Simon Shares

- Revego* (JSE code: RVG) was supposed to list today but has delayed their listing. I applied for allocation as I like the business model of renewable energy with guaranteed inflation-linked off-take agreements. They invest into operational renewable asset and are targeting a 8%-10% dividend yield, based off the 1000c listing price.

Upcoming events;

JSE protections

With the Revego listing delayed the money I put into the book build last Thursday has not been seen since. The company was supposed to issue a SENS on Monday and list on Thursday, but we heard nothing until Thursday morning. It has been delayed by a few days.

What struck me was that I was not worried about the chunk of money that I had put into the book build and which I have not see or heard from in a week now. The reason for my lack of concern is the protections the JSE exchange offers.

- Extra regulation around the companies act.

- Stockbroker regulations.

- Investor fund.

- FSP insurance.

This of course does not stop crookery from executive teams nor does it stop businesses from going bust.

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- South African inflation was 3.2% in March 2021.

- Pick n Pay (JSE code: PIK) results show it was all liquor and tobacco that was the pain as it was off 31%.

- Karooooo (JSE code: KRO) has returned after exiting as Cartrack. The market seemed confused as it opened at 6500c, it is now trading R480. Still well off the adjusted highs f over R900 as everybody got all excited about the Nasdaq listing.

- Long4Life (JSE code: L4L) hints at possible unbundling as it looks to unlock shareholder value. I'm confused, they were just consolidating by buying up businesses? I held them but sold early in the pandemic as they were so small in my portfolio and weren't doing much with their cash.

- Absa (JSE code: ABG) loses their CEO.

- Cell C reports R5.5billion full-year loss. Horror story and I never understood what Blue Label (JSE code: BLU) saw in the business.

- PSG results without Capitec* (JSE code: CPI) and they're buying back their preference shares.

Upcoming events;

- 22 April ~ Introducing the CoreShares Total World ETF

- 06 March ~ JSE Power Hour: Finding income in JSE listings

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ Coinbase lists

/ China Q1 GDP 18.3%

/ Reports Jack Ma will divest from Ant Group

/ Gold looking strong, but miners lagging (Rand strength?)

/ Just more than half of U.S. adults have gotten at least one COVID-19 vaccine dose ~ CDC

Local

/ Rand strength

/ Karoooo lists on Wednesday

/ Capitec results

/ EOH looking better

/ Sasol goes green

/ Local CPI later this week

Simon Shares

- New Global ESG ETF from Sygnia.

- Anglo American (JSE code: AGL) to list their coal assets, Thungela Resources.

- Comair has finally been delisting from the JSE and shareholders will receive 4.26c per share.

Upcoming events;

- 15 April ~ Everything ETFs and tax-free investing

Capitec and Purple Group (EasyEquities) results

Two stocks that I own; Purple Group* (JSE code: PPE) and Capitec* (JSE code: CPI). Both with really good results and I'll go into the numbers in detail.

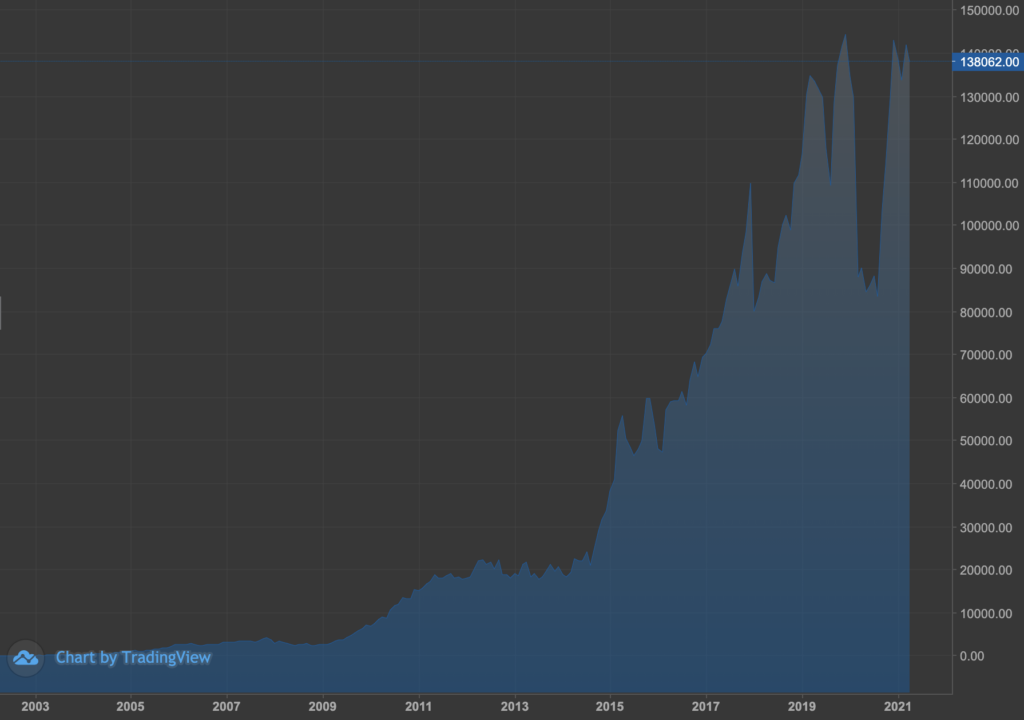

Capitec monthly chart since listing

Capitec monthly chart since listing

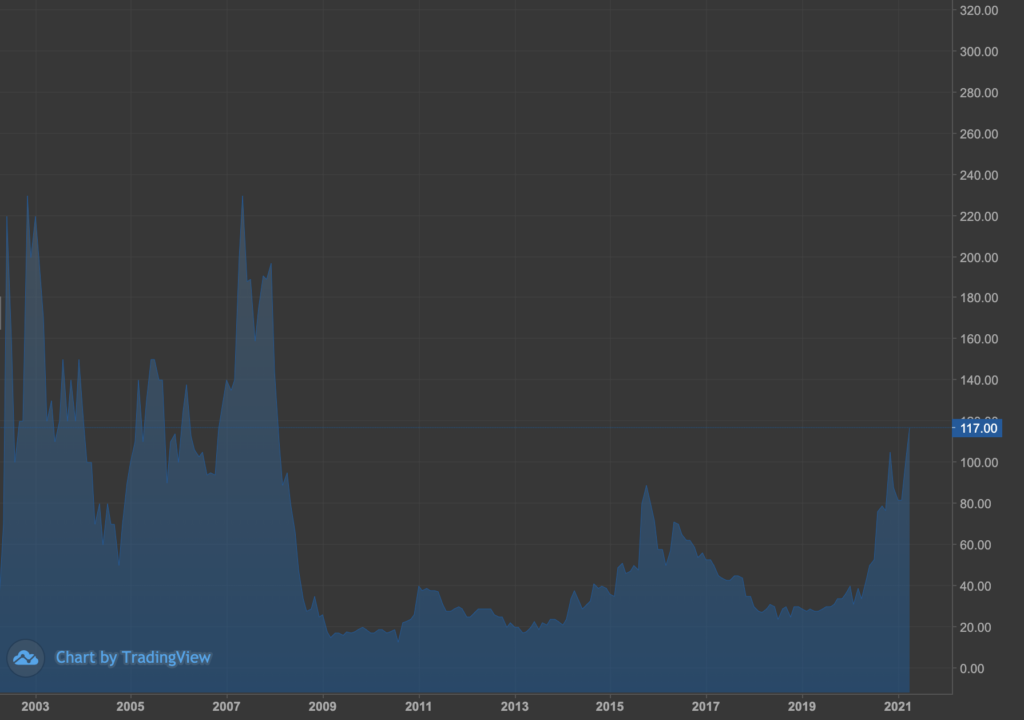

Purple Group monthly chart since listing

Purple Group monthly chart since listing

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Offshore

/ New highs for S&P500 & Nasdaq

/ Yellen wants global minimum corporate tax rate

/ Semi conducter chip shortage continues to hurt production

/ China slaps Alibaba with $2.8 billion fine in anti-monopoly probe

/ Goolge pushes back on WFT, wants staff back in the office from September

Local

/ Prosus sells another 2% of Tencent

/ Purple results

/ IMF says local GDP 3.1% in 2021 and 2% in 2022

/ Anglo exits SA coal by setting up a new JSE-listed miner

/ 650c Cash offer for AdaptIT

/ Pick n Pay update

Simon Shares

- Prosus (JSE code: PRX) selling another 2% of Tencent.

- Purple* (JSE code PPE) trading update for six months ending February. HEPS of about 0.85c. They did 1.54c HEPS for full-year ending August after a loss in the first half last year. So this period showing slower growth.

- Growthpoint (JSE code: GRT) announced that their healthcare fund tops R3.2bn with Cintocare Hospital acquisition.

- The JSE is investigating PPC (JSE code: PPC) trades amid insider trading suspicions as the share moved ahead of the announcement last week.

- The IMF now says SA’s economy will grow faster at 3.1% in 2021 and 2% in 2022, but it will take over two years to recover from the 7% collapse we saw last year.

- Janet Yellen wants all countries to have a minimum corporate tax rate.

Upcoming events;

- 15 April ~ Everything ETFs and tax-free investing

Selling to early

This is a problem for both traders and investors.

Part of the problem is the thrill of a winner, we've made money and we want to lock in that profit so the thrill doesn't go away, and we sell - but we sell way early.

The bigger issue is what are you trying to achieve?

- As always know your strategy and know why you entered a position.

- Be real about taking profits, that is why we're in the market.

- But balance that with giving winners space to win even more.

Analysis of previous winners you exited early. Why did you do exit and what could you have done to stay in longer? What about some you exited at the right profit point?

JSE – The JSE is a registered trademark of the JSE Limited.

JSE Direct is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.