Hedge funds for everybody

Simon Shares

- MTN have concluded the Nigerian fine at around a third of the initially proposed fine. A good deal for the company but they should never have found themsleves in the position in the first place an I still do not like management and am not a buyer.

- Pick n Pay (JSE code: PIK) are finally getting rid of their 35-year pyramid structure that key control of the company in the Ackerman hands even though they only held c26% of the shares. But they are retaining control via special unlisted B shares, so nothing changes and the company remains under the control of a family who frankly have conceded the title of retail to Shoprite (JSE code: SHP).

- Brexit fears are running wild, ignore it. It's just short term noise. Big picture it matters not one way or the other, it just hysteria right now that will reach deafening levels by the time they vote next Thursday.

Jean Pierre Verster portfolio manager Fairtree Capital

The hedge fund industry in South Africa is leading the global trend and changing to make itself open to private investors with regulation for the funds themselves. Jean Pierre explains what the attraction of a hedge fund is and what the new regulations are all about. He also warn that like any other fund some may blow up.

We Get Mail

- Robert

- When I buy ETFs, how do i find out whether it pays out quarterly dividends or re invests them?

- Jonathan

- Shares not in your name, rather on Easyequities books? Thoughts?

Simon Shares

- New logo for JSE Direct to bring it inline with the new Just One Lap branding.

- S&P is negative but not junk, Fitch says we stable, GDP says we half way to a recession.

- GIVISA, the cheapest ETF on the JSE. But is it any good? Kristia goes on a nerdy bender digging into the details.

- Keith McLachlan on building a small cap portfolio.

- The Just One Lap team is starting to do more Periscope videos; follow us all at;

Zack Bezuidenhout S&P Dow Jones Indices

We chat indices, costs, new developments and smart beta. Zack also has a great analogy about the financial services fee structure and the medical industry that really highlights the wrongs in the financial services industry.

We Get Mail

- Lauren

- What about the Swix index for investing?

- Rudolph

- A question, are you still happy with your decision to sell all your BATS shares, after a 40% return the past year?

- Philip

- Regarding the debate of investing in the US or worldwide, why not invest in these 2 ETFs – namely, IXUS and ITO? I do not think you are going to find ETFs with lower fees, 0.03 and 0.14. The IXUS seeks to track the investment results of an index composed of large-, mid- and small- cap non-U.S. equities. The ITOT seeks to track the investment results of a broad-based index composed of U.S. equities.

Can DIY investing beat the market?

Simon Shares

- PPC in real trouble. Management have let the company down by not spending up capex locally, not hedging their USD debt and now they need a massive rights issue. Will they survive?

- Are local markets pricing in a downgrade? Nobody knows either what Standard & Poors will say or what the market is or is not pricing in.

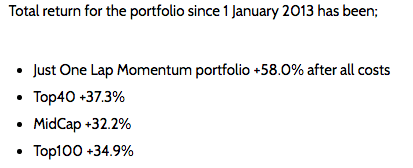

We have a new podcast going live every week, The Fat Wallet Show. In it Just One Lap CEO Kristia van Heerden, picks a topic and asks questions until she gets an answer. She kicked off with structured products. - Momentum portfolio update for the quarter ending May 2016 is here, life time returns below.

We Get Mail

- Daniel

- Now if research shows that the percentage of fund managers that outperform the index over a 1, 3, 5+ year period get smaller and smaller then, what chance do we as retail investors have of: A) outperforming a fund manager (with CFA's, CA's, research teams) when stock picking; and B) outperforming the index?

- Esther

- Please give details on tax and the trader.

- Kenny

- I have a discretionary share portfolio in which I occasionally sell a share after keeping it for less than 3 years. I never withdraw money out of my account, but will keep it in cash and wait for a buying opportunity. Will I be held liable for income tax or does income tax only apply when an investor withdraw money out of his share account?

- Higgo (via twitter)

- Would you rather sell Discovery (JSE code: DSY) and buy British American Tobacco (JSE code: BTI) or Investec (JSE code: INP/INL)?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

A simple diverse ETF portfolio

Simon Shares

- Balwin (JSE code: BWN) knocked their results out of the park, but my bigger picture concerns remain.

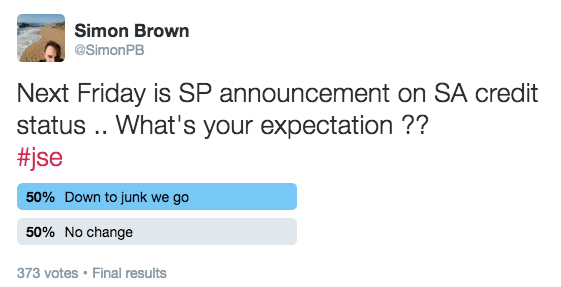

- Standard & Poors down grade or not is next Friday. I did a Twitter poll that came in split by 1 vote. So nobody knows.

- Complexity of costs. Come industry make it simple.

- Mining: Returning to the mean? Peter Major did an excellent JSE Power Hour for us, the video is here.

- On the ETF blog this week we look at the Pref shares ETF (JSE code: PREFTX).

- 2 June at 5.30pm,Keith McLachlan on building a small and mid cap portfolio the right way. Book here.

Nerina Visser, director at ETFsa.co.za

Which ETF if you buying for;

- R300 / month (CTOP50)

- R1000 / month (CTOP50, DBXWD & ASHINF)

- Large lump sum into a TFSA (CTOP50, DBXWD, ASHINF & PTXTEN)

We also chatted about costs, are we missing any ETFs as an industry and how to respond to the potential downgrade from Standard and Poors.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Doing risk right

A very long show this week (over an hour), but totally worth every second of listening.

Last week I reflected on the Sanlam i3 Summit I attend and his week I speak with Roland Rousseau (Head of Barclays Risk Strategy Group) on his presentation at the conference.

Roland is looking at this whole idea of asset or fund manager being outdated and suggesting we rather need risk managers. He has great insights and ideas and this wide ranging conversation on risk has got me thinking a lot more about a lot of things. Real learning, I love it.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

How do we get smarter?

Simon Shares

- Calgro M3 (JSE code: CGR) results were great. We're seeing operational leverage coming through and a lot of projects seem to have only added a modest amount in this year with more coming in the new financial year and the memorial parks look interesting. They did have some issues with Namibia, having to relaunch the retirement development and others. Back in December / January I exited some of my position but am happy to hold the balance.

- Pipcoin = pyramid scam

- What's happened to the PIIGS?

- So Moody's was all nice to us, sure but are we really avoiding the ultimate downgrade to junk? Standard & Poors still the one to watch with June their next update and likely the first to make us junk.

- On the ETF blog this week we look at the Momentum ETF (JSE code: NFEMOM) as well as find out about total return which involves dividends being automatically reinvested into the ETF.

- We're doing a webcast of the lazy trading system on the 12th at 8pm and an IG Boot Camp on Tuesday at 6pm. Book here.

Sanlam i3 2016 Summit

I attended this event last week and have a number of thought from the speakers, in particular Dr Amlan Roy who spoke on demographics (here's a short video interview with him).

My three key learnings;

- Differences more important than similarities (Eusebius McKaiser)

- Demographics most important thing we ignore (Dr Amlan Roy)

- Most of what we think is skill is actually well spent (Roland Rousseau)

We Get Mail

- Samuel

- Is there a way to position my portfolio to minimize risk when a downgrade of the country`s credit rating is on its way? I believe that the downgrade will happen in this year. Is there a way to gain on this?

- Everybody

- Where do I find an offshore broker?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Master class in investing

Simon Shares

- This week we look at a bond ETF, ASHINF.

- We're doing a webcast of the lazy trading system on the 12th at 8pm.

Hlelo Giyose – First Avenue Investment Management

Hlelo talks stocks but the conversation goes into much more than just some of his current preferred stocks. He delves into what makes great companies, how to spot them and when to buy them. A master class in investing.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Where to invest offshore?

Simon Shares

- Pick n Pay (JSE code: PIK) results show the turn around is very much working albeit the stock remains very expensive. But the margins are still way to slim at 2% and less than half that of Shoprite (JSE code: SHP). This has to be the focus going forward if they have any hope of justifying the stretched valuation.

- MTN is getting money out of Iran, reportedly USD1billion and this certainly helps with the Nigerian fine, but once again this comes from third party sources not from the company via SENS.

- Steinhoff (JSE code: SNH) said it won’t raise its offer for French retailer Darty and this is a good thing because in a bidding war the only winner is the seller.

- Berkshire Hathaway is webcasting their AGM this weekend, this Saturday 30th April 2016 at 4pm. you can view it here.

- Kristia van Heerden looks back at a year of erratic ETF buying in our weekly ETF blog.

- We're doing a webcast of the lazy trading system on the 12th at 8pm.

Wehmeyer Ferreira from DB X-Trackers

Where to invest offshore? US, EU, UK or Japan? What of China or maybe just the world?

We've recently covered two of the more popular ETFs from Deutsche Bank; DBXWD and DBXUS.

We Get Mail

- Samuel

- Should a home loan be considered as debt?

- Tshepo

- What is best index to use for a benchmark?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

An investment check list

Simon Shares

- Everybody is freaking out on the Capital&Counties (JSE code: CCO) sell off, some 50% off the highs of January. Really driven by three things; it had been flying, stronger ZAR against Sterling and concerns about Brexit. Long term not an issue, so if you love the stock nows your chance to get more cheaper.

- Kristia van Heerden (Just One Lap CEO) tweeted some thoughts from last weeks podcast where I spoke about expectations. Her comment was that managing expectations doesn't start with investing. It's also about debt, hating on your job. These need fixing long before investing and certainly no investment will make your job better or the debt suddenly disappear.

If you expect your investments to save you from your shitty job or debt or pay for things you can't afford, you're in for disappointment.

— Kristia van Heerden (@kristiavh) April 18, 2016

- Our ETF this week is DBXUS and it has staggering returns of 223% over five years.

- New videos galore;

- Added a bunch of new events, find them here.

Gary Booysen Portfolio Manager Rand Swiss

Gary did a great presentation for the JSE Power Hour last week (find it here). In it he looked at current market conditions, volatility and how to manage a share portfolio in these conditions. In this chat Simon also focuses one of his stock picks (AdaptIT, JSE code: ADI) and his check list. The check list (below) is a simple first filter to find quality stocks worth investigating further. The full video is here.

The check list;

- 3 year total return +20%

- Increasing revenue over 5 years

- Increasing earnings over 5 years

- Increasing dividends

- Increasing gross margin

- Increasing ROE

- Outstanding shares stable or decreasing

- PE, P/B, P/S, PEG, FPE in range

- Current ratio, LT-Debt/Equity

- Management quality

We Get Mail

- Ros

- Once I've put my annual R30,000 into my TFSA, and I've also reached my tax-deductible limit in terms of my RA contribution, would it still be better to invest within the RA for the tax advantages it provides on withdrawal? Or should I just buy ETFs directly?

- Brenda

- My daughter is now in Grade 10. Over the years I have been saving in unit trusts for her university fees. I stopped the monthly debit orders at the beginning of the year when I realised that the performance did not justify the fees. I now have almost R500k in two unit trust. On the one hand I do want some capital protection but also want growth with some income so that she can have funds for a car, deposit for a flat etc. I know that I can do better investing in the market. Should I :

- Liquidate the unit trust and open a trading account in her name?

- Start with about five shares - I am considering Coronation, Old Mutual, Steinhoff, Discovery and Mediclinic.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Realistic expectations and success

Simon Shares

- The rand is back where it was when then Finance Minster Nene was fired. So everybody who was lamenting that they missed their chance to get money offshore into USD, here's your second chance.

- The NewFunds ILBI (JSE code: NFILBI) is our focus ETF this week. Tracking inflation linked bonds it sounds perfectly boring but actually looks really interesting for a broad ETF portfolio.

- Expectations. What are your expectations from your trading and/or investing? Are they reasonable? Are they hurting your ability to create wealth?

We Get Mail

- Terrance

- I also hold Astoria (JSE code: ARA), I bought @ R15.14- 10% of portfolio already down 6.8% but so also is the rand/dollar, I was wondering on your thoughts regarding its value and comments by Keith Mclachlan as there seems quite a bit of negativity surrounding its value and costs. I bought it for the long term 5-10 years and the purpose 2 fold to invest in other markets and rand hedge. Is this all just hear say and noise?

- Everybody

- What about putting your emergency cash into your bond?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Hating on unit trusts

Simon Shares

- SPIVA results for South Africa are out and they track how many active managers fail to beat the index. Truth is that even over 1 year most do NOT beat the index. In short, buy passive or lose money? The PDF of the report is here.

- Standard & Poors has downgraded SA's expected GDP for 2016 from 1.6% to 0.8% further cementing the likelihood of a downgrade to junk from the rating agency.

- African Bank has relaunched, but this is not the one you have shares in. The suspended ABIL sold off good assets and is left with a giant pile of debt and those left holding ABIL when it was suspended in August 2014 hold worthless shares.

- The Satrix Resi (JSE code: STXRES) is our focus ETF this week.

- We published our bubble graphic of Top40 individual stock returns for Q1 2016.

Helena Conradie CEO Satrix

Satrix is best known for their Exchange Traded Funds (ETFs) but have in recent years also moved into index tracking unit trusts. The question is why and if unit trusts are still the evil rip off they were back in the day? It is still a case of watch the fees and know what's inside?

We Get Mail

- clintvanhere via Twitter

- If you withdraw from TFSA, what are the effects on your annual & lifetime limits?

- Ryno

- Can I trade your lazy system in a tax free savings account ? http://justonelap.com/lazy-trading-system/

- Fathima

- After attending your seminar for beginners, I invested in ETFs. However yesterday, I watched your video explaining the benefits of TFSA and I need to know if I made a mistake opening an non TFSA account? Should I close that account and open a TFSA, or keep both? I don't want to incur extra costs.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Capitec (JSE code; CPI) results were solid but bad debts are rising. So is their profits but the bad debts are what we're watching at this point in the process.

- Momentum portfolio doing as it says on the sticker. Good out performance on down days, modest or under performance on up days. But the gold volatility remains wild.

- ZAR X, the first new stock exchange in South Africa in over a century arrives in September.

- We review the Swix40 ETF for those wanting an alternative Top40.

Jean Pierre Verster 36One Asset Management

We last spoke to Jean Pierre in January when all was looking ugly, now everything looks all lovely, but is it? And if this is the year that shorting is as important as going long, is this the testing year for DIY investors? We also touch on inflation, commodities and the US economy.

We Get Mail

- Ryno

- I was reading about hedge funds and came across Ray Dalio. He adheres to the all weather portfolio. Basically he says that its all in asset allocation. -55% bonds -30% shares -7.5% gold -7.5% commodities.

- Marion

- I understand the idea behind an emergency cash fund. But where do I park it?

- Pieter

- I have been contemplating opening an offshore account, but have refrained because of our weak currency and my lack of knowledge about international trading. My question is if it is the right time to take money off shore/open an account? Also which ETF's should one be looking at?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

When to sell?

Simon Shares

- Yesterday, 23rd March, Just One lap turned five. It's been an awesome ride which we couldn't have down without the support of our users. So you everybody, thanks. A huge thank you.

- When to sell? Different answer depending if you are trading or investing.

- Great video from Anthony Clark on his top 5 small cap stocks for 2016.

- Divtrx ETF for those wanting dividends.

We Get Mail

- Tebogo

- I was wondering if it would be advisable to liquidate part of my portfolio held in ETF and use funds to buy ETFs in my TFSA and moving forward fill up my R30k allowance before buying equities in my investment portfolio.

- Patrick

- How often should I rebalance my portfolio?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Trading in your personal capacity or using a PTY or Trust? Which is better?

- ETF changes. The MidCap ETF is now ASHMID and BBET40 is transferring to Core Shares from Nedbank.

- Seriously good interview with Jack Bogle, founder of Vanguard, the issuer of the worlds first indexing mutual fund.

Keith McLachlan Alpha Wealth small/mid cap fund manager

AdvTech (JSE code: ADH) results were really good after years of frankly uninspiring results (Revenue +40%, operating profit+75% & HEPS +27%). Tertiary was especially strong, acquisitions doing very well they finally seem to have found their mojo.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Moody's did not downgrade us, but they did put us on review for a downgrade that will put us one notch above junk status. Then we'll have all three rating agencies on the same level with Standard & Poor heading the pack as we're on a negative outlook with them.

- Local bank results looking good with impairments improving (expect for Barclays Africa). On the surface they look cheap, but not if earnings weaken going forward, and earnings will weaken.

- Now Old Mutual (JSE code: OML) may split itself up and return back to South Africa. But will (can) it sell Nedbank (JSE code: NED)?

We Get Mail

- AntonK (via Twitter)

- Simon, why would you call it (AB Inbev, JSE code ANB) ex growth as the two brewers together have roughly 30% global market share?.

- CraigNotAlan (via Twitter)

- Investing lump sum in ETFs in these markets, local & int - immediate or phased over time (& period)?

- Arin

- The issue I have is that I don't have any pure property ETFs or unit trusts (except for the odd property companies within my ETFs/unit trusts). I am aware that the ProptraxTen is more of a income yielding portfolio which may be good for the TFSA, where as BBET40 may be more of a growth portfolio if I'm not mistaken.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Clover (JSE code: CLR) has "decided to withdraw from future investments in Nigeria", seems hasty?

- Barclays exiting Africa selling off their ABSA (JSE code: BGA) stake, more hasty decisions?

- Nice boring results from Metrofile (JSE code: MFL), exactly as wanted. Big seller seems to now be gone after large transactions on Monday and stock has run hard since.

- New tax year, you can add another R30k into your TFSA.

- The Momentum portfolio update, new stocks and methodology is online here.

Janine Weilbach Senior Research Analyst Thebe Stock Broking

Construction stocks have had a very hard time since the 2010 World Cup in South Africa. With this in mind, how does one look at a construction company in order to make investment decisions? order books seem to be popular but often misleading, large piles of cash seem great but suddenly disappear. We speak to an expert to better understand investing in local construction.

We Get Mail

- Matt C (via twitter)

- Can you, or someone in the know, please explain Dow Theory to us?

- Cardiprox (via Twitter)

- How about the opposite momentum. Taking the bottom 15 top 100 shares and shorting them for the same period?

- Johan

- I've started looking at the costs involved in opening an US trading account through my broker, and to a relatively new investor like me, all the costs involved in opening an account is quite difficult to understand. Would you mind maybe giving an overview of the costs involved please?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Woolies (JSE code: WHL) offering script of cash for dividend. Default is cash, I'm taking new shares.

- Standard Bank (JSE code: SBK) trading update looks great, HEPS some 30% higher. But what of the R1,6bn write down for lost aluminium in China the previous year? The stock initially popped 8% higher but traded red by late morning.

Budget 2016, Simon's thoughts

- Budget is R1.46tn vs R1.45tn in the October MTBPS.

- Deficit R139bn, which we have to borrow and that cost is increasing as R186 government bond is 9.8% from 9.3%.

- Budget deficit will fall from 3.2% in the 2016/2017 year to 2.4% in 2018/2019

- Capital Gains Tax (CGT) gets increased from 33.3% or marginal rate to 40% while the amount of tax free CGT every year goes from R30k to R40k.

- No change to Dividend Withholding Tax (DWT) or Securities Transfer Tax (STT).

- Lots of small tax increases and some new ones;

- Increased; fuel levy, bag levy, sin taxes, transfer duty on +R10m properties, etc.

- New; sugar tax, globe tax and tyre tax.

- Social grants on the up, R11.5bn over next three years.

- Fiscal drag coupled with increased inflation and interest rates going to hurt consumers.

- 150,000 TFSA accounts opened and R1bn deposited. But no changes to the limits.

- Was it enough taxing and enough slashing to avoid a downgrade later this year?

- Bottom line, can he stop the junk status looming over SA?

We Get Mail

- Marcia

- Are you selling your Woolies after the results?

- Stef

- I see the PLD and PLT ETFs have 'partial delisting'. What's this about? Should I worry if I hold them?

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Minister Gordhan delivers his budget speech next Wednesday, what can we expect in terms of new or higher taxes? STT, DWT and CGT?

- Remember, remember. The end of February is end of the tax year and you have until then to fill in your R30k limit for TFSA. If you already have hit your limit new year starts on 1 March 2016. We have recommended portfolio and my picks here.

- Anglo America (JSE code: AGL) announced their restructuring. The big, but not unsurprising was the exiting of Kumba Iron Ore (JSE code: KIO). But how? They could just unbundle to shareholders, or try sell it. Latter will not be easy and former would put serious pressure on the KIO share price if the almost 70% AGL holds hit the market.

- ARB Holdings (JSE code: ARB) remains ungeared with R190,9m net cash on hand. I first discovered this company in about 2008 when they had some R300m. They've been spending it very very cautiously, too cautiously?

- Discovery (JSE code: DSY) update has spooked the market. We've seen this before.

- Latest Boot Camp Video, trading the news flow is online and next month we're looking at FX and index trading and again we'll include some trading systems. You can book here.

Garth McKenzie TradersCorner.co.za

Ketef (via Twitter) asks "Simon from experience-have you made more money trading short term compared to longer term? Any correlation btn timeframe & profits?"

The answer is more than just about returns. It is about sleeping well at night, time required to manage the trades and experience in the market. There is no get rich quick here, but a well balanced portfolio of money split between trading and investing can boost returns while we learn and sleep well.

===

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Grindrod (JSE code: GND) just hit multi-year lows trading just above 900c with a net asset value (NAV) of over 2200c. Don't fight the trend, especially on cyclical stocks.

- RBA (JSE code: RBA) went bust on Tuesday. Of the three; RBA, Seakay and Calgro M3 (JSE code: CGR) only Calgro M3 remains. Lesson is simple. Go back five years, Calgro M3 was by far the best of the three, always buy the winners.

- Volatility, lots of it. Welcome to bear markets, they move fast and trading them is tough, very tough.

Eugene Chemaly - Afrifocus Securities

- Chris asks "how does one protect cash?".

- Preference shares are debt instruments issued by banks and others that pay set dividends linked to the prime rate.

- Typically trade at discount to their cash levels and have no market makers meaning capital loss is possible. In an ideal world they would offer no gain or loss, but reality is different.

- New Basel 3 rules may see preference shares phased out by the issuers (via repurchase) and there is a risk that the budget speech will see an increase in the dividend withholding tax rate (currently 15%).

- PREFTX is the Exchange Traded Fund (ETF) or individual ones liked by Afrifocus are; Discovery and the three form Investec.

We Get Mail

- Thando

- Sandra

- What will the TFSA be increased for next year?

- Chris

- How does one protect cash?

===

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Where's the party?

- Review: Superforecasting: The Art and Science of Prediction by Philip E. Tetlock & Dan Gardner

- Great Davos 2016 report back presentation with Nicky Newton-King (JSE CEO) and Bronwyn Nielsen (CNBC Africa). Next week Thursday we have another JSE Power Hour on Tax Free Savings Accounts (TFSA).

Clive Butkow GroTech

A Venture Capital company one can invest into and receive a tax break thanks to the SARS section 12J clause. They then invest into disruptive internet based companies with the strategy buy, build, flip.

====

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

Simon Shares

- Markets are volatile, but is the bear dead?

- I am buying Metrofile (JSE code: MFL). Good solid business that has solid earnings and currently on a dividend yield of just over 4%.

- Why is low oil causing such concerns on global markets? One would think it is good for consumers and hence good for economies?

- Davos 2016 report back presentation with Nicky Newton-King (JSE CEO) and Bronwyn Nielsen (CNBC Africa).

- MPC coming to an interest rate increase ear you. Today is likely to be the first of many, reduce debt.

Jean Pierre Verster 36One Asset Management

What's the big picture, world economy soft or markets just jittery? What about China and oil and how is the US and EU economies doing?

We Get Mail

- Casey

- With the end of the tax year looming I want to make sure my TFSA is in good standing. Can you tell me; Is my 30k limit based on cost (the amount of money I spent buying shares throughout the year) or current share value? If I go over my annual threshold can I simply sell some shares so my balance bought minus sold is worth R30k?

- Mary-Anne

- Looking at ETNs I compared the performance of BNPEUR at 47.47 to DBXEU 26.58 in past year, and BNPUSA at 45.61 to DBXUS at 37.46 in past year. What is the downside to these investment? They are not mentioned or recommended. DBXJapan also at 45.59 over the past twelve months, is this likely to perform well in future?

Simon Shares

- AB Inbev (JSE code: ANB) has arrived on the JSE as the largest stock by a mile. But I am not excited nor am I buying.

- The market is looking just weak, but this does not smell like 2008. How many people saying that actually were in the markets in 2008? That said more downside likely, under 40,000 on the Top40 seems certain. 35,000 anybody?

Drikus Combrinck Capicraft

How much money should we have in an off-shore account? This question was posed on Twitter and we get an expert view as well as other sage advice about investing off-shore (like maybe even bring some money back into Rands?).

We Get Mail

- Sipho

- The TFSA is R30k a year. Is this calendar year so I can add another R30k now in

January?

- The TFSA is R30k a year. Is this calendar year so I can add another R30k now in

- Clayton

- Is DBX World (JSE code: DBXWD) and Astoria (JSE code: ARA) about as good as having money offshore? Should one monthly add more to these in these circumstances instead of buying more BBET40 and other ETF's?

- Gerrit

- Is it really necessary to have stop loss orders with regards to ETF's e.g. DBX-trackers, Satrix Indi etc.

Tweet or Facebook us your questions.

====

Subscriber to our feed here or sign up for email alerts as a new show goes live or subscribe in iTunes.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.

We’re back! It's 2016, wowzer.

This week’s show is our annual predictions show with Marc Ashton, GM at Moneyweb, Keith McLachlan, Small/Midcap fund manager at Alpha Wealth and Simon Brown from JustOneLap.

We did our first predictions show in January 2014 and and the second a year later and this is now our third show. Find 2014 here and 2015 here. We promised to revisit our predictions a year later and here we are marking our 2015 predictions and also making our 2016 predictions.

Tweet or Facebook us your predictions.

====

Subscriber to our feed here or sign up for email alerts as a new show goes live or subscribe in iTunes.

JSE – The JSE is a registered trademark of the JSE Limited.

JSEDirect is an independent broadcast and is not endorsed or affiliated with, nor has it been authorised, or otherwise approved by JSE Limited. The views expressed in this programme are solely those of the presenter, and do not necessarily reflect the views of JSE Limited.