- 21 October ~ JSE Power Hour: Small cap investing with Anthony Clark

- 27 October ~ FX and Commodity prices and their effects on investments

- 04 November ~ JSE Power Hour: Bold predictions from SA's top broker

- 11 November ~ Investment Valuation with Keith McLachlan

Offshore

/ September, the CPI increased 5.4% after advancing 5.3% on a year-on-year basis in August.

/ China Q3 GDP at 4.9%

/ Biden announced that the Port of Los Angeles would start operating around the clock, following the Port of Long Beach's lead, to ease congestion

/ $2.7 Trillion in Crisis Savings Stay Hoarded by Wary Consumers

/ Microsoft shuts down LinkedIN in China

/ MTNs IHS Towers lists in NY, MTN stake worth R22bn

Local

/ Government cracking down on imported cement, but not with tariffs.

/ IMF bumps local GDP to 5% for 2021

/ Murray & Roberts expands in the US

/ Long4Life results and offer on the table

/ Tharisa gets their Chrome plant cold commissioned

/ Alaris & CSG both have delisting offers.

Simon Shares

- Murray & Roberts* (JSE code: MUR) expands in the US.

- The government says they'll only use locally produced cement in projects. PPC (JSE code: PPC) and Sephaku (JSE code: SEP both fly higher. But is the market right about this?

- We're off the UK red list, good for local hotels?

- Aveng (JSE code: AEG) have announced plans for a 1:500 share consolidation in December. This usually sees prices weakness after the consolidation.

Upcoming events;

- 14 October ~ Investment Fundamentals with Keith McLachlan

- 21 October ~ JSE Power Hour: Small cap investing with Anthony Clark

- 27 October ~ FX and Commodity prices and their effects on investments

Offshore

/ US jobs disappoints, but unemployment 4.8%.

/ 15% global tax rate approved.

/ Oil continues to run higher

/ Reports that Malaysia is getting back on track with chip packaging sees PGMs run hard as it could be good news for vehicle production

/ Last Tuesday was tenth commemoration of the death of Steve Jobs. A legend and the iPhone one of the best products ever?

/ All facebook properties down on Monday for 6 hours.

Local

/ EOH update shows it’ll make an operating profit

/ Invicta buys Dartcom, moving into communications and renewable energy

/ Zeder results, still waiting on value unlock

/ Sanlam Investment Holdings buying Absa investment businesses.

/ Home loans worth +R56.6 billion were granted in Q2 2021, +40% compared to the same period in 2019.

Simon Shares

- Facebook (Nasdaq code: FB), Instagram and WhatsApp all down on Monday.

- Evergrande is suspended.

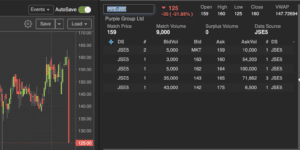

- Last week it was a fat finger Purple Group* (JSE code: PPE) taking the stock down to 125c. This week it hits 225c.

- Murray and Robert* (JSE code; MUR) starting to move higher.

- Brent oil is now around $82.

- PGMs remains under pressure.

- EOH (JSE code: EOH) makes an operational profit, but the debt pile remains.

Upcoming events;

- 14 October ~ Investment Fundamentals with Keith McLachlan

- 21 October ~ JSE Power Hour: Small cap investing with Anthony Clark

Offshore

/ China & Europe power shortages

/ Brent oil trading around $80

/ Merck Covid-19 pill, expected to produce 1.7 million courses for the U.S. government for $1.2B

/ Tesla delivered record 241,300 vehicles in the third quarter

/ Work-from-home forever: PwC offers US employees full-time remote work

Local

/ Level 1 & SA expected to be removed UK red list, will tourists return?

/ Capitec results

/ Bidcorp results

/ PPC debt restructuring

/ Purple Group tie up with Discovery Bank

Simon Shares

- FOMC and MPC both keep rates unchanged, No surprise.

- Evergrande is not a threat to the global financial system.

- Fat finger on Purple Group* (JSE code: PPE).

Upcoming events;

- 30 September ~ Power Hour - JSE traded ETNs on Tesla, Apple, clean energy and more

- 14 October ~ Investment Fundamentals with Keith McLachlan

Offshore

/ FOMC leaves rates unchanged and no tapering just yet.

/ Evergrande a worry but not a global threat

/ China bans crypto, again.

/ Britain has a shortage of lorry drivers, and so a petrol shortage.

/ Nike cut its 2022 revenue outlook because of the temporary bottlenecks plaguing supply chains.

Local

/ MPC no change

/ Telkom to spin out towers (Swiftnet) worth about R13billion. Openserve will happen afterwards.

/ PGM prices remain under pressure as vehicle production the world over in under pressure due to chip shortages.

/ Spur results

/ Exxaro has announced the development of a 70 MW solar project as part of the groups “overall renewable energy strategy”.

/ Grindrod sells remaining stake in Grindrod Shipping for R370million

Simon Shares

- Clicks (JSE code: CLS) revised trading update, previous EPS growth was 8%-13%. Now revised to 0%-3%.

- Afrocentric (JSE code: ACT). Great little stock.

- Not a bad update from Famous Brands* (JSE code: FBR)

- US inflation for August was 5.3%.

- US poverty levels went down in 2020, during the pandemic.

- AB Inbev (JSE code: ANH) just keeps on falling, why?

- PGMs getting crushed. Platinum down at US$934, palladium around US$2,000 and rhodium US$13,300. What's happening? When does it reverse?

Offshore

/ PayPal announced plans to buy Japanese "Buy Now, Pay Later" BNPL company Paidy Inc. for $2.7B

/ US judge rule against Apple and in Epic Games favour in antitrust lawsuit; judge says Apple's conduct in enforcing anti-steering restrictions is anticompetitive

/ China Evergrande Group default risk ($300bn)

/ U.S. Senate Democrats float stock buyback tax as part of $3.5 trillion bill

/ The World’s Shippers Are Earning The Most Money Since 2008

Local

/ Local Q2 GDP, we’re 1.4% below pre-pandemic levels

/ SARB governor Lesetja Kganyago suggests we work towards a 3% inflation target, with a 2-4% tolerance range

/ FSCA fines Viceroy R50m

/ Result; Shoprite

/ Results; Momentum

/ Results; Bidvest

Simon Shares

- Shoprite* (JSE code: SHP) results. Christo Wiese gets R342m in dividends. 21million consumers using their Xtra Savings and 1.5million downloads of the Sixty60 app.

- The market did not much like the Murray & Roberts* (JSE code: MUR) results.

- Old Mutual updates 2021 GDP forecast to 5.5%. This is after Stats SA released GDP for Q2 QonQ at 1.2% (YonY 19.3%) and better than expected. The economy remains 1.4% below pre-covid levels.

- FSCA fines Viceroy R50million. They won't pay.

- SARB governor Kganyago Lesetja suggests we work towards a 3% inflation target, with a 2-4% tolerance range.

- New infrastructure ETF from Satrix.

Upcoming events;

- 30 September ~ Power Hour - JSE traded ETNs on Tesla, Apple, clean energy and more

- 14 October ~ Investment Fundamentals with Keith McLachlan

Offshore

/ US jobs data slows. Likely means tapering not just yet even as ECB starts talking tapering.

/ New China restriction, kids gaming limited to one hour a day on Friday, weekend days and public holidays

/ Pfizer has recognized over $10 billion in profits from the COVID-19 vaccine alone, making it the best drug introduction in history.

/ After hurricane Ida oil recovery begins with ports and refineries restarting but most production in the Gulf of Mexico is still shut.

/ Chip shortage holds back German car sales in August

Local

/ SA trade surplus at R37bn July vs R55bn June. YTD R290bn.

/ Mediclinic plans to go green in R2.2bn renewable energy deal

/ Results; Murray & Roberts

/ Results; Discovery

/ Results; Implats

/ Results; Aspen

Simon Shares

- Jackson Hole

- Bonang Mohale and his Serialong trust converts a Purple Group* (JSE code: PPE) loan into 11.46% shares in the group

- ADvTECH* (JSE code: ADH)

- Stadio (JSE code: SDO)

- Cashbuild (JSE code: CSB)

- Sun International (JSE code: SUI)

- MAS Real Estate (JSE code: MSP)

- Motus (JSE code: MTH)

- Woolies* (JSE code: WHL)

Is this Woolworths’ attempt at Athleisure ?

Yikes! 😬

Crop Top : R249.99

Leggings : R299.99I am flattered they think I,their customer, is a 20 year old Instagram Fitness star 🤣🤣 pic.twitter.com/B4xsTJ36ho

— Moms 💖 investing (@mommy_moneyza) September 1, 2021

Upcoming events;

- 02 September ~ JSE Power Hour: Picking the next winning stock

- 14 October ~ Investment Fundamentals with Keith McLachlan

Offshore

/ Jackson Hole. Powell says nothing new.

/ TSMC, the world's largest maker of semiconductor chips, says it's raising its prices by about 20%

/ Hurricane Ida heading for the Gulf of Mexico, shutting down oil production.

/ China reportedly weighs ban on U.S. IPOs from domestic tech companies with sensitive data

Local

/ Bonang Mohale and his Serialong trust converts a Purple Group loan into 11.46% shares in the group

/ Unemployment 34.4%

/ South African GDP rebased. The economy is 11% larger than previously measured. It is still the second-largest economy in Africa, after Nigeria.

/ National treasury says KZN July violence will take 0.7%-0.9% off 2021 GDP.

/ Sibanye Stillwater results

/ Woolies results

Simon Shares

- Jackson Hole

- South African GDP rebased. The economy is 11% larger than previously measured. It is still the second-largest economy in Africa, after Nigeria.

- South Africa unemployment 34.4%.

- National treasury says KZN July violence will take 0.7%-0.9% off 2021 GDP.

- New oil & copper ETNs

Upcoming events;

- 02 September ~ JSE Power Hour: Picking the next winning stock

- 14 October ~ Investment Fundamentals with Keith McLachlan

Offshore

/ New Zealand going into lockdown, the world is getting vaccinated but the pandemic is far from over.

/ Pfizer expected to get full FDA approval for its covid vaccine this week. A whole new business (covid jabs & mRNA possibilities).

/ Tesla wants to build an AI robot

/ Jackson Hole this week

/ China securities regulator signals willingness to work with the US on audits

Local

/ South Africa inflation lower at 4.6% in July 2021.

/ Sasol results

/ Shoprite / Massmart deal

/ ARB Holdings results

/ Metair results

Simon Shares

- JSE is broken.

- 100 MW gazetted.

- Renergen* (JSE code: REN) update.

- South Africa inflation lower at 4.6% in July 2021.

- Tencent (Hong Kong code: 700) results.

- Resource stocks ex-div. But still lots of pain. Super BHP Group* (JSE code: BHP) results.

- New Clean energy and water ETNs listed.

Upcoming events;

- 19 August ~ JSE Power Hour: BEE shares and the JSE

- 02 September ~ JSE Power Hour: Picking the next winning stock

- 14 October ~ Investment Fundamentals with Keith McLachlan

Offshore

/ US inflation comes in as expected

/ Britain's GDP grew by 4.8% in the second quarter of this year, leaving the economy just 2.2% below its pre-pandemic level

/ Google employees who work from home could lose money

/ US infrastructure bill moving forward

/ India to unveil US$1.35trillion infrastructure bill

Local

/ 100mw power generation laws gazetted

/ Naspers / Prosus swap is unconditional

/ Strong Merafe results

/ MTN results and Sanlam tie up

/ Nedbank results

/ Exxaro and Thungela results

Offshore

/ US GDP 6.5% , below expectations but the economy now larger than pre-pandemic

/ US moving forward with an infrastructure bill

/ The U.S. debt ceiling officially became operative again on Sunday after a two-year suspension

/ Amazon results see stock down 7%

/ Alphabet results & $50bn buyback

/ Microsoft results, LinkedIn does +$10bn

Local

/ Tencent woes hit JSE (but all-time closing high on Thursday)

/ Results; Anglo Platinum, Kumba Iron Ore and Anglo American

/ Liberty2Degrees results

/ ArcelorMittal South Africa results

/ Treasury considering access to retirement savings

Simon Shares

- Wild week for Naspers (JSE code: NPN), Prosus (JSE code: PRX) as Tencent (Hong Kong code: 700) got slapped down by the Chinese government.

- We're back at level 3, adjusted. Alcohol sales are allowed and Distell (JSE code: DGH) put out another great trading update. No doubt better if no alcohol bans, but the argument that your industry is under threat wears thin after such an update.

- President Ramaphosa also announced the return of the pandemic grant to the unemployed at R350 a month until March 2022. This pays to some 9.5million South African and means just over R3billion a month into the economy.

- How do we pay for it? Dividend tax on these super dividends.

- Apple $21.7billion in profits, almost doubling the previous year.

- Alphabet nearly tripled its profits to $18.5billion as advertising revenue grew 69%.

- Microsoft profits hit $19.1B, up 42% from the previous year.

- The market capitalization of Amazon, Apple, Facebook, Alphabet, and Microsoft is now over 30% of the entire S&P 500 index and over 40% for the Nasdaq100.

- Tigerbrands (JSE code: TBS) are recalling 20million tins.

- Two new ETFs coming to market. Global healthcare from Sygnia and a diverse and inclusive ETF from Satrix.

Upcoming events;

- 19 August ~ JSE Power Hour: BEE shares and the JSE

Forget super cycle, hello super dividends

- Anglo Platinum (JSE code: AMS) paid an R175.00 total dividend.

- Kumba Iron Ore (JSE code: KIO) paid a 7270c.

In both cases, this amounted to a dividend yield (DY) of around 10% at the interim stage.

No share buybacks as Anglo American (JSE code: AGL) own a significant majority of the shares and likely want the dividend back at home.

The question is will other miners be as generous or will they do some share buybacks as well?

If commodity prices stay where they are, we'll see the same again in six months and into 2022?

If prices remain the same to the end of 2022 (big if?) we'll get a 40% return from just dividends?

This is what super profits look like.

Offshore

/ New closing highs for S&P500 & Nasdaq. But Russel2000 is lagging.

/ Apple delays back to the office to October

/ Twitter and Snap - good results

/ China regulator bars Tencent from exclusive rights in online music

/ Big results due this week; Apple & Amazon. So far reported results have been very strong.

Local

/ Rioting impact, retail about 8% of store space impacted. REITs bigger concern.

/ Local inflation drops

/ Anglo Americana and BHP production updates

/ City lodge sells East African assets

/ Cashbuild update

/ Distell update

Simon Shares

- We now have updates from listed retailers as to the damage caused by last weeks rioting. Chantal Marx ran the data and says we saw almost 1,700 stores looted or closed due to the rioting and this is about 8% of the retailers' local footprint and some 5% of global footprint. This is a significant number, but considering many are open for trade again, with many opening last weekend already. The impact on earnings is likely to be very modest, if at all.

- PwC expects last weeks riots to take about 0.4% off local GDP for 2021. They already had a low expectation of under 3%, but that drop of 0.4% does illustrate how listed retailers may be okay, the real pain is in the unlisted and especially the small one-off store.

- Local CPI dropped a little in June to 4.9% (5.2% in May).

- The population of South Africa was estimated to be 60.14million at mid-year 2021, an increase of about 604,281 (1.01%) since mid-year 2020.

- Stellar production updates from Anglo American (JSE code: AGL) and BHP* (JSE code: BHP). They are both firing on all cylinders, even if there have been some issues (iron ore rail line for example). But they're largely debt-free, no massive projects or M&A activity and Greg Katzenellenbogen says the worlds top miners will make almost US$120billion profit this year, double from last year. So massive dividends?

- Sygnia did not steal your dividend.

Upcoming events;

- 22 July ~ JSE Power Hour: Power of savings

- 19 August ~ JSE Power Hour: BEE shares and the JSE

Risk is good

I got an email from a listener asking about risk free investments on the JSE. Thing is, there is no risk free on the JSE - and that's a good thing.

Without risk there would be no reward.

When I am looking for investments, I always look for the good things about the business. Margins, growth, product and the like.

But I also dig into the risks, competition, input inflation and the like.

The thing is, I like to see risk, I just want risk that I think the company can manage and ultimately maybe even turn into a benefit. For example, new product is absolutely a risk. But what if they disrupt themselves and create a new product that hits sales of their existing product, but creates an entire new category.

Apple did this with the iPhone, killing off the iPod.

When researching into long-term 'til death do us part' investments

I create a short list of the three main features I like in a stock. But I also create a list of the three main risks and I keep a close eye on both lists.

Offshore

/ US inflation, again above expectations

/ Delta airline results show travel returning

/ US bank earnings as previsions put back into the income statement

/ Netflix looking into gaming

/ QoQ China's GDP increased 1.3% in Q2, 7.9% YoY

Local

/ Rioting impacts as listed companies report details

/ South African Special Risks Insurance Association (Sasria) will cover claims

/ Standard Bank taking out Liberty Holdings

/ Very strong Richemont update

/ Tongaat results

/ Steinhoff increases settlement offer

Simon Shares

- I'm recording Wednesday afternoon and the violence of the past week seems to be abating, certainly in Gauteng. It has been a horror week for our country and most importantly; look after yourself if you can somebody else as well and above all else, be kind.

- US CPI YoY 5.4%. Core YoY 4.5%. Both ahead of expectations.

- A very strong production update from Pan African (JSE code: PAN) and their 15ha blueberry farm.

- OPEC+ seems to have reached a compromise between Saudi Arabia and UAE that should see an OPEC+ deal possible.

- US earnings season has kicked off and is expected to be the best ever - and it needs to be with S&P500 and Nasdaq100 at all-time highs.

- Gold US$1,825.

- Lost in all the rioting is another two weeks of level 4 adjusted lockdown, albeit restaurants can seat customers.

Upcoming events;

- 22 July ~ JSE Power Hour: Power of savings

- We're starting to see SENS announcements about the impact of the rioting. The worst-hit so far seems to be Cashbuild (JSE code: CSB), they have 36 stores directly impacted by rioting and looting and a further 33 stores closed as a precautionary measure.

- Ethekwini Region, according to its mayor, Mxolisi Kaunda. R1billion loss of stock has been affected & R15billion rand of damage to property and equipment.

- Fuel refinery Sapref declares force majeure and shuts the plant.

- Large parts of N3 remain closed and Durban harbour has thirteen ships waiting for entry (according to VesselFinder.com). To my memory of living in KZN and counting the ships waiting whenever I could, that's about as many as I've ever seen.

- These will resolve as the rioting quietens down, and evidence is that it peaked on Monday. Longer-term the impact is hard to tell. Certainly, thousands of small businesses are gone and with them jobs. The Rand has fallen to 14.66 after hitting 14.76 early on Wednesday after it was trading at 14.20 on Friday. The JSE is actually up some 3% so far for the week.

Riot insurance

So the answer here is fairly simple, South Africa has an SOE that covers riot insurance - South African Special Risks Insurance Association (Sasria).

They repeatedly have clean audits (financials are here).

Assets under management is a little over R8billion.

But they have reinsurance.

Pretty much any property insurance you have will include a line item for Sasria and it is very cheap.

For corporates, it is a larger cost every month and the question is are corporates 10% insured or have they done some self insuring.