Simon Shares

- Capitec* (JSE code: CPI) through R800. This is why I don't try time exits on long-term investments. Things can get crazy.

- Pembury is listing their schools division and it will likely do well on listing but I am not convinced and am not applying for allocation.

- Has the Trump rally hit a wall?

- Most of the cash for my Sea Harvest allocation has reappeared in my brokerage account, suggesting I got 3.8% allocation. We'll see how it trades as to whether I buy more in open market sell and run. I would like to hold in my second tier portfolio, but only if the numbers work and if it spikes madly on day one I will more likely sell into the spike and wait for things to settle.

Buying Bitoin (Code: BTC)

Started in October 2008 with zero value as the first crypto currency it now trades around US$1,100 and has an ardent fan base. The questions are if it is the future of money? CoinMarketCap lists over 750 crypto currencies with a total market cap of over USD24billion. That said Bitcoin has a market cap of almost US$18billion with Ethereum on a market cap of almost US$4billion (up almost 50% in the last week) leaving very little for the other 750 crypto currencies. But they are very volatile and a commodity rather than a currency, but should we be investing or trading in them?

We Get Mail

- George

- If people want interest, they want the most interest. My question is simple. Why are there so many options? Govi, Ilbi, or a call account with my bank? Which do I pick and why do I pick it?

- Stephen

- If I am looking for somewhere to park cash (i.e. protection of capital and quick access are key), other putting the money in a bank what would be the more suitable options? Also in this respect would there been any advantage in investing in an inflation linked bond ETF as opposed to directly in a bond?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Anchor Capital (JSE code: ACG) been getting pounded, after almost 2000c in late 2015 now around 600c.

- HomeChoice International (JSE code: HIL) is an online machine at making money, but liquidity is zero. Four trades this months and a spread of 1400c / 3540c. So just avoid.

- Oil under pressure, good for fishing companies and motorists. Sasol* (JSE code: SOL) has some hedges at around $47 and is looking good for a buy at around R360.

- Last week I commented was looking to pick up more Tongaat* (JSE code: TON) around R123.50 then then the drought update and stock has flown, now R133.

- I have updated most of the prices to be paid for my death till us part stocks here.

- Standard & Poors still rattling around pondering a downgrade for SA. Next release in June and then December by when they have to either downgrade us or remove the negative outlook.

- Choppies (JSE code: CHP) results tough as they try and take on the big guns on their back yard.

- Blue Label (JSE code: BLU) about to buy Cell C, I not impressed with buying the their operator in a tight market. Some saying they are next Capitec* (JSE code: CPI), can't see how or why.

- Foresight Solar Fund listing, looks interesting as a dividend / Sterling play.

- Upcoming events

We Get Mail

- Anon

- I hold a small penny stock I bought years ago and it is now down about 95%. What do I do now?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Metrofile* (JSE code: MFL) results were modest but the dividend was up 18% at 13c and core operations also increased 18%.

- You can now buy shares in the South African Reserve Bank! But should you?

- Sea Harvest (JSE code: SHG) will be listing later this month. I will apply for allocation.

- Tongaat* (JSE code: TON) is coming under some selling pressure down to around R123.50.

- Upcoming events

Is Buffett a value investor?

@JustOneLap @SimonPB Please also make mention of Buffett's 180 degree flip and new love affair with 'cheap' airlines

— Wes Hellyar (@WesHellyar) March 7, 2017

It is well known that Warren Buffett learnt investing from the father of value investing - Benjamin Graham and many still consider Buffett to be the worlds greatest value investor. But while he may be the worlds greatest investor he is not a value investor having abandoned that strategy way back. If anything he is 'growth at reasonable price' investor. The book Common Stocks and Uncommon Profits by Phil Fisher really explains his current investing methodology.

We Get Mail

- Glen

- I am wondering which one of these 2 would be best: ABSA Newfunds TRACI 3-M or SBK tax free call account?

- LH

- But what do you do when your ETF of choice halves in value?!

- Boitumelo

- Basically I want to know if switching is worth the tax free incentive.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- New tax year and I have already loaded another R33k into my tax-free account and will be buying as per our high risk model portfolio.

- The annual Buffett letter was published last weekend. Always good reading, I especially like his comments on buying assets with shares (and hence paying a fortune). He also updates on his bet on the VOO vs. hedge funds (spoiler, VOO wining by a mile). The AGM will be webcast here on 6 May.

- We update the momentum portfolio stocks for 2017/8. Last years return was -5.2% after all costs and behind the benchmark so disappointing. I am NOT re-entering the portfolio this year for two reasons. Too much stuff and the ABSA NFEMOM ETF now uses my methodology and is more tax efficient.

- Upcoming events

Becoming a trader

The most frequent question Simon gets is about becoming a trader and his first answer is always the same, it will take time. Lots of time. In this weeks podcast he goes into details about the skills needed, capital, tools and more.

Some resource;

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Murray & Roberts (JSE code: MUR) mystery buyer is out, ATM Holding, Munich with now almost 25% stake in MUR. So now what, surely they don't want just 25%?

- Shoprite* (JSE code: SHP) merger is off and their results were excellent. I am a double happy shareholder.

- Adcock Ingram (JSE code: AIP) results show turn around happening but share price seems to be pricing this in already on PE of over 20x.

- Mediclinic (JSE code: MEI), Al Noor a less than rosy acquisition for the company. Why do these big deals always seem to go wrong?

- Upcoming events

Budget 2017 and your investments

Key highlights and how they'll impact various investments;

- Tax-free - annual limit increased to R33,000 a year. Effective 1 March 2017, NOT this tax year.

- Dividend Withholding Tax (DWT) up from 15% to 20%.

- Capital gains tax (CGT), company tax & VAT - no change.

- New top tax bracket at 45% for those earning over R1.5million.

- Sugar - still on the cards.

- Petrol - +39c.

- Relief will be provided in the threshold above which transfer duty is paid from R750 000 to R900 000.

- Social grants;

- The old age grant will increase R1600 for pensioners over the age of 60, and R1620 for those over 75. The disability and care grants increase to R1600. Foster care grants increase to R920.The child support grant increases R380.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- ZAR X and 4AX exchanges are coming. But do they have any listings we care about and are we able to trade them with our current brokers.

- Kumba Iron Ore (JSE code: KIO) very impressive and cost per tonne is well down from over $40 to $29, but no dividend.

- Brait* (JSE code: BAT) shows what a mess New Look as they slice R10billion of the NAV to R8.7billion, and the UK just released best unemployment rate in 11 years but wages under pressure.

- Rand heading for R13/US$, no surprises as it one of my predictions for 2017. Question is how much stronger and as important any strengthening will not be in a straight line.

- Full list of ETFs that can be used in a tax-free account.

- Upcoming events

* Simon holds ungeared positions.

Trading tax-free accounts

In last weeks JSE Power Hour on tax-free investing Simon mentioned trading a tax-free account. This got many excited thinking about derivatives and shares, but no. The restrictions for tax-free accounts remain but Simon has ways we can still trade without gearing and enhance returns (or losses).

We Get Mail

- Eric

- Honestly, it's never been easier or this cheap to bulletproof your Rand wealth through diversified products covering the globe.

- Janus

- Many people

- I want to buy an unlisted share, is it a good idea?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Now Sea Harvest coming to market mid March hot on the heels of Premier Fishing.

- Spar (JSE code: SPP) another weak retailer trading update, BuildIt very weak, local weak, Ireland alright but hurt but currency and Switzerland also poor.

- MTN (JSE code: MTN) reports they will have a headline loss for FY2016 after a 1204c HEPS in FY2015. Lots of reasons, mostly Nigeria.

- Two new Satrix ETFs coming. One property (capped at 10% per stock) and a government inflation-linked bond ETF.

- Understanding the DCCUSD ETF that tracks US Treasury Bonds.

- Upcoming events

Jean Pierre Verster Portfolio Manager - Fairtree Capital

Chatting market fears and opportunities specifically; Hudaco (JSE code: HDC), Naspers (JSE code: NPN), MTN and Invicta (JSE code: IVT).

We Get Mail

- Anton

- Do you know why I am paying double the share price to purchase a share at my broker? Is it brokerage fee?

- Hendrik

- At which point do we have to outsource the investment club to protect the alliance. Each member's share is now quite substantial.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- African Phoenix (JSE code: AXL) is back and trading around 55c after a trading update suggesting around 3c HEPS for the first half. With a potential for maybe 8c-10c HEPS for the FY17 that's a PE of around 5x.

- Local markets gained 4.8% in January, this time last year after a horrid January everybody was saying 'as goes January so goes the year". Well they was wrong and what January does is only what January does, not the rest of the year.

- Upcoming events

Investment clubs

A few requests on investment clubs; how to set them up, manage them, regulations etc. So here's my views, ideas and suggestion for getting your own investment club off the ground.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Abils back

Simon Shares

- African Bank (Abil) returns to the JSE on Wednesday as African Phoenix Investments (JSE code: AXL). I never expected that, a busted bank survives, albeit this is not the banking assets, just insurance.

- Top40 index at highs for the year, ya I know it early days and as Stuart reminded me on Twitter the Springboks are also unbeaten for the year.

- Huge trading update from Kumba Iron Ore (JSE code: KIO) as iron prices were markedly higher.

- Too much stuff, sell everything. Wow a huge response and all positive except for two people who said I would miss the garden and everybody wants my books. Also a lot of requests that I keep people in the loop as to process etc. No comments on my potential portfolio restructuring.

- Up coming events;

- Four events loaded, find them here.

We Get Mail

- Lucky

- Hi Simon, want to start TFSA acc ,is there a way to add RSA Retail bonds into the TFSA?

- Michael

- Would you recommend setting up a tax-free savings account through FNB?

- Charmaine

- Tax saving in ABSA momentum ETF (NFEMOM) what does this mean.

- Hoosain

- I just want to get your take on buying shares that are already in your unit trusts or ETFs. Do you think its advisable to buy the same shares that are in those products?

- Franz

- What is the procedure for opening an offshore account?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Too much stuff, sell it all

Simon Shares

- Local retail sales updates thus far are poor. Standouts; Mr Price (JSE code: MRP) still getting their lunch handed to them, Shoprite* (JSE code: SHP) is a retail monster with rest of Africa booming.

Too much stuff

I'm calling it life style creep when you wake up one morning and my large house is no longer big enough. We're surely doing it wrong? So my lovely wife an I are pushing back, down scaling into a small apartment and getting rid of 95% of our stuff. Pretty much everything except essential furniture, share portfolio (some portfolios are potentially under the hammer) and art. We simple have too much stuff and a simpler life with less stuff is in order. Bigger picture is to become a digital nomad living in AirBNB apartments; watching whales from Stillbaai in August / September and so on. But it starts with less stuff.

The 2017 predictions show

Every year the first JSE Direct of the year is our annual predictions show. Marc Ashton, GM at Moneyweb, Keith McLachlan, Small/Midcap fund manager at Alpha Wealth and Just One Lap founder Simon Brown review their predictions from the previous year and make their top three predictions for 2017. They then also make a call on the Top40 and ZAR/US$ for the year.

You can find the 2016 edition here.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Position your portfolio for 2017 with Simon Brown

Every year we conclude the JSE Power Hour series with a presentation by Just One Lap founder, Simon Brown. He gives his insights for the year ahead and how to position your portfolio accordingly.

Last year the presentation was just days before then Minister Nene was fired and this year’s event will be just days after the Standard and Poor’s announcement regarding South Africa’s credit status.

Simon will review his predictions from last year and look at what the year ahead holds and how we can best position our investment portfolio.

Issues that to be covered will include;

- Junk status

- The Rand

- Interest rates

- Offshore investments

- Impact of the looming Brexit

- Our local economy and its growth potential

- A selection of preferred stocks for the year ahead including for your ETF portfolio

- The PDF of the presentation is here.

Reviewing my portfolio for 2016

Simon Shares

Standard & Poor's left offshore debt as is (one notch above junk) and dropped the ZAR debt to two notches above junk and on a negative outlook. Standard & Poor's have to decide on junk or not by end 2017 or change the negative outlook to stable, so another anxious 2017 awaits us.

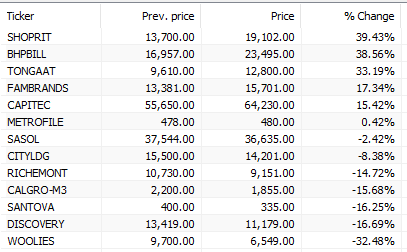

Reviewing Simon's portfolio for 2016

Some great returns, some middling and one very nasty. Portfolio is published here and returns (ex dividends for the 12 months to close 3 December 2016) as below.

We Get Mail

- @luckysibiya74

- Hi Simon, do you think it's a good idea to borrow money to buy shares and is there a type of loan that's purely for buying shares?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Metrofile* (JSE code: MFL) seller in market, use it to pick up some at great price / yield.

- Sygnia (JSE code: SYG) results see diluted HEPS at 54.16c (vs. 60.40 previous year) and dividend at 52c. I like the business but it is very expensive for a low margin operation without performance fees.

- Moody's not so moody. Fitch full of surprises and Standard and Poor's lurking.

- We got Marc Ashton, MD at Moneyweb, giving us his preferred ETF list.

- Up coming events;

- Trading Master Class: Tuesday 6th at 6.00pm - Lazy trading indices and FX.

- JSE Power Hour: Thursday 8th at 5.30pm - Position your portfolio for 2017.

We Get Mail

- Charles

- Would you pay for a guaranteed stop loss?

- Hermanus Trade

- In your video "A complete CFD share trading system" you stated that the system is based on the top 40 stocks, for the liquidity behind it. I was wondering, to what point would you consider a stock to be liquid enough to trade on a 15 or 30min chart (average daily volume)?

- Franz

- What is the procedure for opening an offshore account?

- Anon

- I bought Anglogold Ashanti 300 shares at R241.03 each now the shares price dropped with more than 35%. Should I sell them or hold on?

- Anon

- Current situation I find myself over a total of R176 438.67 in debt.

- Dominic

- What I don't understand is what drives the price on that index and how does it change 24/7? What am i buying and who buys what I sell. Also what indicators drive this price, type of events.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Are we Brazilian?

Simon Shares

- Metrofile* (JSE code: MFL) 1million shares on offer at 500c. Subtle?

- Dis-Chem (JSE code: DCP), like everybody else I did not get in the private placement and I am not looking to buy in the open market.

- Santova* (JSE code: SNV) getting hit. I hold and continue to hold, not buying any more as I have plenty. Twelve month low is 320c on 25 November 2015, looks like we could get back to that level soon enough.

- Woolies* (JSE code: WHL) saw massive volume on Tuesday, R1.3billion which is 2x - 3x normal value traded.

- Tongaat* (JSE code: TON) up at R130, nice but I hadn't finished buy below R120. Not buying up at R130 at the moment, albeit target is likely R150-R180 over next 6-12 months. Let's see if we get some weakness.

- I been digging into Stor-Age Property (JSE code: SSS) as a possible investment. Thus far not excited by what I see.

- Up coming events;

- Trading Master Class: Tuesday 6th at 6.00pm - Lazy trading indices and FX.

- JSE Power Hour: Thursday 8th at 5.30pm - Position your portfolio for 2017

Are we the next Brazil?

Since their first junk downgrade in September 2015 the Brasil Sao Paulo Stock Exchange Index (IBOV) is up some 50% while the Brazilian Real has strengthened about 20% against the USD. Could we follow the same after a downgrade to junk?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Trump wins, now what?

- Trump wins, now what?

(Image from Business Insider)

Simon Shares

- Astoria (JSE code: ARA) backs down from its incentive scheme that could have seen up to 25% of new shares issued to directors.

- Shoprite (JSE code: SHP) = very good. Spar (JSE code: SPP) update = good. Massmart (JSE code: MSM) = poor. Truworths (JSE code: TRU) = horrid. Food doing alright, clothing really struggling.

- The downgrade and your ETF portfolio.

- Up coming events;

Now what?

Brexit, Trump. What's next?

Trump wins, pollsters and social media are amazed. But is it our fault? I tweeted

The problem with SM is that we follow our own echo chamber .. all sides are here in equal measure, yet we only follow the side we agree with

— Simon Brown (@SimonPB) November 9, 2016

We believe our own BS. I said way back in February that Trump could win, I wasn't predicting anything but rather understanding that our ability to see into the future is zero and as always we need resilient portfolios that withstand the surprises. If your portfolio is all gold because of the end of the world you're having a good day but a really bad decade. iI your portfolio is all US stocks because SA is toast you have a good run post the crisis, but now? We need a broad, robust thoughtful portfolio that can withstand downgrades, Brexits and Trump victories.

Uncertainty is the only certainty. Recession in the US within a year? No idea. USD weaker, who really knows? Republicans are good for stock markets say the pundits, what of Clinton 1994-2001 and Obama 2008-present? Don't fall into the stereo types.

Bottom line. Don't panic. Predictions about the immediate future are like predicting election results.

Are we seeing a swing globally to the right, what you think politically about that doesn't matter, what matters is how this impacts the global economy and it will be about barriers. Barriers to free trade, barriers to immigration, barriers to the flow of money, ideas and ultimately capitalism. No capitalism is not dead but we may need to rethink our broad investment ideas. There's no rush, if this is a swing to the right it's playing out over the next couple of decades.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

I hate my life, teach me to trade

Simon Shares

- Dis-Chem, I will likely apply and stag them on listing.

- Whitey Basson quitting as Shoprite (JSE code: SHP) CEO at end of year.

- Buying Tongaat (JSE code: TON).

- Finance minister Gordhan charges dropped, good for junk threat?

- Trading Master Class - Trend lines video is online.

- Up coming events;

- JSE Power Hour: Thursday 3rd at 5.30pm - offshore investing. The how.

- JSE Power Hour: Thursday 10th at 5.30pm - TraderPetri on becoming a better trader

We Get Mail

- All

- I have xxx of debt. I hate my job. I hate my life. Please teach me how to trade?

- All

- How many years experience one must acquire to be profitable in trading?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

A letter for when you're dead

Simon Shares

- Still on holiday.

- Up coming events;

- IG Trading Master Class: Tuesday at 6pm - Trend lines, break outs and Turtle trading.

- JSE Power Hour: Thursday at 5.30pm - Offshore investing. The how.

A letter for when you're dead

When we die hopefully we have a will that'll deal with our estate. But if we've been the one managing investments what happens to them? Sure they go to your heirs, but do they know what to do with them, the strategy and plans? We ned to write a letter to those surviving us explaining it all.

Does you partner / family have a full understanding of how you've put together your investments and finances?

- What do you own and with who?

- What's the strategy?

- Keep each strategy in a separate account.

- Who can manage your investment portfolio now that you're dead?

- What to watch out for.

- How to change / adapt the strategy. Who to appoint to manage this.

- Where is the emergency fund and how is it accessed?

- Your speculative / derivative positions need to be closed ASAP as your estate could take ages to finalise.

- What policies do you have in your name and in other names?

- Where did you hide the Kruger millions?

- Not money related but; passwords, subscriptions, social media etc.?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Pick n Pay (JSE code: PIK) results. Everybody loves them but I am not wowed. Operating margin of 1.5% up from 1.3% is tiny. By comparison Shoprite (JSE code: SHP) is 5.6% and Spar (JSE code: SPP) is 2.8%. Like for like constant currency turnover grew 3.8% against selling price inflation of 5.5%, so still losing market share?

- New offshore ETFs from CoreShares. A S&P500 tracker and a Global Property fund. I have applied for the later.

- Up coming events;

Keith McLachlan fund manager at Alpha Wealth

Chatting Calgro M3 results, memorial parks, new CEO and their residential Reit. We also touch on the Dischem listing and Cell C results that we got a first look at due to the Blue Label 45% stake in the business.

123

Download the audio file here or subscribe to our feed here or sign up for email alerts as a new show goes live or subscribe in iTunes.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Hello junk

Simon Shares

- Fees feedback. Seems some active managers are getting serious about fees. But still not 100% in favour of client who pays the fees and some have done odd things. But nobody came back and said my ideas of last week were truly horrid, nor eve slightly horrid.

- Just last week I was commenting that my odds of a downgrade to junk were retreating. Still above 50%, but only just. Then Gordhan arrest and odds increase again, I think chance of a downgrade to junk is now around 61%.

- Important dates;

- 26 October - Mid Term Budget Policy Statement (MTBPS)

- 2 November - Gordhan to appear in court on fraud charges

- 24 November MPC rate decision

- 2 December - SP announce SA credit rating

- 6 December - GDP for Q3 2016

- Calgro M3 (JSE code: CGR) disappointed, I am not selling but waiting for results to see details.

- Taste Holdings (JSE code: TAS) results have lots of moving parts, but they're burning cash at a rapid rate and need to get profitable otherwise they run out. Potentially a good business, but first we need to see the profits kicking I and food (even at core level) needs to start turning real profits wit the new brands.

- Up coming events;

- Trading Master Class, mastering binary options with a follow up webcast on Tuesday at 4pm.

Brexit

- Time line, late 2018 / early 2019

- Sterling? Weaker for longer?

- Trade, surely they will get good tarde deals with major partners?

- Movement of people, this is going to be a problem?

- City of London, does it move elsewhere? But where? Europe has language barriers so New York?

- Economy? Surely weak for a while? Longer term = probably do fine, no shooting the lights out.

- Bottom line is that free movement of people and goods is good for capitalism. The UK is moving away from free movement, that's not good.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Still hating active fees

Simon Shares

- With SABMiller exiting the JSE new weightings in the indices with Naspers (JSE code: NPN) now 19% in the Top40 and 31% in the Indi25.

- Rating downgrade to junk, still on the cards?

- Deutsche Bank and the deal on their ETFs and ETNs.

- Live followup reversal patterns video is online.

- Two events next week;

Still hating active fees

- Is the benchmark being used a total return index (TRI) that includes dividends? If not the active manager wins because they get dividends that immediately put them ahead of the benchmark by a few percent.

- Are performance fees paid back when the fund manager under performs? If not the manager and clients are not aligned as performance is paid when they do well but not returned when they do poorly.

We Get Mail

- George

- I have a CFD acc on the JSE, it has buy and sell options, but I want to short shares when they go down, must I buy it and then sell or do I sell something and later buy it back.

- Myron

- Difference between book and intrinsic value?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Thursday 29 September is the last day for SABMiller (JSE code: SAB). Shareholders approved the take over and it will be suspended and delisted from close on 29th. It has been listed on the JSE since 1897 Index changes; IMP into Top40, AVI into Indi25 & FFA/B into Findi.

- There is a chart floating around of Lehman Brothers just before they hit the wall and one of Deutsche Bank over laid on each other. Nice to look at but in no way telling us anything worth being told.

- Deutsche Bank is the largest German bank, fourth largest European bank, and 11th largest bank in the world with assets of over $1.9 trillion – equal to half the size of the German economy. (source Sparkfin.com)

- Remgro (JSE code: REM) is doing another rights issue at R192.50, a decent discount to the current price of some R240. That said the book value of Remgro in the most recent results was R153.17 (intrinsic value was R306.44).

- MTN, more woes in Nigerian. I remain a happy ex-shareholder.

- What happens to bonds and bond ETFs if we get downgraded?

Can we trust Capitec?

Capitec (JSE code: CPI) results were decent enough albeit Keith McLachlan pointed out on Twitter "Quick calc: If Capitec had kept Arrears Coverage Ratio flat at 239% (not dropping it to 229%), Basic Earnings would've been R1504m =only +2%"

Capitec defines Arrears Coverage Ratio as "The provision/arrears coverage ratio expresses the provision for doubtful debts as a percentage of the loans in arrears. The ratio is therefore affected by the arrears performance of the month in which it is measured, while the impairment model is used to determine the provision for doubtful debts over the loan period. The ratio should therefore not be considered in isolation."

We Get Mail

- Samuel

- If you own CSEW40 do you get invited to the different companies AGM? Who makes decisions for all the investors shares?

- Alec

- Points out the very marked difference between saving and investing.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Reviewing small cap results with Keith McLachlan

Simon Shares

- Wells Fargo is the sort of stock that if I owned it, I would sell it as management totally failed and refuse to accept any blame.

- There is a theory that equal weight ETFs have higher costs because they have to rebalance every stock every quarter. But checking the STXIND over the last four quarters. Twice every stock changed weight and twice only two stocks did not change weightings.

- Harmony (JSE code: HAR) buys the half of the Hidden Valley mine in Papua New Guinea for US$1!

- PPC (JSE code: PPC) rights offer was 92% taken up but with excess allocation requests of another 509%. Some serious big hitters thinking this a great deal.

- Sasfin (JSE code: SFN) nonperforming loans more than doubled. They operate in the small-and medium-sized enterprises so it is a telling number. The economy is seriously struggling and while I have seen some economists upgrading GDP expectations for 2016, none have us at above 1% for the year. So better but not close enough to good.

- Moody's says a one third chance of a downgrade but what really matters is Fitch and Standard and Poors as they have us just above junk status. Things are looking a bit better but I still think we're on track for a downgrade to junk.

- Proptrax SAPY ETF from CoreShares.

- Trading Master Class, reversal patterns video is online. Follow up webcast (live on the IG platform) is 5th October 1pm (book here).

Keith McLachlan small / mid cap fund manager at Alpha Wealth

Tough conditions for SA inc. but we've seen some great results from small and mid cap listed companies. Simon chats to Keith about recent results from;

- Afrocentric (JSE code: ACT)

- Rolfes (JSE code: RLF)

- Acendis Health (JSE code: ACS)

- Master Drilling (JSE code: MDI)

We Get Mail

- Sarel

- SAB Options. Any strong opinions regarding these two options?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Reviewing results

Simon Shares

- Feedback on making sense of SENS

- AVI (JSE code: AVI) results show good numbers in a tough market. People tend to look to Pioneer (JSE code: PFG) or TigerBrands (JSE code: TBS) but this is the real gem in the space with a dividend yield of 4%.

- Holdsport (JSE code: HSP) trading update shows increased comparable sales growth, but after inflation they're going backwards. I never been a fan of this business albeit the share is up some 100% in the last five years, around 15% a year which is nice, but average? But then add a chunky dividend that currently yields 5%, can they hold the dividend or even increase it? I suspect they can but I still not interested.

- Clover (JSE code: CLR) were good considering the tough times with drought yet they had an over supply of milk? I used to own this stock but they weren't growing and expanding as I had expected so I exited.

- Sasol (JSE code: SOL) results came in as expected albeit with help from translations gains (FX moving in their favour) and a tax issue in Nigeria together adding almost R2.7billion. Point is they make a profit even at the low point of the cycle, that's impressive. Lake Charles remains their massive deal. I continue to hold Sasol and below R400 it is cheap but I am not buying more until Lake Charles is completed and we see if starting to make money rather than cost money.

- Richemont (JSE code: CFR) update is ugly, sales down across the board with operating profit for the six months ending September expected to be down 45%! Some of this is restructuring but sales are weak. I hold the stock and continue to hold but it not fun right now. Adding to this is the SENS on the AGM voting, no real disclosure just "all other matters on the agenda were also approved by the shareholders by an overwhelming majority.". Not good enough.

- Burger King, owned by Grand Parade (JSE code: GPL) saw average monthly sales per store decline 20% to R800k / month. That is a massive drop. They also have the brand rights to Dunkin' Donuts and Baskin-Robbins, neither of which excites me. The leader in this space remains Famous brands and that's the one I own.

- Last week Wealth Creation 101 video is online. Go watch it.

- Next Tuesday, 20th, we have our third Trading Master Class with IG focusing on reversal patterns.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Local GDP came in better then expected and importantly positive, so no technical recession. Manufacturing and mining were the strong sectors but we need a lot more very strong quarters to get out of the bad spot we find ourselves in and a down grade is still very much on the cards in December.

- Discovery (JSE code: DSY) has so many moving parts but for me the key is Vitality is now in 14 markets around the world. I remain a happy shareholder albeit they've done very little over the last year or so.

- We have a lot of shopping malls in South Africa, b some reports more per capita than any other country. Hyprop (JSE code: HYP) is by far the best of the bunch with regard local malls as they own high traffic top end malls.

- Mr Price (JSE code: MRP) seems to have lost the mantle. They have now had three reporting seasons over the last year and all disappointed. Is it just bad buying and the weather? I suspect they're seriously struggling under the weight on new competition from the likes of H&M and Cotton On. This is a biggie and if I was a shareholder I would be looking to exit.

- Capitec (JSE code: CPI) trading update sees HEPS 17%-20% higher. Wth a historic PE of almost 22x a little light but well ahead of consensus that was looking for single digit growth.

- Does volatility give you indigestion? Kristia reviews the CoreShares LowVoltrax ETF with expert commentary from Warren Ingram.

- Tonight, going back to basics with wealth creation 101 at the JSE.

- The Fat Wallet Show did the follow up about buying a house vs. renting.

Stock Exchange News Service (SENS)

Some listed companies seem to use it as marketing (witness the Sibanye proudly announcing their inclusion into the Top40 later this month and CarTrack announcing 550k subscribers) while other publish the bare bones (Comiar and Master Drilling just giving numbers in previous years). Others like Steinhoff seem to have moved onto Europe forgotten about us and just push links through SENS.

I would also like to see a standard applied by the JSE. For example all results have to have the top four points (HEPS, Dividend, revenue & debt) right up front so you can't hide.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.