Simon Shares

- Federal Reserve FOMC raises 0.25% and the market drops as Fed says almost at the top.

- Local CPI comes in slightly higher at 7.0%.

- MPC meets next week, hold on rates or another +0.25%?

- Credit Suisse 'sold' to UBS.

- Steinhoff (JSE code: SNH) votes against the debt deal, now what? Bankruptcy surely?

- Transaction Capital (JSE codeL TCP) bounces, where's the value?

Simon Shares

- Silicon Valley Bank collapse, does this put a pause on US rate increases? FOMC next Tuesday/Wednesday.

- "Moody's cuts outlook on U.S. banking system to negative, citing 'rapidly deteriorating operating environment'"

- Miss expectations and get slammed

- Transaction Capital

- Absa

- MTN

- Multichoice

- Hold winners, ditch laggers.

- Sun International (JSE code: SUI) vs. City Lodge (JSE code: CLH).

ff

Simon Shares

- The local Q4 GDP came in at -1.3%, worse than expected -0.4% and shows the real pain of load shedding and Transnet issues. Q1 2023 not expected to be any better. Every set of results mentions load shedding and retailers are spending ±R1billion a year on diesel.

- Rand is looking weak, very weak.

- Grindrod (JSE code: GND) had good results and are clearly benefiting from the failure of Transnet ports.

- Bank results are looking good with Firstrand (JSE code: FSR) very strong and Nedbank (JSE code: NED) good and doing a R5billion share buy back.

Simon Shares

- Budget 2023 show, audio is fixed

- Solar as a service

- Retail Savings Bonds five-year fixed now at 10.5%

- Satrix takes over most Absa ETFs

City Lodge* (JSE code: CLH) results

- Stale bulls

- Dividend of 5c

- Occupancies at 57%

- Debt gone

- Cater for business, who are Zooming more

- Overall a bit light

Spur (JSE code: SUR) results vs. Famous Brands (JSE code: FBR).

Budget 2023

- Pieter Janse van Rensburg ~ AJM Tax

- Tony Leon ~ former leader of the opposition & ambassador

- Lesego Majatladi ~ Stay Latatude

- Simon Brown

Great insights into the budget, who should be our finance minister and even the Coronation* (JSE code: CML) Con Court appeal against the SARS judgement.

Simon Shares

- Sasol (JSE code: SOL) update was all about troubles with power, ports and rail. In other words SA infrastreucture.

- Pick n Pay (JSE code: PIK), they spending R60million a month on diesel.

- US unemployment is the lowest since 1969 at 3.4%.

- Grey listing for South Africa. The Financial Action Task Force will announce their decision at their 24 February meeting.

A paradigm shift is happening

AI has suddenly landed and it's going to be wild.

I rate it with some other major technological paradigm shifts;

- The personal computer in 1974

- The internet in 1990 (yes we had dial up bulletin boards before then, but that wasn't internet).

- Smart phones with the iPhone in 2007

All were horrid when they launched. But now they drive humanity.

Facebook getting their ads working AI after Apple locked them out.

Search is changing and will Google be the new winner.

We use Dali-E for images on JOL

Chat GPT is great, but it is not accurate. That is actually a design feature, but this is only version 3.5 and already lots of people are using it for real world practical examples.

How is it going to change investing and trading? I don't know but I know many, myself included, are trying things to see what works and what actually adds value.

Quick update, I buying Coronation (JSE code:CML) at ±3750c.

View my portfolio ==>> www.SimonBrown.co.za

Simon Shares

- MPC Thursday (26 January) raised 0.25% and FOMC Wednesday (1 February) expected is 0.25%.

- Capco (JSE code: CCO) good trading update and dividend.

- Renergen* (JSE code: REN) proposing US ADRs with Nasdaq listing in time to raise last capital required for phase 2.

Stocks losing money from load shedding

All listed companies are mentioning load shedding in their updates.

Shoprite* (JSE code: SHP);

"The Group's additional spend on diesel to operate generators across our Supermarkets RSA store base in order to trade uninterrupted during load shedding stages five and six amounted to R560 million for the period."

For the six months ending 2 January 2022 operating profit was R5,113billion. So load shedding costing the group ±10% of operating profit?

Astral (JSE code: ARL) selling chicken R2/kg below cost of production.

"A large portion of the capital expenditure commitments amounting to R737 million, outlined during the F2022 results presentation, has been placed on hold given the current adverse market conditions. The Group has however committed funds towards backup electricity generation solutions to reduce the adverse impact of load shedding."

Simon Shares

- Renergen* (JSE code: REN) finally gets phase 1 helium flowing.

- ArcelorMittal (JSE code: ACL) update, everything they warned about went wrong.

- MPC Thursday (26 January) and FOMC Wednesday (1 February). Raising 0.25% each.

Stocks making money from load shedding

- Reunert (JSE code: RLO). High voltage cables and circuit breakers.

- Mustek (JSE code: MST). Green energy division.

- Famous Brands (JSE code: FBR). Lights out need food.

- Mahube Infrastructure (JSE code: MHB). Wind and solar operations paying a dividend (DY ±13.5%) and trading below NAV.

- Kibo Energy (JSE code: KBO). Are they a going concern? They issued shares to pay a £19,635.44 invoice.

This is well worth a listen, some important data points from @StefMarani that help understands the road ahead .. https://t.co/6CGNRd6QUe

— Simon Brown (@SimonPB) January 24, 2023

@simonbrown_za ArcelorMittal SA horror update as the second half was loss making #investing #share #jse ♬ original sound - SimonBrown

Simon Shares

- Top40 is all about China. Economic data from China for 2022 released this week was weak, but better than expected.

Which food retailer offers the best value?

Food inflation is still high, 12.7% YonY for December.

But likely peaked (good rains, diesel lower and reducing input costs)

Preferred food retailer?

- Always Shoprite* (JSE code: SHP). But expensive, forward PE 19.5x

- Pick n Pay (JSE code: PIK). Forward PE 20.5x and not as good as Shoprite.

- Woolies* (JSE code: WHL). Exited disaster that is Australia. Forward PE 15x and if they can also fix clothing, real winner.

- Spar (JSE code: SPP). CEO and chair exiting after bad press recently. Poland issues but forward PE 10x.

Now for the tenth year in a row, we kick off the new year with a prediction show.

Marc Ashton, Keith McLachlan and Simon Brown put their heads on the block with three wild and woolly predictions for the markets for 2023 followed by a call on the Top40 and ZAR for the year ahead.

Importantly we start each show with a review of the previous year’s predictions and you’ll find the 2022 predictions show here.

I've been buying some Zeda on the JSE.

- Here's why

- A bit about the business

- Risks

- Possible target price

Oil below US$ 80, the first time this year.

-

- OPEC+ made no production changes.

- EU price cap on Russian oil. Done via insurance, but will it work and if it does will oil not move higher?

Simon Shares

- Nampak (JSE code: NPK) results and book build. Worth a speculative punt after the rights issue is done?

- Solid Sygnia (JSE code: SYG) results and strong dividend.

- RMI becomes Outsurance on the JSE, code OUT.

- China zero-covid.

- Local GDP, better than expected.

- Worst ETFs of 2022

- Position your portfolio for 2023

Simon Shares

- MPC upped rates 0.75% with more expected in the new year.

- Solid City Lodge* (JSE code: CLH) update with November occupancies at 60%.

- Rand below R17/US$ and more strength expected.

- Top40 sneaks green for the year after a rough ride.

- This is why we hold

- And don't panic

- Markets recover

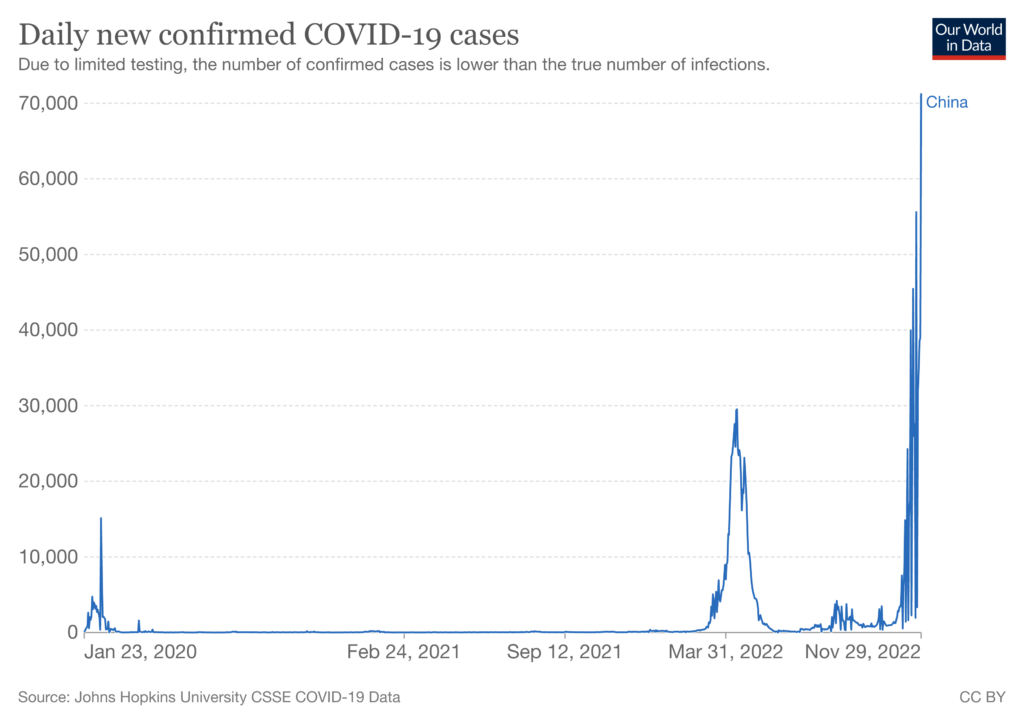

Chinese covid-19 cases hitting new records, by a long way.

This has real implications (bad ones) for the global economy as the second largest is going to be struggling in 2023.

Chinese covid cases since the start of the pandemic

Simon Shares

- Renergen* (JSE code: REN) did a small capital raise and the market not liking after they said earlier in November they wouldn't do one.

- Cilo Cybin will not be listed on the JSE. They planned to raise R500million but only got R20.5million. Those who applied will be refunded.

- Local October CPI was 7.6%, up from 7.5% and vs. an expected 7.4%. Expect MPC to do 0.75% and two 0.25% next taking prime to 11%.

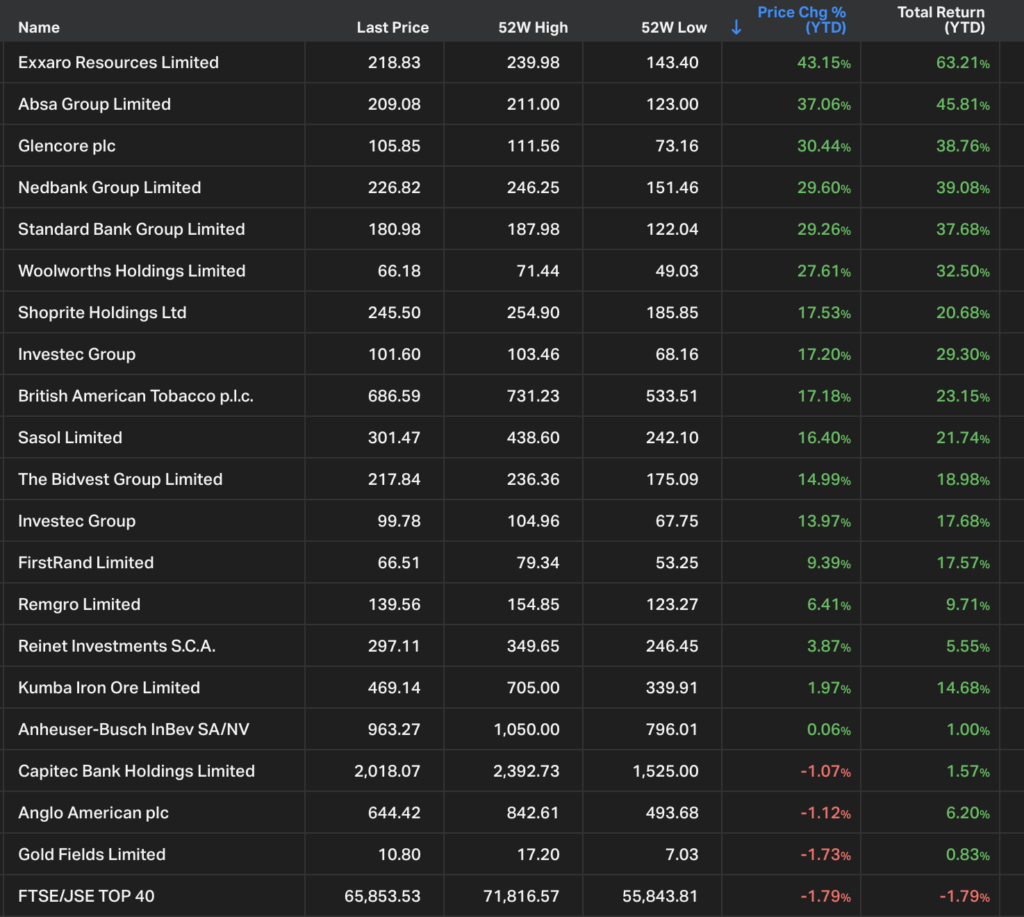

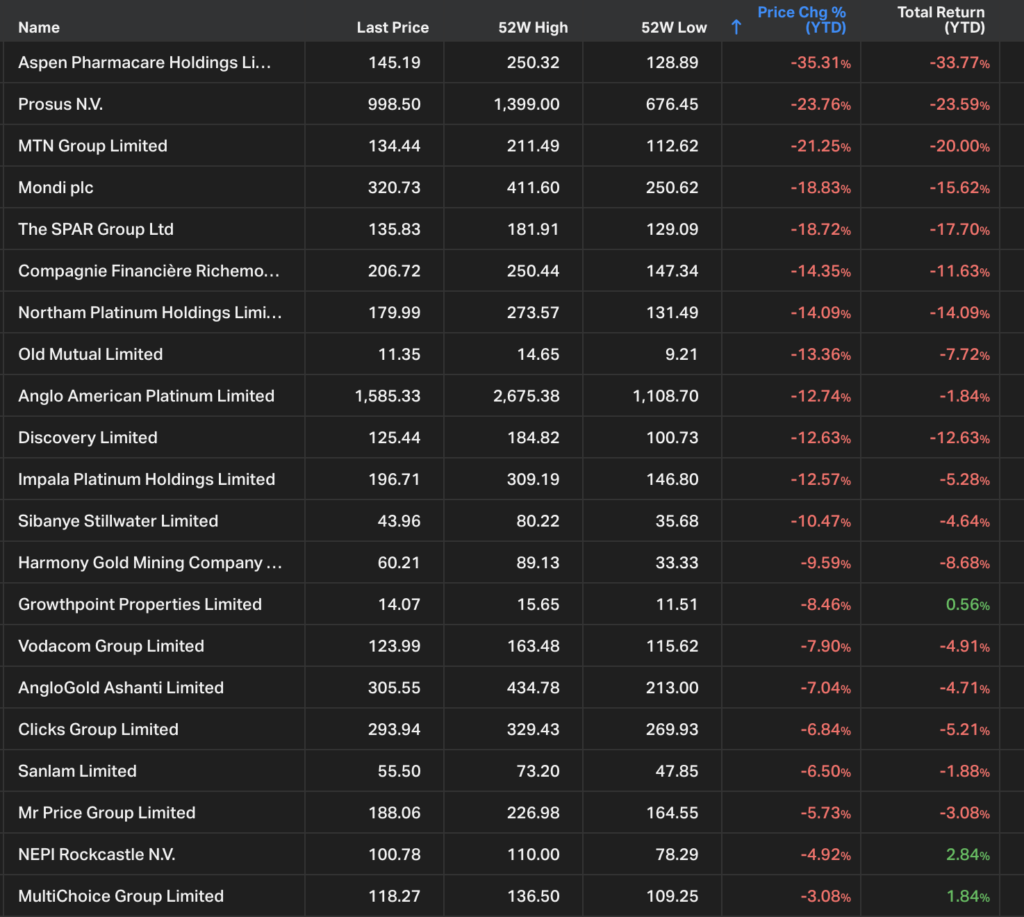

Locally 2022 has not been all horror

It feels really bad but the JSE has had a fair year with sen decent winners as the two images below show.

JSE Top40 stocks year-to-date. (winners)

JSE Top40 stocks year-to-date. (losers)

Binance buys FTX.

No, they walk away.

FTX goes bust.

Keep your coins in a hardware wallet, not on the blockchain unless you trading it. I use a Ledger Nano S Plus.

What's the future for crypto with another exchange hitting the wall?

Simon Shares

- Results wrap;

- Purple Group* (JSE code: PPE)

- Stor-Age* (JSE code: SSS)

- Ninety One (JSE code: N91)

- Transaction Capital (JSE code: TCP)

So you bought a stock and it's done good and you're making money, maybe even lots of it.

Now what?

- First, why did you buy it? That'll often help you decide when to sell.

- Second, is it still going up? Have a line in the sand, using charts, at which you sell.

- Third, is the news still all good? Bad news means to sell.

Simon Shares

- US inflation due Thursday, expected is 7.9%.

- Binance buys FTX

- Time for gold?

- Murray & Roberts (JSE code: MUR) sell Clough for very little but get rid of a lot of inter-company debt.

- Leisure stocks looking good, especially the Sun International* (JSE code: SUI) chart.

- "However, due to the immense interest from the public, as well as international investors to date, we decided to extend the period by 2 more weeks. This will allow for the investors that missed the deadline, to be part of this amazing opportunity to own shares in Cilo Cybin Holdings.". Not a good sign.

- Elon Musk sells Tesla (Nasdaq code: TSLA) shares worth US$4billion after saying in April he would sell no more. But this should be enough to keep Twitter afloat for the next year.

- Meta (Nasdaq code: META) to fire 11,000 workers, about 13% of the workforce.

After the results, are any FAANGs worth buying?

FAANGs, a mixed bag with Meta (NASDAQ code: META) the biggest loser.

Is it worth buying or what of the other FAANGs?

Apple (NASDAQ share code: AAPL) and Amazon (NASDAQ code: AMZN) would be my picks. Why buy the losers?

Simon Shares

- RMI, I got confused between RMI and RMH last week. Former is becoming Outsurance.

- Capital & Counties (JSE code: CCO) trading update shows strong leasing activity at Covenant Garden.

- Octodec (JSE code: OCT) results, discout to NAV +50%, dividend yield ±14%.

- Sasol (JSE code: SOL) convertible bond issue essential a back door right issue. Bonds expire in five years and convert into Sasol shares at US$20.3863.

- RSA Retail Savings bonds now offer 11.5% fixed for five years.

fff

Go where the money is

The Fini15 (JSE code: STXFIN*) is the only green index so far in 2022 and the strongest bank YTD? Absa (JSE code: ABG).

Simon takes us through the journey of finding the strongest sectors and then the strongest shares to find a trade where the money is.

Simon Shares

- Niche JSE listed property stocks, there are a bunch of them and they're mostly looking good.

- Famous Brands (JSE code: FBR) results are back at pre-pandemic levels.

- MTBPS

- Buy triggers on Nasdaq and S&P500

My lazy system has triggered buys on both S&P500 and Nasdaq. A close above last night's close and I'll be long pic.twitter.com/8HAisLdPZr

— Simon Brown (@SimonPB) October 26, 2022

Murray & Roberts (JSE code: MUR) horror update.

"working capital requirements are especially acute"

"financial results for the six months period ending 31 December 2022, to be at least 100% down"

This is not South Africa at all, it's Australia and the US. We've seen Wilson Bayly (JSE code: WBO) walk away from their Australian operations.

Low margins and bankers not keen on bonding projects are going to crunch this industry globally. I would suggest Aveng (JSE code: AEG) is not immune either.

The only time this industry really made money was in the run-up to the world cup, and they were colluding to get operating margins of +5%. So really this is a bust industry.

That all said, decent results from Calgro M3 (JSE code: CGR) while we wait for Balwin (JSE code: BWN).

Simon Shares

- MTN (JSE code: MTN) ditches Telkom (JSE code: TKG) over their Rain talks.

- Pick n Pay (JSE code: PIK) results. Not bad but the market hated selling the stock down 9.3%. Is the issue valuation? Forward PE is ±29c vs. Shoprite* (JSE code: SHP) is on ±21x.

- Combined Motor Holdings* (JSE code: CMH) has great results driven by car rentals surging. But it going to be tough going from here.

- UK inflation returns to a 40-year high of 10.1%.

Simon Shares

- Remgro (JSE code: REM) plans to unbundle its stake in Grindrod (JSE code: GND). There were ideas that maybe Remgro would take out Grindrod, but the unbundling is going in a different direction and Remgro unbundles shares they don't want. Remember also that after the unbundling expect weakness in the Grindrod share price for a few weeks.

- They've held them since 2011 and hold a 24.81% stake

- For every 100 Remgro you'll receive 30.70841 Grindrod shares.

- Last day to trade (LDT) is 11 October 2022.

- You'll receive them with a base cost that Remgro paid, that value is still to be determined.

- Barloworld (JSE code: BAW) trading update is not bad. The big news is that they plan to list Avis by year-end.

- Tiger Brands (JSE code: TBS) trading update was solid off a low base. The chart looks bullish as it rose +10% on Monday after the update. Chart looking decent and a potential delisting target?

- The UK is an absolute mess.

Here the UK 5, 10 & 30 year bonds for September .(with correct carts) . Just September pic.twitter.com/hMj5yP65bC

— Simon Brown (@SimonPB) September 28, 2022

Rampant Dollar

The US$ Index (code: DXY) is at twenty-year highs and within a few percent taking out the highs from the early 2000s and heading back to levels last seen in the mid-1980s.

The reasons are simple and two-fold;

- The world is scared and fear sees investors rushing to the safety of the US$.

- Rising rates in the US now see the US ten-year treasury bills trading around 4%, the highest level in over a decade. So investors can flee to the US$ and buy 10-year bills for a ±4% return.

Importantly this is hitting every currency in the world.

Has earnings implications for US companies selling products offshore as those profits are now lower due to US strength.

When does the strength stop?

- In the short-term a pullback is likely.

- But as long as fears remain the strength will continue and could continue well into next year.

What to do?

- Don't panic.

- Consider some JSE listed currency ETFs.

- Continue with your offshoring strategy.

The tables have turned. Emerging markets are much more resilient against the US Dollar than the rest of the G10. Year-to-date, the Dollar has risen a stunning 15% against the G10 (black), but only 5% against emerging markets (blue). EM is the new standard bearer for stability... pic.twitter.com/ToaQvQB9DS

— Robin Brooks (@RobinBrooksIIF) September 27, 2022

hh

Simon Shares

- FedEx (NYSE code: FDX) spooks the market by withdrawing guidance and saying demand is collapsing.

- Thungela Resources (JSE code TGA) went ex-dividend to 6000c.

- Wilson Bayly (JSE code: WBO) is letting their Australian operations go bust, not giving any more financial assistance.

Has inflation peaked?

- Local inflation down at 7.6% for August from 7.8%.

- US August inflation at 8.3% from 8.5%.

- UK August 9.9% from 10.1%.

- EU 10.1% up from 9.8%.

- Europe and UK still have a winter of energy crisis to contend with.

- US and local looks to have topped, but energy/petrol still needs watching.

- Food inflation remains high and remains a risk.

- A recession will dampen demand and help inflation lower.

- Transport costs are down.

BUT, what of interest rates?

The problem is getting back to target.

- Locally 3%-6%

- US 2%

Rate increases still coming, likely into the new year before pausing.

Then the long wait for inflation to get to target (or near) before rates start coming down. In the US this is at best 2024 but probably 2025. Locally rates may start moving lower in early 2024.

Simon Shares

Trading

- Trading in the Zone – Mark Douglas (detailed review)

- Trend Following – Michael Covel (detailed review)

- Reminiscences of a Stock Operator – Edwin Lefevre

- Market Wizards - Jack Schwager

- The Complete Turtle Trader: How 23 Novice Investors Became Overnight Millionaires - Michael Covel

Investing

- The Little Book of Common Sense Investing - John C. Bogle

- One up on Wall Street – Peter Lynch (detailed review)

- Common Stocks and Uncommon Profits – Phil Fisher (detailed review)

- Effective Investor – Franco Busetti

- The Little Book that Beats the Market - Joel Greenblatt

General

- Thinking, Fast and Slow - Daniel Kahneman

- Fooled by Randomness - Nassim Taleb